AHEAD OF WHAT’S NEXT™

Prologis Proxy Statement

Notice of annual meeting of stockholders

Prologis Park Ontario, Ontario, California

Thursday, April 29, 2021

1:30 p.m., Pacific time

The date of this proxy statement is March 19,

2021

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No.)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ☒ | Definitive Proxy Statement | |||

| ☐ | Definitive Additional Materials | |||

| ☐ | Soliciting Material Pursuant to Rule 14a-12 | |||

| Prologis, Inc. | ||||

| (Name of Registrant as Specified In Its Charter)

| ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

AHEAD OF WHAT’S NEXT™

Prologis Proxy Statement

Notice of annual meeting of stockholders

Prologis Park Ontario, Ontario, California

Thursday, April 29, 2021

1:30 p.m., Pacific time

The date of this proxy statement is March 19,

2021

Notice of 2021 Annual Meeting

of

Stockholders

March 19, 2021

To our stockholders:

I invite you to attend the 2021 annual meeting of stockholders of Prologis, Inc. at 1:30 p.m. on April 29, 2021. Due to the COVID-19 outbreak and to support the health and well-being of our stockholders, directors and employees, our annual meeting will be held in a virtual format only. You will not be able to attend the annual meeting physically.

Items of business. The following items of business will be conducted at our 2021 annual meeting of stockholders:

| 1. |

Elect eleven directors to our Board to serve until the next annual meeting of stockholders and until their successors are duly elected and qualified. | |

| 2. |

Advisory vote to approve the company’s executive compensation for 2020. | |

| 3. |

Ratify the appointment of KPMG LLP as our independent registered public accounting firm for the year 2021. | |

| 4. |

Consider any other matters that may properly come before the meeting and at any adjournments or postponements of the meeting. | |

| Record Date. If you were a holder of shares of our common stock at the close of business on March 8, 2021, you are entitled to receive this notice and to vote at the annual meeting and any adjournment(s) or postponement(s) of the annual meeting. | How to Vote. You can vote your shares by proxy through the Internet, by telephone or by mail using the instructions on the proxy card or you can vote during the virtual annual meeting. Any proxy may be revoked in the manner described in the accompanying proxy statement at any time prior to its exercise at the annual meeting. |

Meeting Attendance. To be admitted to the annual meeting at

www.virtualshareholdermeeting.com/ |

Proxy Materials. On or about March 19, 2021, we intend to distribute to our stockholders:

| (i) | Either in printed form by mail or electronically by email, a Notice of Annual Meeting and Internet Availability of Proxy Materials containing instructions on: (a) how to electronically access our 2021 Proxy Statement and 2020 Annual Report to Stockholders, which includes our 2020 Annual Report on Form 10-K; (b) how to vote; and (c) how to request printed proxy materials (if desired). |

| (ii) | If requested or required, printed proxy materials, which will include our 2021 Proxy Statement, our 2020 Annual Report on Form 10-K and a proxy card. |

| On behalf of the Board of Directors,

EDWARD S. NEKRITZ Chief Legal Officer, General Counsel and Secretary |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on April 29, 2021. This proxy statement and accompanying form of proxy are first being made available to you on or about March 19, 2021. Proxy materials are available at www.proxyvote.com.

|

| Prologis Proxy Statement | March 19, 2021

|

|

This proxy statement contains important information for you to consider when deciding how to vote on the matters brought before the Annual Meeting of the Stockholders. Please read it carefully.

The following summary highlights information contained in this proxy statement. This summary does not contain all the information you should consider and you should read the entire proxy statement before voting. For more complete information regarding our 2020 performance, please review our Annual Report on Form 10-K for the year ended December 31, 2020. All company operational information in this proxy statement is for the year ended or as of December 31, 2020, unless otherwise noted. See Appendix A for definitions and discussion of non-GAAP measures and reconciliations to GAAP measures and for additional detail regarding definitions of terms as generally explained in the proxy statement. References in this proxy statement to “we,” “us,” “our,” the “company,” and “Prologis” refer to Prologis, Inc. and its subsidiaries, unless the context otherwise requires.

| Proxy Summary |

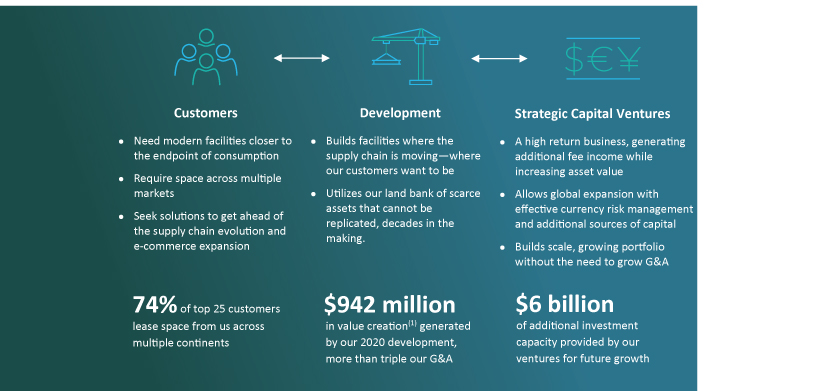

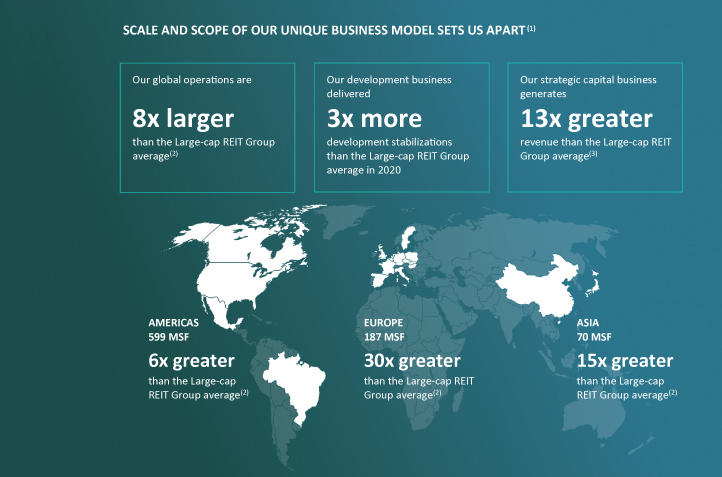

Our business model delivers long-term growth and outperformance.

In 2020, we stood resilient through the pandemic, outperforming both operationally and in the equity markets for yet another successful year.

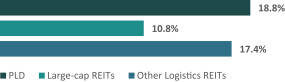

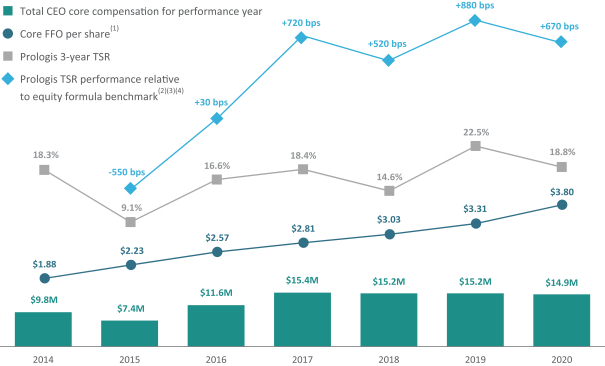

| Exceptional TSR Outperformance(1) | Sector-Leading Financial Performance | |

|

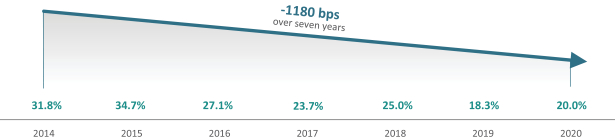

234.7% seven-year TSR

Over 1,100 bps outperformance |

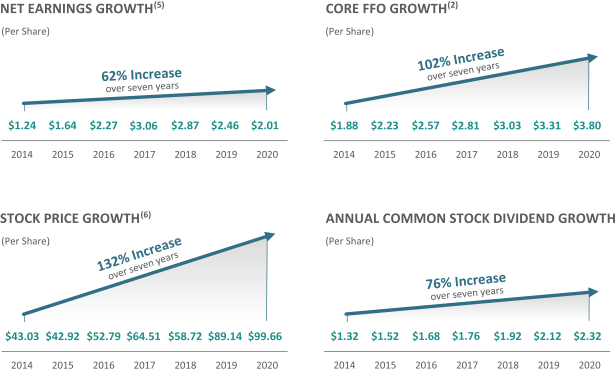

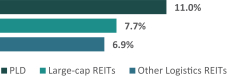

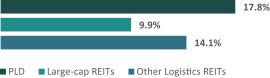

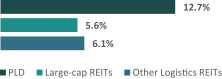

17.8% net earnings and 12.7% Core FFO per share seven-year CAGR(3),

790 bps and 710 bps above the Large- cap REIT Group seven-year CAGR average,(4) respectively |

