Prologis Supplemental Information First Quarter 2019 Unaudited Prologis Park Cajamar 1, Sao Paulo, Brazil

1Q 2019 Supplemental Highlights 1Company Profile 3Company Performance 5Guidance Financial Information 6Consolidated Balance Sheets 7Consolidated Statements of Income 8Reconciliations of Net Earnings to FFO 9Reconciliations of Net Earnings to Adjusted EBITDA Strategic Capital 10Summary and Financial Highlights 11 Operating and Balance Sheet Information of the Unconsolidated Co-Investment Ventures 12 Non-GAAP Pro-Rata Financial Information Operations 13Overview 14Operating Metrics 16Operating Portfolio 19Customer Information Capital Deployment 20Overview 21Development Stabilizations 22Development Starts 23Development Portfolio 24Third Party Building Acquisitions 25Dispositions and Contributions 26Land Portfolio Capitalization 28Overview 29Debt Components - Consolidated 30Debt Components - Noncontrolling Interests and Unconsolidated Net Asset Value 31Components Notes and Definitions 33Notes and Definitions (A) Terms used throughout document are defined in the Notes and Definitions Copyright © 2019 Prologis

3,717 Buildings Highlights * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. NOI calculation based on Prologis share of the Operating Portfolio. Company Profile 1Q 2019 Supplemental 1 Prologis, Inc., is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. As of March 31, 2019, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 772 million square feet (72 million square meters) in 19 countries. Prologis leases modern logistics facilities to a diverse base of approximately 5,100 customers across two major categories: business-to-business and retail/online fulfillment. 772M Square Feet 5,100 Customers U.S. 457M SF (59% of SF) 77% of NOI*(A) Other Americas 59M SF (8% of SF) 7% of NOI*(A) Europe 177M SF (23% of SF) 12% of NOI*(A) Asia 79M SF (10% of SF) 4% of NOI*(A)

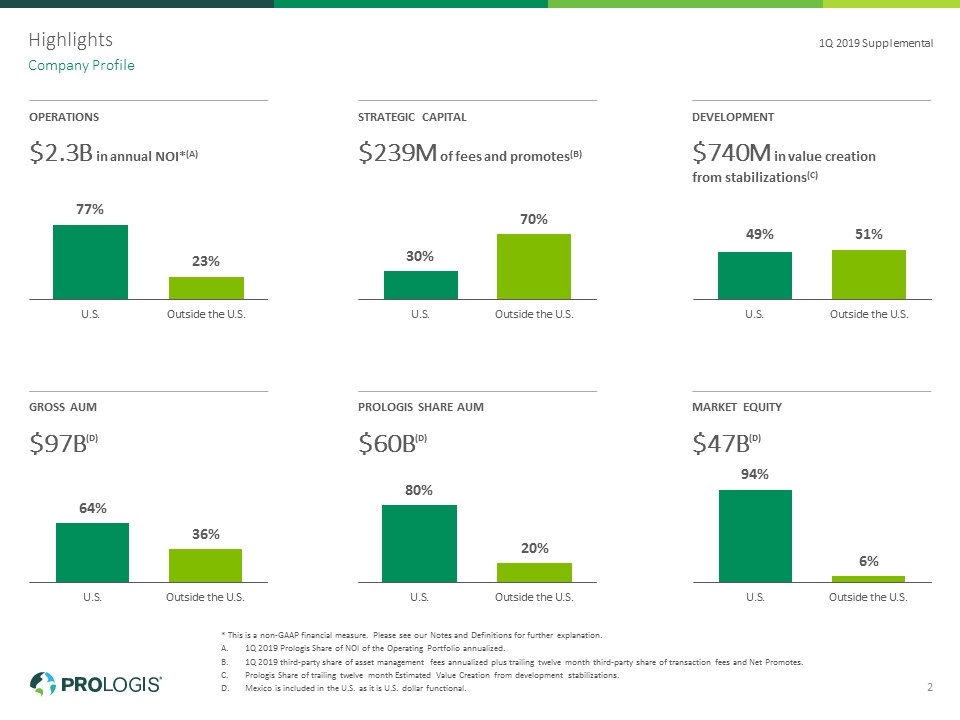

Highlights * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. 1Q 2019 Prologis Share of NOI of the Operating Portfolio annualized. 1Q 2019 third-party share of asset management fees annualized plus trailing twelve month third-party share of transaction fees and Net Promotes. Prologis Share of trailing twelve month Estimated Value Creation from development stabilizations. Mexico is included in the U.S. as it is U.S. dollar functional. Company Profile 2 1Q 2019 Supplemental Operations $2.3B in annual NOI*(A) Strategic Capital $239M of fees and promotes(B) Development $740M in value creation from stabilizations(C) Gross AUM $97B(D) Prologis Share AUM $60B(D) Market Equity $47B(D)

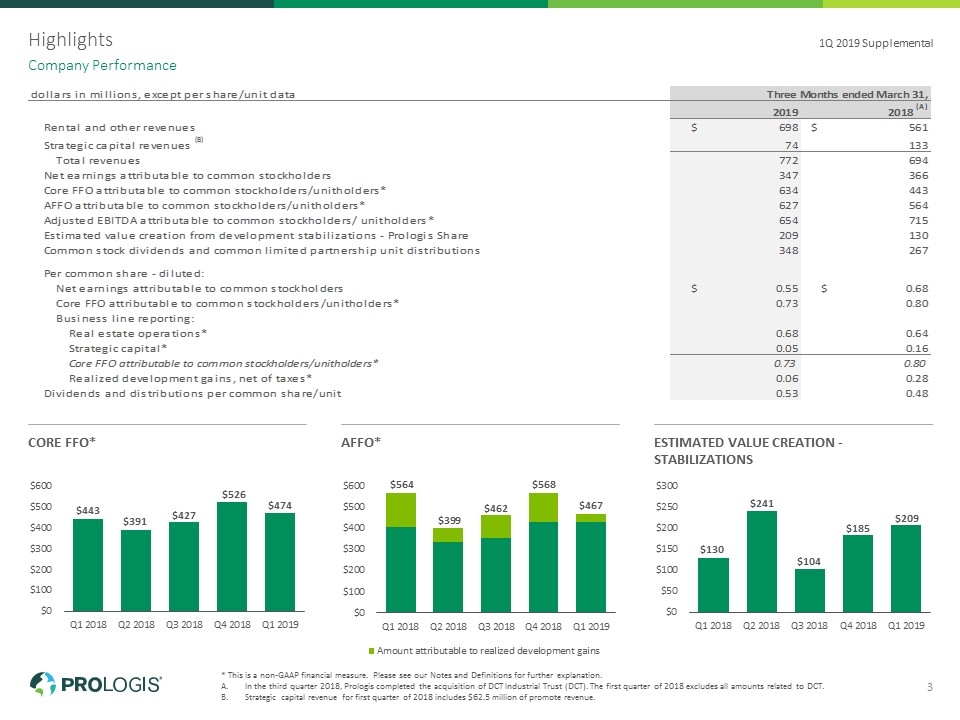

Highlights * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. In the third quarter 2018, Prologis completed the acquisition of DCT Industrial Trust (DCT). The first quarter of 2018 excludes all amounts related to DCT. Strategic capital revenue for first quarter of 2018 includes $62.5 million of promote revenue. Company Performance 1Q 2019 Supplemental 3 Core FFO* AFFO* Estimated Value Creation - Stabilizations

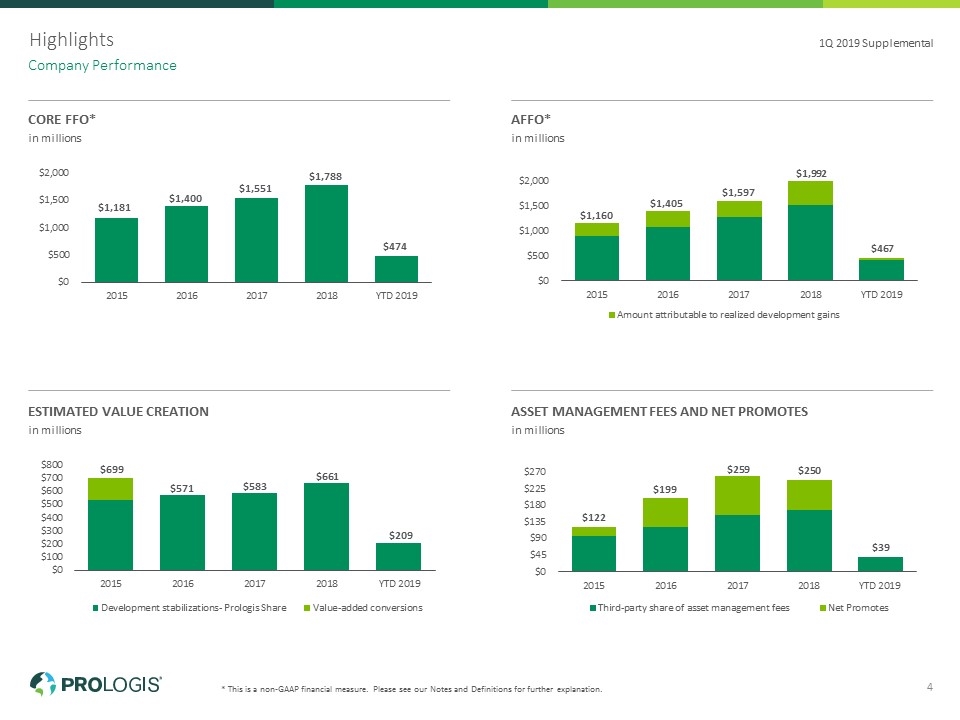

* This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Core FFO* in millions AFFO* in millions Estimated Value Creation in millions Asset Management Fees and Net Promotes in millions Highlights Company Performance 1Q 2019 Supplemental 4

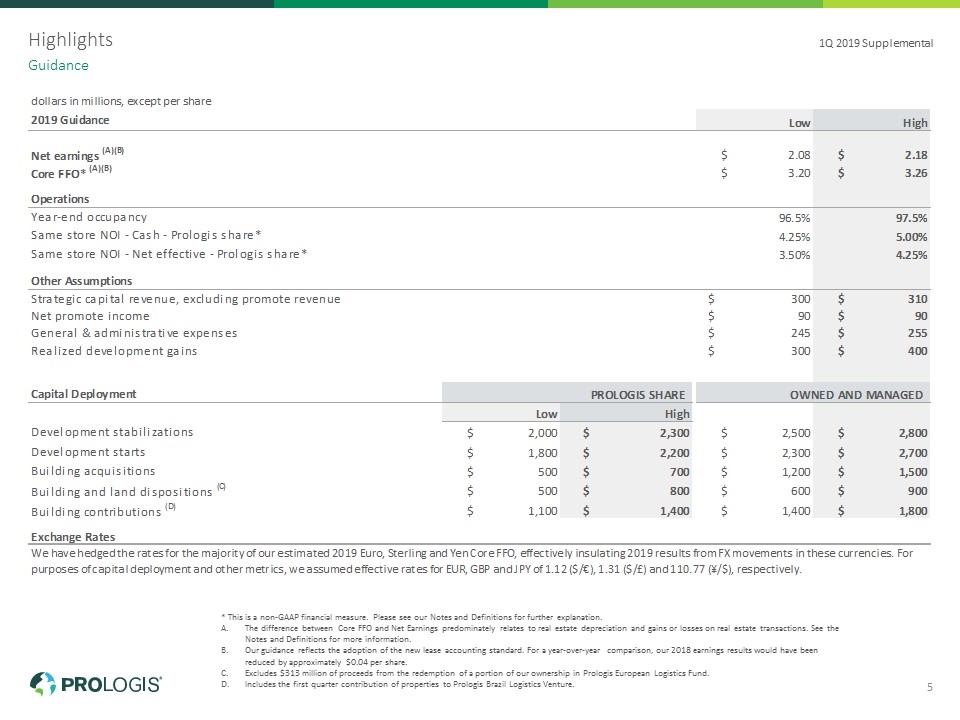

Highlights * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. The difference between Core FFO and Net Earnings predominately relates to real estate depreciation and gains or losses on real estate transactions. See the Notes and Definitions for more information. Our guidance reflects the adoption of the new lease accounting standard. For a year-over-year comparison, our 2018 earnings results would have been reduced by approximately $0.04 per share. Excludes $313 million of proceeds from the redemption of a portion of our ownership in Prologis European Logistics Fund. Includes the first quarter contribution of properties to Prologis Brazil Logistics Venture. Guidance 1Q 2019 Supplemental 5

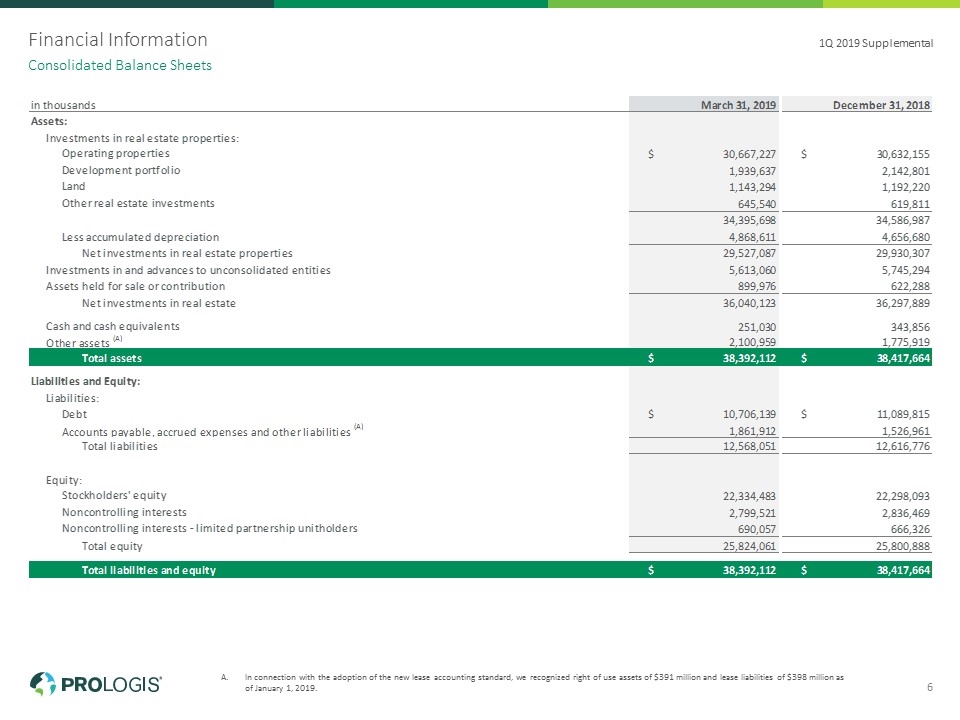

Financial Information In connection with the adoption of the new lease accounting standard, we recognized right of use assets of $391 million and lease liabilities of $398 million as of January 1, 2019. Consolidated Balance Sheets 1Q 2019 Supplemental 6

