April 30, 2018 Prologis and DCT Industrial Merger Conference Call Exhibit 99.2

Important Information This presentation includes certain terms and non-GAAP financial measures that are not specifically defined herein. These terms and financial measures are defined and, in the case of the non-GAAP financial measures, reconciled to the most directly comparable GAAP measure, in Prologis’s and DCT’s first quarter Earnings Release and Supplemental Information that are available on Prologis’s investor relations website at www.ir.prologis.com, DCT’s investor relations website at http://investors.dctindustrial.com and on the SEC’s website at www.sec.gov. Amounts in the presentation for Prologis and Prologis Combined are determined in accordance with Prologis’s methodology and amounts for DCT are determined in accordance with DCT’s methodology. The statements in this document that are not historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are based on current expectations, estimates and projections about the industry and markets in which Prologis, Inc. (“Prologis”) and DCT Inc. (“DCT”) operate as well as beliefs and assumptions of management of Prologis and management of DCT. Such statements involve uncertainties that could significantly impact financial results of Prologis or DCT. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” and “estimates” including variations of such words and similar expressions are intended to identify such forward-looking statements, which generally are not historical in nature. All statements that address operating performance, events or developments that Prologis or DCT expect or anticipate will occur in the future — including statements relating to rent and occupancy growth, development activity, contribution and disposition activity, general conditions in the geographic areas where Prologis and DCT operate, debt, capital structure and financial position, Prologis’s ability to form new co-investment ventures and the availability of capital in existing or new co-investment ventures — are forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Although we believe the expectations reflected in any forward-looking statements are based on reasonable assumptions, we can give no assurance that our expectations will be attained, and therefore actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. Some of the factors that may affect outcomes and results include, but are not limited to: (i) national, international, regional and local economic and political climates; (ii) changes in global financial markets, interest rates and foreign currency exchange rates; (iii) increased or unanticipated competition for our properties; (iv) risks associated with acquisitions, dispositions and development of properties; (v) maintenance of REIT status, tax structuring and changes in income tax laws and rates; (vi) availability of financing and capital, the levels of debt that we maintain and our credit ratings; (vii) risks related to our investments in our co-investment ventures, including our ability to establish new co-investment ventures; (viii) risks of doing business internationally, including currency risks; (ix) environmental uncertainties, including risks of natural disasters; (x) risks associated with achieving expected revenue synergies or cost savings; (xi) risks associated it the ability to consummate the merger and the timing of the closing of the merger and (xii) those additional risks and factors discussed in the reports filed with the Securities and Exchange Commission (“SEC”) by Prologis and DCT from time to time, including those discussed under the heading “Risk Factors” in their respective most recently filed reports on Form 10-K and 10-Q. Neither Prologis nor DCT undertakes any duty to update any forward-looking statements appearing in this document except as may be required by law. Additional Information In connection with the proposed transaction, Prologis will file a registration statement on Form S-4, which will include a document that serves as a prospectus of Prologis and a proxy statement of DCT (the “proxy statement/prospectus”), and each party will file other documents regarding the proposed transaction with the SEC. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. A definitive proxy statement/prospectus will be sent to DCT’s shareholders. Investors and security holders will be able to obtain the registration statement and the proxy statement/prospectus free of charge from the SEC’s website or from Prologis or DCT. The documents filed by Prologis with the SEC may be obtained free of charge at the Investor Relations section of Prologis’s website at www.ir.prologis.com or at the SEC’s website at www.sec.gov. These documents may also be obtained free of charge from Prologis by requesting them from Investor Relations by mail at Pier 1, Bay 1 San Francisco, CA 94111 or by telephone at 415-394-9000. The documents filed by DCT with the SEC may be obtained free of charge at DCT’s website at the Investor Relations section of http:/investors.dctindustrial.com/Corporate Profile or at the SEC’s website at www.sec.gov. These documents may also be obtained free of charge from DCT by requesting them from Investor Relations by mail at 555 17th Street, Suite 3700 Denver, CO 80202, or by telephone at 303-597-1550. Participants in the Solicitation Prologis and DCT and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about Prologis’s directors and executive officers is available in Prologis’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017 and in its proxy statement dated March 22, 2018, for its 2018 Annual Meeting of Shareholders. Information about DCT’s directors and executive officers is available in DCT’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017 and in its proxy statement dated March 21, 2018, for its 2018 Annual Meeting of Shareholders. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the transaction when they become available. Investors should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from Prologis or DCT as indicated above. This document shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