Prologis Datteln Distribution Center 1, Datteln, Germany

| (1) | Total stockholder return (“TSR”) is calculated based on the stock price appreciation and dividends paid to show the total return to a stockholder over a period of time. TSR assumes dividends are reinvested in common stock on the day the dividend is paid. Measured in seven-year TSR. |

| (2) | MSCI US REIT Index is the “MSCI REIT Index.” Measured in seven-year TSR. |

| (3) | Seven-year compound annual growth rate (“CAGR”). Core FFO per share is a non-GAAP measure. Please see Appendix A for a discussion and reconciliation to the most directly comparable GAAP measure and for a calculation of the CAGR of our Core FFO per share. |

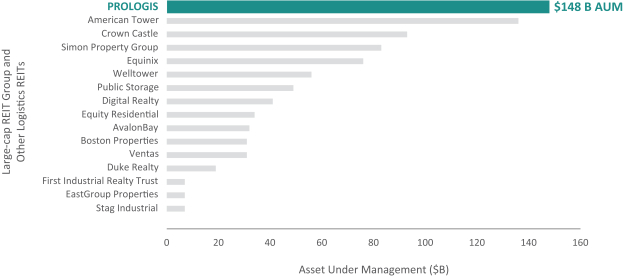

| (4) | The “Large-cap REIT Group” is our historical REIT compensation comparison group (American Tower Corporation, AvalonBay Communities, Inc., Boston Properties, Inc., Crown Castle International Corp., Digital Realty Trust, Inc., Equinix, Inc., Equity Residential, Public Storage, Inc., Simon Property Group, Inc., Ventas, Inc. and Welltower Inc.) The average rates of the Large-cap REIT Group are weighted by market capitalization. See footnotes to “Strong Growth Relative to Peers” for further detail on the calculation of the Large-cap REIT Group average. |

For further detail, please see “Compensation Discussion and Analysis.”

| Prologis Proxy Statement | March 19, 2021

|

1

|

| Proxy Summary |

2020 Environmental Stewardship, Social Responsibility and Governance (ESG) Highlights

We have a long-standing commitment to ESG leadership.

| Global 100 Corporations

12th year on Global 100 list by Corporate Knights |

Continuous Board

Five new directors in six years; appointed third female director in 2020 | |

| 18 Consecutive Years

A leading REIT in corporate governance by Green Street |

Top 10% in World

Global sustainable companies recognized | |

Nanjing Airport Logistics Center, Nanjing, China

For further detail, please see “Board of Directors and Corporate Governance”, “Environmental Stewardship, Social Responsibility and Governance” and “Compensation Discussion and Analysis.”

| Prologis Proxy Statement | March 19, 2021

|

3

|

| Proxy Summary |

Proposals Submitted to Vote at the 2021 Annual Meeting

| · | We are asking our stockholders of record on March 8, 2021 to vote on the following matters at our 2021 annual meeting of stockholders to be held on April 29, 2021. Please see the section entitled “Additional Information” for details on how to vote and the vote required to approve those matters. |

| Proposal | Board Recommendation | |

| PROPOSAL 1: Election of Directors

· At the annual meeting you will be asked to elect to the board of directors (the “Board”) of Prologis, Inc. the eleven persons nominated by the Board. The directors will be elected to one-year terms and will hold office until the 2022 annual meeting and until their successors are duly elected and qualified.

|

| |

|

PROPOSAL 2: Advisory Vote to Approve the Company’s Executive Compensation for 2020

· At the annual meeting you will be asked to approve a resolution on the company’s executive compensation for 2020 as reported in this proxy statement.

|

| |

|

PROPOSAL 3: Ratification of the Appointment of our Independent Registered Public Accounting Firm

· At the annual meeting you will be asked to ratify the appointment of KPMG LLP by the Audit Committee (the “Audit Committee”) of the Board as the company’s independent registered public accounting firm (“independent public accountant”) for the year 2021.

|

| |

| Prologis Proxy Statement | March 19, 2021

|

4

|

| Board of Directors and Corporate Governance |

Prologis Corporate Governance Tear Sheet

| Director Independence |

· 91% of our Board is independent: All directors, other than our chairman, are independent.

· No related-party transactions.

· No hedging or pledging of our securities.

· All directors attended 75% or more of Board and Board committee meetings.

· All directors are in compliance with our stock ownership guidelines (5x annual cash retainer). | |

| Director Composition and Evaluation Process |

· Annual Board evaluation process involving Board, Board committee and individual director assessments: Administered by the chair of our Board Governance and Nomination Committee (the “Governance Committee”) and our lead independent director, with a third-party evaluation every other year.

· Age/tenure policy: 75 years maximum age limit.(1) Impact of tenure on director independence is evaluated through our extensive annual Board evaluation process.

· Our mix of director tenure, skills and background provides a balance of experience and institutional knowledge with fresh perspectives.

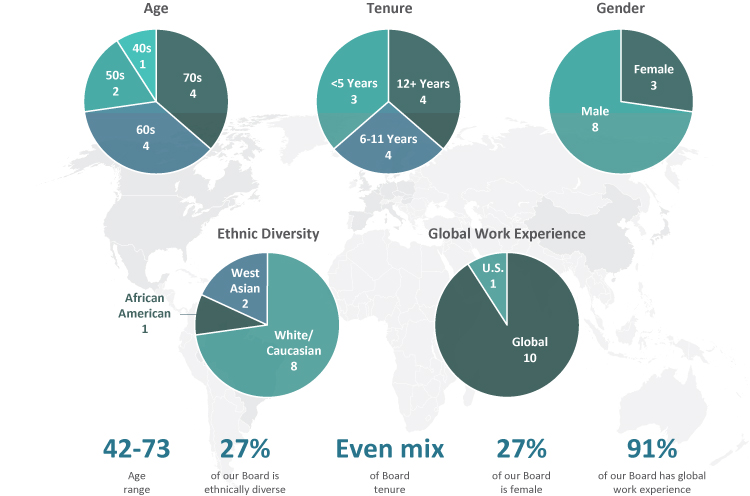

· Three directors are female, and three are ethnically diverse.(2) | |

| Board Leadership |

· Lead independent director role with significant authority and responsibilities.

· Chairman and CEO policy gives Board flexibility to determine best candidate for the positions. | |

| Strong Stockholder

|

· Adopted proxy access with 3/3/20/20 market standard (adopted in 2016).(3)

· No stockholder rights plan.

· Irrevocably opted out of Maryland staggered board provisions: All directors elected annually (adopted in 2014).

· Majority vote is the standard in uncontested director elections (adopted in 2007).

· Stockholders can amend bylaws with majority vote (adopted in 1997). | |

| (1) | Our governance guidelines provide that directors will not be nominated or appointed to the Board if they are, or would be, 75 years or older at the time of the election or appointment. |

| (2) | One director has self-identified as African American and two directors have self-identified as West Asian/Middle Eastern/Asian American. |

| (3) | See “Additional Information” for further detail on proxy access. |

| Prologis Proxy Statement | March 19, 2021

|

6

|

| Board of Directors and Corporate Governance |

Election of Directors (Proposal 1)

|

· The Board is currently comprised of eleven directors, all of whom are standing to be elected to the Board at the 2021 annual meeting of stockholders to hold office until the 2022 annual meeting and until their successors are duly elected and qualified.

· The Board has affirmatively determined that all of our director nominees, other than Hamid Moghadam, are independent directors in accordance with New York Stock Exchange (“NYSE”) rules, our governance guidelines and our bylaws.

· Our bylaws provide for a majority voting standard for the election of directors. See “Additional Information—Majority Voting” for further detail.

· We do not know of any reason why any nominee would be unable or unwilling to serve as a director, if elected. However, if a nominee becomes unable to serve or will not serve, proxies may be voted for the election of such other person nominated by the Board as a substitute or the Board may reduce the number of directors. Each of the director nominees has consented to be named in this proxy statement and to serve as a director if elected.

· Information about each director nominee’s share ownership is presented below under “Security Ownership.”

· The shares represented by the proxies received will be voted for the election of each of the eleven nominees named below, unless you indicate in the proxy that your vote should be cast against any or all of the director nominees or that you abstain from voting. Each nominee elected as a director will continue in office until his or her successor has been duly elected and qualified, or until the earliest of his or her resignation, retirement or death.