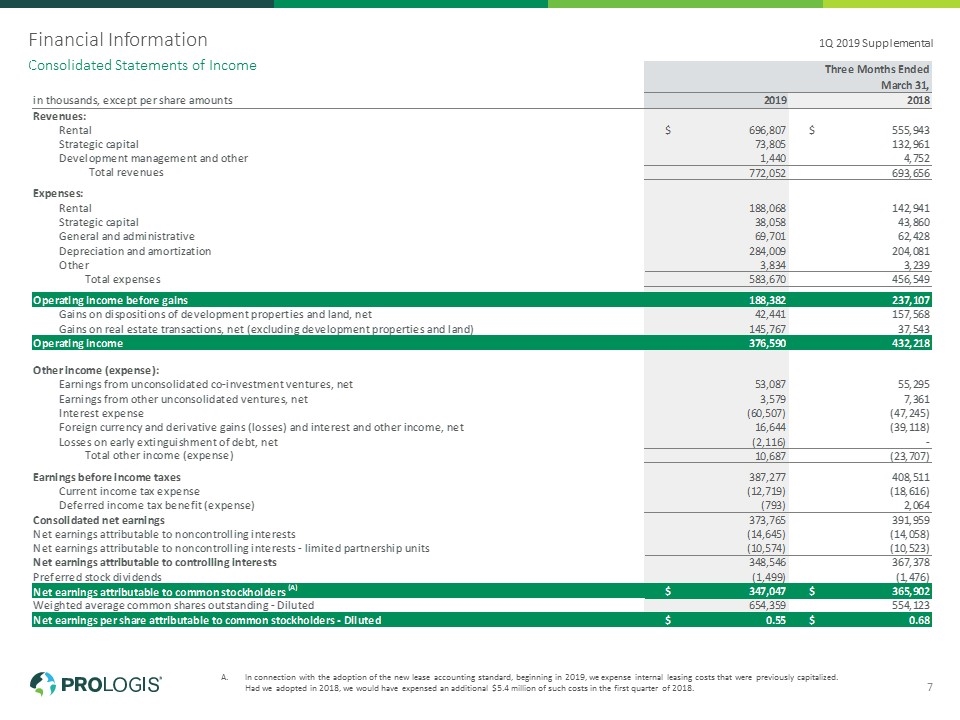

Financial Information In connection with the adoption of the new lease accounting standard, beginning in 2019, we expense internal leasing costs that were previously capitalized. Had we adopted in 2018, we would have expensed an additional $5.4 million of such costs in the first quarter of 2018. Consolidated Statements of Income 1Q 2019 Supplemental 7

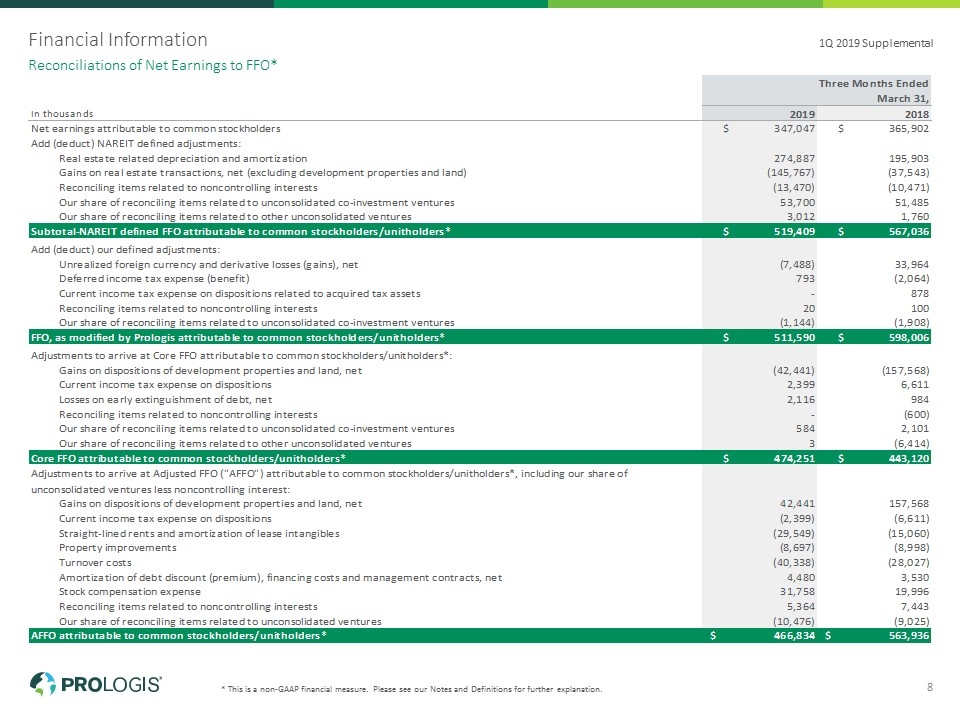

Financial Information * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Reconciliations of Net Earnings to FFO* 1Q 2019 Supplemental 8

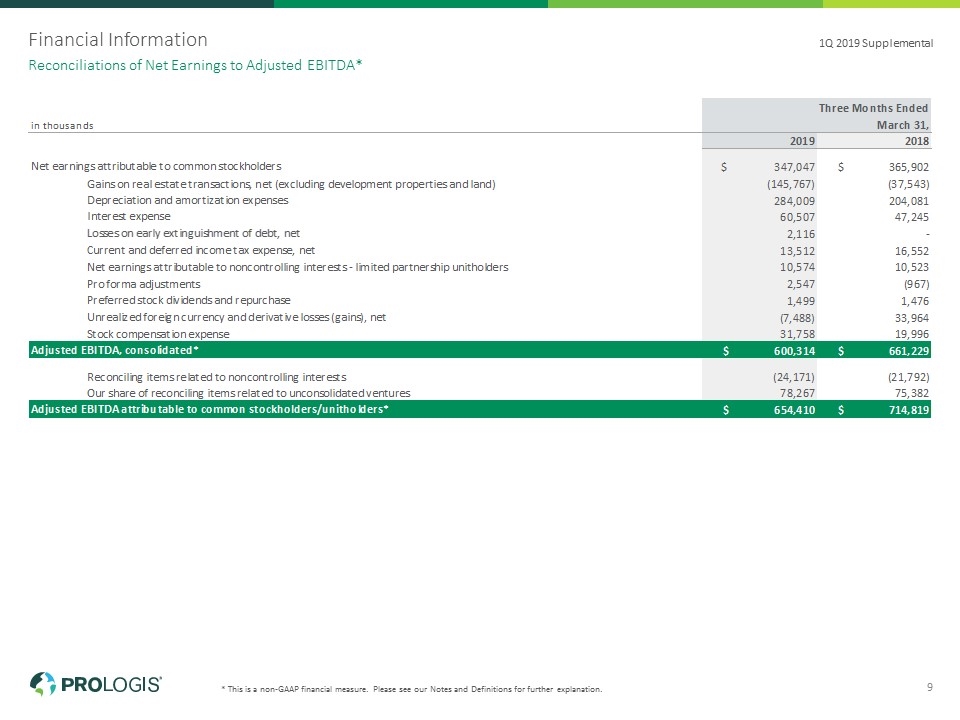

Financial Information * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Reconciliations of Net Earnings to Adjusted EBITDA* 1Q 2019 Supplemental 9

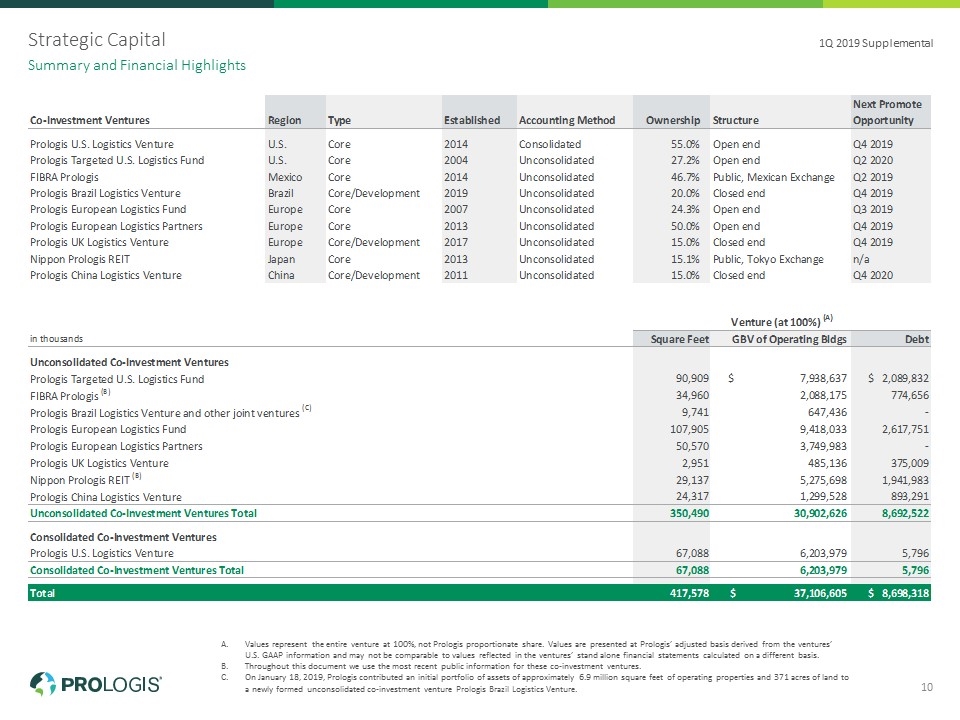

Strategic Capital Values represent the entire venture at 100%, not Prologis proportionate share. Values are presented at Prologis’ adjusted basis derived from the ventures’ U.S. GAAP information and may not be comparable to values reflected in the ventures’ stand alone financial statements calculated on a different basis. Throughout this document we use the most recent public information for these co-investment ventures. On January 18, 2019, Prologis contributed an initial portfolio of assets of approximately 6.9 million square feet of operating properties and 371 acres of land to a newly formed unconsolidated co-investment venture Prologis Brazil Logistics Venture. Summary and Financial Highlights 1Q 2019 Supplemental 10

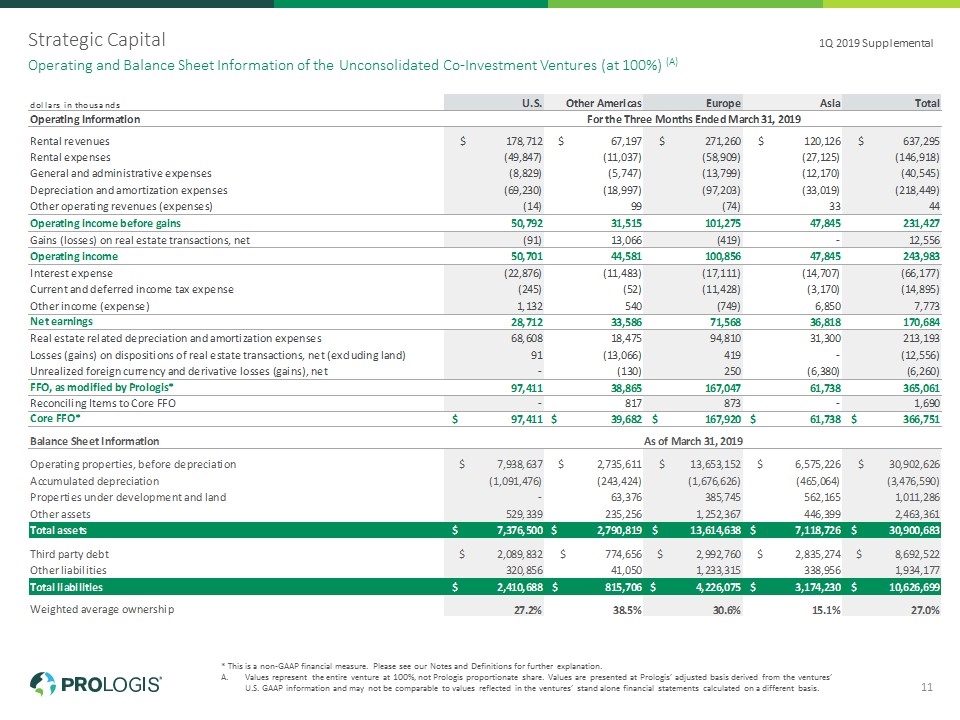

Strategic Capital * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Values represent the entire venture at 100%, not Prologis proportionate share. Values are presented at Prologis’ adjusted basis derived from the ventures’ U.S. GAAP information and may not be comparable to values reflected in the ventures’ stand alone financial statements calculated on a different basis. Operating and Balance Sheet Information of the Unconsolidated Co-Investment Ventures (at 100%) (A) 1Q 2019 Supplemental 11

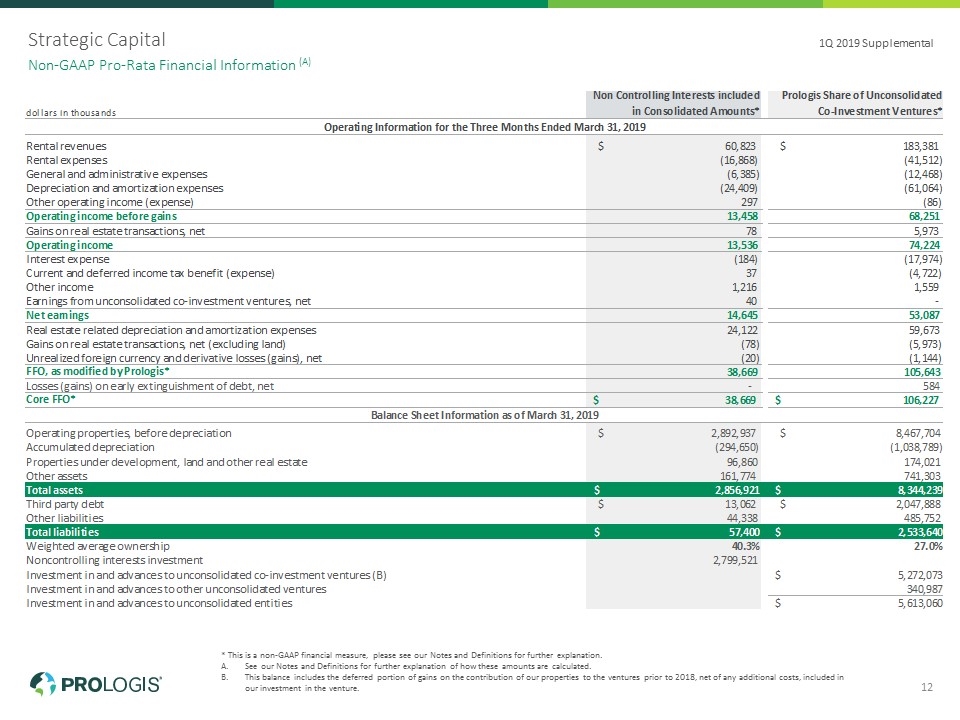

Strategic Capital * This is a non-GAAP financial measure, please see our Notes and Definitions for further explanation. See our Notes and Definitions for further explanation of how these amounts are calculated. This balance includes the deferred portion of gains on the contribution of our properties to the ventures prior to 2018, net of any additional costs, included in our investment in the venture. Non-GAAP Pro-Rata Financial Information (A) 1Q 2019 Supplemental 12

* This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Occupancy Customer Retention Same Store Change Over Prior Year – Prologis Share* Rent Change – Prologis Share Operations Overview 1Q 2019 Supplemental 13 Trailing four quarters – net effective

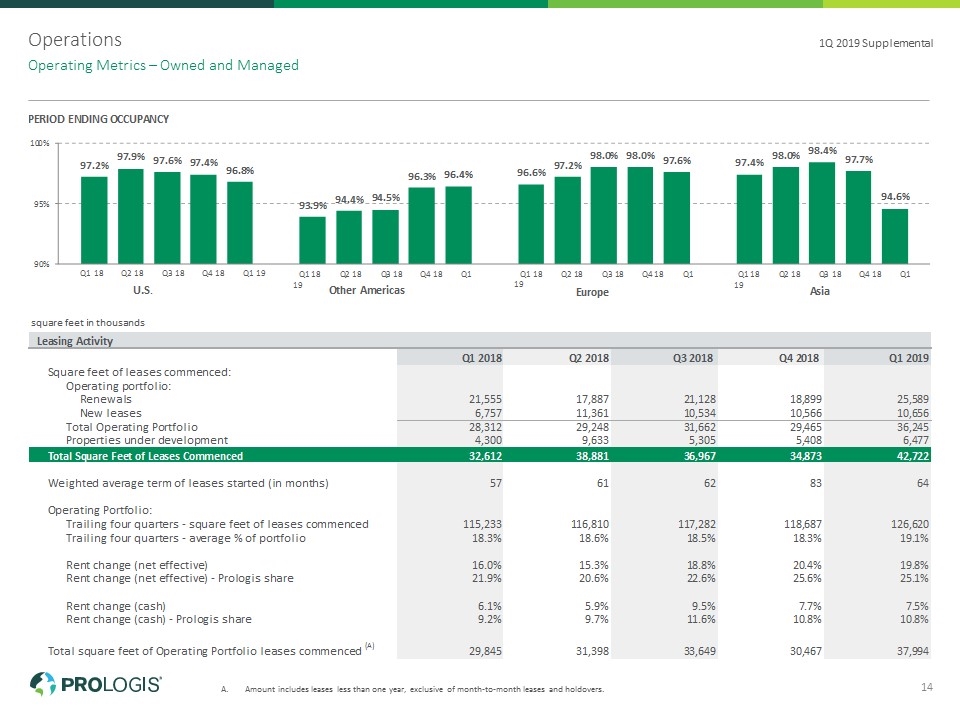

Operations Amount includes leases less than one year, exclusive of month-to-month leases and holdovers. Operating Metrics – Owned and Managed 1Q 2019 Supplemental 14

