Exhibit 10.1

PROLOGIS, INC.

Amended and restated 2018 OUTPERFORMANCE PLAN

WHEREAS, the Compensation Committee (the “Committee”) of the Board of Directors (the “Board”) of Prologis, Inc. (the “Company”) previously adopted the 2016 Outperformance Plan (the “Prior Plan”); and

WHEREAS, in order to increase the retentive value of the Prior Plan and to implement the imposition of an absolute aggregate limit on the amounts payable under the Prior Plan given the increase in the Company’s market capitalization, the Committee has determined that it is in the best interests of the Company to amend and restate the Prior Plan.

ARTICLE 1 - GENERAL

1.1Purpose and Authority. This 2018 Outperformance Plan (as amended, restated and supplemented from time to time, this “2018 Outperformance Plan”) was adopted by the Committee of the Board of the Company effective as of January 11, 2018, pursuant to authority delegated to it by the Board as set forth in the Committee’s charter. Equity awards granted under this 2018 Outperformance Plan shall be issued pursuant to the Company’s existing equity incentive plans, or any equity incentive plan approved by the Company’s stockholders in the future, and only to the extent there are shares of the Company’s common stock, par value $0.01 per share (the “Common Stock”), available under such equity incentive plans. The purpose of this 2018 Outperformance Plan is to create a supplemental long-term incentive opportunity to support the Company’s multi-year business plans and to drive outstanding performance.

1.2Administration. This 2018 Outperformance Plan and all Awards issued hereunder shall be administered by the Committee; provided that all powers of the Committee hereunder can be exercised by the full Board if the Board so elects.

1.3Definitions.

“Absolute Shareholder Return” means, with respect to any measurement period, the cumulative return that would have been realized by a stockholder who (1) bought one share of Common Stock for the Common Stock Price on the last trading day immediately preceding the first date of such measurement period, (2) reinvested each dividend and other distribution declared and having an ex-dividend date during such measurement period with respect to such share of Common Stock (and any other shares previously received upon reinvestment of dividends or other distributions) in additional shares of Common Stock at the Fair Market Value on the ex-dividend date for such dividend or other distribution, and (3) sold such shares of Common Stock on the last day of such measurement period for the Common Stock Price on such date. Appropriate adjustments to the Absolute Shareholder Return shall be made to take into account all stock dividends, stock splits, reverse stock splits and other events that in the good faith judgment of the Committee necessitates action by way of equitable or proportionate adjustment.

“Additional Share Baseline Value” means, with respect to each Additional Share, the

121946-166515 EAS ACTIVE/85991108.7

ACTIVE/93648196.13 AM57

gross proceeds received by the Company upon the issuance of such Additional Share, which amount shall be deemed to equal, as applicable:

(a)if such Additional Share is issued for cash in a public offering or private placement, the gross price to the public or to the purchaser(s);

(b)if such Additional Share is issued in exchange for assets or securities of another Person or upon the acquisition of another Person, the cash value imputed to such Additional Share for purposes of such transaction by the parties thereto, as determined by the Committee, or, if no such value was imputed, the Common Stock Price as of the date of issuance of such Additional Share;

(c)if such Additional Share is issued upon conversion or exchange of equity or debt securities of the Company or any Related Company, which securities were not previously counted as either Initial Shares or Additional Shares, the conversion or exchange price in effect as of the date of conversion or exchange pursuant to the terms of the security being exchanged or converted;

(d)if such Additional Share is issued in connection with a Time-Based Award granted after the Initial Date to employees, non-employee directors, consultants, advisors or other persons or entities as incentive or other compensation for services provided or to be provided to the Company or any Related Company, the grant date fair value per share of Common Stock subject to such Time-Based Award, determined in accordance with generally accepted accounting principles;

(e)if such Additional Share is issued in connection with a Performance-Based Award earned after the Initial Date by employees, non-employee directors, consultants, advisors or other persons or entities as incentive or other compensation for services provided or to be provided to the Company or any Related Company (without regard to (i) the date when such award was granted or (ii) time-based vesting conditions (if any) that may apply after the award becomes earned on the basis of performance-based vesting conditions), the Fair Market Value of a share of Common Stock, on the date the Performance-Based Award is earned, used by the Committee to convert Total Value into LTIPs or into shares of Common Stock (if such Performance-Based Award was granted under this 2018 Outperformance Plan), or otherwise, the Fair Market Value of a share of Common Stock used to determine the number of LTIPs or shares of Common Stock (as applicable) earned under the terms of the applicable Performance-Based Award; and

(f)if the Additional Share is issued in lieu of cash dividends in a transaction where the stockholder made an election between receipt of cash dividends or Common Stock in lieu thereof, the value of the dividends that would otherwise have been paid.

“Additional Shares” means (without double-counting), as of a particular date of determination, the sum of:

(a)shares of Common Stock issued after the Initial Date and on or before such date of determination in a capital raising transaction, in exchange for assets or securities, upon the acquisition of another entity, upon conversion or exchange of equity or debt securities

2

121946-166515 EAS ACTIVE/85991108.7

ACTIVE/93648196.13 AM57

of the Company, which securities were not previously counted as either Initial Shares or Additional Shares, or through the reinvestment of dividends; plus

(b)the REIT Shares Amount for all Units not held by the Company (assuming that such Units were converted, exercised, exchanged or redeemed for shares of Common Stock as of such date of determination at the applicable conversion, exercise, exchange or redemption rate (or rate deemed applicable by the Committee if there is no such stated rate) pursuant to the applicable instrument governing such Units as of such date), issued after the Initial Date and on or before such date of determination in a capital raising transaction, in exchange for assets or securities, or upon the acquisition of another entity; plus

(c)shares of Common Stock (including, without duplication, the REIT Shares Amount for Units, as applicable) underlying Time-Based Awards granted after the Initial Date and Performance-Based Awards earned after the Initial Date and on or before such date of determination to employees, non-employee directors, consultants, advisors or other persons or entities as incentive or other compensation for services provided or to be provided to the Company or any Related Company; plus

(d)shares of Common Stock (including, without duplication, the REIT Shares Amount for Units, as applicable) issued in lieu of cash dividends in a transaction where the stockholder (or Unit-holders) made an election between receipt of cash dividends or Common Stock (or Units) in lieu thereof.

For the avoidance of doubt, the definition of “Additional Shares” shall exclude (i) shares of Common Stock issued after the Initial Date upon exercise of stock options granted to employees, non-employee directors, consultants, advisors or other persons or entities as incentive or other compensation for services provided or to be provided to the Company or any Related Company, whether such stock options are outstanding on the Initial Date or are awarded thereafter and (ii) all Initial Shares.

“Award” means an award of Participation Points to a Participant under this 2018 Outperformance Plan.

“Award Letter” means the individual letter provided by the Company to a Participant in connection with the Participant’s participation in this 2018 Outperformance Plan that sets forth the number of Participation Points granted to the Participant with respect to a Performance Period.