· The eleven nominees for election to the Board at the 2021 annual meeting, all proposed by the Board, are listed below, along with brief biographies. |

The Board unanimously recommends that the stockholders vote FOR the

election of each nominee.

| Prologis Proxy Statement | March 19, 2021

|

7

|

| Board of Directors and Corporate Governance |

HOW IT WORKS

| (1) | The entire Board was rebuilt in 2011 at the time of the merger (the “Merger”) between AMB Property Corporation and ProLogis (the “Trust”) and the tenure of the rebuilt Board started at that time. However, we include Mr. Moghadam, Ms. Kennard, Mr. Webb and Mr. Skelton in the 12+ year category as they were directors of the legal acquirer prior to the Merger. |

| (2) | Includes Philip Hawkins, who joined our Board in 2018 and stepped down from our Board in 2020 to assume an executive chairman position at a U.S. industrial real estate company. |

| Prologis Proxy Statement | March 19, 2021

|

8

|

| Board of Directors and Corporate Governance |

Board Evaluations and Process for Selecting Directors

Rigorous board evaluation and refreshment process

| · | Our annual Board evaluation process involves assessments at the Board, Board committee and individual director levels. Through this process, the Board determines who should be nominated to stand for election based on current company and Board needs. |

| · | In this process, directors complete a Board survey to identify key skills and characteristics currently needed for the Board, as well as to provide information relating to Board composition and planning. |

| · | Director interview questions are prepared based on current areas of focus as well as feedback from our stockholder outreach efforts. |

| · | Annual one-on-one director interviews are conducted by our lead independent director and chair of the Governance Committee and, every other year, by an independent third party. |

| · | The results of the director interviews are aggregated by our lead independent director, Governance Committee chair, and if applicable, the independent third party, and reported to the Governance Committee and then to our full Board. Our Board will follow up on items identified in the evaluation process. |

| · | Our Governance Committee discusses Board succession and reviews potential candidates. This process is based on the results of annual board evaluations and takes place throughout the course of the year. |

| · | Our director candidate search process actively identifies and assesses a pool of potential candidates through a variety of sources, primarily through internal references. Although the committee may retain third parties to assist in identifying potential nominees, it prefers internal references by directors who understand the needs and dynamics of the Board with a particular focus on inclusion and diversity of ideas and background. |

| · | In 2021, we implemented a director/CEO recruitment diversity policy that requires the Governance Committee to consider (and any staffing agencies to recruit) ethnic and gender diverse candidates in formal director searches and recruitment for external CEO candidates. |

| · | Our governance guidelines also ensure regular board refreshment, providing that directors will not be nominated or appointed to the Board if they are, or would be, 75 years or older at the time of the election or appointment. Term limits on directors’ service have not been instituted. |

Regular Board refreshment

| · | The Board is committed to regular refreshment to maintain an optimal balance of different perspectives, skills and backgrounds. We have onboarded five new directors in the past six years, increasing the ethnic, gender and geographical diversity of the Board as well as breadth of experience. As a priority, the Board continues to be particularly focused on ethnic and gender diverse candidates who meet the current needs of the company. |

| · | The Board was completely refreshed and rebuilt at the time of the Merger in 2011. The Merger essentially created a new company with a new operating and corporate platform. At that time, all directors underwent intensive review to determine which directors would best fit the newly created combined company. |

| · | Each director selected in this rebuilding process was onboarded as a new director to the newly established company. These directors were required to perform in a new governance environment, with new structures, processes, committees, charters and guidelines. |

| · | We have continued to refresh the Board since the Merger. David O’Connor onboarded as a new director in 2015, Olivier Piani in 2017, Cristina Bita and Philip Hawkins in 2018, and Avid Modjtabai in 2020. (In 2020, Mr. Hawkins took a position as executive chairman of a U.S. industrial real estate portfolio company and, as a result, decided to step down from our Board). |

| Prologis Proxy Statement | March 19, 2021

|

9

|

| Board of Directors and Corporate Governance |

| · | As a result of our regular board refreshment, the Board comprises an appropriate mix of tenures: three directors with up to five years of tenure, four directors with tenure between six and eleven years and four with over twelve years of tenure. This mix provides an even balance of experience and institutional knowledge with fresh perspectives. |

Director Qualifications, Skills and Experience

Board composition and diversity

| · | Our board diversity policy centers on our commitment to maintaining Board diversity in thought, background and experience—a mix of gender, ethnic background, geographic origin and professional experience that supports our business strategy and the current needs of the Board. As such, the Governance Committee focuses on identifying and nominating qualified and diverse director candidates with commensurate experience and background and each of our director nominees was chosen on this basis. For information about our director nominees and our business, strategy and goals, please see “Director Nominees” and “Compensation Discussion and Analysis” (“CD&A”). |

| · | In making its nominations, the Governance Committee also assessed each director nominee by key characteristics, including courage to voice opinions, integrity, experience, accountability, good judgment, supportiveness in working with others and willingness to commit the time needed to satisfy the requirements of Board and committee membership. |

| Prologis Proxy Statement | March 19, 2021

|

10

|

| Board of Directors and Corporate Governance |

PROLOGIS BOARD DIVERSITY

| Prologis Proxy Statement | March 19, 2021

|

11

|

| Board of Directors and Corporate Governance |

Board Qualifications

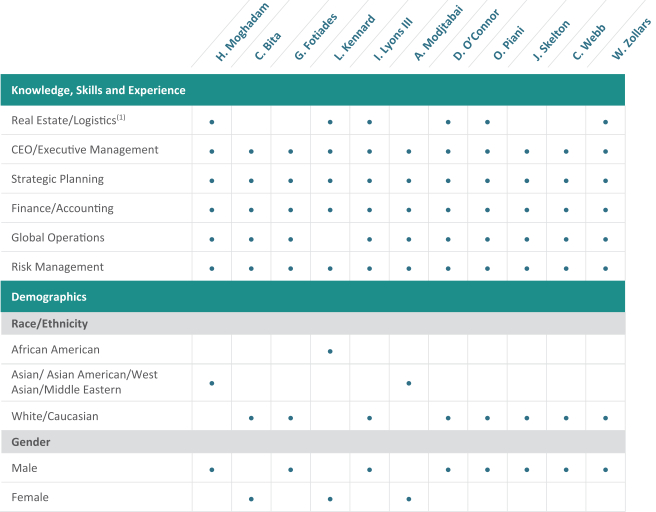

Director skills and experience support our business strategy.

| · | We have deep experience on our Board covering all components of our business model. The Board believes a balance of perspectives from other industries is critical to well-rounded oversight and insight into the perspectives of our customers covering a wide range of industries. |

| (1) | Over seven-year period 2014-2020. |

| (2) | Our global platform outperformed the average of the “Large-cap REIT Group” in net earnings per share and Core FFO per share CAGR by 790 bps and 710 bps, respectively, over the last seven years. The average rates for the Large-cap REIT Group are weighted by market capitalization. See footnotes to “Strong Growth Relative to Peers” for further detail on the calculation of the Large-cap REIT Group average. Core FFO per share is a non-GAAP measure. Please see Appendix A for a discussion and reconciliation to the most directly comparable GAAP measure and a calculation of the CAGR of our Core FFO per share. |

| (3) | “G&A” are our general and administrative expenses. |

| (4) | Value created over our total expected investment through development and leasing activities based on current projections. Please see Appendix A for further detail regarding how we calculate “Value creation.” Development value creation is calculated across our owned and managed portfolio. |

| Prologis Proxy Statement | March 19, 2021

|

12

|

| Board of Directors and Corporate Governance |

| · | Along with the fundamental characteristics necessary for all directors, such as courage, wisdom and good judgment, below are qualifications of our Board identified in our Board evaluation process as important to support our current business strategy. These characteristics, coupled with diversity of thought and background, are critical to strong oversight and proven long-term results. Also, in addition to these qualifications, director experience in innovation and technology, like Ms. Bita’s tenure at Google, supports our strategic initiatives to stay ahead of the evolution of the supply chain and our customers’ needs. As the former Chief Information Officer and head of technology of Wells Fargo, Ms. Modjtabai also brings her experience overseeing core technology functions including information/cybersecurity. |

| · | Race, ethnic and gender demographics of the board are also included below. |

| (1) | Includes development, operations, real estate investments and fund management. |

| Prologis Proxy Statement | March 19, 2021

|

13

|

| Board of Directors and Corporate Governance |

Hamid R. Moghadam

|

· Chairman of the Board since January 2000; Director since November 1997

· Board Committees: Executive

· Other public directorships: None |

Mr. Moghadam, 64, has been our Chief Executive Officer since the end of December 2012 and was our Co-Chief Executive Officer from June 2011 to December 2012. He is the co-founder of AMB Property Corporation and was AMB’s Chief Executive Officer from November 1997 (from the time of AMB’s initial public offering) to June 2011 when AMB merged with the Trust.