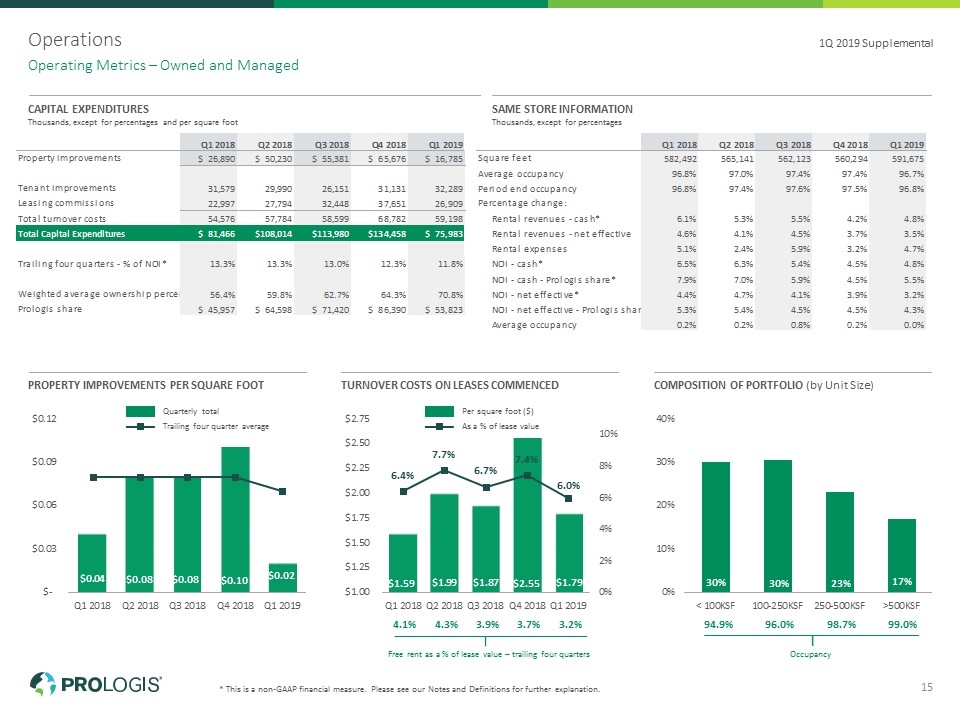

Operations * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Operating Metrics – Owned and Managed 1Q 2019 Supplemental 15 CAPITAL EXPENDITURES Thousands, except for percentages and per square foot SAME STORE INFORMATION Thousands, except for percentages PROPERTY IMPROVEMENTS PER SQUARE FOOT TURNOVER COSTS ON LEASES COMMENCED COMPOSITION OF PORTFOLIO (by Unit Size) Free rent as a % of lease value – trailing four quarters 4.1% 4.3% 3.9% 3.7% 3.2% Occupancy 94.9% 96.0% 98.7% 99.0% Trailing four quarter average Quarterly total As a % of lease value Per square foot ($)

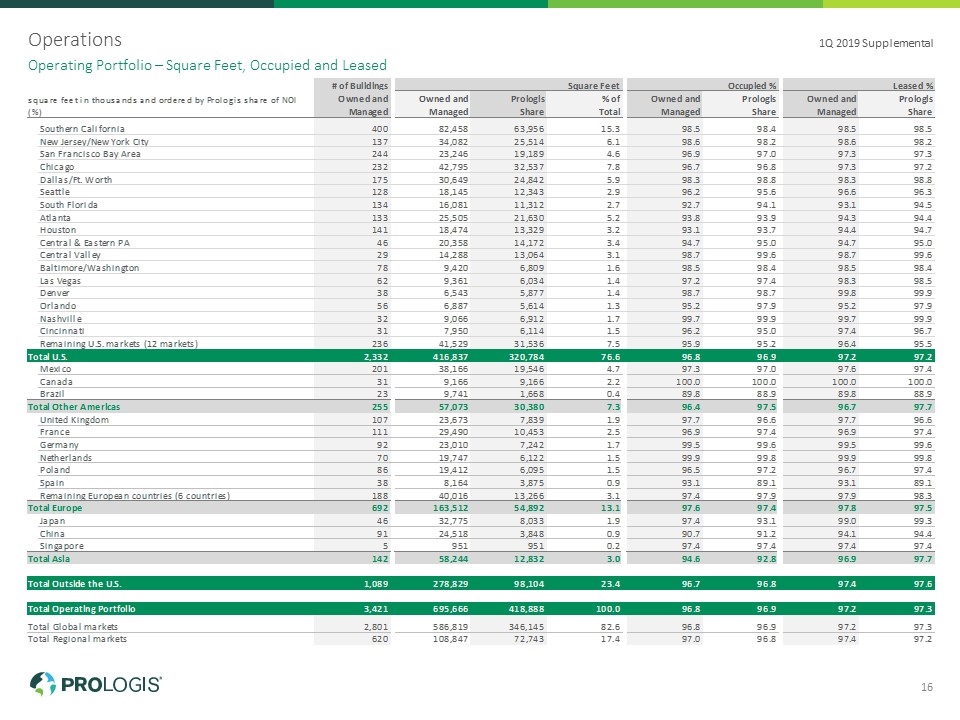

Operations Operating Portfolio – Square Feet, Occupied and Leased 1Q 2019 Supplemental 16

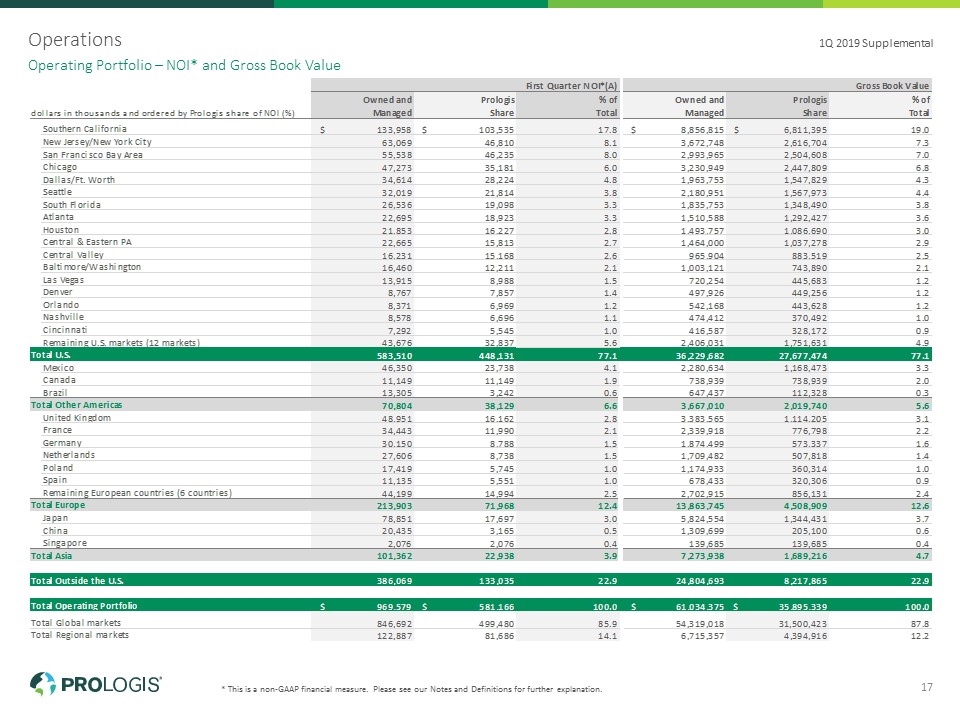

Operations * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Operating Portfolio – NOI* and Gross Book Value 1Q 2019 Supplemental 17

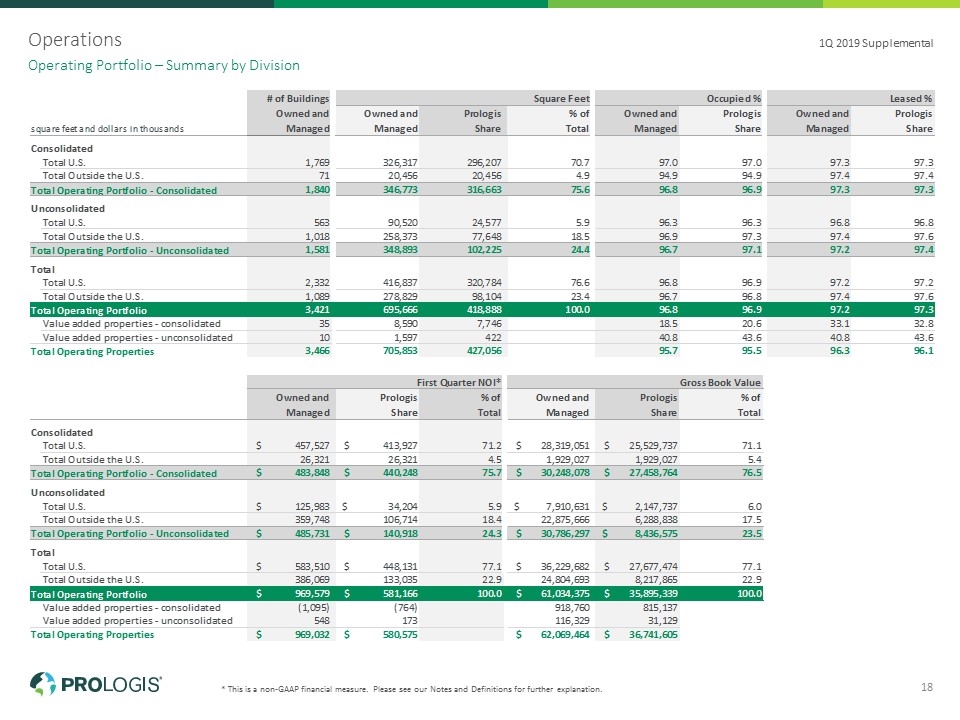

Operations * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Operating Portfolio – Summary by Division 1Q 2019 Supplemental 18

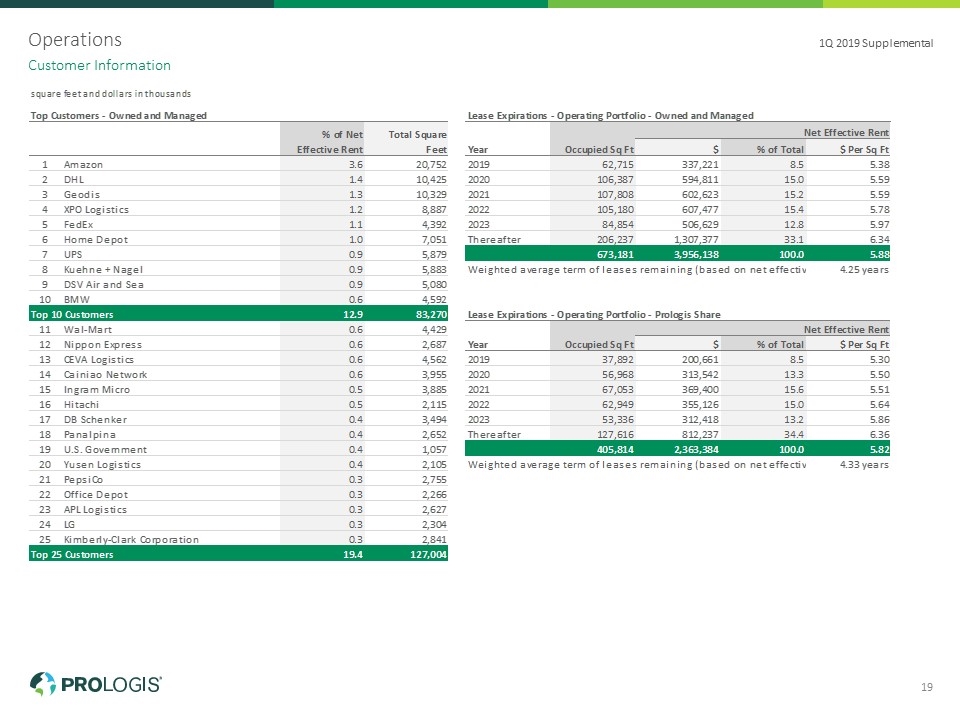

Operations Customer Information 1Q 2019 Supplemental 19

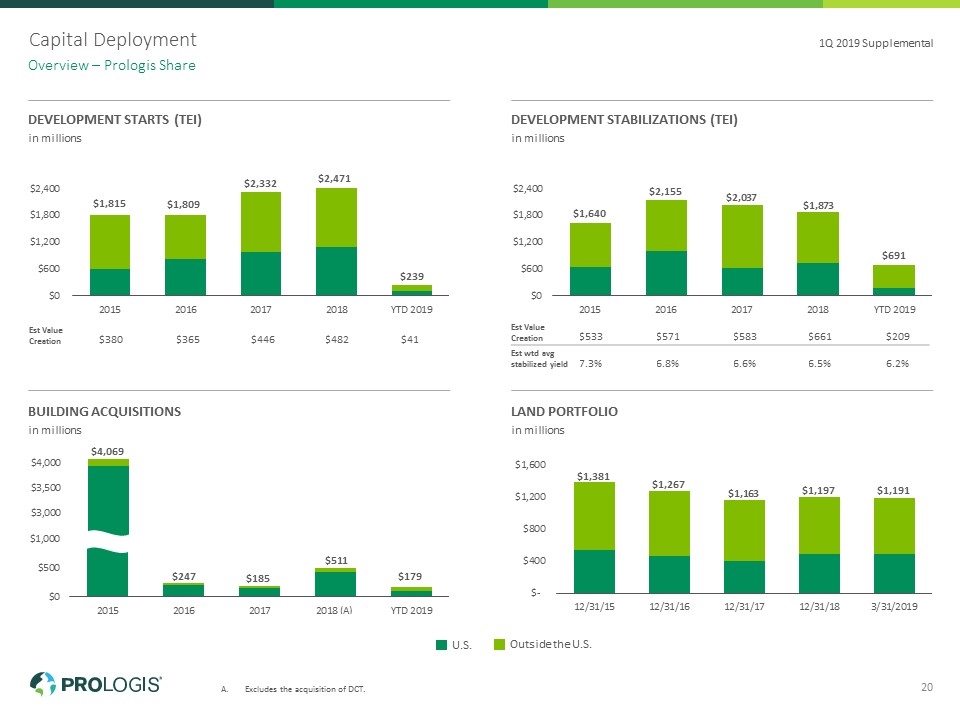

Development Starts (TEI) in millions Development Stabilizations (TEI) in millions Building Acquisitions in millions Land Portfolio in millions Capital Deployment Overview – Prologis Share 1Q 2019 Supplemental 20 Outside the U.S. U.S. Est Value Creation $533 $571 $583 $661 $209 Est wtd avg stabilized yield 7.3% 6.8% 6.6% 6.5% 6.2% Est Value Creation $380 $365 $446 $482 $41 Excludes the acquisition of DCT.