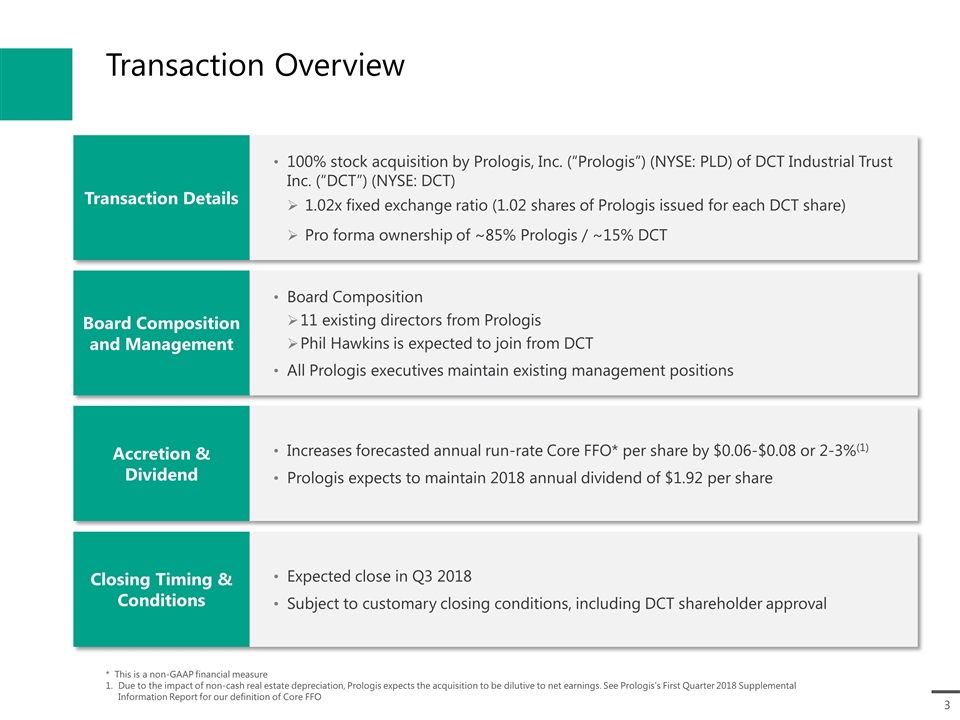

Transaction Overview Board Composition and Management Board Composition 11 existing directors from Prologis Phil Hawkins is expected to join from DCT All Prologis executives maintain existing management positions Accretion & Dividend Increases forecasted annual run-rate Core FFO* per share by $0.06-$0.08 or 2-3%(1) Prologis expects to maintain 2018 annual dividend of $1.92 per share Closing Timing & Conditions Expected close in Q3 2018 Subject to customary closing conditions, including DCT shareholder approval Transaction Details 100% stock acquisition by Prologis, Inc. (“Prologis”) (NYSE: PLD) of DCT Industrial Trust Inc. (“DCT”) (NYSE: DCT) 1.02x fixed exchange ratio (1.02 shares of Prologis issued for each DCT share) Pro forma ownership of ~85% Prologis / ~15% DCT * This is a non-GAAP financial measure Due to the impact of non-cash real estate depreciation, Prologis expects the acquisition to be dilutive to net earnings. See Prologis’s First Quarter 2018 Supplemental Information Report for our definition of Core FFO