Other relevant qualifications. Mr. Moghadam is on the board of the Stanford Management Company and formerly served as its chairman. He is a former trustee of Stanford University and previously served on the Executive Committee of the Board of Directors of the Urban Land Institute. Mr. Moghadam holds Bachelor’s and Master’s degrees in engineering from the Massachusetts Institute of Technology and a Master of Business Administration from the Graduate School of Business at Stanford University.

Irving F. Lyons III

|

· Lead independent director since June 2011 (prior to the Merger served as a trustee of the Trust from September 2009 to June 2011 and from March 1996 to May 2006)

· Board Committees: Executive

· Other public directorships: Equinix, Inc. and Essex Property Trust, Inc. |

Mr. Lyons, 71, has been a principal with Lyons Asset Management, a private equity firm, since January 2005. In 2004, Mr. Lyons retired from the Trust where he served as chief investment officer from 1997 until his retirement. He joined the Trust in 1993 and served as president from 1999 to 2001 and vice chairman from 2001 to 2004. Mr. Lyons is a member of the boards of Equinix, Inc., a global data center operator, and Essex Property Trust, Inc., a real estate investment trust investing in apartment communities. Mr. Lyons previously served as chairman of the board of BRE Properties, Inc.

Other relevant qualifications. Mr. Lyons joined the Trust when King & Lyons, an industrial real estate management and development company, was acquired by the Trust in 1993. Mr. Lyons had been the managing general partner in that firm since its inception in 1979 and was one of its principals at the time of the acquisition. Mr. Lyons holds a Master in Business Administration from Stanford University and a Bachelor of Science in industrial engineering and operations research from the University of California at Berkeley.

| Prologis Proxy Statement | March 19, 2021

|

14

|

| Board of Directors and Corporate Governance |

Cristina G. Bita

|

· Director since May 2018

· Board Committees: Audit

· Other public directorships: None |

Ms. Bita, 42, is a Vice President of Finance at Google, and Business Finance Officer for Google’s Devices and Services product area, Google Marketing organization and Google Sustainability. She has served in a number of finance leadership roles since joining Google in 2006 across a range of business areas, including Global Partnerships and Business Development, Global Sales, and Consumer Products and Platforms. Prior to Google, Ms. Bita spent six years with Siemens/Osram, where she held various positions in Business Unit Controllership and Corporate FP&A.

Other relevant qualifications. Ms. Bita holds a Master of Science in Finance from the Boston College Wallace E. Carroll School of Management and a Bachelor of Science in Business Administration (Accounting) from Salem State University. Ms. Bita is also a Certified Management Accountant (CMA).

George L. Fotiades

|

· Director since June 2011 (prior to the Merger served as a trustee of the Trust from December 2001 to June 2011)

· Board Committees: Compensation (Chair)

· Other public directorships: AptarGroup, Inc. and Cantel Medical Corp.* |

Mr. Fotiades, 67, was appointed President and Chief Executive Officer* of Cantel Medical Corp., a provider of infection prevention and control products, in March 2019. Mr. Fotiades was an operating partner at Five Arrows Capital Partners (Rothschild Merchant Banking) from April 2017 until March 2019. From April 2007 to April 2017, Mr. Fotiades was a partner, healthcare investments at Diamond Castle Holdings, LLP, a private equity firm. Mr. Fotiades was chairman of Catalent Pharma Solutions, Inc., a provider of advanced technologies for pharmaceutical, biotechnology, and consumer health companies, from June 2007 to February 2010. Mr. Fotiades is Chairman of the board of AptarGroup, Inc., a global dispensing systems company and is also a director of Cantel Medical Corp. He previously served on the board of Alberto-Culver Company, a consumer products company specializing in hair and skin care products.

Other relevant qualifications. Mr. Fotiades was previously the president and chief operating officer of Cardinal Health, Inc. and also served as president and chief executive officer of Cardinal’s Pharmaceutical Technologies and Services segment. Mr. Fotiades also served as president of Warner-Lambert’s consumer healthcare business, as well as in other senior positions at Bristol-Myers Squibb, Wyeth, and Procter & Gamble. Mr. Fotiades holds a Master of Management from The Kellogg School of Management at Northwestern University and a Bachelor of Arts from Amherst College.

* Mr. Fotiades will no longer be CEO of Cantel Medical Corp. (or CEO in any other capacity) upon the closing of Steris Corporation’s acquisition of Cantel Medical Corp., expected to occur in the second quarter of 2021. Should the Steris acquisition terminate or not close, Mr. Fotiades will nevertheless retire as CEO of Cantel Medical Corp.

| Prologis Proxy Statement | March 19, 2021

|

15

|

| Board of Directors and Corporate Governance |

Lydia H. Kennard

|

· Director since August 2004

· Board Committees: Governance

· Other public directorships: Freeport-McMoRan Copper & Gold Inc., Healthpeak Properties, Inc. (formerly known as HCP Inc.) and AECOM |

Ms. Kennard, 66, is the founder and chief executive officer of KDG Construction Consulting, a provider of project and construction management services, a principal of KDG Aviation, an aviation focused real estate operating and development company, and a principal with 1031 N. Brand Boulevard, Glendale, LLC, a single-purpose real estate entity. Ms. Kennard is a member of the boards of Freeport-McMoRan Copper & Gold Inc., a natural resource company, Healthpeak Properties, Inc., a healthcare real estate investment trust, and AECOM, an infrastructure consulting firm. Ms. Kennard was previously a member of the boards of URS Corporation, a provider of engineering, construction and technical services, and Intermec, Inc., an automated identification and data collection company.

Other relevant qualifications. Ms. Kennard served as Chief Executive Officer of Los Angeles World Airports, a system of airports comprising Los Angeles International, Ontario International Airport, Palmdale Regional, and Van Nuys General Aviation Airports from 1999 to 2003 and again from 2005 to 2007. From 1994 to 1999, she served as the system’s deputy executive for design and construction. Ms. Kennard holds a Juris Doctor degree from Harvard University, a Master’s degree in city planning from the Massachusetts Institute of Technology, and a Bachelor of Science in urban planning and management from Stanford University.

Avid Modjtabai

|

· Director since February 2020

· Other public directorships: Avnet, Inc. |

Ms. Modjtabai, 59, served as the Senior Executive Vice President and head of the Payments, Virtual Solutions and Innovation Group at Wells Fargo from 2016 to her retirement in March 2020. Prior to that, she served in various leadership roles at Wells Fargo, including Group head for Wells Fargo Consumer Lending from 2011 to 2016, Chief Information Officer and head of Technology and Operations Group from 2008 to 2011, Chief Information Officer and head of technology from 2007 to 2008, and Director of Human Resources from 2005 to 2007. Ms. Modjtabai is a member of the board of Avnet, Inc., a global technology solutions provider.

Other relevant qualifications. Ms. Modjtabai holds a Master in Business Administration in finance from Columbia University and a Bachelor of Science in industrial engineering from Stanford University.

| Prologis Proxy Statement | March 19, 2021

|

16

|

| Board of Directors and Corporate Governance |

David P. O’Connor

|

· Director since January 2015

· Board Committees: Compensation

· Other public directorships: Regency Centers Corporation |

Mr. O’Connor, 56, is a private investor, managing partner of High Rise Capital Partners, LLC, a private real estate investment firm, and a non-executive co-chairman of HighBrook Investors LLC. He was the co-founder and senior managing partner of High Rise Capital Management LP, a real estate securities hedge fund manager that operated from 2001 to 2011. Mr. O’Connor is a member of the board of Regency Centers Corporation, a publicly traded real estate investment trust specializing in shopping centers. He previously served on the board of Songbird Estates plc, the former majority owner of Canary Wharf in London, UK and Paramount Group, Inc., a publicly traded real estate investment and management company specializing in office buildings.

Other relevant qualifications. Mr. O’Connor was previously a principal, co-portfolio manager and investment committee member of European Investors, Inc., a large dedicated real estate investment trust investor, from 1994 to 2000. Mr. O’Connor received a Master of Science in real estate from New York University and holds a Bachelor of Science degree from the Boston College Wallace E. Carroll School of Management.

Olivier Piani

|

· Director since May 2017

· Board Committees: Audit

· Other public directorships: None |

Mr. Piani, 67, is the chief executive officer and founder of OP Conseils, a consulting company in real estate and finance that Mr. Piani started in January 2016. Mr. Piani is also a senior consultant with Ardian, a major European private equity group. From September 2008 to December 2015, Mr. Piani was chief executive officer of Allianz Real Estate, the real estate and asset management investment platform for the Allianz Group.