“Baseline Value” means the average of the Fair Market Value of one share of Common Stock over the 20 consecutive trading days immediately preceding the Initial Date of any Performance Period.

“Buyback Shares” means (without double-counting), as of a particular date of determination:

(a)shares of Common Stock repurchased or redeemed for cash by the Company after the Initial Date and on or before such date of determination in a stock buyback or other similar transaction;

3

121946-166515 EAS ACTIVE/85991108.7

ACTIVE/93648196.13 AM57

(b)the REIT Shares Amount for all Units not held by the Company (assuming that such Units were converted, exercised, exchanged or redeemed for shares of Common Stock as of such date of determination at the applicable conversion, exercise, exchange or redemption rate (or rate deemed applicable by the Committee if there is no such stated rate) pursuant to the applicable instrument governing such Units as of such date) repurchased or redeemed for cash by the Company after the Initial Date and on or before such date of determination; and

(c)shares of Common Stock (including, without duplication, the REIT Shares Amount for Units, as applicable) underlying previously granted Time-Based Awards and Performance-Based Awards (excluding, for the avoidance of doubt, stock options) to employees, non-employee directors, consultants, advisors or other persons or entities as incentive or other compensation for services provided or to be provided to the Company or any Related Company to the extent they are forfeited for failure to become vested or are repurchased for cash (including in respect of tax withholding) by the Company after the Initial Date and on or before such date of determination, if such shares were included in either Initial Shares or Additional Shares.

“Buyback Value” means the cash amount paid to repurchase or redeem a Buyback Share, or in the case of a Buyback Share forfeited without any expenditure of cash by the Company, the Fair Market Value of a share of Common Stock on the date of forfeiture.

“Cause” means, with respect to a Participant, except as otherwise provided in a separate agreement between the Participant and the Company, (a) the willful and continued failure by the Participant to substantially perform his or her duties with the Company or any Related Company after written notification by the Company or any Related Company, (b) the willful engaging by the Participant in conduct which is demonstrably injurious to the Company or any Related Company, monetarily or otherwise, or (c) the engaging by the Participant in egregious misconduct involving serious moral turpitude, determined in the reasonable judgment of the Committee. For purposes hereof, no act, or failure to act, on the Participant’s part shall be deemed “willful” unless done, or omitted to be done, by the Participant not in good faith and without reasonable belief that such action was in the best interest of the Company or any Related Company.

“Change of Control” means any transaction that constitutes a change in the ownership or effective control of the Company or in the ownership of a substantial portion of the assets of the Company within the meaning of Section 409A of the Code and applicable guidance issued thereunder. For purposes of applying the foregoing requirements, the default provisions of Section 409A of the Code and applicable guidance shall apply; provided, however, that for purposes of determining (a) whether a change in effective control of a corporation has occurred based on the acquisition of stock ownership, the percentage threshold that shall be applied shall be “50 percent or more” (rather than “30 percent or more”), and (b) whether a change in the ownership of a substantial portion of a corporation’s assets has occurred, based on an acquisition of threshold of assets having a total gross fair market value equal to or more than 50 percent of the total gross fair market value of all of the assets of the corporation (rather than 40 percent thereof).

“Code” means the Internal Revenue Code of 1986, as amended.

4

121946-166515 EAS ACTIVE/85991108.7

ACTIVE/93648196.13 AM57

“Common Stock Price” means, as of a particular date, the average of the Fair Market Value of one share of Common Stock over the twenty (20) consecutive trading days immediately preceding and including such date; provided, however, that if such date is the date of the Public Announcement of a Transactional Change of Control, the Common Stock Price as of such date shall be equal to the fair market value, as determined by the Committee, of the total consideration payable in the transaction that ultimately results in the Transactional Change of Control for one share of Common Stock, or if such transaction is an asset disposition the fair market value of a share of Common Stock after giving effect to receipt of the total consideration payable for the asset so disposed of, in each case as determined by the Committee.

“Deferred Vesting Amount” means, with respect to the Performance Period for which a Performance Pool has been generated, eighty percent (80%) of the Total Value.

“Disability” means, with respect to a Participant, except as otherwise provided by the Committee, the Participant’s inability, by reason of a medically determinable physical or mental impairment, to engage in the material and substantial duties of his or her regular occupation, which condition is expected to be permanent.

“Dollar-Based Cap” means, with respect to all Awards granted under the Plan in the aggregate, $100,000,000; provided that the Dollar-Based Cap shall be such amount, if different, as the Committee establishes in its sole discretion.

“Eligible Person” means any executive or employee of the Company or any Related Company.

“Ending Value” with respect to any Performance Period means (without double-counting), as of the Valuation Date, a dollar amount equal to the sum of:

(a)the Total Shares as of the Valuation Date multiplied by the Common Stock Price as of the Valuation Date, plus

(b)the Buyback Value for all Buyback Shares, plus

(c)an amount equal to the amount that would have been realized had (i) each dividend and other distribution declared by the Company and having an ex-dividend date during a Performance Period (or the portion thereof for which Additional Shares or Buyback Shares are included in the calculation of the Relative Baseline, as applicable) been reinvested in additional shares of Common Stock (“Dividend Stock”) at the Fair Market Value on the ex-dividend date for such dividend or other distribution and (ii) such shares of Dividend Stock been sold as of the Valuation Date for such Performance Period for the Common Stock Price as of such date. For the avoidance of doubt, this dividend reinvestment component of Ending Value shall (i) not include dividends originally paid in Common Stock in lieu of cash dividends to the extent that such shares are included in Additional Shares pursuant to clause (d) of the definition thereof, and (ii) include dividends and other distributions declared thereafter on such Additional Shares.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Fair Market Value” means, as of any given date, the fair market value of a security

5

121946-166515 EAS ACTIVE/85991108.7

ACTIVE/93648196.13 AM57

determined by the Committee using any reasonable method and in good faith (such determination will be made in a manner that satisfies Section 409A of the Code); provided that with respect to a share of Common Stock, “Fair Market Value” means the value of such share determined as follows: (a) if on the determination date the Common Stock is listed on the New York Stock Exchange, The NASDAQ Stock Market, Inc. or another national securities exchange or is publicly traded on an established securities market, the Fair Market Value of a share of Common Stock shall be the last reported sale price at which Common Stock is traded on such exchange or in such market (if there is more than one such exchange or market, the Committee shall determine the appropriate exchange or market) on the determination date or, if no sale of Common Stock is reported for such trading day, on the next preceding day on which any sale shall have been reported; or (b) if the Common Stock is not listed on such an exchange, quoted on such system or traded on such a market, Fair Market Value of a share of Common Stock shall be the value determined by the Committee in good faith in a manner consistent with Code Section 409A.