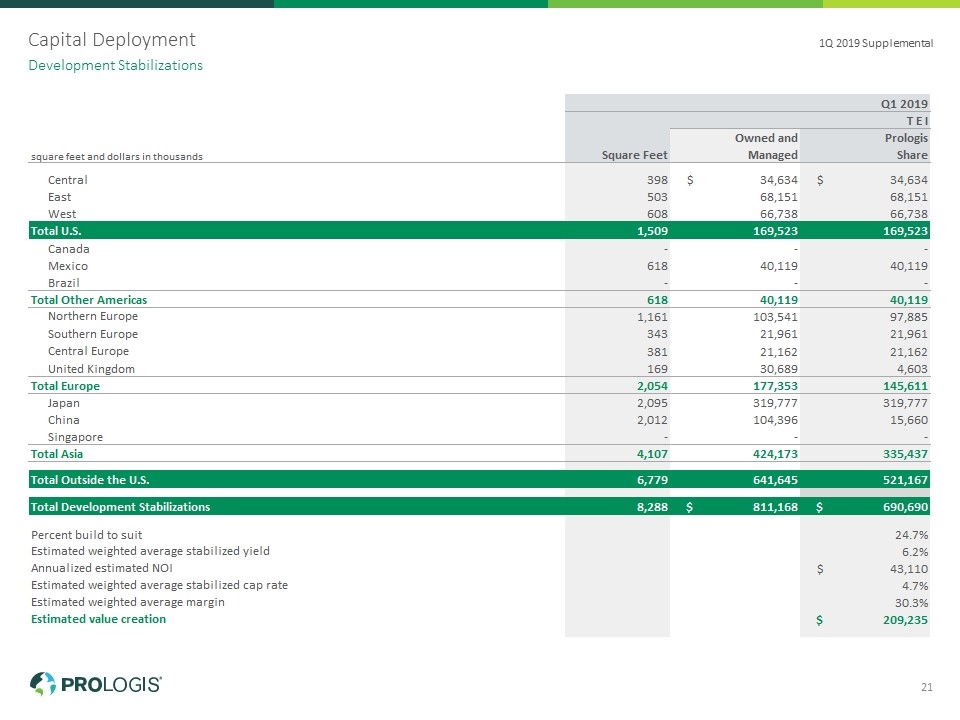

Capital Deployment Development Stabilizations 1Q 2019 Supplemental 21

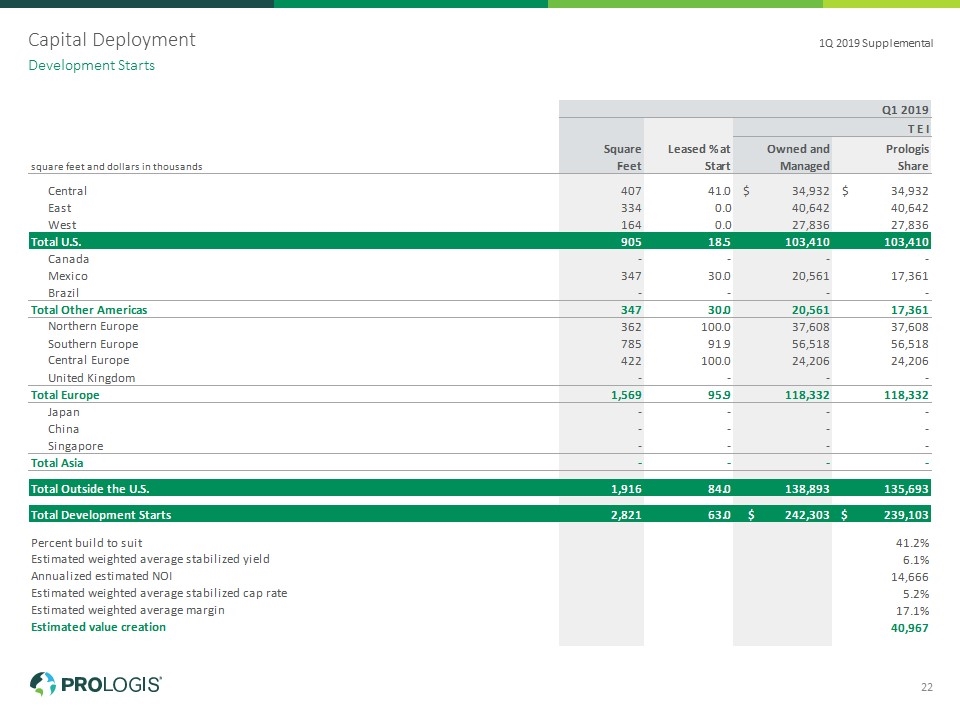

Capital Deployment Development Starts 1Q 2019 Supplemental 22

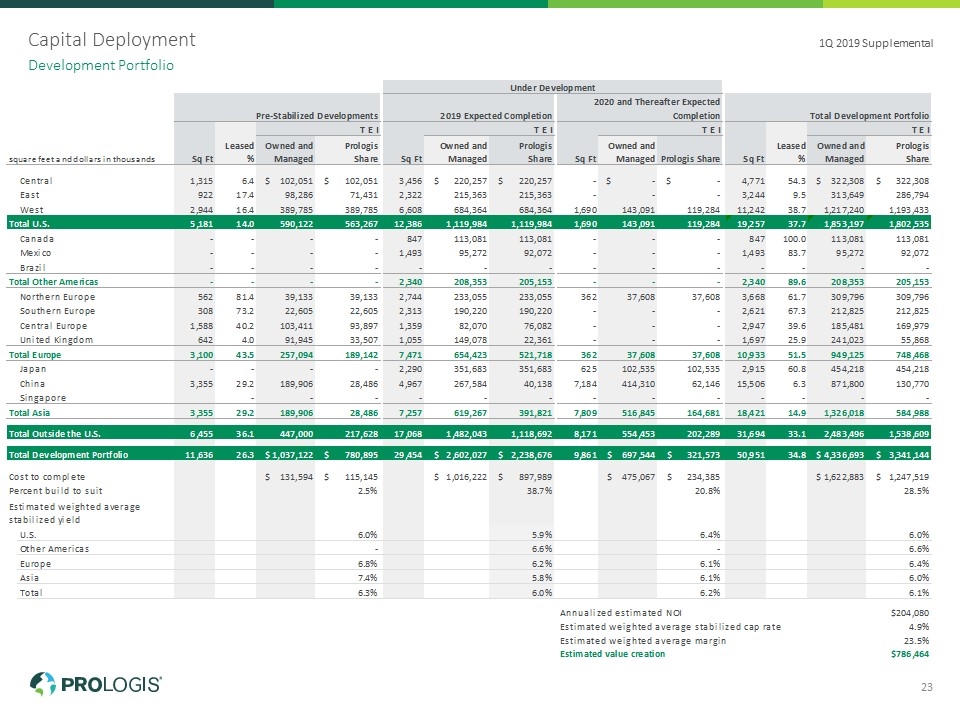

Capital Deployment Development Portfolio 1Q 2019 Supplemental 23

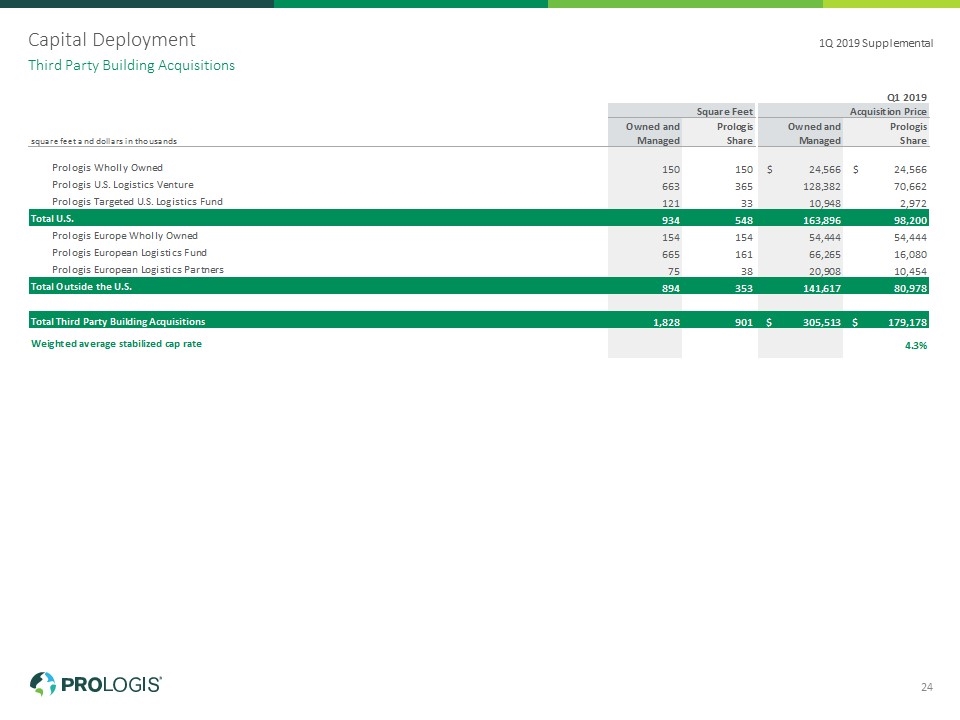

Capital Deployment Third Party Building Acquisitions 1Q 2019 Supplemental 24

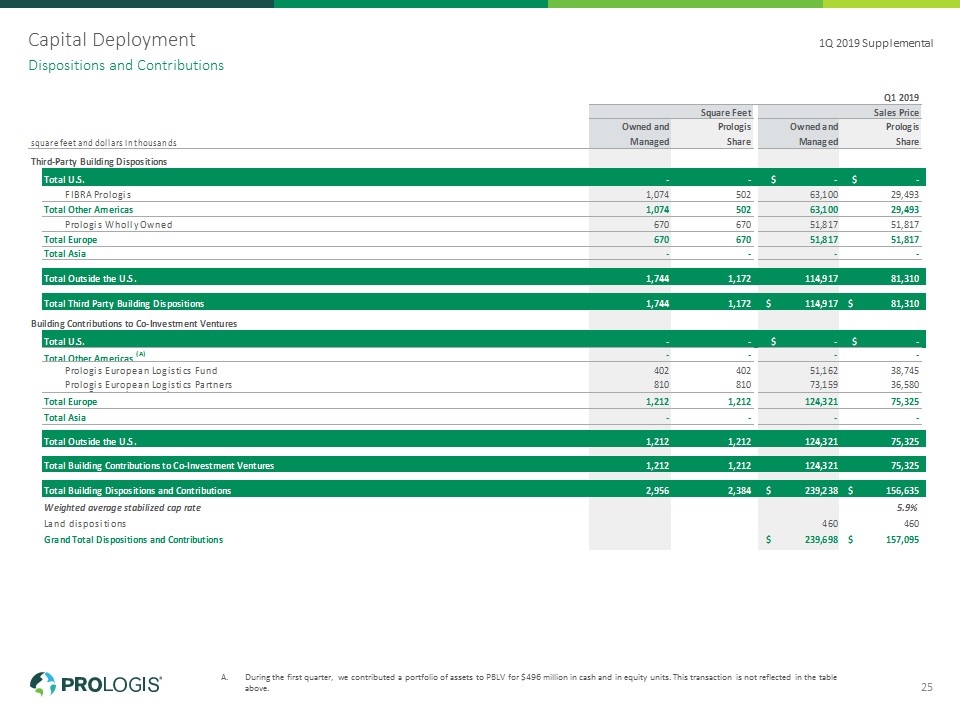

Capital Deployment During the first quarter, we contributed a portfolio of assets to PBLV for $496 million in cash and in equity units. This transaction is not reflected in the table above. Dispositions and Contributions 1Q 2019 Supplemental 25

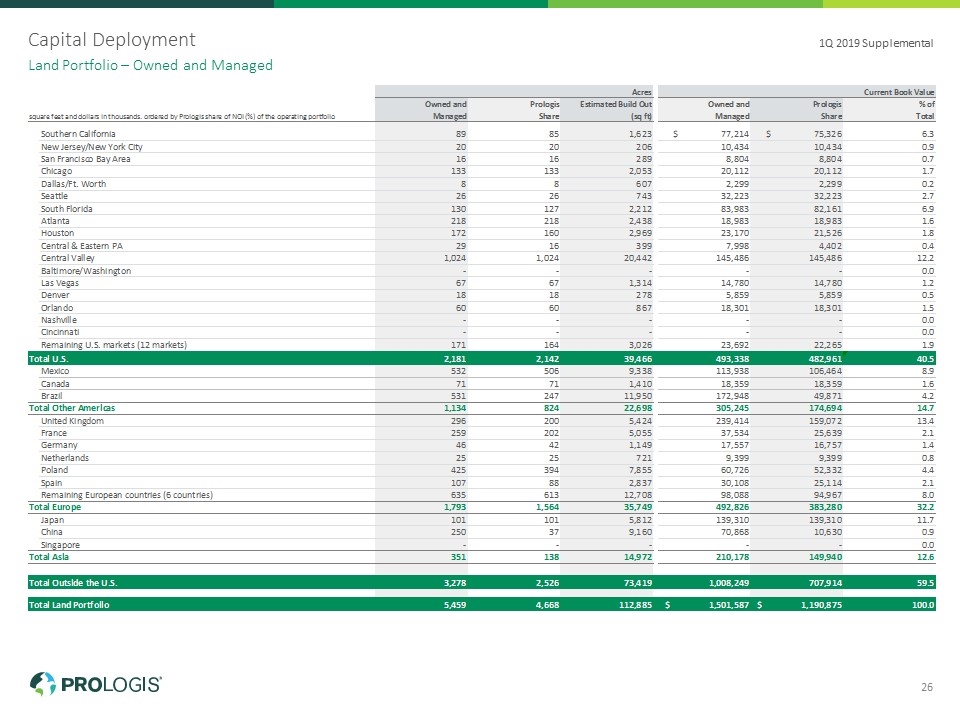

Capital Deployment Land Portfolio – Owned and Managed 1Q 2019 Supplemental 26

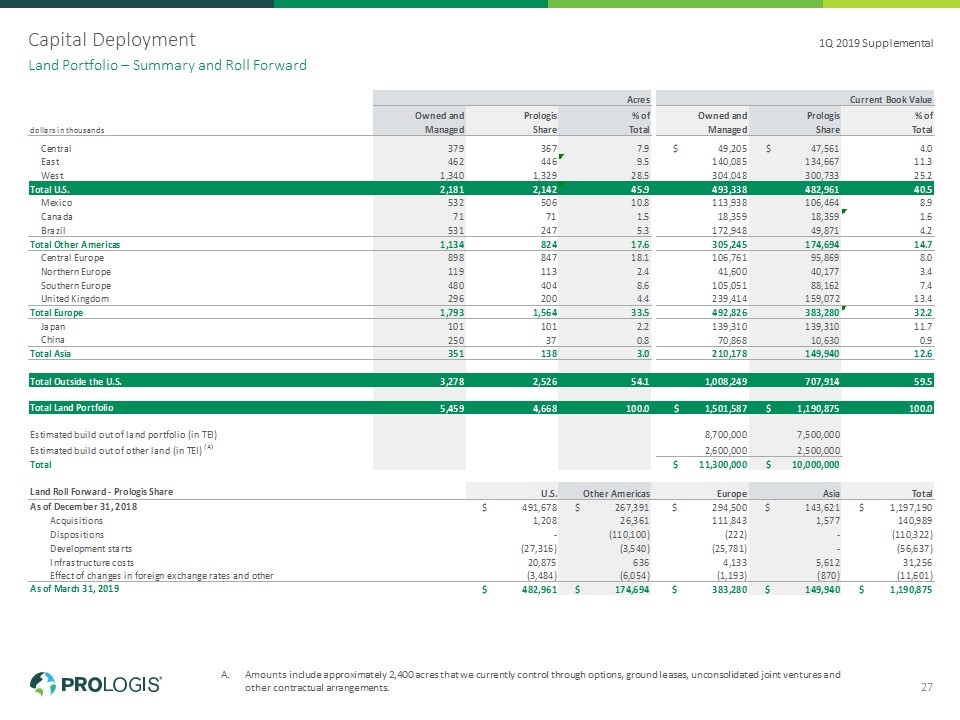

Capital Deployment Amounts include approximately 2,400 acres that we currently control through options, ground leases, unconsolidated joint ventures and other contractual arrangements. Land Portfolio – Summary and Roll Forward 1Q 2019 Supplemental 27