Other relevant qualifications. From 1998 to 2008, Mr. Piani built the pan-European platform for GE Capital Real Estate spanning seven different countries. Prior to joining GE in 1998, Mr. Piani was chief executive officer of UIC-Sofal, a real estate bank. From 1982 to 1995, Mr. Piani held various leadership positions in the Paribas Group in Paris, New York and London. Mr. Piani is a graduate of Paris Ecole Superieure de Commerce de Paris and received a Master of Business Administration from Stanford University.

| Prologis Proxy Statement | March 19, 2021

|

17

|

| Board of Directors and Corporate Governance |

Jeffrey L. Skelton

|

· Director since November 1997

· Board Committees: Governance (Chair), Executive (Chair)

· Other public directorships: None |

Mr. Skelton, 71, retired in 2009 as president and chief executive officer of Symphony Asset Management, a subsidiary of Nuveen Investments, Inc., an investment management firm. After his retirement in 2009 and until 2013, Mr. Skelton was a co-founder and managing partner of Resultant Capital Partners, an investment management firm.

Other relevant qualifications. Prior to founding Symphony Asset Management in 1994, Mr. Skelton was with Wells Fargo Nikko Investment Advisors from 1984 to 1993, where he served in a variety of capacities, including chief research officer, vice chairman, co-chief investment officer and chief executive officer of Wells Fargo Nikko Investment Advisors Limited in London. Previously, Mr. Skelton was also an assistant professor of finance at the University of California at Berkeley, Walter A. Haas School of Business. Mr. Skelton holds a Ph.D. in mathematical economics and finance and a Master of Business Administration from the University of Chicago.

Carl B. Webb

|

· Director since August 2007

· Board Committees: Audit (Chair)

· Other public directorships: Hilltop Holdings Inc. |

Mr. Webb, 71, is currently a co-managing member of Ford Financial Fund II, L.P. and Ford Financial Fund III, L.P., private equity firms focusing on equity investments in financial services, a position he has held since February 2012 and March 2019, respectively. Mr. Webb has served as chairman of the Mechanics Bank board since April 2015. From June 2008 until December 2012, Mr. Webb was a senior partner of Ford Management, L.P. Mr. Webb was also the chief executive officer and a board member of Pacific Capital Bancorp and chairman of Santa Barbara Bank and Trust from August 2010 until December 2012. Mr. Webb has also served as a consultant to Hunter’s Glen/Ford, Ltd., a private investment partnership, since November 2002. Additionally, Mr. Webb is a member of the board of Hilltop Holdings Inc., a publicly traded financial services holding company.

Other relevant qualifications. Mr. Webb previously served on the boards of Plum Creek Timber Company, M & F Worldwide Corp. and Triad Financial SM LLC, where he was co-chairman from July 2007 to October 2009 and served as interim president and chief executive officer from August 2005 to June 2007. Since 1983, Mr. Webb held executive positions at banking institutions, including Golden State Bancorp, Inc. and its subsidiary, California Federal Bank, FSB, First Madison Bank, FSB, First Gibraltar Bank, FSB and First National Bank at Lubbock. Mr. Webb holds a Bachelor of Business Administration from West Texas A&M University and a graduate banking degree from Southwestern Graduate School of Banking at Southern Methodist University.

| Prologis Proxy Statement | March 19, 2021

|

18

|

| Board of Directors and Corporate Governance |

William D. Zollars

|

· Director since June 2011 (prior to the Merger served as a trustee of the Trust from December 2001 to May 2010)

· Board Committees: Governance, Compensation

· Other public directorships: Cerner Corporation |

Mr. Zollars, 73, retired from YRC Worldwide, Inc., a global transportation service provider, in July 2011 where he served as chairman, president, and chief executive officer from 1999 until his retirement. He was president of Yellow Transportation, Inc. from 1996 to 1999. Mr. Zollars is a member of the board of Cerner Corporation, a supplier of healthcare information technology solutions, healthcare devices and related services. Mr. Zollars also serves on the U.S. Postal Service Board of Governors. He is a former director of CIGNA Corporation, a global health service organization.

Other relevant qualifications. Mr. Zollars was previously a senior vice president of Ryder Integrated Logistics, a division of Ryder System, Inc. and he spent 24 years in various executive positions, including eight years in international locations, at Eastman Kodak. Mr. Zollars holds a Bachelor of Arts in economics from the University of Minnesota.

| Prologis Proxy Statement | March 19, 2021

|

19

|

| Board of Directors and Corporate Governance |

We require that a majority of the Board be independent in accordance with NYSE rules. To determine whether a director is independent, the Board must affirmatively determine that there is no direct or indirect material relationship between the company and the director.

91% of the Board is independent.

| · | The Board has determined that all our directors other than our chairman, Mr. Moghadam, are independent. |

The Board reached this determination after considering all relevant facts and circumstances, reviewing director questionnaires and considering transactions and relationships, if any, between us, our affiliates, our executive officers and their affiliates, and each of the directors, members of each of their immediate families and their affiliates.

Audit, Governance and Talent and Compensation Committees are 100% independent.

| · | The Board has also determined that all members of the Audit, Governance and Talent and Compensation Committees of the Board are independent in accordance with NYSE and Securities and Exchange Commission (“SEC”) rules. |

Our governance guidelines do not specify a leadership structure for the Board, allowing the Board the flexibility to choose the best option for the company as circumstances warrant. The Board believes that strong independent leadership ensures effective oversight over the company. Such independent oversight is maintained through:

| · | our lead independent director; |

| · | our independent directors; |

| · | the Audit, Governance and Talent and Compensation Committees, which are all comprised entirely of independent directors; |

| · | annual review of the Board leadership structure and effectiveness of oversight through the Board evaluation process; and |

| · | strong adherence to our governance guidelines. |

All of our independent directors have the ability to provide input for meeting agendas and are encouraged to raise topics for discussion by the Board. In addition, the Board and each Board committee has complete and open access to any member of management.

Each committee has the authority to retain independent legal, financial and other advisors as they deem appropriate without consulting or obtaining the approval of any member of management. The Board also holds regularly scheduled executive sessions of only independent directors in order to promote free and open discussion among the independent directors.

| Prologis Proxy Statement | March 19, 2021

|

20

|

| Board of Directors and Corporate Governance |

Chairman and CEO assessment

Our chairman and CEO and our lead independent director act together in a system of checks and balances, providing both strong oversight and operational insight.

Our CEO, Mr. Moghadam, serves as chairman of the Board. The lead independent director role is focused on ensuring independent oversight of the company. Mr. Moghadam’s roles as both CEO and chairman enable him to act as a bridge between management and the Board, ensuring that the Board understands our business when making its decisions.

Mr. Moghadam has the breadth of experience to execute our unique business plan and to provide special insights to the Board.

Very few have experience running a public company with extensive global operations and substantial strategic capital and development businesses. Mr. Moghadam co-founded the company and has served on the Board since the company’s initial public offering in November 1997. As one of our founders, Mr. Moghadam has extensive knowledge and expertise in the real estate and REIT industries, as well as history and knowledge of our company.

Considering all of these factors, the Board believes that a structure that combines the roles of CEO and chairman, along with an independent lead director, independent chairs for each of the Board committees and independent non-employee directors, provides the best leadership for the company at this time and places the company in a competitive position to provide long-term value to our stockholders.

Lead independent director

If the offices of chairman and CEO are held by the same person, the independent members of the Board will annually elect an independent director to serve in a lead capacity. The lead independent director is generally expected to serve for more than one year. Mr. Lyons has been selected as the lead independent director by our Governance Committee and the independent members of our Board and has served in that capacity for nearly ten years.

The lead independent director coordinates the activities of the other independent directors and performs other duties and responsibilities as determined by the Board.