“Good Reason” means, with respect to a Participant, except as otherwise provided in a separate agreement between the Participant and the Company, (a) a material diminution in the Participant’s responsibilities, authority or duties, (b) a material reduction in the Participant’s base salary and bonus opportunity, or (c) a material change in the geographical location at which the Participant provides services to the Company, and in any case, the Company fails to take corrective action within 30 days after the Participant notifies the Company of the event giving rise to “Good Reason.”

“Good Works” means service for an organization unrelated to the Company and approved by the Committee as a primary occupation, subject to such terms and conditions as determined by the Committee in connection with its approval. By way of illustration, the following could qualify as Good Works unless the Committee determines in its discretion that allowing it to so qualify would not be in the best interests of the Company and its stockholders: (i) service to non-profit organizations such as non-governmental organizations or charities active in education, public policy, human rights, humanitarian activities, sustainability or environmental stewardship, (ii) service for departments, agencies or instrumentalities of federal, state or local governments; (iii) military service or (iv) positions in the administration or faculty of non-profit educational institutions of any level. If the Committee approves a Participant’s engagement in Good Works, the Participant’s employment with the Company shall not be considered interrupted if he or she ceases his or her service to the Company or a Related Company, as applicable, while the Participant continues to engage in the Good Works, and if he or she resumes employment with the Company or a Related Company without interruption after performing Good Works, he or she shall be deemed to have been continuously employed by the Company or a Related Company, as applicable. If the Participant ceases to perform Good Works (“Good Works Interruption”) (a) after he or she would have been eligible for Retirement or (b) by reason of the Participant’s death or Disability, he or she shall be deemed for purposes of Section 2.5 to have terminated his or her employment with the Company and Related Companies as of the date of the Good Works Interruption in a “Qualified Termination.” Unless the Committee otherwise determines, Good Works Interruption other than under the circumstances described in clause (a) or (b) above shall be deemed termination of the Participant’s employment with the Company as of the date of the Good Works Interruption other than in a Qualified Termination.

6

121946-166515 EAS ACTIVE/85991108.7

ACTIVE/93648196.13 AM57

Notwithstanding the foregoing, the benefits associated with Good Works shall cease in the event the Participant engages, participates or assists, directly or indirectly, in activities relating to any Competing Business (as hereinafter defined) (except for activities performed on behalf of the Company or any of its affiliates), whether as employee, owner, partner, shareholder, consultant, agent, co-venturer or otherwise, or invests in industrial real estate or a fund or entity holding industrial real estate, other than through ownership of not more than five percent (5%) of the outstanding shares of a public company provided that Grantee is a passive investor in and does not actively manage or exercise control over such entity.

The term “Competing Business” shall mean (other than the Company or a surviving or resulting entity upon a Change of Control, or any of their respective affiliates) (A) a publicly-traded company that owns, operates, manages, acquires, develops or holds investments in 10 million square feet or more of commercial real estate or commercial real estate comprising more than 5% of such company’s total assets reported in its most recently filed Annual Report on Form 10-K with the Securities and Exchange Commission or its total assets under management or (B) any privately-held entity, including investment funds, advisory firms, operating companies or closely-held ventures, engaged in the business of owning, operating, managing, acquiring, developing or otherwise investing in commercial real estate.

“Immediate Vesting Amount” means, with respect to the Performance Period for which a Performance Pool has been generated, twenty percent (20%) of the Total Value.

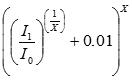

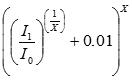

“Index Return Multiplier” means, with respect to any measurement period, a factor representing (a) the compound, annualized percentage return for the MSCI US REIT Index (assuming dividends reinvested on a daily basis) plus (b) one percent (1%) per year, converted to a non-annualized percentage return for the measurement period, which is expressed by the following formula:

Where:

I0 = The average of the MSCI US REIT Index value over the twenty (20) consecutive trading days (I) immediately preceding the first day of such measurement period (0), such average calculated as of such day.

I1 = The average of the MSCI US REIT Index value over the twenty (20) consecutive trading days (I) immediately preceding and including the last day of such measurement period (1), such average calculated as of such day.

x = The period between the first day of such measurement period (0) and the last day of such measurement period (1) expressed as a number of years to the fourth decimal (e.g., 365 days = 1.0000 year).

7

121946-166515 EAS ACTIVE/85991108.7

ACTIVE/93648196.13 AM57

“Initial Date” with respect to any Performance Period means the first day of the Performance Period.

“Initial Shares” means a number of shares of Common Stock equal to the sum of:

(a)the number of shares of Common Stock outstanding as of the Initial Date (including all shares of Common Stock or, without duplication, the REIT Shares Amount for Units, as applicable, underlying Time-Based Awards and Performance-Based Awards granted prior to the Initial Date), plus

(b)the number of shares of Common Stock representing the REIT Shares Amount for all of the Units (other than those held by the Company and those underlying Performance-Based Awards or Time-Based Awards, which are provided for in clause (a) above) outstanding as of the Initial Date, assuming that all such Units were exchanged, converted or redeemed for shares of Common Stock as of such date.

For the avoidance of doubt, Initial Shares exclude all shares of Common Stock issuable upon exercise of currently outstanding stock options.

“LTIPs” means partnership interests intended to be treated as profits interests under the Code which are convertible into, exchangeable for or redeemable in consideration of shares of Common Stock or the value thereof in cash pursuant to the applicable instrument governing such interests.

“MSCI US REIT Index” means the MSCI US REIT Index (RMS) as published from time to time (or a successor index including a comparable universe of publicly traded U.S. real estate investment trusts), provided that if (a) the MSCI US REIT Index ceases to exist or be published prior to the Valuation Date and the Committee determines that there is no successor to such index or (b) the Committee reasonably determines that the MSCI US REIT Index is no longer suitable for the purposes of this 2018 Outperformance Plan, then the Committee in its good faith reasonable discretion shall select for subsequent Performance Periods, or if the Committee in its reasonable good faith discretion so determines, for any portion of an outstanding Performance Period, a substitute comparable index for purposes of calculating the Relative Baseline.

“Participant” means an Eligible Person designated by the Committee to receive an Award.

“Participation Point” means, with respect to a Participant, the unit measurement used to determine the Participant’s share of the Performance Pool generated with respect to a Performance Period.

“Performance-Based Awards” means, as of a particular date of determination and to the extent that that the sum of (i) and (ii) below is denominated in shares of Common Stock, Units or other equity securities or interests, in each case (if applicable) as converted, exercised, exchanged or redeemed for a number of shares of Common Stock as of such date of determination at the applicable conversion, exercise, exchange or redemption rate (or rate deemed applicable by the Committee if there is no such stated rate), the sum of (i) in respect of Awards, if and to the extent that each of the following conditions has been satisfied: (A) the date

8

121946-166515 EAS ACTIVE/85991108.7

ACTIVE/93648196.13 AM57

of determination is after the Valuation Date for the applicable Performance Period, (B) the Total Value has been earned, in whole or in part, (C) such earned portion of the Award has been paid in shares of Common Stock or, if the Award is represented by LTIPs, a number of LTIPs has become vested based on performance, and (D) Positive TSR has been achieved, and (ii) in respect of performance-based incentive compensation awards other than Awards, if and to the extent that the performance-based vesting conditions applicable to such awards have been satisfied as of the determination date.