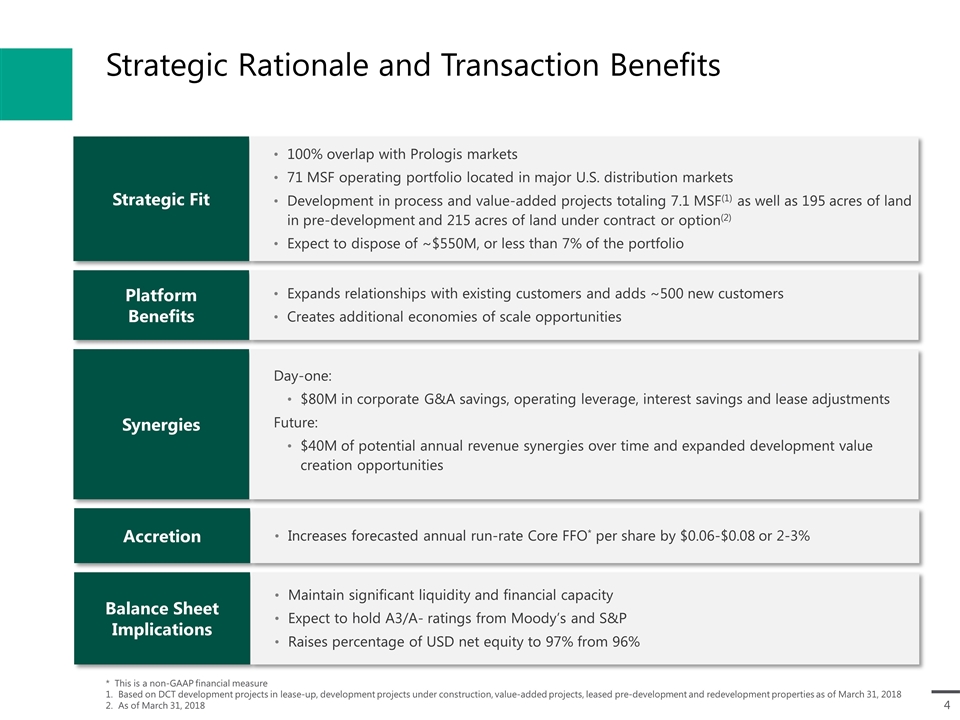

Strategic Rationale and Transaction Benefits * This is a non-GAAP financial measure Based on DCT development projects in lease-up, development projects under construction, value-added projects, leased pre-development and redevelopment properties as of March 31, 2018 As of March 31, 2018 Strategic Fit 100% overlap with Prologis markets 71 MSF operating portfolio located in major U.S. distribution markets Development in process and value-added projects totaling 7.1 MSF(1) as well as 195 acres of land in pre-development and 215 acres of land under contract or option(2) Expect to dispose of ~$550M, or less than 7% of the portfolio Platform Benefits Expands relationships with existing customers and adds ~500 new customers Creates additional economies of scale opportunities Synergies Day-one: $80M in corporate G&A savings, operating leverage, interest savings and lease adjustments Future: $40M of potential annual revenue synergies over time and expanded development value creation opportunities Balance Sheet Implications Maintain significant liquidity and financial capacity Expect to hold A3/A- ratings from Moody’s and S&P Raises percentage of USD net equity to 97% from 96% Accretion Increases forecasted annual run-rate Core FFO* per share by $0.06-$0.08 or 2-3%