The specific responsibilities of the lead independent director are currently as follows:

| Executive Sessions/ Committee Meetings

|

· Presides at all meetings of the Board at which the chairman is not present, including executive sessions of the independent directors (generally held at every regular Board meeting)

· Attends meetings of the various Board committees regularly

| |

|

Meetings of Independent Directors

|

· Has the authority to call meetings of the independent directors and set the agenda

| |

| Board Evaluations

|

· Oversees, with the chair of the Governance Committee and, when applicable, an independent third-party, annual evaluations of the Board, Board committees and individual directors, including an evaluation of the chairman’s effectiveness as both chairman and CEO

| |

| Prologis Proxy Statement | March 19, 2021

|

21

|

| Board of Directors and Corporate Governance |

| Liaison with Chairman and CEO

|

· Serves as liaison between the independent directors and the chairman

· Meets regularly between Board meetings with the chairman and CEO

| |

| Board Processes and Information

|

· Ensures the quality, quantity, appropriateness and timeliness of information provided to the Board and provides input to create meeting agendas

· Ensures that feedback is properly communicated to the Board and chairman

· Ensures the institution of proper Board processes, including the number, frequency and scheduling of Board meetings and sufficient time for discussion of all agenda items

| |

| Communications with Stockholders

|

· Responds to stockholder inquiries and communicates with stockholders when appropriate, following consultation with the chairman and CEO

| |

| Prologis Proxy Statement | March 19, 2021

|

22

|

| Board of Directors and Corporate Governance |

Pursuant to the Maryland General Corporation Law and our bylaws, our business, property and affairs are managed under the direction of the Board. Members of the Board are kept informed of our business through our executive management team.

The four standing committees of the Board are: Audit, Governance, Talent and Compensation (the “Compensation Committee”) and Executive Committee (the “Executive Committee”). The Board has determined that each member of the Audit, Governance and Compensation Committees is an independent director in accordance with NYSE and SEC rules.

The current membership information for our Board committees is presented below.

Each committee has a charter which generally states the purpose of the committee and outlines the committee’s structure and responsibilities. The committees, other than the Executive Committee, must review their charter on an annual basis.

PROLOGIS BOARD COMMITTEES

Audit Committee

Members: Carl Webb (Chair), Cristina Bita, Avid Modjtabai and Olivier Piani

Number of Meetings in 2020: 9

|

· Oversees the financial accounting and reporting processes of the company

· Responsible for the appointment, compensation and oversight of our public accountants

· Monitors: (i) the integrity of our financial statements; (ii) our compliance with legal and regulatory requirements; (iii) our public accountant’s qualifications and independence; and (iv) the performance of our internal audit function and public accountants

· Oversees financial and cybersecurity risks relating to the company

· All committee members are designated by the Board as “audit committee financial experts” in accordance with SEC regulations and meet the independence, experience and financial literacy requirements of the NYSE and Section 10A of the Securities Exchange Act of 1934, as amended |

Talent and Compensation Committee

Members: George Fotiades (Chair), David O’Connor and William Zollars

Number of Meetings in 2020: 6

|

· Discharges the Board’s responsibilities relating to compensation of directors and executives and produces an annual report on executive compensation for inclusion in the proxy statement

· Approves and evaluates our director and officer compensation plans, policies and programs

· Reviews and recommends to the Board corporate goals and objectives relative to the compensation of our CEO

· Evaluates our CEO’s performance in light of corporate goals and objectives, and sets the CEO’s compensation level based on this evaluation, including incentive and equity-based compensation plans

· Sets the amount and form of compensation for the executive officers who report to the CEO |

| Prologis Proxy Statement | March 19, 2021

|

23

|

| Board of Directors and Corporate Governance |

|

· Makes recommendations to the Board (including recommendations for non-employee directors) on general compensation practices, including incentive and equity-based compensation plans, and adopts, administers and makes awards under annual and long-term incentive compensation and equity-based compensation plans, including any amendments to the awards under any such plans, and reviews and monitors awards under such plans

· Reviews and approves any new employment agreements, change in control agreements and severance or similar termination payments proposed to be made to the CEO or any other executive officer of the company

· Confirms that relevant reports are made to the Board or in periodic filings as required by governing rules and regulations of the SEC and NYSE

· Reviews and discusses with management CD&A and determines whether to recommend its inclusion in the proxy statement to the Board

· Participates in succession planning for key executives

· Focuses on risks relating to remuneration of our officers and employees and administers our equity compensation plans, our nonqualified deferred compensation arrangements and our 401(k) plan

· Advises management in human capital strategies and practices, attracting, developing and retaining key employees, including annual review of inclusion and diversity initiatives, metrics and information |

Board Governance and Nomination Committee

Members: Jeffrey Skelton (Chair), Lydia Kennard and William Zollars

Number of Meetings in 2020: 3

|

· Reviews and makes recommendations to the Board on Board organization and succession matters

· Assists the full Board in evaluating the effectiveness of the Board and its committees

· Reviews and makes recommendations for committee appointments to the Board

· Identifies individuals qualified to become Board members consistent with any criteria approved by the Board and proposes to the Board a slate of nominees for election to the Board

· Assesses and makes recommendations to the Board on corporate governance matters

· Develops and recommends to the Board a set of corporate governance principles applicable to the company

· Oversees ESG matters, assesses ESG risks and assists the Board in reviewing and approving the company’s ESG and sustainability activities, goals and policies

· Reviews the adequacy of our governance guidelines on an annual basis and focuses on reputational and corporate governance risks |

Executive Committee

Members: Jeffrey Skelton (Chair), Irving Lyons III and Hamid Moghadam

Number of Meetings in 2020: 0

|

· Acts only if action by the Board is required, the Board is unavailable and the matter is time-sensitive

· Has all of the powers and authority of the Board, subject to such limitations as the Board, the committee’s charter and/or applicable law, rules and regulations may from time to time impose |

| Prologis Proxy Statement | March 19, 2021

|

24

|

| Board of Directors and Corporate Governance |

Board’s role in risk oversight

Risk awareness is embedded throughout our operations, underpinned by an integrated framework for identifying, assessing and managing risk.

The Board has the primary responsibility for overseeing risk management of the company. Oversight for certain specific risks falls under the responsibilities of our Board committees.

| · | The Audit Committee focuses on financial and cybersecurity risks relating to the company. |

| · | The Compensation Committee focuses on risks relating to human capital management, talent retention and remuneration of our officers and employees. |

| · | The Governance Committee focuses on reputational, corporate governance and ESG risks. |

These committees regularly advise the full Board of their risk oversight activities.

Critical components of our risk oversight framework include regular communication among the Board, our management executive committee and our risk management infrastructure to identify, assess and manage risk.

| Prologis Proxy Statement | March 19, 2021

|

25

|

| Board of Directors and Corporate Governance |

Identifying, Managing and Assessing Risks

Our risk oversight framework includes:

|

· Board engagement with executive and risk management teams including multi-dimensional risk reviews, risk assessment mapping and one-on-one interviews between each director and our risk management team

· Executive management committee meetings focused on strategic risks

· A structured approach to capital deployment vetted through weekly investment committee meetings, including assessments of ESG, resilience, and natural disaster/weather/climate risks

· Management of one of the strongest balance sheets in the REIT industry achieved by lowering our financial risk and foreign currency exposure

· Rigorous internal and third-party audits assessing the company’s controls and procedures

· Centralized team dedicated to managing risk globally and staying closely engaged with Prologis’ teams at the individual market level |

Cybersecurity

Our Chief Technology Officer and our Vice President of IT Governance oversee our information security program. They report to the audit committee/board at least annually and also conduct annual information security compliance training. The Prologis Information Security Policy is governed by the NIST Cybersecurity Framework (CSF) and includes mandatory annual training for all employees. Prologis’ cybersecurity posture is reviewed and benchmarked against its peers through regular participation in a third-party security benchmarking survey. Our IT infrastructure is externally audited as part of our Sarbanes Oxley audit process and our controls include information security standards. Also, we maintain standalone cybersecurity insurance. To our knowledge, we have not experienced a material breach in information security.

CEO and management succession planning

The Board is responsible for ensuring that we have a high-performing management team in place. The Board, with the assistance of the Compensation Committee, regularly conducts a detailed review of management development and succession planning activities to ensure that top management positions, including the CEO position, can be filled without undue interruption.

Our succession planning process is two-tiered to ensure orderly succession. One tier contemplates succession planning in the case of an emergency during which one or more members of our current management are unable to perform their duties. The second tier involves long-term planning to identify and develop talent with potential to step in as our future management team. As part of our longer term succession planning, we made changes in 2019 and 2020 to our organizational architecture to prepare the company for the next chapter in its evolution. Executive roles were reorganized to drive our platform initiatives focusing on customer centricity and extracting value beyond our real estate while allowing for growth opportunities for the next generation of potential leaders.

Communications with directors

We appreciate your input. Our lead independent director (or any of our other directors) are accessible to our stockholders for engagement as appropriate. You can communicate with any of the directors, individually or as a group, by writing to them in care of Edward S. Nekritz, Secretary, Prologis, Inc., Pier 1, Bay 1, San Francisco, California 94111. Each communication intended for the Board and received by the secretary that is related to the operation of the company and is not otherwise commercial in nature will be forwarded to the specified party following its clearance through normal security procedures. The directors will be advised of any communications that were excluded through normal security procedures as appropriate and they will be made available to any director who wishes to review them.

| Prologis Proxy Statement | March 19, 2021

|

26

|

| Board of Directors and Corporate Governance |

Director attendance

The Board held four meetings in 2020, including telephonic meetings, and all of the directors attended 75% or more of the aggregate number of Board and applicable committee meetings on which he or she served during 2020 (held during the periods they served). Each director standing for election in 2021 is expected to attend the annual meeting of stockholders, either virtually or telephonically, absent cause. All of our directors attended the annual meeting last year, virtually or telephonically.