“Performance Period” means the three-year period commencing on January 1 of a calendar year and ending on December 31 of the second calendar year that follows such calendar year. The first Performance Period under this 2018 Outperformance Plan runs from January 1, 2018 through December 31, 2020. There shall be overlapping Performance Periods.

“Performance Pool” with respect to any Performance Period means, as of the Valuation Date, a dollar amount determined pursuant to the provisions of Section 2.2.

“Person” means an individual, corporation, partnership, limited liability company, joint venture, association, trust, unincorporated organization, other entity or “group” (as defined in the Exchange Act).

“Positive TSR” means, as of a particular date of determination, that the Company’s Absolute Shareholder Return on a cumulative basis over the period starting on the Initial Date with respect to the applicable Performance Period and ending on such determination date is a positive number.

“Public Announcement” means, with respect to a Transactional Change of Control, the earliest press release, filing with the SEC or other publicly available or widely disseminated communication issued by the Company or another Person who is a party to such transaction which discloses the consideration payable in and other material terms of the transaction that ultimately results in the Transactional Change of Control; provided, however, that if such consideration is subsequently increased or decreased, then the term “Public Announcement” shall be deemed to refer to the most recent such press release, filing or communication disclosing a change in consideration whereby the final consideration and material terms of the transaction that ultimately results in the Transactional Change of Control are announced. For the avoidance of doubt, the foregoing definition is intended to provide the Committee in the application of the proviso clause in the definition of “Common Stock Price” with the information required to determine the fair market value of the consideration payable in the transaction that ultimately results in the Transactional Change of Control as of the earliest time when such information is publicly disseminated, particularly if the transaction consists of an unsolicited tender offer or a contested business combination where the terms of the transaction change over time.

“Qualified Termination” has the meaning set forth in Section 2.5(b) hereof.

“REIT Shares Amount” means the per Unit number of shares of Common Stock into which a Unit is convertible, for which a Unit is exchangeable for or in consideration of which a Unit is redeemable pursuant to the applicable instrument governing such Unit.

“Related Company” means any corporation, partnership, joint venture or other entity

9

121946-166515 EAS ACTIVE/85991108.7

ACTIVE/93648196.13 AM57

during any period in which a controlling interest in such entity is owned, directly or indirectly, by the Company (or any entity that is a successor to the Company), and any business venture designated by the Committee in which the Company (or any entity that is a successor to the Company) has, directly or indirectly, a significant interest (whether through the ownership of securities or otherwise), as determined in the discretion of the Committee.

“Relative Baseline” with respect to a Performance Period means, as of the applicable Valuation Date, an amount representing (without double-counting) the sum of:

(a)the Baseline Value multiplied by:

(i)the difference between:

(x)the Initial Shares and

|

|

(y) |

all Buyback Shares repurchased, redeemed or forfeited between the Initial Date and the Valuation Date, |

and then multiplied by:

|

|

(ii) |

the Index Return Multiplier for the Performance Period; plus |

(b)with respect to each Additional Share issued after the Initial Date, the product of:

|

|

(i) |

the Additional Share Baseline Value of such Additional Share, multiplied by |

|

|

(ii) |

the Index Return Multiplier for the period beginning on the date of issuance of such Additional Share and ending on the Valuation Date; plus |

(c)with respect to each Buyback Share repurchased, redeemed or forfeited after the Initial Date, the product of:

|

|

(i) |

the Baseline Value multiplied by |

|

|

(ii) |

the Index Return Multiplier for the period beginning on the Initial Date and ending on the date such Buyback Share was repurchased, redeemed or forfeited. |

If the Company consummates an individual issuance involving 500,000 or more Additional Shares and/or an individual repurchase, redemption or forfeiture involving 500,000 or more Buyback Shares during any calendar quarter, the Company will track the precise issuance date and value of each such individual Additional Share and/or repurchase, redemption or forfeiture date and value of each such individual Buyback Share. If the Company consummates one or more issuances each involving less than 500,000 Additional Shares and/or repurchases, redemptions or forfeitures each involving less than 500,000 Buyback Shares during any calendar

10

121946-166515 EAS ACTIVE/85991108.7

ACTIVE/93648196.13 AM57

quarter, it would be impractical to track the precise issuance date and value of each such Additional Share and/or repurchase, redemption or forfeiture date and value of each such Buyback Share, and in such event (a) the Company will consider all such issuances and/or repurchases, redemptions or forfeitures (on a net basis if both issuances and repurchases, redemptions or forfeitures occur in the same quarter) to have taken place on the last day of the quarter during which such transaction or transactions occurred and (b) the Additional Share Baseline Value (if the netting of all such transactions results in a net issuance of Additional Shares) or the Buyback Value (if the netting of all such transactions results in a net repurchase, redemption or forfeiture of Buyback Shares) of the shares of Common Stock involved shall be calculated using the weighted average price at which such shares were issued and/or repurchased, redeemed or forfeited.

“Retirement” means, with respect to a Participant, the occurrence of the Participant’s Termination Date after the Participant has attained at least age 62 and provided that the sum of the Participant’s age plus the Participant’s years of service to the Company or any Related Company is equal to at least 75 years.

“SEC” means the U.S. Securities and Exchange Commission.

“Securities Act” means the Securities Act of 1933, as amended.

“Senior Participant” means, with respect to the applicable Performance Period, a Participant identified as such in the Committee’s resolutions granting him or her an Award for such Performance Period, which is expected to include the CEO and certain executive officers of the Company .

“Time-Based Awards” means, as of a particular date of determination, the sum of all then-outstanding (whether or not vested) restricted stock unit awards and other incentive compensation awards denominated in shares of Common Stock, Units, or other equity securities or interests, in each case, granted under the Company’s equity incentive plans, in each case, subject to time-based vesting requirements and (if applicable) assuming that such awards were converted, exercised, exchanged or redeemed for a number of shares of Common Stock as of such date of determination at the applicable conversion, exercise, exchange or redemption rate (or rate deemed applicable by the Committee if there is no such stated rate).

“Total Participation Points” with respect to any Performance Period means the total outstanding Participation Points held by all Participants on the Valuation Date (after taking into account all awards and all forfeitures of Participation Points for such Performance Period).

“Total Shares” with respect to any Performance Period means (without double-counting), as of the Valuation Date, the algebraic sum of:

(a)the Initial Shares, plus

(b)all Additional Shares issued between the Initial Date and the Valuation Date, minus

(c)all Buyback Shares repurchased, redeemed or forfeited between the Initial

11

121946-166515 EAS ACTIVE/85991108.7

ACTIVE/93648196.13 AM57

Date and the Valuation Date.