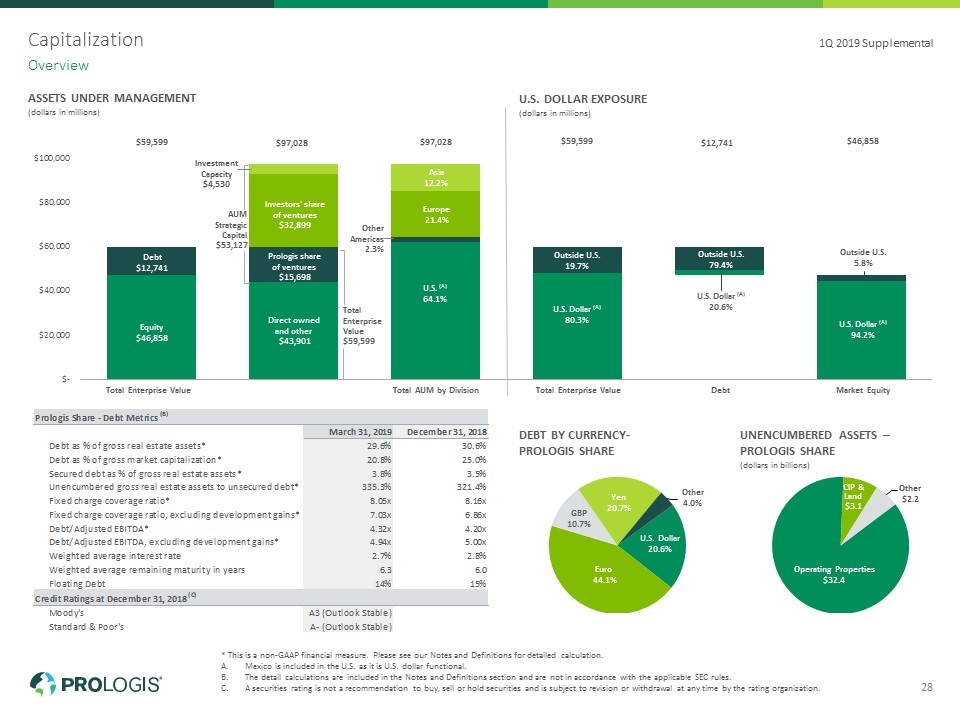

Capitalization * This is a non-GAAP financial measure. Please see our Notes and Definitions for detailed calculation. Mexico is included in the U.S. as it is U.S. dollar functional. The detail calculations are included in the Notes and Definitions section and are not in accordance with the applicable SEC rules. A securities rating is not a recommendation to buy, sell or hold securities and is subject to revision or withdrawal at any time by the rating organization. Overview 1Q 2019 Supplemental 28 ASSETS UNDER MANAGEMENT (dollars in millions) Total Enterprise Value Total AUM by Division Market Equity U.S. DOLLAR EXPOSURE (dollars in millions) Total Enterprise Value Debt U.S. Dollar (A) 20.6% U.S. Dollar (A) 80.3% Outside U.S. 19.7% Outside U.S. 79.4% DEBT BY CURRENCY- PROLOGIS SHARE UNENCUMBERED ASSETS – PROLOGIS SHARE (dollars in billions)

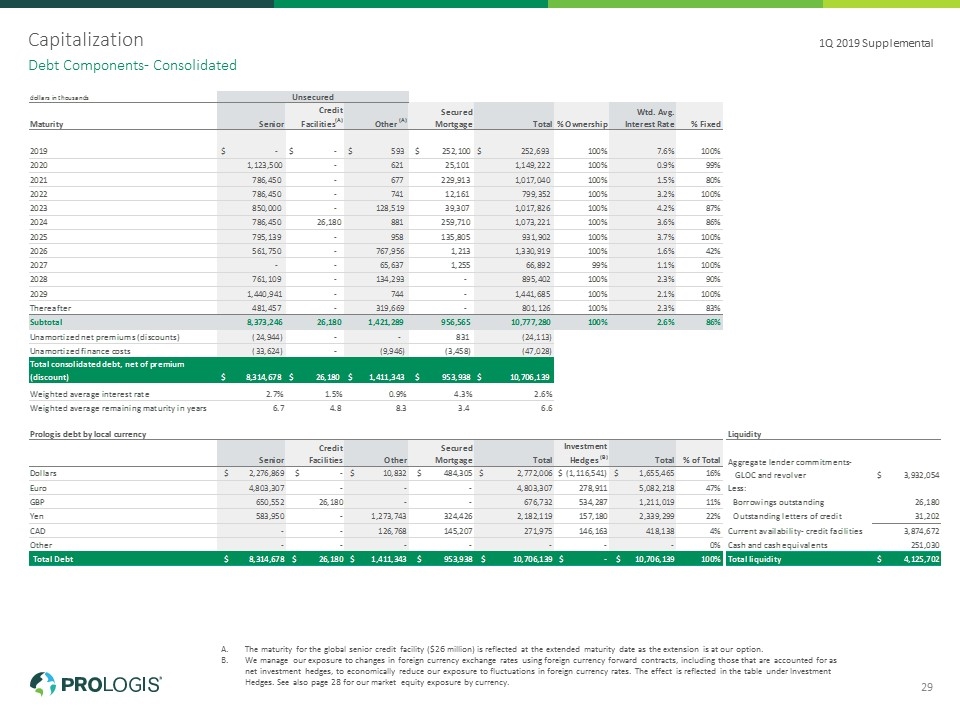

Capitalization The maturity for the global senior credit facility ($26 million) is reflected at the extended maturity date as the extension is at our option. We manage our exposure to changes in foreign currency exchange rates using foreign currency forward contracts, including those that are accounted for as net investment hedges, to economically reduce our exposure to fluctuations in foreign currency rates. The effect is reflected in the table under Investment Hedges. See also page 28 for our market equity exposure by currency. Debt Components- Consolidated 1Q 2019 Supplemental 29

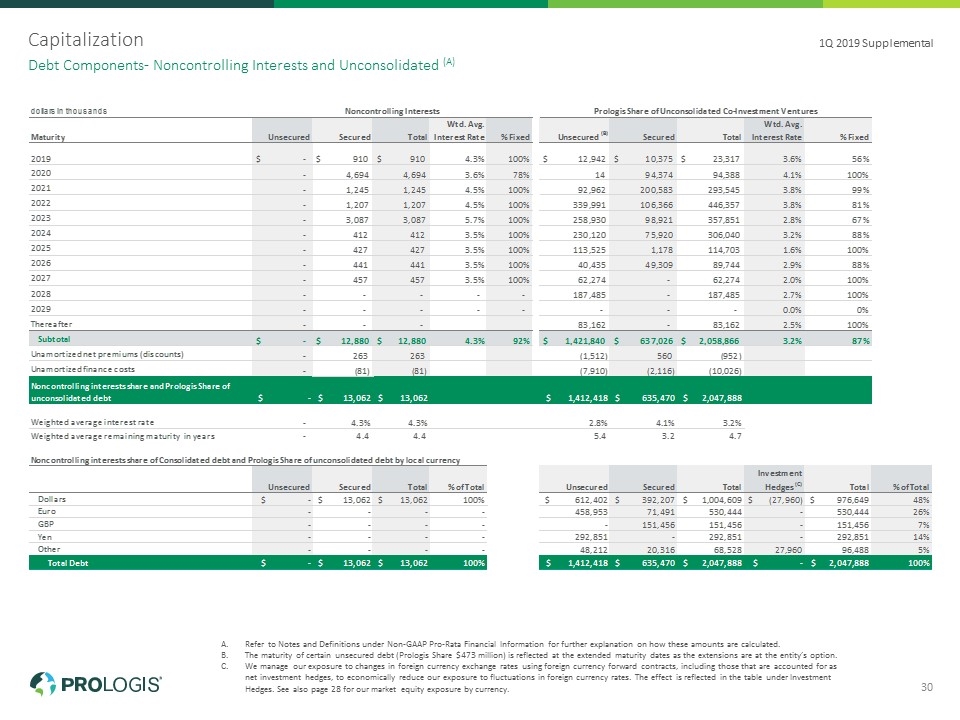

Capitalization Refer to Notes and Definitions under Non-GAAP Pro-Rata Financial Information for further explanation on how these amounts are calculated. The maturity of certain unsecured debt (Prologis Share $473 million) is reflected at the extended maturity dates as the extensions are at the entity’s option. We manage our exposure to changes in foreign currency exchange rates using foreign currency forward contracts, including those that are accounted for as net investment hedges, to economically reduce our exposure to fluctuations in foreign currency rates. The effect is reflected in the table under Investment Hedges. See also page 28 for our market equity exposure by currency. Debt Components- Noncontrolling Interests and Unconsolidated (A) 1Q 2019 Supplemental 30

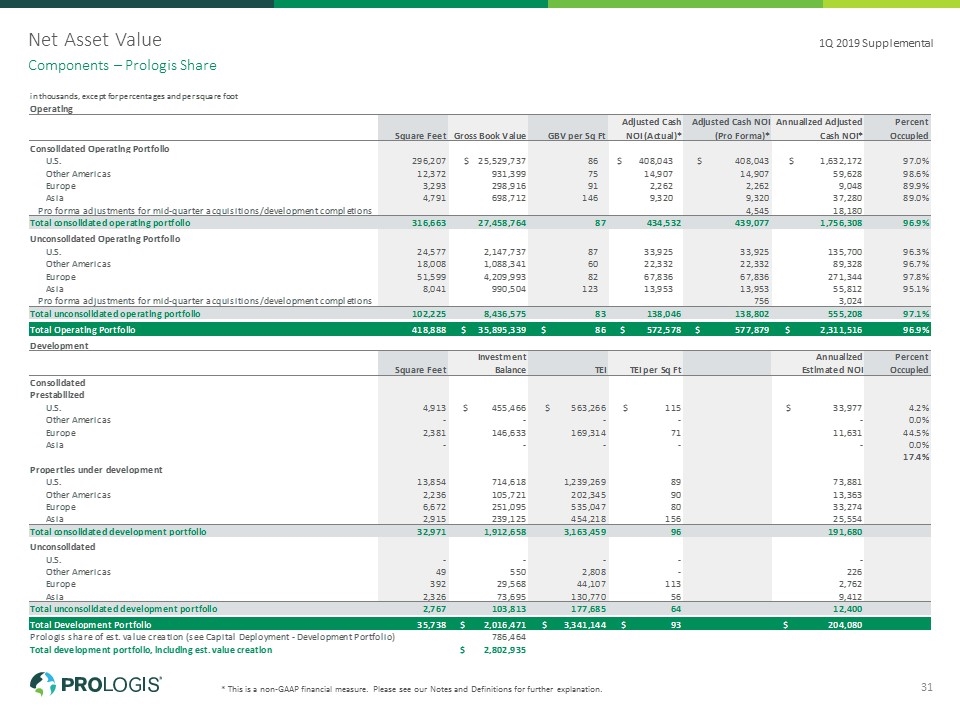

Net Asset Value * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Components – Prologis Share 1Q 2019 Supplemental 31

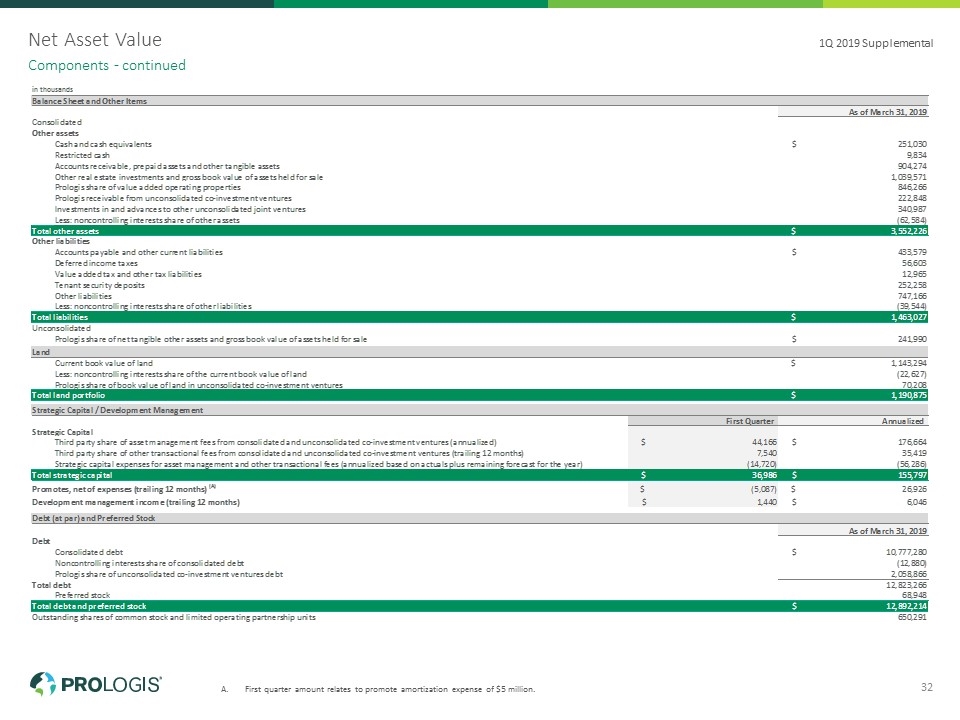

Net Asset Value First quarter amount relates to promote amortization expense of $5 million. Components - continued 1Q 2019 Supplemental 32 in thousands Balance Sheet and Other Items As of March 31, 2019 Consolidated Other assets Cash and cash equivalents $,251,030 Restricted cash 9,834 Accounts receivable, prepaid assets and other tangible assets ,904,274 Other real estate investments and gross book value of assets held for sale 1,039,571 Prologis share of value added operating properties ,846,266 Prologis receivable from unconsolidated co-investment ventures ,222,848 Investments in and advances to other unconsolidated joint ventures ,340,987 Less: noncontrolling interests share of other assets ,-62,584.3713832266 Total other assets $3,552,225.6286167735 Other liabilities Accounts payable and other current liabilities $,433,579 Deferred income taxes $56,603 Value added tax and other tax liabilities $12,965 Tenant security deposits $,252,258 Other liabilities $,747,166 Less: noncontrolling interests share of other liabilities ,-39,544 Total liabilities $1,463,027 Unconsolidated Prologis share of net tangible other assets and gross book value of assets held for sale $,241,989.9884338 Land Current book value of land $1,143,294 Less: noncontrolling interests share of the current book value of land $,-22,627 Prologis share of book value of land in unconsolidated co-investment ventures $70,208 Total land portfolio $1,190,875 Strategic Capital / Development Management First Quarter Annualized Strategic Capital Third party share of asset management fees from consolidated and unconsolidated co-investment ventures (annualized) $44,166 $,176,664 Third party share of other transactional fees from consolidated and unconsolidated co-investment ventures (trailing 12 months) $7,540 $35,419 Strategic capital expenses for asset management and other transactional fees (annualized based on actuals plus remaining forecast for the year) $,-14,720 $,-56,286 Total strategic capital $36,986 $,155,797 Promotes, net of expenses (trailing 12 months) (A) $-5,087 $26,926 Development management income (trailing 12 months) $1,440 $6,046 Debt (at par) and Preferred Stock As of March 31, 2019 Debt Consolidated debt $10,777,280 Noncontrolling interests share of consolidated debt $,-12,880 Prologis share of unconsolidated co-investment ventures debt $2,058,866 Total debt $12,823,266 Preferred stock $68,948 Total debt and preferred stock $12,892,214 Outstanding shares of common stock and limited operating partnership units $,650,291