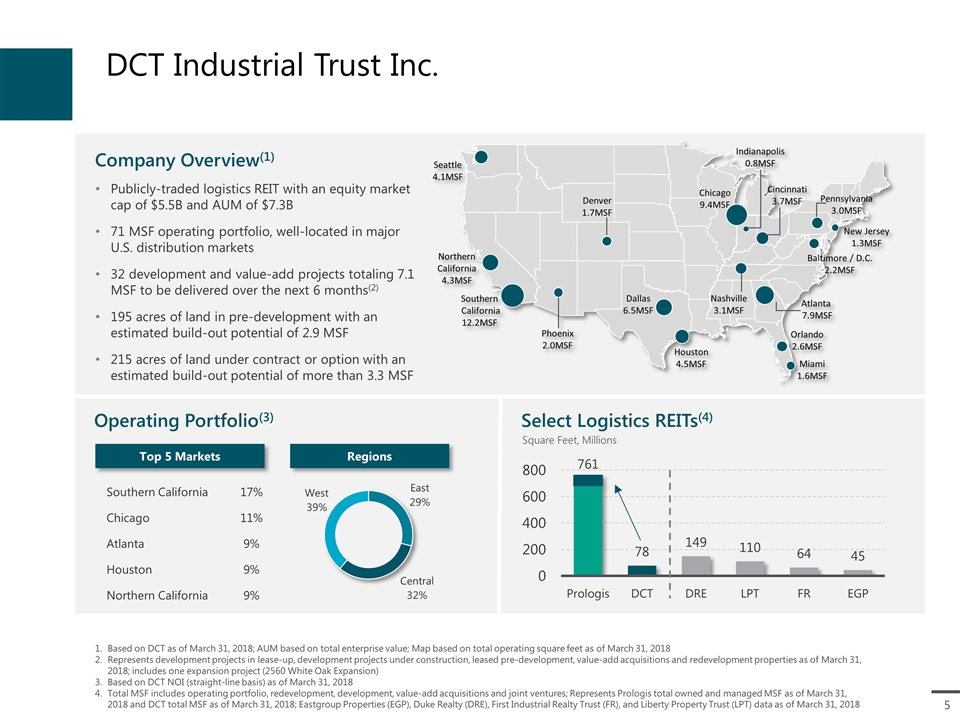

DCT Industrial Trust Inc. Based on DCT as of March 31, 2018; AUM based on total enterprise value; Map based on total operating square feet as of March 31, 2018 Represents development projects in lease-up, development projects under construction, leased pre-development, value-add acquisitions and redevelopment properties as of March 31, 2018; includes one expansion project (2560 White Oak Expansion) Based on DCT NOI (straight-line basis) as of March 31, 2018 Total MSF includes operating portfolio, redevelopment, development, value-add acquisitions and joint ventures; Represents Prologis total owned and managed MSF as of March 31, 2018 and DCT total MSF as of March 31, 2018; Eastgroup Properties (EGP), Duke Realty (DRE), First Industrial Realty Trust (FR), and Liberty Property Trust (LPT) data as of March 31, 2018 Publicly-traded logistics REIT with an equity market cap of $5.5B and AUM of $7.3B 71 MSF operating portfolio, well-located in major U.S. distribution markets 32 development and value-add projects totaling 7.1 MSF to be delivered over the next 6 months(2) 195 acres of land in pre-development with an estimated build-out potential of 2.9 MSF 215 acres of land under contract or option with an estimated build-out potential of more than 3.3 MSF Company Overview(1) Operating Portfolio(3) Select Logistics REITs(4) Top 5 Markets Regions 17% Southern California 11% Chicago 9% Atlanta 9% Houston 9% Northern California Square Feet, Millions New Jersey 1.3MSF Phoenix 2.0MSF Denver 1.7MSF Seattle 4.1MSF Cincinnati 3.7MSF Dallas 6.5MSF Houston 4.5MSF Miami 1.6MSF Orlando 2.6MSF Northern California 4.3MSF Southern California 12.2MSF Indianapolis 0.8MSF Pennsylvania 3.0MSF Chicago 9.4MSF Atlanta 7.9MSF Baltimore / D.C. 2.2MSF Nashville 3.1MSF