“Total Value” means, with respect to an Award for a Performance Period for which a Performance Pool has been generated, the aggregate dollar value of such Award, subject to the Dollar-Based Cap applicable to all Awards for the same Performance Period.

“Transactional Change of Control” means a Change of Control arising as a result of one of the following events:

(a)the consummation of a transaction, approved by the stockholders of the Company, to merge the Company into or consolidate the Company with another entity where the Company is not the surviving entity, or to sell or otherwise dispose of all or substantially all of its assets or adopt a plan of liquidation; or

(b)a “person” or “group” as defined in Sections 13(d) and 14(d) of the Exchange Act (other than any trustee or other fiduciary holding securities under an employee benefit or other similar equity plan of the Company) making a tender offer for Common Stock.

“Units” means interests in limited partnerships (including LTIPs), limited liability companies or other similar entities which are convertible into, exchangeable for or redeemable in consideration of shares of Common Stock or the value thereof in cash pursuant to the applicable instrument governing such interests.

“Valuation Date” with respect to any Performance Period means the earliest of:

(a)the last day of such Performance Period,

(b)in the event of a Change of Control that is not a Transactional Change of Control, the date on which such Change of Control shall occur, or

(c)in the event of a Transactional Change of Control, and subject to the consummation of such Transactional Change of Control, the date of the Public Announcement of such Transactional Change of Control.

ARTICLE 2 - AWARDS, PERFORMANCE POOL AND PAYMENTS

2.1Awards. For each Performance Period, the Committee, in its discretion, shall (a) select those Eligible Persons who shall be Participants, (b) designate the Senior Participants and the percentage of the Performance Pool allocated to each Senior Participant’s Award, and (c) determine the number of Participation Points allocated to the Award of each Participant who is not a Senior Participant; provided that the Committee shall have the power to grant up to 200 additional points, either to Participants who already have an Award for such Performance Period or to new Participants, after the Committee initially awards Participation Points. Promptly after the Committee selects a Participant to receive an Award (or additional Participation Points), the Company will notify the Participant of his or her Award with an Award Letter that may include additional or modified terms that the Committee decided to make applicable to such Award.

2.2Determination of Performance Pool. As soon as practical following the Valuation

12

121946-166515 EAS ACTIVE/85991108.7

ACTIVE/93648196.13 AM57

Date of a Performance Period, the Committee shall determine the size of the Performance Pool in accordance with the following steps: (a) determine the Relative Baseline and the Ending Value, (b) subtract the Relative Baseline from the Ending Value, (c) multiply the resulting amount by three percent (3%); provided that in no event shall the Performance Pool exceed an amount equal to the Dollar-Based Cap. If the Performance Pool is not a positive number, no amount shall be payable to any Participant with respect to such Performance Period. If the Performance Pool is a positive number, the Committee shall certify in writing the size of the Performance Pool.

2.3Allocation of Performance Pool. The Committee shall determine the Total Value of each Participant’s Award (or all Awards in case of multiple Awards to a particular Participant for the same Performance Period) with respect to the Performance Period for which a Performance Pool has been generated. The Total Value of a Senior Participant’s Award shall be the fixed percentage specified in his or her Award and, unless the Committee determines otherwise, if his or her award is forfeited prior to the Valuation Date, his or her portion of the Performance Pool shall be added to the portion available for Participants who are not Senior Participants (such portion, as so adjusted if applicable, the “Allocable Performance Pool”). The Total Value of the Award of each Participant who is not a Senior Participant shall be calculated by multiplying the Allocable Performance Pool by a fraction, (a) the numerator of which shall be the Participation Points held by such Participant with respect to such Performance Period (after giving effect to all Awards to such Participant with respect to the applicable Performance Period and any forfeitures of Awards by such Participant with respect to the applicable Performance Period) and (b) the denominator of which shall be the Total Participation Points outstanding for the Performance Period (after giving effect to all Awards to all Participants with respect to the applicable Performance Period and any forfeitures of Awards by any Participants with respect to the applicable Performance Period). The Total Value of each Award shall be bifurcated, concurrently with the Committee’s determination in accordance with this Section 2.3, into the Immediate Vesting Amount and the Deferred Vesting Amount.

2.4Payments to Participants.

(a)Subject to the Positive TSR requirement set forth in Section 2.4(c) and 2.4(d), the Immediate Vesting Amount shall be payable either in cash or in shares of Common Stock, LTIPs or other property, as determined by the Committee, to the Participant as soon as reasonably practicable, but no later than 75 days after the end of the Performance Period. If the Immediate Vesting Amount is paid out in accordance with the foregoing sentence in shares of Common Stock or LTIPs, (i) the Immediate Vesting Amount shall be converted into a fixed number of shares of Common Stock (or LTIPs) based on the Fair Market Value as of the Valuation Date, (ii) such shares (or LTIPs) shall be fully vested as of the date of issuance, and (ii) such shares (or LTIPs) shall not be sold, assigned, transferred, pledged, hypothecated, given away or in any other manner disposed of, or encumbered, whether voluntarily or by operation of law (each such action a “Transfer”) until after the third anniversary of the Valuation Date for the applicable Performance Period; provided, however, that (i) the Participant may elect to have a portion of such shares of Common Stock (or LTIPs) used to satisfy taxes with respect to such payments in accordance with Section 3.6 hereof and (ii) such shares of Common Stock (or LTIPs) may be Transferred prior to such date in accordance with the Company’s equity incentive plan pursuant to which such shares of Common Stock (or LTIPs) were granted, so long as the transferee agrees in writing with the Company to be bound by all applicable terms and conditions

13

121946-166515 EAS ACTIVE/85991108.7

ACTIVE/93648196.13 AM57

and that subsequent Transfers shall be prohibited except those in accordance with this Section 2.4(a). Any attempted Transfer of such shares of Common Stock (or LTIPs) not in accordance with the terms and conditions of this Section 2.4(a) shall be null and void, and the Company shall not reflect on its records any change in record ownership of any such shares of Common Stock (or LTIPs) as a result of any such Transfer, shall otherwise refuse to recognize any such Transfer and shall not in any way give effect to any such Transfers.