Notes and Definitions Prologis Fokker Park, Oude Meer, the Netherlands

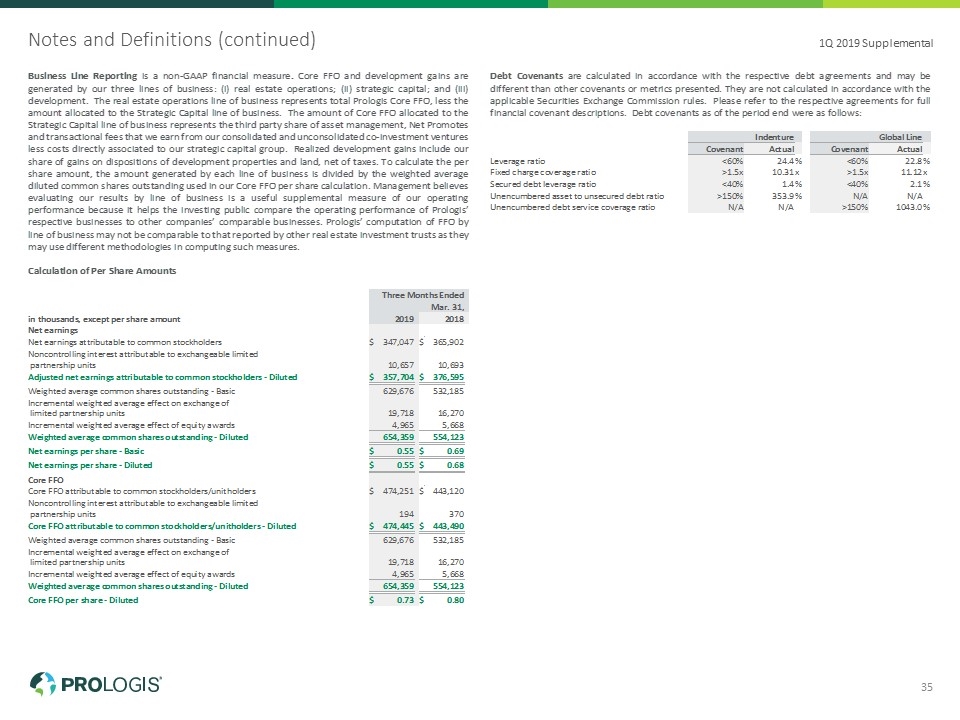

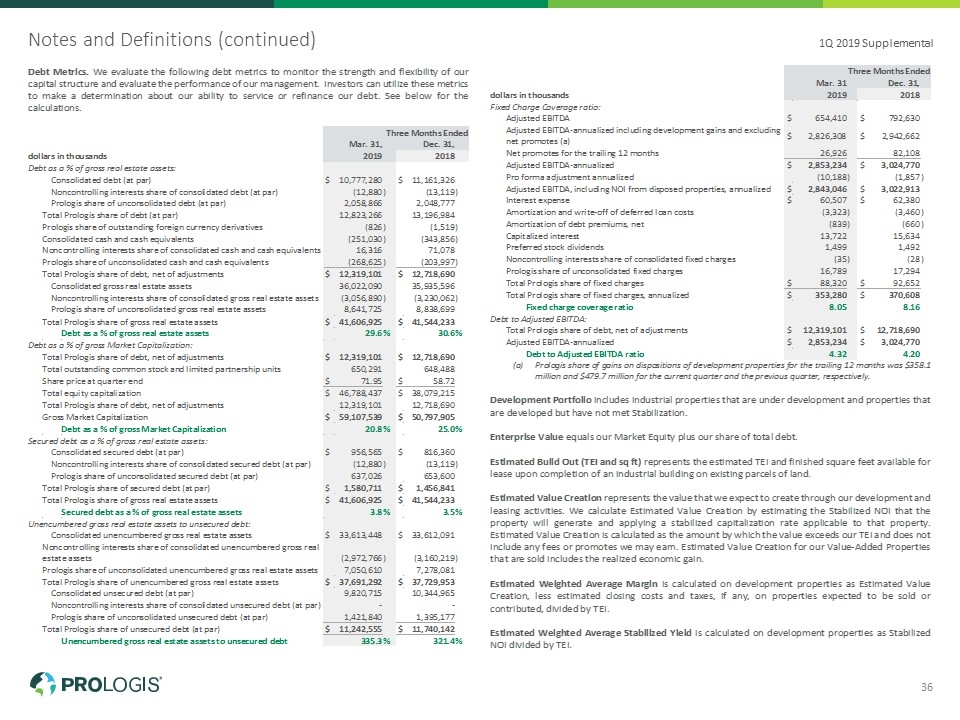

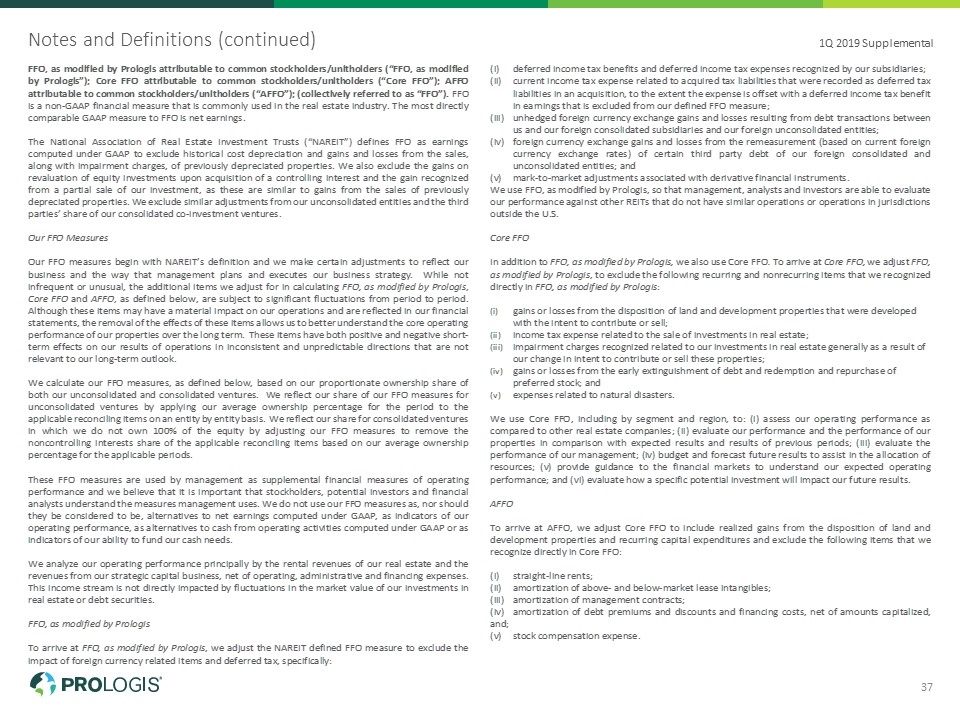

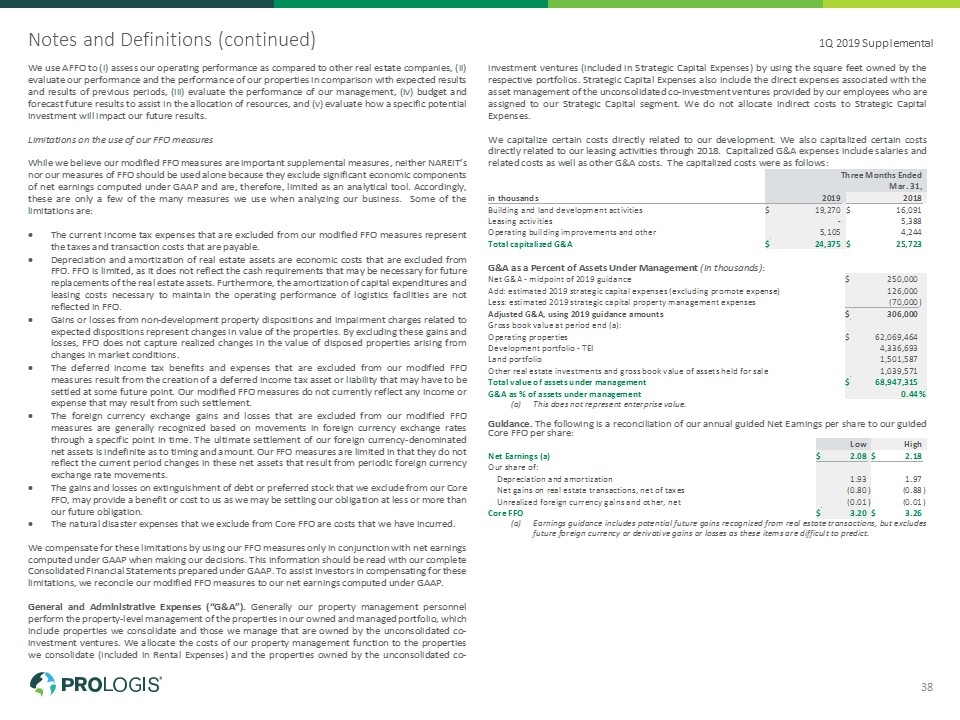

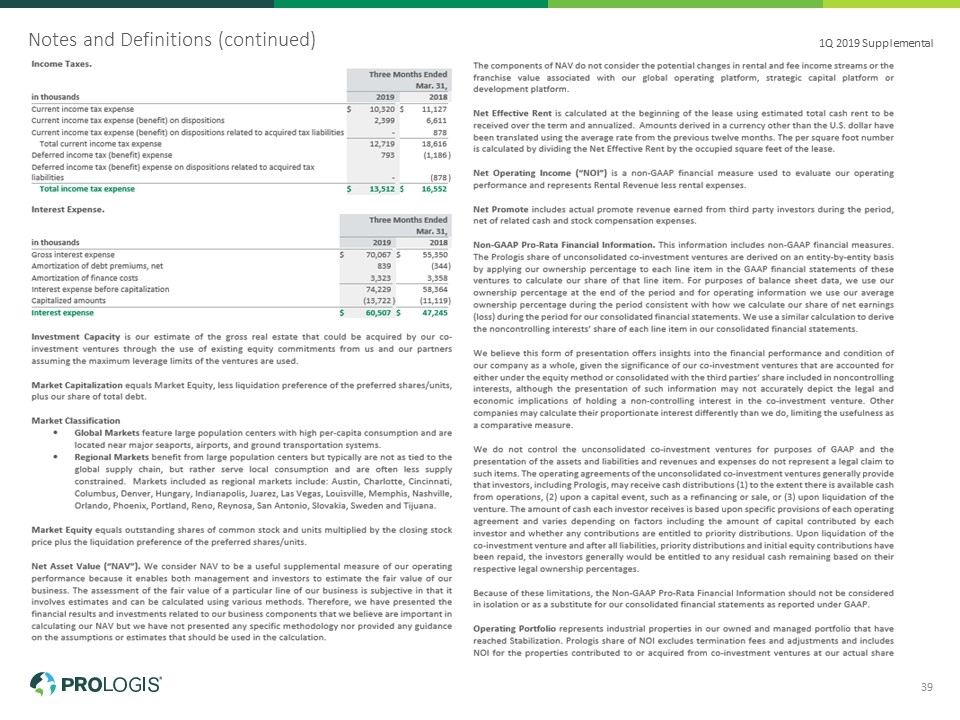

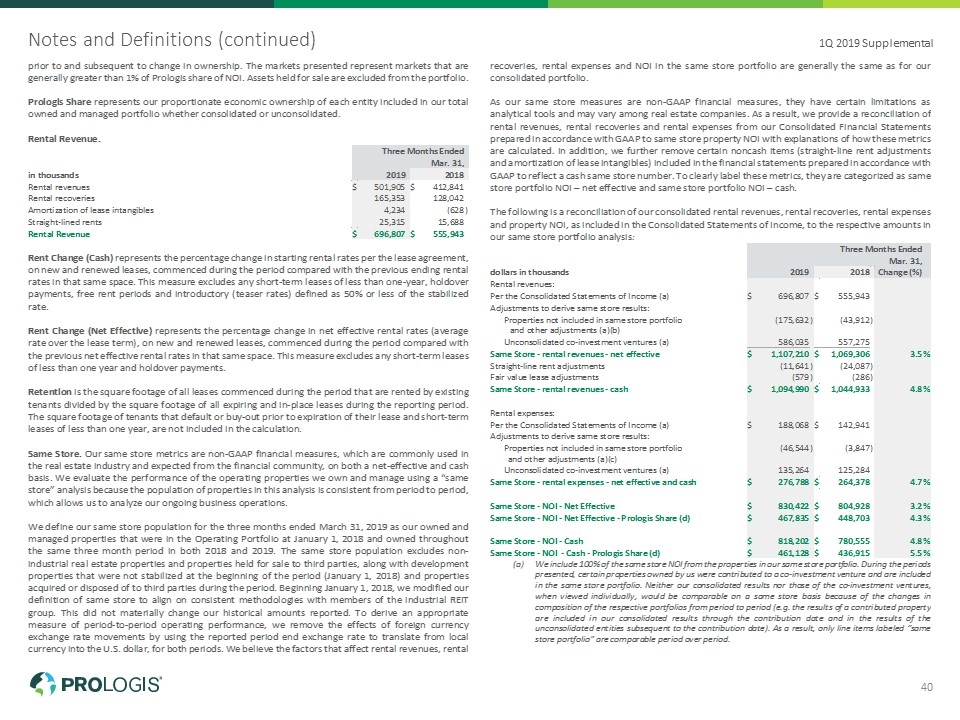

Notes and Definitions 1Q 2019 Supplemental 34Please refer to our annual and quarterly financial statements filed with the Securities and Exchange Commission on Forms 10-K and 10-Q and other public reports for further information about us and our business. Certain amounts from previous periods presented in the Supplemental Information have been reclassified to conform to the current presentation. Acquisition Price, as presented for building acquisitions, represent economic cost. This amount includes the building purchase price plus 1) transaction closing costs, 2) due diligence costs, 3) immediate capital expenditures (including two years of property improvements and all leasing commissions and tenant improvements required to stabilize the property), 4) the effects of marking assumed debt to market and 5) the net present value of free rent and discounts, if applicable. Adjusted Cash NOI (Actual) is a non-Generally Accepted Accounting Principles (“GAAP”) financial measure and a component of Net Asset Value (“NAV”). It is used to assess the operating performance of our properties and enables both management and investors to estimate the fair value of our operating portfolio. A reconciliation for the most recent quarter ended of our rental income and rental expenses included in our Consolidated Statement of Income to Adjusted Cash NOI for the consolidated Operating Portfolio is as follows (in thousands):Rental revenues$696,807 Rental expenses (188,068)NOI 508,739 Net termination fees and adjustments (a) (1,945)Less: actual NOI for development portfolio and other (21,184)Property management fees 1,264 Less: properties contributed or sold (b) (2,671)Less: noncontrolling interests share of NOI (43,955)Prologis share of adjusted NOI for consolidated Operating Portfolio at March 31, 2019 440,248 Straight-line rents (c) (18,715)Free rent (c) 16,716 Amortization of lease intangibles (c) (3,815)Effect of foreign currency exchange (d) (71)Less: noncontrolling interests and other 169 First quarter Adjusted Cash NOI (Actual)$434,532 (a) Net termination fees generally represent the gross fee negotiated at the time a customer is allowed to terminate its lease agreement offset by that customer’s rent leveling asset or liability, if any, that has been previously recognized. Removing the net termination fees from rental income allows for the calculation of Adjusted Cash NOI (Actual) to include only rental income that is indicative of the property’s recurring operating performance.(b) Actual NOI for properties that were contributed or sold during the three-month period is removed.(c) Straight-line rents, free rent and amortization of lease intangibles (above and below market leases) are removed from the rental income of our Operating Portfolio to allow for the calculation of a cash yield. (d) Actual NOI and related adjustments are calculated in local currency and translated at the period end rate to allow for consistency with other assets and liabilities as of the reporting date.Adjusted Cash NOI (Pro forma) is a non-GAAP financial measure and consists of Adjusted Cash NOI (Actual) for the properties in our Operating Portfolio adjusted to reflect NOI for a full quarter for operating properties that were acquired or stabilized during the quarter. Adjusted EBITDA. We use Adjusted EBITDA attributable to common stockholders/unitholders (“Adjusted EBITDA”), a non-GAAP financial measure, as a measure of our operating performance. The most directly comparable GAAP measure to Adjusted EBITDA is net earnings. We calculate Adjusted EBITDA beginning with consolidated net earnings attributable to common stockholders and removing the effect of: interest expense, income taxes, depreciation and amortization, impairment charges, gains or losses from the disposition of investments in real estate (excluding development properties and land), gains from the revaluation of equity investments upon acquisition of a controlling interest, gains or losses on early extinguishment of debt and derivative contracts (including cash charges), similar adjustments we make to our FFO measures (see definition below), and other items, such as, stock based compensation and unrealized gains or losses on foreign currency and derivatives. We also include a pro forma adjustment to reflect a full period of NOI on the operating properties we acquire or stabilize during the quarter and to remove NOI on properties we dispose of during the quarter, assuming all transactions occurred at the beginning of the quarter. The pro forma adjustment also includes economic ownership changes in our ventures to reflect the full quarter at the new ownership percentage.We believe Adjusted EBITDA provides investors relevant and useful information because it permits investors to view our operating performance, analyze our ability to meet interest payment obligations and make quarterly preferred stock dividends on an unleveraged basis before the effects of income tax, depreciation and amortization expense, gains and losses on the disposition of non-development properties and other items (outlined above), that affect comparability. While all items are not infrequent or unusual in nature, these items may result from market fluctuations that can have inconsistent effects on our results of operations. The economics underlying these items reflect market and financing conditions in the short-term but can obscure our performance and the value of our long-term investment decisions and strategies. We calculate our Adjusted EBITDA, based on our proportionate ownership share of both our unconsolidated and consolidated ventures. We reflect our share of our Adjusted EBITDA measures for unconsolidated ventures by applying our average ownership percentage for the period to the applicable reconciling items on an entity by entity basis. We reflect our share for consolidated ventures in which we do not own 100% of the equity by adjusting our Adjusted EBITDA measures to remove the noncontrolling interests share of the applicable reconciling items based on our average ownership percentage for the applicable periods.While we believe Adjusted EBITDA is an important measure, it should not be used alone because it excludes significant components of net earnings, such as our historical cash expenditures or future cash requirements for working capital, capital expenditures, distribution requirements, contractual commitments or interest and principal payments on our outstanding debt and is therefore limited as an analytical tool. Our computation of Adjusted EBITDA may not be comparable to EBITDA reported by other companies in both the real estate industry and other industries. We compensate for the limitations of Adjusted EBITDA by providing investors with financial statements prepared according to GAAP, along with this detailed discussion of Adjusted EBITDA and a reconciliation to Adjusted EBITDA from consolidated net earnings attributable to common stockholders.Annualized Estimated NOI for the properties in our Development Portfolio is based on current TEI multiplied by the Estimated Weighted Average Stabilized Yield.Assets Under Management (“AUM”) represents the estimated fair value of the real estate we own or manage through both our consolidated and unconsolidated entities. We calculate AUM by adding Investment Capacity and the third-party investors’ share of the estimated fair value of the assets in the co-investment ventures to Enterprise Value.Business Line Reporting is a non-GAAP financial measure. Core FFO and development gains are generated by our three lines of business: (i) real estate operations; (ii) strategic capital; and (iii) development. The real estate operations line of business represents total Prologis Core FFO, less the amount allocated to the Strategic Capital line of business. The amount of Core FFO allocated to the Strategic Capital line of business represents the third party share of asset management, Net Promotes and transactional fees that we earn from our consolidated and unconsolidated co-investment ventures less costs directly associated to our strategic capital group. Realized development gains include our share of gains on dispositions of development properties and land, net of taxes. To calculate the per share amount, the amount generated by each line of business is divided by the weighted average diluted common shares outstanding used in our Core FFO per share calculation. Management believes evaluating our results by line of business is a useful supplemental measure of our operating performance because it helps the investing public compare the operating performance of Prologis’ respective businesses to other companies’ comparable businesses. Prologis’ computation of FFO by line of business may not be comparable to that reported by other real estate investment trusts as they may use different methodologies in computing such measures.Calculation of Per Share Amounts Three Months Ended Mar. 31, in thousands, except per share amount 2019 2018 Net earnings Net earnings attributable to common stockholders$347,047 $365,902 Noncontrolling interest attributable to exchangeable limited partnership units 10,657 10,693 Adjusted net earnings attributable to common stockholders - Diluted$357,704 $376,595 Weighted average common shares outstanding - Basic 629,676 532,185 Incremental weighted average effect on exchange of limited partnership units 19,718 16,270 Incremental weighted average effect of equity awards 4,965 5,668 Weighted average common shares outstanding - Diluted 654,359 554,123 Net earnings per share - Basic$0.55 $0.69 Net earnings per share - Diluted$0.55 $0.68 Core FFO Core FFO attributable to common stockholders/unitholders$474,251 $443,120 Noncontrolling interest attributable to exchangeable limited partnership units 194 370 Core FFO attributable to common stockholders/unitholders - Diluted$474,445 $443,490 Weighted average common shares outstanding - Basic 629,676 532,185 Incremental weighted average effect on exchange of limited partnership units 19,718 16,270 Incremental weighted average effect of equity awards 4,965 5,668 Weighted average common shares outstanding - Diluted 654,359 554,123 Core FFO per share - Diluted$0.73 $0.80 Debt Covenants are calculated in accordance with the respective debt agreements and may be different than other covenants or metrics presented. They are not calculated in accordance with the applicable Securities Exchange Commission rules. Please refer to the respective agreements for full financial covenant descriptions. Debt covenants as of the period end were as follows: Indenture Global Line CovenantActual CovenantActual Leverage ratio<60% 24.4% <60% 22.8%Fixed charge coverage ratio>1.5x10.31x >1.5x11.12xSecured debt leverage ratio<40% 1.4% <40% 2.1%Unencumbered asset to unsecured debt ratio>150% 353.9% N/AN/A Unencumbered debt service coverage ratioN/AN/A >150% 1043.0%Debt Metrics. We evaluate the following debt metrics to monitor the strength and flexibility of our capital structure and evaluate the performance of our management. Investors can utilize these metrics to make a determination about our ability to service or refinance our debt. See below for the calculations. Three Months Ended Mar. 31, Dec. 31, dollars in thousands2019 2018 Debt as a % of gross real estate assets: Consolidated debt (at par)$ 10,777,280 $ 11,161,326 Noncontrolling interests share of consolidated debt (at par) (12,880) (13,119) Prologis share of unconsolidated debt (at par) 2,058,866 2,048,777 Total Prologis share of debt (at par) 12,823,266 13,196,984 Prologis share of outstanding foreign currency derivatives (826) (1,519) Consolidated cash and cash equivalents (251,030) (343,856) Noncontrolling interests share of consolidated cash and cash equivalents 16,316 71,078 Prologis share of unconsolidated cash and cash equivalents (268,625) (203,997) Total Prologis share of debt, net of adjustments$ 12,319,101 $ 12,718,690 Consolidated gross real estate assets 36,022,090 35,935,596 Noncontrolling interests share of consolidated gross real estate assets (3,056,890) (3,230,062) Prologis share of unconsolidated gross real estate assets 8,641,725 8,838,699 Total Prologis share of gross real estate assets$ 41,606,925 $ 41,544,233 Debt as a % of gross real estate assets 29.6% 30.6% Debt as a % of gross Market Capitalization: Total Prologis share of debt, net of adjustments$ 12,319,102 $ 12,718,690 Total outstanding common stock and limited partnership units 650,291 648,488 Share price at quarter end$ 71.95 $ 58.72 Total equity capitalization$ 46,788,437 $ 38,079,215 Total Prologis share of debt, net of adjustments 12,319,102 12,718,690 Gross Market Capitalization$ 59,107,539 $ 50,797,905 Debt as a % of gross Market Capitalization 20.8% 25.0% Secured debt as a % of gross real estate assets: Consolidated secured debt (at par)$ 956,565 $ 816,360 Noncontrolling interests share of consolidated secured debt (at par) (12,880) (13,119) Prologis share of unconsolidated secured debt (at par) 637,026 653,600 Total Prologis share of secured debt (at par)$ 1,580,711 $ 1,456,841 Total Prologis share of gross real estate assets$ 41,606,925 $ 41,544,233 Secured debt as a % of gross real estate assets 3.8% 3.5% Unencumbered gross real estate assets to unsecured debt: Consolidated unencumbered gross real estate assets$ 33,613,448 $ 33,612,091 Noncontrolling interests share of consolidated unencumbered gross real estate assets (2,972,766) (3,160,219) Prologis share of unconsolidated unencumbered gross real estate assets 7,050,610 7,278,081 Total Prologis share of unencumbered gross real estate assets$ 37,691,292 $ 37,729,953 Consolidated unsecured debt (at par) 9,820,715 10,344,965 Noncontrolling interests share of consolidated unsecured debt (at par) - - Prologis share of unconsolidated unsecured debt (at par) 1,421,840 1,395,177 Total Prologis share of unsecured debt (at par)$ 11,242,555 $ 11,740,142 Unencumbered gross real estate assets to unsecured debt 335.3% 321.4% Three Months Ended Mar. 31 Dec. 31, dollars in thousands2019 2018 Fixed Charge Coverage ratio: Adjusted EBITDA$ 654,410 $ 792,630 Adjusted EBITDA-annualized including development gains and excluding net promotes (a)$ 2,826,308 $ 2,942,662 Net promotes for the trailing 12 months 26,926 82,108 Adjusted EBITDA-annualized$ 2,853,234 $ 3,024,770 Pro forma adjustment annualized (10,188) (1,857) Adjusted EBITDA, including NOI from disposed properties, annualized$ 2,843,046 $ 3,022,913 Interest expense$ 60,507 $ 62,380 Amortization and write-off of deferred loan costs (3,323) (3,460) Amortization of debt premiums, net (839) (660) Capitalized interest 13,722 15,634 Preferred stock dividends 1,499 1,492 Noncontrolling interests share of consolidated fixed charges (35) (28) Prologis share of unconsolidated fixed charges 16,789 17,294 Total Prologis