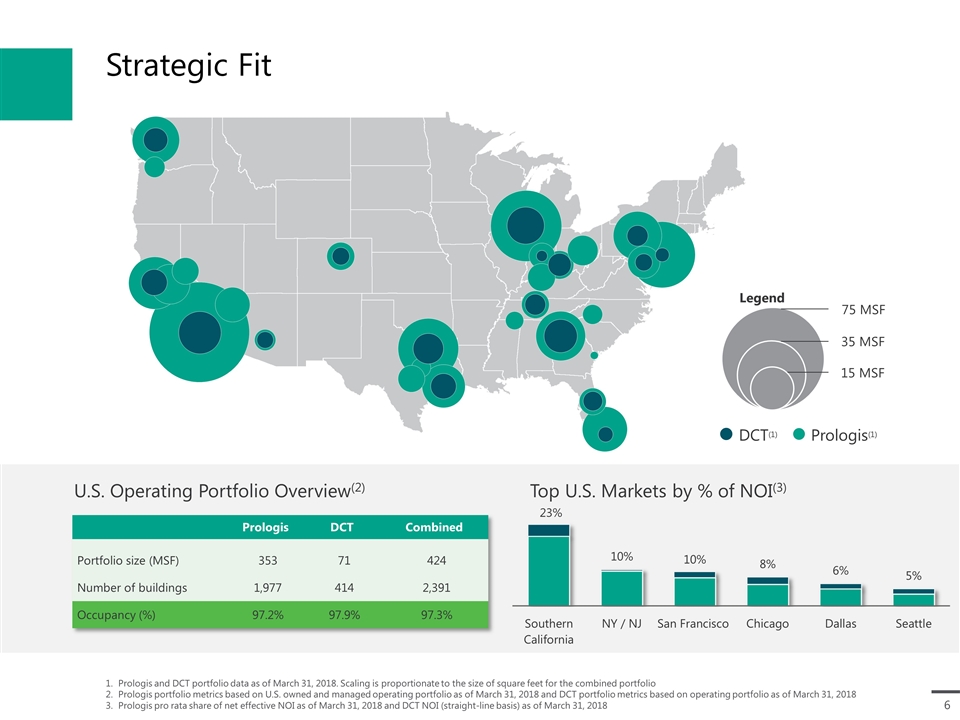

Strategic Fit Prologis and DCT portfolio data as of March 31, 2018. Scaling is proportionate to the size of square feet for the combined portfolio Prologis portfolio metrics based on U.S. owned and managed operating portfolio as of March 31, 2018 and DCT portfolio metrics based on operating portfolio as of March 31, 2018 Prologis pro rata share of net effective NOI as of March 31, 2018 and DCT NOI (straight-line basis) as of March 31, 2018 U.S. Operating Portfolio Overview(2) Prologis DCT Combined Portfolio size (MSF) 353 71 424 Number of buildings 1,977 414 2,391 Occupancy (%) 97.2% 97.9% 97.3% DCT(1) Prologis(1) 75 MSF 35 MSF 15 MSF Legend Top U.S. Markets by % of NOI(3)

