Unaudited

Fourth Quarter 2013

Earnings Release and Supplemental Information

Exhibit 99.1 |

Unaudited

Fourth Quarter 2013

Earnings Release and Supplemental Information

Exhibit 99.1 |

Copyright ©

2014 Prologis

Supplemental 4Q 2013

Table of Contents

Prologis

Park

Iwanuma,

Miyagi,

Japan

Douglas

Hill

Park

Distribution

Center,

Atlanta,

Georgia,

USA

Cover:

Prologis Park 275,

Hebron, Kentucky, USA

Prologis

Park

Nove

Mesto,

Bratislava,

Slovakia

Overview

Press Release

1

Highlights

Company Profile

4

Company Performance

5

Financial Information

Consolidated Balance Sheets

6

Consolidated Statements of Operations

7

Reconciliation of Net Earnings (Loss) to FFO

8

EBITDA Reconciliation

9

Pro-rata Information

10

Operations Overview

Operating Portfolio

12

Operating Metrics

15

Customer Information

17

Capital Deployment

Overview

18

Dispositions and Contributions

19

Third Party Building Acquisitions and Equity Invested in

Co-Investment Ventures

20

Development Starts

21

Value Creation from Development Stabilization

22

Development Portfolio

23

Land Portfolio

24

Co-Investment Ventures

Summary and Financial Highlights

26

Operating and Balance Sheet Information

27

Capitalization

Debt and Equity Summary

28

Debt Covenants and Other Metrics

29

Assets Under Management

30

Net Asset Value

Components

31

Notes and Definitions

33 |

Copyright ©

2014 Prologis

1

Prologis, Inc. Announces Fourth Quarter 2013 Earnings Results

-

Leased record 43.7 million square feet in Q4 and 152 million square

feet in 2013 - -

Occupancy increased to 95.1 percent at year end -

-

$426 million in estimated value creation with estimated margin of 30.4

percent from 2013 stabilizations- -

Raised record $4.1 billion of third-party equity in 2013 -

SAN FRANCISCO (Jan. 30, 2014) – Prologis, Inc. (NYSE: PLD), the leading

global owner, operator and developer of industrial real estate, today reported

results for the fourth quarter and full year 2013.