share of fixed charges$ 88,320 $ 92,652 Total Prologis share of fixed charges, annualized$ 353,280 $ 370,608 Fixed charge coverage ratio 8.05 8.16 Debt to Adjusted EBITDA: Total Prologis share of debt, net of adjustments$ 12,319,102 $ 12,718,690 Adjusted EBITDA-annualized$ 2,853,234 $ 3,024,770 Debt to Adjusted EBITDA ratio 4.32 4.20 Prologis share of gains on dispositions of development properties for the trailing 12 months was $358.1 million and $479.7 million for the current quarter and the previous quarter, respectively.Development Portfolio includes industrial properties that are under development and properties that are developed but have not met Stabilization.Enterprise Value equals our Market Equity plus our share of total debt.Estimated Build Out (TEI and sq ft) represents the estimated TEI and finished square feet available for lease upon completion of an industrial building on existing parcels of land.Estimated Value Creation represents the value that we expect to create through our development and leasing activities. We calculate Estimated Value Creation by estimating the Stabilized NOI that the property will generate and applying a stabilized capitalization rate applicable to that property. Estimated Value Creation is calculated as the amount by which the value exceeds our TEI and does not include any fees or promotes we may earn. Estimated Value Creation for our Value-Added Properties that are sold includes the realized economic gain.Estimated Weighted Average Margin is calculated on development properties as Estimated Value Creation, less estimated closing costs and taxes, if any, on properties expected to be sold or contributed, divided by TEI. Estimated Weighted Average Stabilized Yield is calculated on development properties as Stabilized NOI divided by TEI.FFO, as modified by Prologis attributable to common stockholders/unitholders (“FFO, as modified by Prologis”); Core FFO attributable to common stockholders/unitholders (“Core FFO”); AFFO attributable to common stockholders/unitholders (“AFFO”); (collectively referred to as “FFO”). FFO is a non-GAAP financial measure that is commonly used in the real estate industry. The most directly comparable GAAP measure to FFO is net earnings. The National Association of Real Estate Investment Trusts (“NAREIT”) defines FFO as earnings computed under GAAP to exclude historical cost depreciation and gains and losses from the sales, along with impairment charges, of previously depreciated properties. We also exclude the gains on revaluation of equity investments upon acquisition of a controlling interest and the gain recognized from a partial sale of our investment, as these are similar to gains from the sales of previously depreciated properties. We exclude similar adjustments from our unconsolidated entities and the third parties’ share of our consolidated co-investment ventures.Our FFO MeasuresOur FFO measures begin with NAREIT’s definition and we make certain adjustments to reflect our business and the way that management plans and executes our business strategy. While not infrequent or unusual, the additional items we adjust for in calculating FFO, as modified by Prologis, Core FFO and AFFO, as defined below, are subject to significant fluctuations from period to period. Although these items may have a material impact on our operations and are reflected in our financial statements, the removal of the effects of these items allows us to better understand the core operating performance of our properties over the long term. These items have both positive and negative short-term effects on our results of operations in inconsistent and unpredictable directions that are not relevant to our long-term outlook.We calculate our FFO measures, as defined below, based on our proportionate ownership share of both our unconsolidated and consolidated ventures. We reflect our share of our FFO measures for unconsolidated ventures by applying our average ownership percentage for the period to the applicable reconciling items on an entity by entity basis. We reflect our share for consolidated ventures in which we do not own 100% of the equity by adjusting our FFO measures to remove the noncontrolling interests share of the applicable reconciling items based on our average ownership percentage for the applicable periods.These FFO measures are used by management as supplemental financial measures of operating performance and we believe that it is important that stockholders, potential investors and financial analysts understand the measures management uses. We do not use our FFO measures as, nor should they be considered to be, alternatives to net earnings computed under GAAP, as indicators of our operating performance, as alternatives to cash from operating activities computed under GAAP or as indicators of our ability to fund our cash needs.We analyze our operating performance principally by the rental revenues of our real estate and the revenues from our strategic capital business, net of operating, administrative and financing expenses. This income stream is not directly impacted by fluctuations in the market value of our investments in real estate or debt securities. FFO, as modified by Prologis To arrive at FFO, as modified by Prologis, we adjust the NAREIT defined FFO measure to exclude the impact of foreign currency related items and deferred tax, specifically:deferred income tax benefits and deferred income tax expenses recognized by our subsidiaries;current income tax expense related to acquired tax liabilities that were recorded as deferred tax liabilities in an acquisition, to the extent the expense is offset with a deferred income tax benefit in earnings that is excluded from our defined FFO measure;unhedged foreign currency exchange gains and losses resulting from debt transactions between us and our foreign consolidated subsidiaries and our foreign unconsolidated entities;foreign currency exchange gains and losses from the remeasurement (based on current foreign currency exchange rates) of certain third party debt of our foreign consolidated and unconsolidated entities; and mark-to-market adjustments associated with derivative financial instruments.We use FFO, as modified by Prologis, so that management, analysts and investors are able to evaluate our performance against other REITs that do not have similar operations or operations in jurisdictions outside the U.S.Core FFO In addition to FFO, as modified by Prologis, we also use Core FFO. To arrive at Core FFO, we adjust FFO, as modified by Prologis, to exclude the following recurring and nonrecurring items that we recognized directly in FFO, as modified by Prologis:gains or losses from the disposition of land and development properties that were developed with the intent to contribute or sell;income tax expense related to the sale of investments in real estate;impairment charges recognized related to our investments in real estate generally as a result of our change in intent to contribute or sell these properties; gains or losses from the early extinguishment of debt and redemption and repurchase of preferred stock; andexpenses related to natural disasters.We use Core FFO, including by segment and region, to: (i) assess our operating performance as compared to other real estate companies; (ii) evaluate our performance and the performance of our properties in comparison with expected results and results of previous periods; (iii) evaluate the performance of our management; (iv) budget and forecast future results to assist in the allocation of resources; (v) provide guidance to the financial markets to understand our expected operating performance; and (vi) evaluate how a specific potential investment will impact our future results. AFFOTo arrive at AFFO, we adjust Core FFO to include realized gains from the disposition of land and development properties and recurring capital expenditures and exclude the following items that we recognize directly in Core FFO: (i) straight-line rents; (ii) amortization of above- and below-market lease intangibles; (iii) amortization of management contracts; (iv) amortization of debt premiums and discounts and financing costs, net of amounts capitalized, and; (v) stock compensation expense. We use AFFO to (i) assess our operating performance as compared to other real estate companies, (ii) evaluate our performance and the performance of our properties in comparison with expected results and results of previous periods, (iii) evaluate the performance of our management, (iv) budget and forecast future results to assist in the allocation of resources, and (v) evaluate how a specific potential investment will impact our future results.Limitations on the use of our FFO measuresWhile we believe our modified FFO measures are important supplemental measures, neither NAREIT’s nor our measures of FFO should be used alone because they exclude significant economic components of net earnings computed under GAAP and are, therefore, limited as an analytical tool. Accordingly, these are only a few of the many measures we use when analyzing our business. Some of the limitations are:The current income tax expenses that are excluded from our modified FFO measures represent the taxes and transaction costs that are payable.Depreciation and amortization of real estate assets are economic costs that are excluded from FFO. FFO is limited, as it does not reflect the cash requirements that may be necessary for future replacements of the real estate assets. Furthermore, the amortization of capital expenditures and leasing costs necessary to maintain the operating performance of logistics facilities are not reflected in FFO.Gains or losses from non-development property dispositions and impairment charges related to expected dispositions represent changes in value of the properties. By excluding these gains and losses, FFO does not capture realized changes in the value of disposed properties arising from changes in market conditions.The deferred income tax benefits and expenses that are excluded from our modified FFO measures result from the creation of a deferred income tax asset or liability that may have to be settled at some future point. Our modified FFO measures do not currently reflect any income or expense that may result from such settlement.The foreign currency exchange gains and losses that are excluded from our modified FFO measures are generally recognized based on movements in foreign currency exchange rates through a specific point in time. The ultimate settlement of our foreign currency-denominated net assets is indefinite as to timing and amount. Our FFO measures are limited in that they do not reflect the current period changes in these net assets that result from periodic foreign currency exchange rate movements. The gains and losses on extinguishment of debt or preferred stock that we exclude from our Core FFO, may provide a benefit or cost to us as we may be settling our obligation at less or more than our future obligation. The natural disaster expenses that we exclude from Core FFO are costs that we have incurred. We compensate for these limitations by using our FFO measures only in conjunction with net earnings computed under GAAP when making our decisions. This information should be read with our complete Consolidated Financial Statements prepared under GAAP. To assist investors in compensating for these limitations, we reconcile our modified FFO measures to our net earnings computed under GAAP.General and Administrative Expenses (“G&A”). Generally our property management personnel perform the property-level management of the properties in our owned and managed portfolio, which include properties we consolidate and those we manage that are owned by the unconsolidated co-investment ventures. We allocate the costs of our property management function to the properties we consolidate (included in Rental Expenses) and the properties owned by the unconsolidated co-investment ventures (included in Strategic Capital Expenses) by using the square feet owned by the respective portfolios. Strategic Capital Expenses also include the direct expenses associated with the asset management of the unconsolidated co-investment ventures provided by our employees who are assigned to our Strategic Capital segment. We do not allocate indirect costs to Strategic Capital Expenses.We capitalize certain costs directly related to our development. We also capitalized certain costs directly related to our leasing activities through 2018. Capitalized G&A expenses include salaries and related costs as well as other G&A costs. The capitalized costs were as follows: Three Months Ended Mar. 31, in thousands2019 2018 Building and land development activities$19,270 $16,091 Leasing activities- 5,388 Operating building improvements and other 5,105 4,244 Total capitalized G&A$24,375 $25,723 G&A as a Percent of Assets Under Management (in thousands):Net G&A - midpoint of 2019 guidance$250,000 Add: estimated 2019 strategic capital expenses (excluding promote expense) 126,000 Less: estimated 2019 strategic capital property management expenses (69,000)Adjusted G&A, using 2019 guidance amounts$307,000 Gross book value at period end (a): Operating properties$62,069,464 Development portfolio - TEI 4,336,693 Land portfolio 1,501,587 Other real estate investments and gross book value of assets held for sale 1,039,571 Total value of assets under management$68,947,315 G&A as % of assets under management 0.45%This does not represent enterprise value.Guidance. The following is a reconciliation of our annual guided Net Earnings per share to our guided Core FFO per share: Low High Net Earnings$3.20 $3.26 Our share of: Depreciation and amortization (1.93) (1.97)Net gains on real estate transactions, net of taxes 0.92 1.00 Unrealized foreign currency gains and other, net (a) 0.01 0.01 Core FFO$2.20 $2.30 Earnings guidance includes potential future gains recognized from real estate transactions, but excludes future foreign currency or derivative gains or losses as these items are difficult to predict.Income Taxes. Three Months Ended Mar. 31, in thousands2019 2018 Current income tax expense$10,320 $11,127 Current income tax expense (benefit) on dispositions 2,399 6,611 Current income tax expense (benefit) on dispositions related to acquired tax liabilities - 878 Total current income tax expense 12,719 18,616 Deferred income tax (benefit) expense 793 (1,186)Deferred income tax (benefit) expense on dispositions related to acquired tax liabilities - (878)Total income tax expense$13,512 $16,552 Interest Expense. Three Months Ended Mar. 31, in thousands2019 2018 Gross interest expense$70,067 $55,350 Amortization of debt premiums, net 839 (344)Amortization of finance costs 3,323 3,358 Interest expense before capitalization 74,229 58,364 Capitalized amounts (13,722) (11,119)Interest expense$60,507 $47,245 Investment Capacity is our estimate of the gross real estate that could be acquired by our co-investment ventures through the use of existing equity commitments from us and our partners assuming the maximum leverage limits of the ventures are used.Market Capitalization