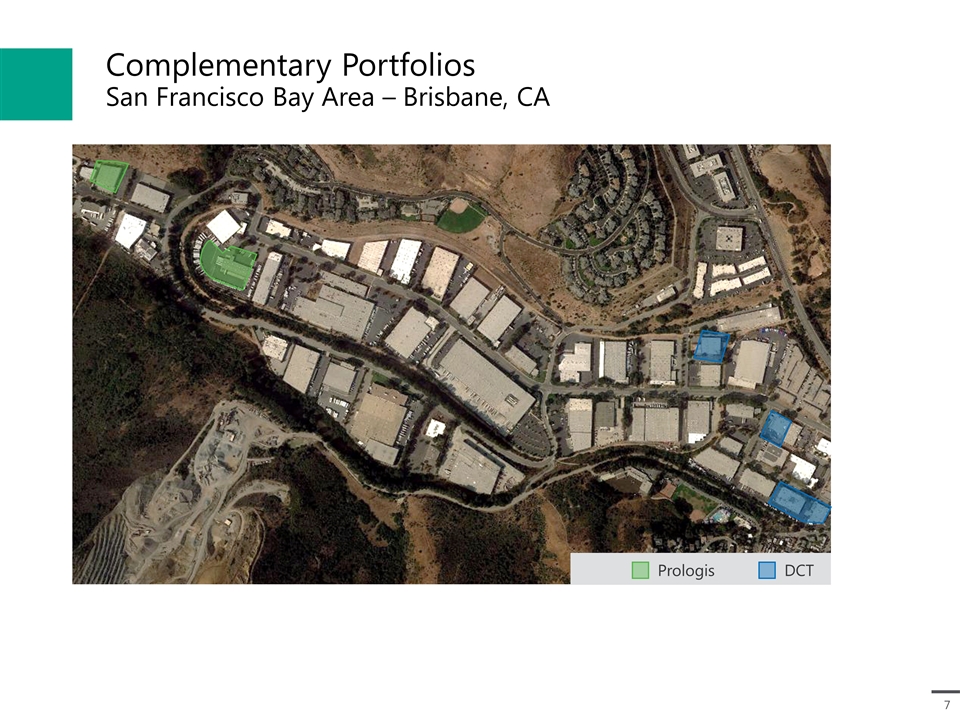

Complementary Portfolios San Francisco Bay Area – Brisbane, CA Prologis DCT

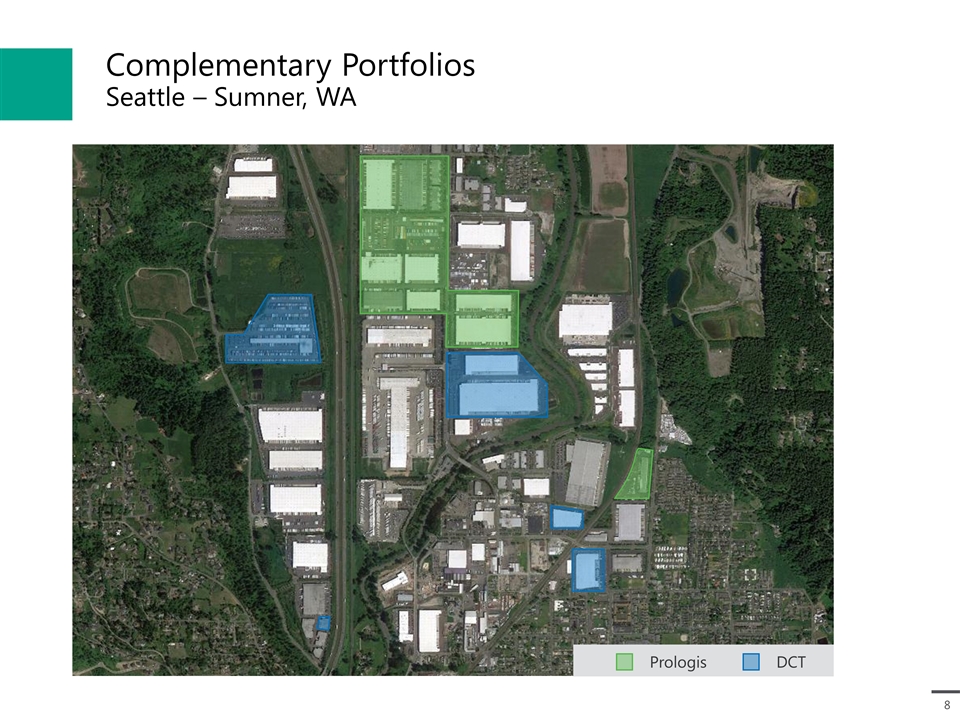

Complementary Portfolios Seattle – Sumner, WA Prologis DCT

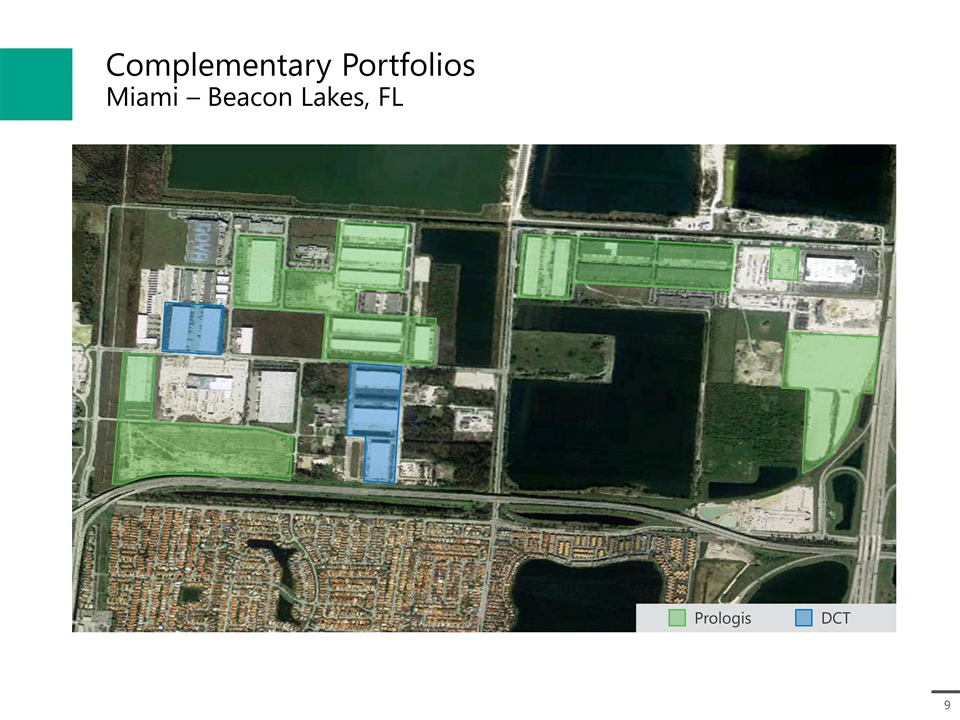

Complementary Portfolios Miami – Beacon Lakes, FL Prologis DCT

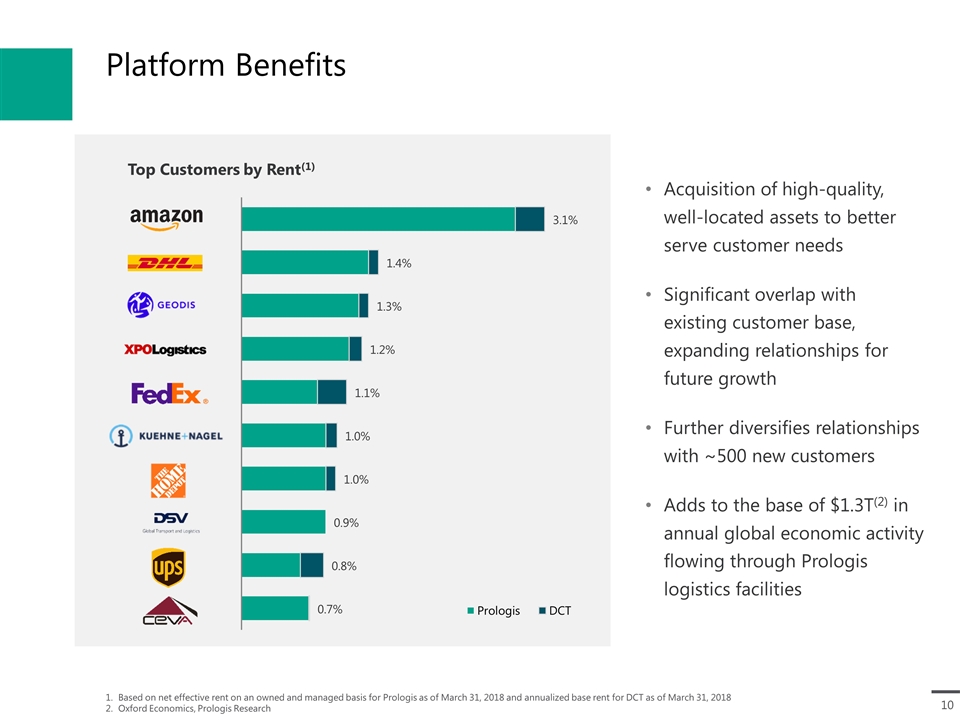

Platform Benefits Based on net effective rent on an owned and managed basis for Prologis as of March 31, 2018 and annualized base rent for DCT as of March 31, 2018 Oxford Economics, Prologis Research Acquisition of high-quality, well-located assets to better serve customer needs Significant overlap with existing customer base, expanding relationships for future growth Further diversifies relationships with ~500 