Director compensation

Please see “Director Compensation” and the table titled “Director Compensation for Fiscal Year 2020.”

Stock ownership guidelines and prohibition on hedging/pledging

Our directors must comply with our stock ownership guidelines which require the director to maintain an ownership level in our common stock equal to five times the annual cash retainer (a total of $600,000 as of December 31, 2020). Shares included as owned by directors for purposes of the guidelines include common stock owned, vested or unvested equity awards (restricted stock, restricted stock units, shares and share units deferred under the terms of the Director Deferred Fee Plan or the applicable non-qualified deferred compensation plan, deferred share units and dividend equivalent units) and operating partnership or other partnership units exchangeable or redeemable for common stock. Until such time as the ownership thresholds are met, we will require directors to retain and hold 50% of any net shares of our common stock issued to our directors under our equity compensation plans.

Additionally, our insider trading policy prohibits our directors and employees from hedging the economic risk of ownership of our common stock and from pledging shares of our common stock.

All of our directors and executive officers are currently in compliance with the stock ownership guidelines and the prohibition on hedging and pledging our common stock.

Independent compensation consultant

The Compensation Committee directly engaged an outside compensation consulting firm, Frederic W. Cook & Co., Inc. (“FW Cook”) to assist the committee in assessing our compensation programs for our Board, our CEO and other members of executive management. FW Cook reported directly to the Compensation Committee. FW Cook received no compensation from the company other than for its work in advising the Compensation Committee and maintained no other economic relationships with the company. FW Cook interacted directly with members of our management only on matters under the Compensation Committee’s oversight.

FW Cook conducted a comprehensive competitive review of the compensation program for our executive officers and our non-employee directors in April 2020, which was used by the Compensation Committee to assist it in making compensation recommendations to the Board. Our CEO makes separate recommendations to the Compensation Committee concerning the form and amount of the compensation of our executive officers (excluding his own compensation). FW Cook has also assisted the Compensation Committee in evaluating the design of certain outperformance compensation plans first implemented in 2012.

The Compensation Committee considered the independence of FW Cook in light of the rules regarding compensation committee advisor independence mandated under the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”). The Compensation Committee reviewed factors, facts and circumstances regarding compensation consultant independence, including a letter from FW Cook addressing FW Cook’s and their consulting team’s independent status with respect to the following factors: (i) other services provided to us by FW Cook; (ii) fees we pay to FW Cook as a

| Prologis Proxy Statement | March 19, 2021

|

27

|

| Board of Directors and Corporate Governance |

percentage of their total revenues; (iii) FW Cook’s policies and procedures that are designed to prevent conflicts of interest; (iv) any business or personal relationship between FW Cook or members of their consulting team that serves the Compensation Committee and a member of the Compensation Committee; (v) any shares of our stock owned by FW Cook or members of their consulting team that serves the Compensation Committee; and (vi) any business or personal relationships between our executive officers and FW Cook or members of their consulting team that serves the Compensation Committee. After discussing these factors, facts and circumstances, the Compensation Committee affirmed the independent status of FW Cook and concluded that there are no conflicts of interest with respect to FW Cook.

At the end of 2020, the Compensation Committee engaged another compensation consulting firm, Pay Governance, switching our compensation consulting firms as a good compensation governance practice. Pay Governance reports directly to the Compensation Committee. Pay Governance receives no compensation from the company other than for its work in advising the Compensation Committee and maintains no other economic relationships with the company. Pay Governance interacts directly with members of our management only on matters under the Compensation Committee’s oversight.

The Compensation Committee considered the independence of Pay Governance in light of the rules regarding compensation committee advisor independence mandated under the Dodd-Frank Act. The Compensation Committee reviewed factors, facts and circumstances regarding compensation consultant independence, including a letter from Pay Governance addressing Pay Governance and their consulting team’s independent status with respect to the following factors: (i) other services provided to us by Pay Governance; (ii) fees we pay to Pay Governance as a percentage of their total revenues; (iii) Pay Governance’s policies and procedures that are designed to prevent conflicts of interest; (iv) any business or personal relationship between Pay Governance or members of their consulting team that serves the Compensation Committee and a member of the Compensation Committee; (v) any shares of our stock owned by Pay Governance or members of their consulting team that serves the Compensation Committee; and (vi) any business or personal relationships between our executive officers and Pay Governance or members of their consulting team that serves the Compensation Committee. After discussing these factors, facts and circumstances, the Compensation Committee affirmed the independent status of Pay Governance and concluded that there are no conflicts of interest with respect to Pay Governance.

Compensation Committee interlocks and insider participation

No member of the Compensation Committee (i) was, during the year ended December 31, 2020, or had previously been, an officer or employee of the company or (ii) had any material interest in a transaction with the company or a business relationship with, or any indebtedness to, the company. No interlocking relationships existed during the year ended December 31, 2020, between any member of the Board or the Compensation Committee and an executive officer of the company.

Code of Ethics and Business Conduct and Governance Guidelines

The Board has adopted a code of ethics and business conduct that applies to all employees and directors. The Board has formalized policies, procedures and standards of corporate governance that are reflected in our Governance Guidelines.

Our Code of Ethics and Business Conduct outlines in great detail the key principles of ethical conduct expected of our employees, officers and directors, including matters related to conflicts of interest, use of company resources, fair dealing, and financial reporting and disclosure. The code establishes formal procedures for reporting illegal or unethical behavior to the company’s internal ethics committee. These procedures permit employees to report any concerns, including concerns about the company’s accounting, internal accounting controls or auditing matters, on a confidential or anonymous basis if desired. Employees may contact the ethics committee by email, in writing, by web-based report or by calling a toll-free telephone number. Any significant concerns are reported to the Audit Committee in accordance with the code.

| Prologis Proxy Statement | March 19, 2021

|

28

|

| Board of Directors and Corporate Governance |

Simultaneous Board service

Our governance guidelines require that, if a director serves on three or more public company boards simultaneously, including our Board, a determination is made by our Board as to whether such simultaneous service impairs the ability of such member to effectively serve the company. Messrs. Fotiades and Lyons and Ms. Kennard currently serve on at least three public company boards, including our Board. In each case, our Board has determined that such simultaneous board service does not impair the Board member’s ability to be an effective member of our Board.

Mr. Fotiades is the chief executive officer and a director of Cantel Medical Corp. He has advised us that he will no longer be CEO of Cantel Medical Corp. (or CEO in any other capacity) upon the closing of Steris Corporation’s acquisition of Cantel Medical Corp., expected to occur in the second quarter of 2021. Should the Steris acquisition terminate or not close, Mr. Fotiades will nevertheless retire as CEO of Cantel Medical Corp.

Certain relationships and related party transactions

We do not have any related party transactions to report under relevant SEC rules and regulations. According to our Articles of Incorporation, the Board may authorize any agreement or other transaction with any party even though one or more of our directors or officers may be a party to such an agreement or is an officer, director, stockholder, member or partner of the other party if: (i) the existence of the relationship is disclosed or known to the Board, and the contract or transaction is authorized, approved or ratified by the affirmative vote of not less than a majority of the disinterested directors, even if they constitute less than a quorum of the Board; (ii) the existence is disclosed to the stockholders entitled to vote, and the contract or transaction is authorized, approved or ratified by a majority of the votes cast by the stockholders entitled to vote (excluding shares owned by any interested director or officer or the organization in which such person is a director or has a material financial interest); or (iii) the contract or transaction is fair and reasonable to the company.

We recognize that transactions between us and related parties can present potential or actual conflicts of interest and create the appearance that our decisions are based on considerations other than the company’s best interests and the best interests of our stockholders. Related parties may include our directors, executives, significant stockholders and immediate family members and affiliates of such persons. Accordingly, several provisions of our code of ethics and business conduct are intended to help us avoid the conflicts and other issues that may arise in transactions between us and related parties, prescribing that:

|

· employees will not engage in conduct or activity that may raise questions as to the company’s honesty, impartiality or reputation or otherwise cause embarrassment to the company;

· employees shall not hold financial interests that conflict with, or leave the appearance of conflicting with, the performance of their assigned duties;

· employees shall act impartially and not give undue preferential treatment to any private organization or individual; and

· employees should avoid actual conflicts or the appearance of conflicts of interest. |

These provisions of our code of ethics and business conduct may be amended, modified or waived by the Board or the Governance Committee, subject to the disclosure requirements and other provisions of the rules and regulations of the SEC and the NYSE.