equals Market Equity, less liquidation preference of the preferred shares/units, plus our share of total debt.Market Classification Global Markets feature large population centers with high per-capita consumption and are located near major seaports, airports, and ground transportation systems. Regional Markets benefit from large population centers but typically are not as tied to the global supply chain, but rather serve local consumption and are often less supply constrained. Markets included as regional markets include: Austin, Charlotte, Cincinnati, Columbus, Denver, Hungary, Indianapolis, Juarez, Las Vegas, Louisville, Memphis, Nashville, Orlando, Phoenix, Portland, Reno, Reynosa, San Antonio, Slovakia, Sweden and Tijuana. Market Equity equals outstanding shares of common stock and units multiplied by the closing stock price plus the liquidation preference of the preferred shares/units.Net Asset Value (“NAV”). We consider NAV to be a useful supplemental measure of our operating performance because it enables both management and investors to estimate the fair value of our business. The assessment of the fair value of a particular line of our business is subjective in that it involves estimates and can be calculated using various methods. Therefore, we have presented the financial results and investments related to our business components that we believe are important in calculating our NAV but we have not presented any specific methodology nor provided any guidance on the assumptions or estimates that should be used in the calculation.The components of NAV do not consider the potential changes in rental and fee income streams or the franchise value associated with our global operating platform, strategic capital platform or development platform. Net Effective Rent is calculated at the beginning of the lease using estimated total cash rent to be received over the term and annualized. Amounts derived in a currency other than the U.S. dollar have been translated using the average rate from the previous twelve months. The per square foot number is calculated by dividing the Net Effective Rent by the occupied square feet of the lease.Net Operating Income (“NOI”) is a non-GAAP financial measure used to evaluate our operating performance and represents Rental Revenue less rental expenses.Net Promote includes actual promote revenue earned from third party investors during the period, net of related cash and stock compensation expenses.Non-GAAP Pro-Rata Financial Information. This information includes non-GAAP financial measures. The Prologis share of unconsolidated co-investment ventures are derived on an entity-by-entity basis by applying our ownership percentage to each line item in the GAAP financial statements of these ventures to calculate our share of that line item. For purposes of balance sheet data, we use our ownership percentage at the end of the period and for operating information we use our average ownership percentage during the period consistent with how we calculate our share of net earnings (loss) during the period for our consolidated financial statements. We use a similar calculation to derive the noncontrolling interests’ share of each line item in our consolidated financial statements. We believe this form of presentation offers insights into the financial performance and condition of our company as a whole, given the significance of our co-investment ventures that are accounted for either under the equity method or consolidated with the third parties’ share included in noncontrolling interests, although the presentation of such information may not accurately depict the legal and economic implications of holding a non-controlling interest in the co-investment venture. Other companies may calculate their proportionate interest differently than we do, limiting the usefulness as a comparative measure.We do not control the unconsolidated co-investment ventures for purposes of GAAP and the presentation of the assets and liabilities and revenues and expenses do not represent a legal claim to such items. The operating agreements of the unconsolidated co-investment ventures generally provide that investors, including Prologis, may receive cash distributions (1) to the extent there is available cash from operations, (2) upon a capital event, such as a refinancing or sale, or (3) upon liquidation of the venture. The amount of cash each investor receives is based upon specific provisions of each operating agreement and varies depending on factors including the amount of capital contributed by each investor and whether any contributions are entitled to priority distributions. Upon liquidation of the co-investment venture and after all liabilities, priority distributions and initial equity contributions have been repaid, the investors generally would be entitled to any residual cash remaining based on their respective legal ownership percentages.Because of these limitations, the Non-GAAP Pro-Rata Financial Information should not be considered in isolation or as a substitute for our consolidated financial statements as reported under GAAP.Operating Portfolio represents industrial properties in our owned and managed portfolio that have reached Stabilization. Prologis share of NOI excludes termination fees and adjustments and includes NOI for the properties contributed to or acquired from co-investment ventures at our actual share prior to and subsequent to change in ownership. The markets presented represent markets that are generally greater than 1% of Prologis share of NOI. Assets held for sale are excluded from the portfolio.Prologis Share represents our proportionate economic ownership of each entity included in our total owned and managed portfolio whether consolidated or unconsolidated. Rental Revenue. Three Months Ended Mar. 31, in thousands2019 2018 Rental revenues$501,905 $412,841 Rental recoveries 165,353 128,042 Amortization of lease intangibles 4,234 (628)Straight-lined rents 25,315 15,688 Rental Revenue$696,807 $555,943 Rent Change (Cash) represents the percentage change in starting rental rates per the lease agreement, on new and renewed leases, commenced during the period compared with the previous ending rental rates in that same space. This measure excludes any short-term leases of less than one-year, holdover payments, free rent periods and introductory (teaser rates) defined as 50% or less of the stabilized rate.Rent Change (Net Effective) represents the percentage change in net effective rental rates (average rate over the lease term), on new and renewed leases, commenced during the period compared with the previous net effective rental rates in that same space. This measure excludes any short-term leases of less than one year and holdover payments.Retention is the square footage of all leases commenced during the period that are rented by existing tenants divided by the square footage of all expiring and in-place leases during the reporting period. The square footage of tenants that default or buy-out prior to expiration of their lease and short-term leases of less than one year, are not included in the calculation.Same Store. Our same store metrics are non-GAAP financial measures, which are commonly used in the real estate industry and expected from the financial community, on both a net-effective and cash basis. We evaluate the performance of the operating properties we own and manage using a “same store” analysis because the population of properties in this analysis is consistent from period to period, which allows us to analyze our ongoing business operations. We define our same store population for the three months ended March 31, 2019 as our owned and managed properties that were in the Operating Portfolio at January 1, 2018 and owned throughout the same three month period in both 2018 and 2019. The same store population excludes non-industrial real estate properties and properties held for sale to third parties, along with development properties that were not stabilized at the beginning of the period (January 1, 2018) and properties acquired or disposed of to third parties during the period. Beginning January 1, 2018, we modified our definition of same store to align on consistent methodologies with members of the industrial REIT group. This did not materially change our historical amounts reported. To derive an appropriate measure of period-to-period operating performance, we remove the effects of foreign currency exchange rate movements by using the reported period end exchange rate to translate from local currency into the U.S. dollar, for both periods. We believe the factors that affect rental revenues, rental recoveries, rental expenses and NOI in the same store portfolio are generally the same as for our consolidated portfolio. As our same store measures are non-GAAP financial measures, they have certain limitations as analytical tools and may vary among real estate companies. As a result, we provide a reconciliation of rental revenues, rental recoveries and rental expenses from our Consolidated Financial Statements prepared in accordance with GAAP to same store property NOI with explanations of how these metrics are calculated. In addition, we further remove certain noncash items (straight-line rent adjustments and amortization of lease intangibles) included in the financial statements prepared in accordance with GAAP to reflect a cash same store number. To clearly label these metrics, they are categorized as same store portfolio NOI – net effective and same store portfolio NOI – cash.The following is a reconciliation of our consolidated rental revenues, rental recoveries, rental expenses and property NOI, as included in the Consolidated Statements of Income, to the respective amounts in our same store portfolio analysis: Three Months Ended Mar. 31, dollars in thousands2019 2018 Change (%) Rental revenues: Per the Consolidated Statements of Income (a) 696,807 555,943 Adjustments to derive same store results: Properties not included in same store portfolio and other adjustments (a)(b) (175,632) (43,912) Unconsolidated co-investment ventures (a) 586,035 557,275 Same Store - rental revenues - net effective$1,107,210 $1,069,306 3.5%Straight-line rent adjustments (11,641) (24,087) Fair value lease adjustments (579) (286) Same Store - rental revenues - cash$1,094,990 $1,044,933 4.8% Rental expenses: Per the Consolidated Statements of Income (a)$188,068 $142,941 Adjustments to derive same store results: Properties not included in same store portfolio and other adjustments (a)(c) (46,544) (3,847) Unconsolidated co-investment ventures (a) 135,264 125,284 Same Store - rental expenses - net effective and cash$276,788 $264,378 4.7% Same Store - NOI - Net Effective$830,422 $804,928 3.2%Same Store - NOI - Net Effective - Prologis Share (d)$467,835 $448,703 4.3% Same Store - NOI - Cash$818,202 $780,555 4.8%Same Store - NOI - Cash - Prologis Share (d)$461,128 $436,915 5.5%We include 100% of the same store NOI from the properties in our same store portfolio. During the periods presented, certain properties owned by us were contributed to a co-investment venture and are included in the same store portfolio. Neither our consolidated results nor those of the co-investment ventures, when viewed individually, would be comparable on a same store basis because of the changes in composition of the respective portfolios from period to period (e.g. the results of a contributed property are included in our consolidated results through the contribution date and in the results of the unconsolidated entities subsequent to the contribution date). As a result, only line items labeled “same store portfolio” are comparable period over period. We exclude non-industrial real estate properties and properties held for sale, along with development properties that were not stabilized at the beginning of the reporting period or properties acquired or disposed of to third parties during the period. We also exclude net termination and renegotiation fees to allow us to evaluate the growth or decline in each property’s rental revenues without regard to one-time items that are not indicative of the property’s recurring operating performance. Net termination and renegotiation fees represent the gross fee negotiated to allow a customer to terminate or renegotiate their lease, offset by the write-off of the asset recorded due to the adjustment to straight-line rents over the lease term. Rental expenses include the direct operating expenses of the property such as property taxes, insurance and utilities. In addition, we include an allocation of the property management expenses for our consolidated properties based on the property management services provided to each property (generally, based on a percentage of revenues). On consolidation, these amounts are eliminated and the actual costs of providing property management services are recognized as part of our consolidated rental expenses. These expenses fluctuate based on the level of properties included in the same store portfolio and any adjustment is included as “effect of changes in foreign currency exchange rates and other” in this table.Same Store- NOI- Prologis Share is calculated using the underlying building information from the Same Store NOI – Net Effective and NOI - Cash calculations and applying our ownership percentage as of March 31, 2019 to the NOI of each building for both periods.Same Store Average Occupancy represents the average occupied percentage of the Same Store portfolio for the period. Stabilization is defined as the earlier of when a property that was developed has been completed for one year or is 90% occupied. Upon Stabilization, a property is moved into our Operating Portfolio.Stabilized NOI is equal to the estimated twelve months of potential gross rental revenue (base rent, including above or below market rents plus operating expense reimbursements) multiplied by 95% to adjust income to a stabilized vacancy factor of 5%, minus estimated operating expenses.Total Expected Investment (“TEI”) represents total estimated cost of development or expansion, including land, development and leasing costs. TEI is based on current projections and is subject to change. Turnover Costs represent the estimated obligations incurred in connection with the signing of a lease; including leasing commissions and tenant improvements and are presented for leases that commenced during the period. Tenant improvements include costs to prepare a space for a new tenant or a lease renewal with the current tenant. It excludes costs for a first generation lease (i.e. a new development property) and short-term leases of less than one year.Value-Added Properties are properties we have either acquired at a discount and believe we could provide greater returns post-stabilization or properties we expect to repurpose to a higher and better use.Weighted Average Interest Rate is based on the effective rate, which includes the amortization of related premiums and discounts and finance costs. Weighted Average Stabilized Capitalization (“Cap”) Rate is calculated as Stabilized NOI divided by the Acquisition Price.