new customers Adds to the base of $1.3T(2) in annual global economic activity flowing through Prologis logistics facilities Top Customers by Rent(1)

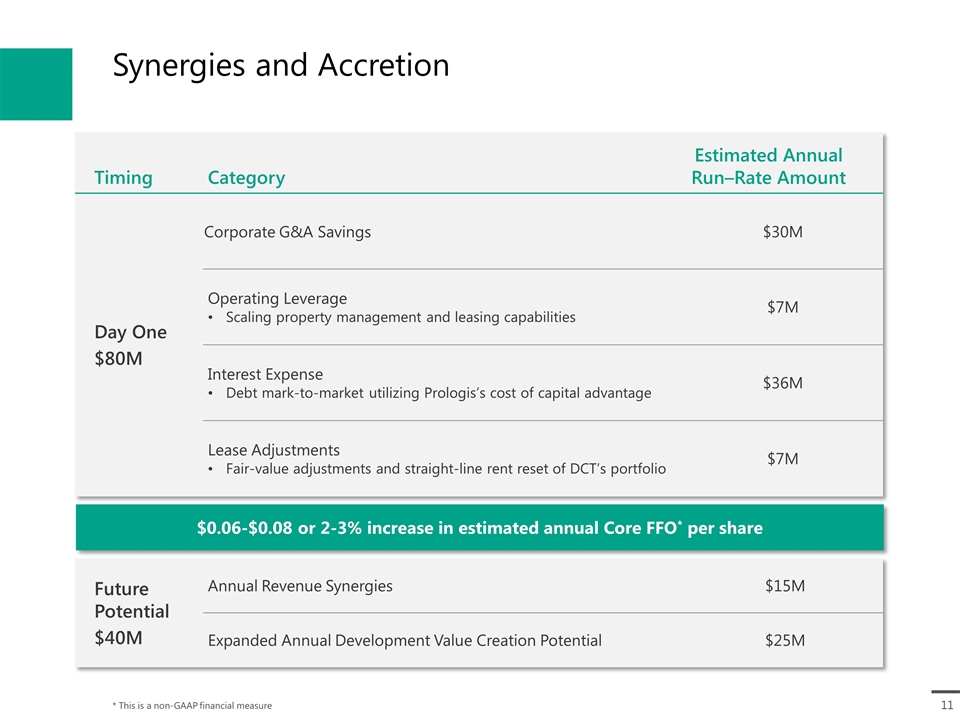

Synergies and Accretion * This is a non-GAAP financial measure Timing Category Estimated Annual Run–Rate Amount Day One $80M Corporate G&A Savings $30M Operating Leverage Scaling property management and leasing capabilities $7M Interest Expense Debt mark-to-market utilizing Prologis’s cost of capital advantage $36M Lease Adjustments Fair-value adjustments and straight-line rent reset of DCT’s portfolio $7M $0.06-$0.08 or 2-3% increase in estimated annual Core FFO* per share Future Potential $40M Annual Revenue Synergies $15M Expanded Annual Development Value Creation Potential $25M