(b)Subject to the Positive TSR requirement set forth in Section 2.4(c) and 2.4(e), the Deferred Vesting Amount shall be payable either in cash or in shares of Common Stock, LTIPs, stock units of the Company (“RSUs”) or other property, as determined by the Committee and converted as described in this Section 2.4(b), to the Participant on the tenth anniversary of the Initial Date (“Tenth Anniversary”), subject to vesting based on the Participant’s continuous employment with the Company or a Related Company through the Tenth Anniversary or a Qualified Termination as provided in Section 2.5, except as provided in Section 2.6 in the event of a Change of Control. If the Immediate Vesting Amount is to be paid out in accordance with the foregoing sentence in shares of Common Stock, RSUs or LTIPs, (i) the Deferred Vesting Amount shall be converted into a fixed number of shares of Common Stock (RSUs or LTIPs) based on the Fair Market Value as of the Valuation Date and (ii) the Participant shall be entitled to receive each dividend or distribution declared and paid on shares of Common Stock (RSUs or LTIPs) after the Valuation Date with respect to such shares (RSUs or LTIPs) until and unless the Participant’s employment terminates for any reason other than a Qualified Termination and the Participant forfeits the Deferred Vesting Amount as provided in Section 2.5. If the Participant does not become vested pursuant to this Section 2.4(b), the Deferred Vesting Amount shall, without payment of any consideration by the Company, automatically and without notice be forfeited and be and become null and void, and neither the Participant nor any of his or her successors, heirs, assigns, or personal representatives will thereafter have any further rights or interests in the Deferred Vesting Amount, but the Participant shall retain all dividends and distributions he or she received on account thereof prior to the date of forfeiture.

(c)Notwithstanding the foregoing, subject to Section 2.6 below in the event of a Change of Control, if Positive TSR has not been achieved, then no payments to Participants on account of either the Immediate Vesting Amount or the Deferred Vesting Amount shall be made unless Positive TSR is achieved within seven (7) years following the end of the applicable Performance Period. For purposes of the preceding sentence, the Company’s Absolute Shareholder Return shall be measured at the end of each quarter, beginning with the first quarter following the end of the applicable Performance Period, and it shall be measured from the beginning of the applicable Performance Period through the end of such quarter. With respect to the Positive TSR requirement of this Section 2.4(c), the Participant’s employment with the Company or a Related Company need not continue past the Valuation Date to be entitled to delayed payment of the Immediate Vesting Amount.

(d)If Positive TSR is achieved within the seven (7) year period following the end of the applicable Performance Period, then the Immediate Vesting Amount shall be paid either in cash or in shares of Common Stock, LTIPs or other property, as determined by the Committee, to the Participant as soon as reasonably practicable, but no later than 75 days after the end of the quarter during which Positive TSR is achieved. If the Immediate Vesting Amount is paid out in shares of Common Stock (or LTIPs), it shall be converted into a fixed number of

14

121946-166515 EAS ACTIVE/85991108.7

ACTIVE/93648196.13 AM57

shares of Common Stock (or LTIPs) based on the Fair Market Value as of the last day of the quarter during which Positive TSR is achieved.

(e)If Positive TSR is achieved within the seven (7) year period following the end of the applicable Performance Period, then the Deferred Vesting Amount shall be paid in accordance with Section 2.4(b) above without further regard to the Company’s Absolute Shareholder Return being a positive or negative number as of the date such payment is due; provided that if the Immediate Vesting Amount is to be paid out in shares of Common Stock or LTIPs, (i) the Deferred Vesting Amount shall be converted into a fixed number of shares of Common Stock (RSUs or LTIPs) based on the Fair Market Value as of the last day of the quarter during which Positive TSR is achieved and (ii) the Participant shall be entitled to receive each dividend or distribution declared and paid on shares of Common Stock (RSUs or LTIPs) only after the last day of the quarter during which Positive TSR is achieved with respect to such shares (RSUs or LTIPs) (not the Valuation Date as provided in Section 2.4(b)), until and unless the Participant’s employment terminates for any reason other than a Qualified Termination and the Participant forfeits the Deferred Vesting Amount as provided in Section 2.5.

(f)Subject to Section 2.6 below in the event of a Change of Control, if Positive TSR is not achieved within the seven (7) year period following the end of the applicable Performance Period, then notwithstanding the determination of the Total Value of Awards pursuant to Sections 2.2 and 2.3, all Awards held by all Participants with respect to the applicable Performance Period shall, without payment of any consideration by the Company, automatically and without notice terminate, be forfeited and be and become null and void, and neither the Participant nor any of his or her successors, heirs, assigns, or personal representatives will thereafter have any further rights or interests in either the Immediate Vesting Amount or the Deferred Vesting Amount with respect to such Awards.

2.5Termination of Participant’s Employment; Death and Disability.

(a)If a Participant’s employment with the Company or a Related Company terminates, the provisions of this Section 2.5 shall govern the treatment of the Participant’s Award exclusively, regardless of the provision of any employment or other agreement to which the Participant is a party or any termination or severance policies of the Company then in effect, which shall be superseded by this 2018 Outperformance Plan such that, by way of illustration, any provisions thereof with respect to payout or the lapse of forfeiture restrictions relating to the Participant’s incentive or other compensation awards in the event of certain types of termination of the Participant’s employment with the Company (such as, for example, termination at the end of the term, termination without Cause by the employer) shall not be interpreted as requiring that any calculations set forth in Sections 2.2, 2.3 or 2.4 hereof be performed.

(b)In the event of termination of a Participant’s employment (i) by the Participant upon Retirement or (ii) by reason of the Participant’s death or Disability (each a “Qualified Termination,” it being understood that in the event of a Participant’s Good Works, Good Works Interruption shall be deemed a “Qualified Termination” under the circumstances described in clause (a) or (b) in the definition of Good Works) after the Initial Date, but prior to the Valuation Date with respect to the applicable Performance Period, then the Participant will retain his or her Participation Points with respect to such Performance Period, but all calculations

15

121946-166515 EAS ACTIVE/85991108.7

ACTIVE/93648196.13 AM57

and payments, if any, with respect to the Participant’s Award shall be made at the same time and on the same conditions set forth in Sections 2.2, 2.3 and 2.4 hereof for all other Participants.

(c)In the event of a termination of a Participant’s employment for any reason other than a Qualified Termination (i) prior to the Valuation Date with respect to the applicable Performance Period or (ii) after the Valuation Date with respect to the applicable Performance Period but prior to the last day of the quarter during which Positive TSR is achieved, all Awards held by the Participant for such Performance Period (including both the Immediate Vesting Amount and the Deferred Vesting Amount) shall, without payment of any consideration by the Company, automatically and without notice terminate, be forfeited and be and become null and void, and neither the Participant nor any of his or her successors, heirs, assigns, or personal representatives will thereafter have any further rights or interests in such Awards, the Immediate Vesting Amount or the Deferred Vesting Amount, or any related Participation Points.

(d)With respect to the Immediate Vesting Amount, in the event of termination of a Participant’s employment after the Valuation Date with respect to the applicable Performance Period for any reason other than Qualified Termination by reason of death or Disability the Transfer restrictions provided in Section 2.4(a) shall continue in effect and shall terminate upon Qualified Termination by reason of death or Disability.