No waivers of our code of ethics and business conduct were granted in 2020.

Although we do not have detailed written procedures concerning the waiver of the application of our code of ethics and business conduct or the review and approval of transactions with directors or their affiliates, our directors would consider all relevant facts and circumstances in considering any such waiver or review and approval.

| Prologis Proxy Statement | March 19, 2021

|

29

|

| Executive Officers |

Biographies of our executive officers as of March 2021, other than Mr. Moghadam, are presented below. Information for Mr. Moghadam is included above under “Board of Directors and Corporate Governance.” All of our executive officers are treated as named executive officers (each an “NEO”) for purposes of this proxy statement.

Thomas S. Olinger: Chief Financial Officer

Mr. Olinger, 54, has been our chief financial officer since May 2012 and was our chief integration officer from June 2011 to May 2012. Mr. Olinger was the chief financial officer of AMB from March 2007 to June 2011. Prior to joining AMB in February 2007, Mr. Olinger was the vice president and corporate controller at Oracle Corporation, an enterprise software company and provider of computer hardware products and services. Prior to his employment with Oracle, Mr. Olinger was an accountant and partner at Arthur Andersen LLP, where he served as the lead partner on our account from 1999 to 2002. Since January 2011, Mr. Olinger has served as a director of American Assets Trust, a real estate investment trust investing in office, retail and residential properties. Mr. Olinger holds a Bachelor of Science in finance from the Kelley School of Business at Indiana University.

Eugene F. Reilly: Chief Investment Officer

Mr. Reilly, 59, has been our chief investment officer since March 2019. Mr. Reilly was our CEO, the Americas, from June 2011 until March 2019, and he served as president, the Americas, as well as a number of other executive positions, at AMB from October 2003 until the Merger in June 2011. Mr. Reilly serves on the technical committee of FIBRA Prologis, a publicly traded Mexican REIT that is sponsored and managed by the company. Prior to joining AMB in October 2003, Mr. Reilly was chief investment officer of Cabot Properties, Inc., a private equity industrial real estate firm of which he was also a founding partner. From August 2009 until December 2015, Mr. Reilly served as a director of Strategic Hotels and Resorts, an owner and asset manager of high-end hotels and resorts. Mr. Reilly holds an A.B. degree in economics from Harvard College.

Edward S. Nekritz: Chief Legal Officer, General Counsel and Secretary

Mr. Nekritz, 55, has been our chief legal officer, general counsel and secretary since the Merger in June 2011. Mr. Nekritz was general counsel of the Trust from December 1998 to June 2011 and secretary of the Trust from March 1999 to June 2011. Mr. Nekritz serves on the technical committee of FIBRA Prologis. Prior to joining the Trust in September 1995, Mr. Nekritz was an attorney with Mayer, Brown & Platt (now Mayer Brown LLP). Mr. Nekritz holds a Juris Doctor degree from the University of Chicago Law School and an A.B. degree in government from Harvard College.

Gary E. Anderson: Chief Operating Officer

Mr. Anderson, 55, has been our chief operating officer since March 2019. Mr. Anderson was our CEO, Europe and Asia, from June 2011 until March 2019. Mr. Anderson held various positions with the Trust from August 1994 to June 2011, including head of the Trust’s global fund business from March 2009 to June 2011 and president of the Trust’s European operations from November 2006 to March 2009. Prior to joining the Trust, Mr. Anderson held various positions with Security Capital Group Incorporated, a diversified real estate investment company. Mr. Anderson holds a Master of Business Administration in finance and real estate from the Anderson Graduate School of Management at the University of California at Los Angeles and a Bachelor of Arts in marketing from Washington State University.

Michael S. Curless: Chief Customer Officer

Mr. Curless, 57, has been our chief customer officer since March 2019. Mr. Curless was our chief investment officer from June 2011 until March 2019. Mr. Curless was chief investment officer of the Trust from September 2010 to June 2011, and he was with the Trust in various capacities from August 1995 through February 2000. Mr. Curless was president and a principal at Lauth, a privately held national construction and development firm, from March 2000 until rejoining the Trust in September 2010. Prior thereto, he was a marketing director with the Trammell Crow Company. Mr. Curless holds a Master of Business Administration in finance and marketing and a Bachelor of Science in finance from the Kelley School of Business at Indiana University.

| Prologis Proxy Statement | March 19, 2021

|

30

|

| Environmental Stewardship, Social Responsibility and Governance |

Environmental Stewardship,

Social

Responsibility and Governance

ESG UNLOCKS VALUE FOR PROLOGIS

ESG is essential to our value-creation strategy, delivering quantifiable benefits today and for the long term

For nearly four decades, our commitment to environmental stewardship, social responsibility and good governance (ESG) has made us a leader in our industry and beyond. ESG is woven into our fabric and informs decision-making from the boardroom to all corners of our global operations. Our ESG focus:

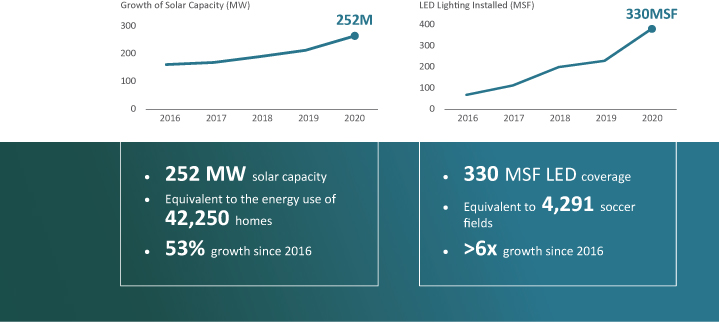

| · | Drives innovation. We future proof our business and build resilience by operating on the cutting edge. We have committed to build 100% sustainably certified new development and are exploring innovative circular and sustainable building design and technologies such as borehole thermal energy storage and dynamic energy monitoring systems. |

| · | Expands our value proposition beyond real estate. For example, 56% of our top 25 customers have turned to our LED programs as a simple solution for enhancing their employees’ work environment while reducing costs and environmental impact. |

| · | Deepens our relationships. The goodwill we build with our stakeholders is a competitive advantage. Through our Community Workforce Initiative (CWI) we have formed partnerships with communities and local governments in nine of our key markets to address our customers’ growing needs for qualified labor. In 2020, we developed a digital training curriculum, leveraging virtual reality and mobile technology. Nearly 4,000 individuals registered in just the first two months after launch. |

| · | Attracts and retains top talent. We received an employee engagement score of 82% on our 2020 Employee Engagement Survey, which captured input from 92% of employees across the globe. This result is ten points above the U.S. average.(2) |

| · | Reduces our capital costs. In 2020, we raised more than $2.5 billion in green bonds globally at a weighted average rate of 1.53% to fund our green projects at some of the tightest credit spreads in the market, demonstrating our financial resilience through the economic uncertainty of the COVID-19 pandemic. |

Prologis Park Venlo, Venlo, Netherlands

| (1) | All data contained in this section is as of 12/31/2020 unless otherwise stated. |

| (2) | Based on comparative data from the Qualtrics global company index of employer data. |

| Prologis Proxy Statement | March 19, 2021

|

31

|

| Environmental Stewardship, Social Responsibility and Governance |

Leading the Way to a Sustainable Future

| 1st |

1st |

1st | ||||||

| among sector peers (Americas & Asia) in Global Real Estate Sustainability Benchmark (GRESB). |

|

WELL-certified logistics building by the International WELL Building Institute. |

|

logistics real estate company to set a carbon reduction target approved by the Science Based Targets initiative (SBTi). | ||||

| Top 10% | 12th year | 3rd | ||||||

| of global sustainable companies recognized by the 2020 DJSI World Index. | on Corporate Knights’ Global 100 Most Sustainable Corporations in the World list. |

most onsite installed solar capacity among U.S. corporations; 1st among real estate companies for commercial solar capacity.(1) | ||||||

Prologis Park DatteIn, DatteIn, Germany

(1) |

|

| Prologis Proxy Statement | March 19, 2021

|

32

|

| Environmental Stewardship, Social Responsibility and Governance |

Prologis’ ESG Goals Raise the Bar

We have made significant progress toward our ESG commitments and are on track to accomplish more, continuing to push the boundaries of ESG leadership globally.

|

|

SDG | Goal |

Target year |

2020 Progress | ||||

|

Environmental Stewardship

| ||||||||

|