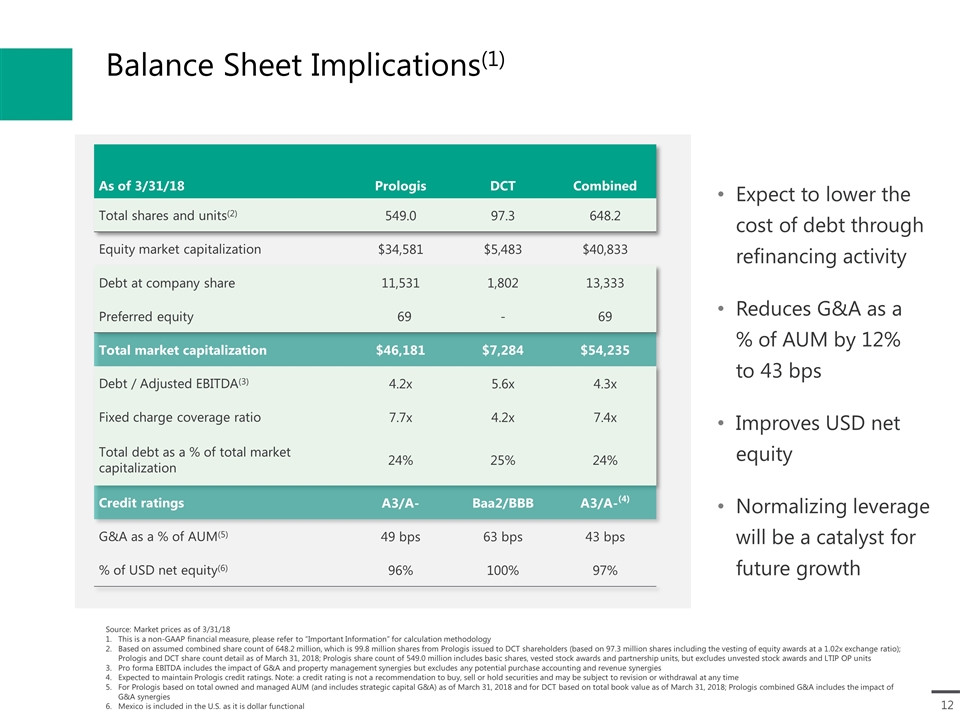

Balance Sheet Implications(1) Source: Market prices as of 3/31/18 This is a non-GAAP financial measure, please refer to “Important Information” for calculation methodology Based on assumed combined share count of 648.2 million, which is 99.8 million shares from Prologis issued to DCT shareholders (based on 97.3 million shares including the vesting of equity awards at a 1.02x exchange ratio); Prologis and DCT share count detail as of March 31, 2018; Prologis share count of 549.0 million includes basic shares, vested stock awards and partnership units, but excludes unvested stock awards and LTIP OP units Pro forma EBITDA includes the impact of G&A and property management synergies but excludes any potential purchase accounting and revenue synergies Expected to maintain Prologis credit ratings. Note: a credit rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time For Prologis based on total owned and managed AUM (and includes strategic capital G&A) as of March 31, 2018 and for DCT based on total book value as of March 31, 2018; Prologis combined G&A includes the impact of G&A synergies Mexico is included in the U.S. as it is dollar functional As of 3/31/18 Prologis DCT Combined Total shares and units(2) 549.0 97.3 648.2 Equity market capitalization $34,581 $5,483 $40,833 Debt at company share 11,531 1,802 13,333 Preferred equity 69 - 69 Total market capitalization $46,181 $7,284 $54,235 Debt / Adjusted EBITDA(3) 4.2x 5.6x 4.3x Fixed charge coverage ratio 7.7x 4.2x 7.4x Total debt as a % of total market capitalization 24% 25% 24% Credit ratings A3/A- Baa2/BBB A3/A-(4) G&A as a % of AUM(5) 49 bps 63 bps 43 bps % of USD net equity(6) 96% 100% 97% Expect to lower the cost of debt through refinancing activity Reduces G&A as a % of AUM by 12% to 43 bps Improves USD net equity Normalizing leverage will be a catalyst for future growth