(e)With respect to the Deferred Vesting Amount, in the event of a Qualified Termination after the Valuation Date and prior to the applicable Tenth Anniversary, a Participant’s Deferred Vesting Amount shall no longer be subject to forfeiture pursuant to Section 2.4(b), but, notwithstanding that no continuous employment requirement applies, all calculations and payments, if any, with respect to the Participant’s Deferred Vesting Amount shall be made at the same time and on the same conditions set forth in Sections 2.2, 2.3, and 2.4, as applicable, for all other Participants. In the event the Committee elects to pay out the Deferred Vesting Amount in shares of Common Stock (or LTIPs) and the Company elects in its discretion to issue such shares (or LTIPs) to such Participant following his or her Qualified Termination, such shares (or LTIPs) shall not be Transferred until after the Tenth Anniversary; provided, however, that (i) the Participant may elect to have a portion of such shares of Common Stock (or LTIPs) used to satisfy taxes with respect to such payments in accordance with Section 3.6 hereof and (ii) such shares of Common Stock (or LTIPs) may be Transferred prior to such date in accordance with the Company’s equity incentive plan pursuant to which such shares of Common Stock (or LTIPs) were granted, so long as the transferee agrees in writing with the Company to be bound by all applicable terms and conditions and that subsequent Transfers shall be prohibited except those in accordance with this Section 2.5(e). Any attempted Transfer of such shares of Common Stock (or LTIPs) not in accordance with the terms and conditions of this Section 2.5(d) shall be null and void, and the Company shall not reflect on its records any change in record ownership of any such shares of Common Stock (or LTIPs) as a result of any such Transfer, shall otherwise refuse to recognize any such Transfer and shall not in any way give effect to any such Transfers

(f)With respect to the Deferred Vesting Amount, in the event of termination of a Participant’s employment for any reason other than a Qualified Termination after the Valuation Date with respect to the applicable Performance Period and prior to the Tenth Anniversary, the Deferred Vesting Amount with respect to all Awards held by the Participant for

16

121946-166515 EAS ACTIVE/85991108.7

ACTIVE/93648196.13 AM57

such Performance Period shall, without payment of any consideration by the Company, automatically and without notice terminate, be forfeited and be and become null and void, and neither the Participant nor any of his or her successors, heirs, assigns, or personal representatives will thereafter have any further rights or interests in the Deferred Vesting Amount with respect to all such Awards.

2.6Change of Control.

(a)In the event of a Change of Control, if the Change of Control occurs prior to the last day of the Applicable Performance Period (the “End Date”), the Committee will determine the size of the Performance Pool for each outstanding Performance Period in accordance with Section 2.2 and the Total Value of the Awards in accordance with Section 2.3 no later than the date of consummation of the Change of Control; provided that (i) the Positive TSR requirement set forth in Section 2.4(c), (d) or (e) shall no longer apply to either the Immediate Vesting Amount or the Deferred Vesting Amount and (ii) if the Valuation Date occurs upon the date of a Change of Control on or before the first anniversary of the Initial Date with respect to the applicable Performance Period, the Total Value of each Award for such Performance Period shall be prorated by multiplying it by a fraction (A) the numerator of which is the number of days elapsed between the Initial Date and the date of the Change of Control and (B) the denominator of which is 365. For avoidance of doubt, in the event of a Change of Control, the performance of all calculations and actions pursuant to Sections 2.2 and 2.3 hereof using the applicable Valuation Date shall be conditioned upon the final consummation of such Change of Control.

(b)With respect to the Immediate Vesting Amount, subject to Section 2.6(d):

(i)if the Change of Control occurs prior to the End Date, the Immediate Vesting Amount shall be payable to Participants who have not forfeited their Award pursuant to Section 2.5(c) in cash or shares of Common Stock (or LTIPs), as determined by the Committee in connection with such Change of Control, upon the earliest of:

(A)the effective date of the Participant’s Qualified Termination,

(B)the effective date of termination of the Participant’s employment by the Company (or its successor) or a Related Company without Cause or by the Participant with Good Reason if such termination occurs within 24 months following the Change of Control, or

(C)the End Date if the Participant remains employed by the Company (or its successor) or a Related Company until such date;

(ii)if the Change of Control occurs after the End Date but payment of the Immediate Vesting Amount has not been made as a result of the Positive TSR requirement set forth in Section 2.4(c) not being satisfied, the Immediate Vesting Amount shall be payable to Participants who have not forfeited their Award pursuant to Section 2.5(c) in cash or shares of Common Stock (or LTIPs), as determined by the Committee in

17

121946-166515 EAS ACTIVE/85991108.7

ACTIVE/93648196.13 AM57

connection with such Change of Control, as soon as reasonably practicable, but no later than 30 days following consummation of the Change of Control; and

(iii)if the Change of Control occurs after the End Date and payment of the Immediate Vesting Amount was made in shares of Common Stock (or LTIPs), the Participants shall be eligible to participate in the Change of Control transaction, if applicable, without regard to the Transfer restrictions provided in Section 2.4(a) and such restrictions shall no longer apply following consummation of the Change of Control.

(c)With respect to the Deferred Vesting Amount, subject to Section 2.6(d):

(i)if the Change of Control occurs prior to the End Date or occurs after the End Date but the Deferred Vesting Amount was deferred as a result of the Positive TSR requirement set forth in Section 2.4(c) not being satisfied, the Deferred Vesting Amount shall be payable, regardless of whether the positive TSR requirement is satisfied, to Participants who have not forfeited their Award pursuant to Section 2.5(c) in cash or shares of Common Stock (RSUs or LTIPs), as determined by the Committee in connection with a Change of Control, upon the earliest of:

(A)the effective date of the Participant’s Qualified Termination,

(B)the effective date of termination of the Participant’s employment by the Company (or its successor) or a Related Company without Cause or by the Participant with Good Reason if such termination occurs within 24 months following the Change of Control, or

(C)the Tenth Anniversary if the Participant remains employed by the Company (or its successor) or a Related Company until such date; and

(ii)if the Change of Control occurs after the End Date and the Positive TSR requirement was satisfied prior to the date of the Change of Control, the Deferred Vesting Amount shall be payable as provided in Section 2.6(c)(i)(A), (B) or (C), as applicable, to Participants who have not forfeited their Award pursuant to Section 2.5(c). Payment shall be in cash if the Committee so determined as of the Valuation Date in accordance with Section 2.4(b), otherwise it shall be in shares of Common Stock (RSUs or LTIPs), in which case the Participant shall be allowed to participate in the Change of Control transaction with respect to such shares (or LTIPs); provided that in the circumstances set forth in Section 2.6(c)(i)(A) or (B), any shares (or LTIPs) or securities of a successor company issued to the Participant shall no longer be subject to the Transfer restrictions provided in Section 2.4(e) following consummation of the Change of Control.

(d)Notwithstanding the foregoing, if the Company’s successor does not irrevocably and unconditionally agree to assume the Awards in connection with the Change of Control, the Awards (including both the Immediate Vesting Amount and the Deferred Vesting Amount) shall be fully paid out to the Participants in cash as soon as reasonably practicable, but no later than 30 days following consummation of the Change of Control.

18

121946-166515 EAS ACTIVE/85991108.7

ACTIVE/93648196.13 AM57

2.7LTIP Units. The Committee may award LTIPs to a Participant. In such event, the agreement granting such LTIPs shall set forth (i) whether and how the LTIPs will be subject to forfeiture to reflect the economic terms of this 2018 Outperformance Plan in light of the different award structure, (ii) whether LTIPs will be issued prior to or after the Valuation Date, it being understood that the Committee may decide to award LTIPs in multiple tranches with respect to a single Award to a Participant, and (iii) the methodology to be followed to convert the dollar amount of any Award determined under Section 2.3 or 2.6 to a number of LTIPs to be earned, or forfeited, as the case may be, and (iv) if such LTIPs constitute equity awards, under which equity incentive plan of the Company they are being issued, whether shares of Common Stock need to be reserved for issuance under such plan, and if so how that number will be determined, which may, depending on the circumstances, include calculations made or to be made under Sections 2.2 or 2.3, capital account allocations and/or balances under the applicable partnership agreement, and the conversion ratio between LTIPs (directly or indirectly) and Common Stock.

2.8Nature of Awards. The Awards granted under this 2018 Outperformance Plan shall be used solely as a device for the measurement and determination of certain amounts to be paid to each Participant as provided herein and such Awards shall not constitute or be treated as property or as a trust fund of any kind or as stock options or other form of equity or security of the Company or any Related Company. A Participant shall have only those rights set forth in this 2018 Outperformance Plan and the Participant’s Award Letter with respect to Awards granted to such Participant and shall have no ownership rights in the Company or any Related Company by virtue of having been granted Awards. Any benefits which become payable hereunder shall be paid from the general assets of the Company.

ARTICLE 3 - MISCELLANEOUS

3.1Amendments. This 2018 Outperformance Plan and any Awards granted hereunder may be amended or modified only with the consent of the Company acting through the Committee or the Board; provided that any amendment or modification which adversely affects a Participant must be consented to by such Participant to be effective as against him or her.

3.2Interpretation by Committee. The Committee may interpret this 2018 Outperformance Plan, with such interpretations to be conclusive and binding on all persons and otherwise accorded the maximum deference permitted by law, provided that the Committee’s interpretation shall not be entitled to deference on and after a Change of Control except to the extent that such interpretations are made exclusively by members of the Committee who are individuals who served as Committee members before the Change of Control and take any other actions and make any other determinations or decisions that it deems necessary or appropriate in connection with this 2018 Outperformance Plan or the administration or interpretation thereof. In the event of any dispute or disagreement as to interpretation of this 2018 Outperformance Plan or of any rule, regulation or procedure, or as to any question, right or obligation arising from or related to this 2018 Outperformance Plan, the decision of the Committee, except as provided above, shall be final and binding upon all persons.

3.3Assignability. Except as otherwise provided by law, no benefit hereunder shall be

19

121946-166515 EAS ACTIVE/85991108.7

ACTIVE/93648196.13 AM57

assignable, or subject to alienation, garnishment, execution or levy of any kind, and any attempt to cause any benefit to be so subject shall be void.

3.4No Contract for Continuing Services. This 2018 Outperformance Plan shall not be construed as creating any contract for continued services between the Company and any Participant and nothing herein contained shall give any Participant the right to be retained as an employee of the Company.

3.5Governing Law. This 2018 Outperformance Plan shall be construed, administered, and enforced in accordance with the laws of the State of California, without giving effect to the principles of conflict of laws of such State.

3.6Tax Withholding. The Company shall have the right to deduct from all payments hereunder any taxes required by law to be withheld with respect to such payments. In the event payment is made in the form of shares of Common Stock, with the approval of the Committee, the minimum tax withholding may be satisfied by the Company withholding from shares of Common Stock to be issued, shares having an aggregate Fair Market Value (as of the date the withholding is in effect) that would satisfy the minimum withholding amount due (or other rates that will not have a negative accounting impact).

3.7Effect on Other Plans. Nothing in this 2018 Outperformance Plan shall be construed to limit the rights of Participants under the Company’s benefit plans, programs or policies.

3.8Benefits and Burdens. This 2018 Outperformance Plan shall inure to the benefit of and be binding upon the Company and the Participants, their respective successors, executors, administrators, heirs and permitted assigns.

3.9Enforceability. If any portion or provision of this 2018 Outperformance Plan shall to any extent be declared illegal or unenforceable by a court of competent jurisdiction, then the remainder of this 2018 Outperformance Plan, or the application of such portion or provision in circumstances other than those as to which it is so declared illegal or unenforceable, shall not be affected thereby, and each portion and provision of this 2018 Outperformance Plan shall be valid and enforceable to the fullest extent permitted by law.

3.10Waiver. No waiver of any provision hereof shall be effective unless made in writing and signed by the waiving party. The failure of any party to require the performance of any term or obligation of this 2018 Outperformance Plan, or the waiver by any party of any breach of this 2018 Outperformance Plan, shall not prevent any subsequent enforcement of such term or obligation or be deemed a waiver of any subsequent breach.

3.11Clawback. All Awards made under this 2018 Outperformance Plan shall be subject to the Recoupment Policy set forth in the Prologis Governance Guidelines and any other clawback policies that may be adopted by the Company in accordance with applicable law, rule or regulation.

3.12Notices. Any notices, requests, demands, and other communications provided for by this 2018 Outperformance Plan shall be sufficient if in writing and delivered in person or sent

20

121946-166515 EAS ACTIVE/85991108.7

ACTIVE/93648196.13 AM57

by registered or certified mail, postage prepaid, to a Participant at the last address the Participant has filed in writing with the Company, or to the Company at their main office, attention of the Committee.

3.13Section 409A. The provisions regarding all payments to be made hereunder shall be interpreted in such a manner that all such payments either comply with Section 409A of the Code or are exempt from the requirements of Section 409A of the Code as “short-term deferrals” as described in Section 409A of the Code. To the extent that any amounts payable hereunder are determined to constitute “nonqualified deferred compensation” within the meaning of Section 409A of the Code, such amounts shall be subject to such additional rules and requirements as specified by the Committee from time to time in order to comply with Section 409A of the Code and the payment of any such amounts may not be accelerated or delayed except to the extent permitted by Section 409A of the Code. The Company makes no representation or warranty and shall have no liability to any Participant or any other person if any payments under any provisions of this Plan are determined to constitute deferred compensation under Section 409A of the Code that are subject to the twenty percent (20%) additional tax under Section 409A of the Code.

21

121946-166515 EAS ACTIVE/85991108.7

ACTIVE/93648196.13 AM57