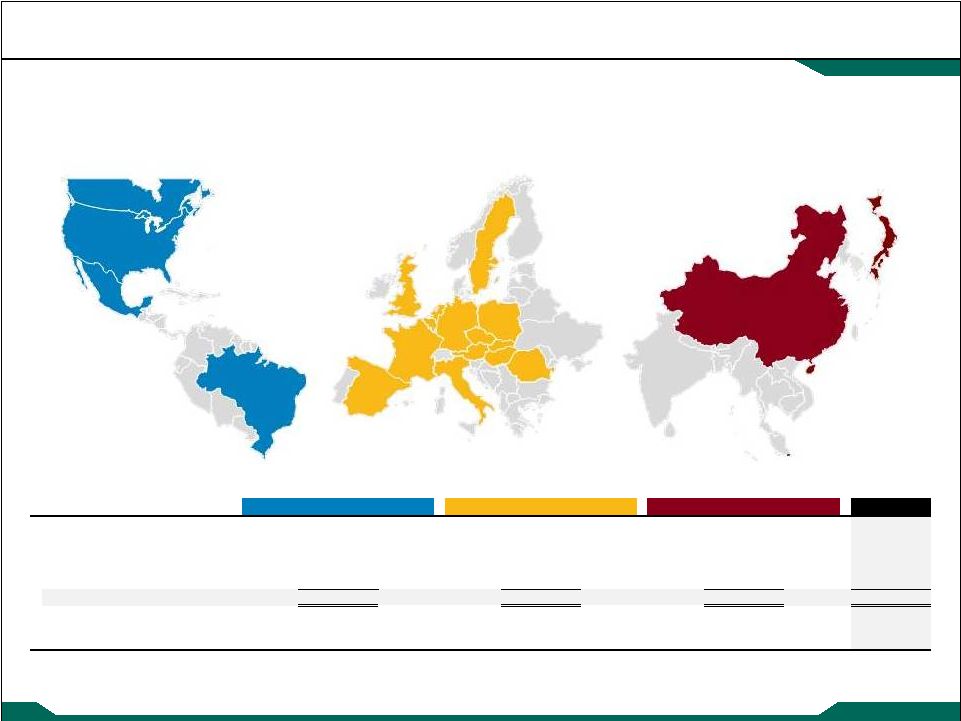

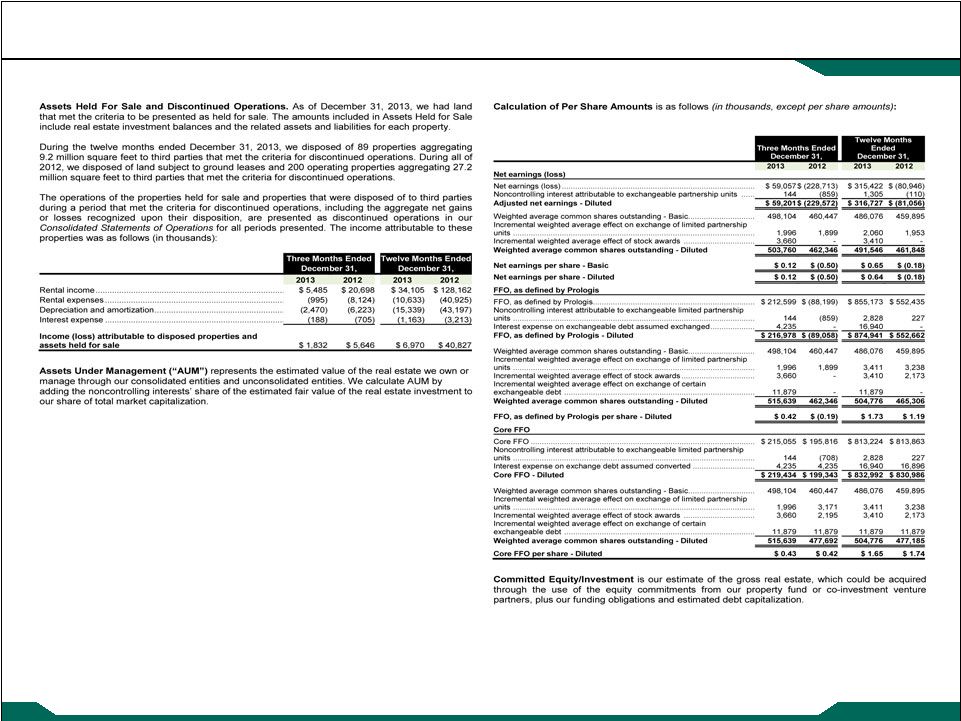

Core funds from operations (Core FFO) per fully diluted share was $0.43 for

the fourth quarter 2013 compared to $0.42 for the same period in 2012. Core

FFO per fully diluted share in 2013 was $1.65 compared to $1.74 for 2012.

Net earnings per fully diluted share was $0.12 for the fourth quarter 2013

compared to a net loss of $0.50 for the same period in 2012. Net earnings per

share was $0.64 for 2013 compared to a net loss of $0.18 in 2012. The year-

over-year increase was primarily due to gains on the disposition of assets.

“Our financial and operating results for the fourth quarter and full year reflect

the strong market fundamentals that continued throughout 2013,” said Hamid

R. Moghadam, chairman and CEO, Prologis. “We significantly increased

occupancy with solid rent growth, exceeded our value creation objectives with

above-average development margins, and substantially grew our Investment

Management business.”

“As we look forward, the combination of rental growth, the profitable build-out of

our land bank, and improvements in efficiencies resulting from our global scale

sets us up well for an extended period of robust earnings growth,” Moghadam

added.

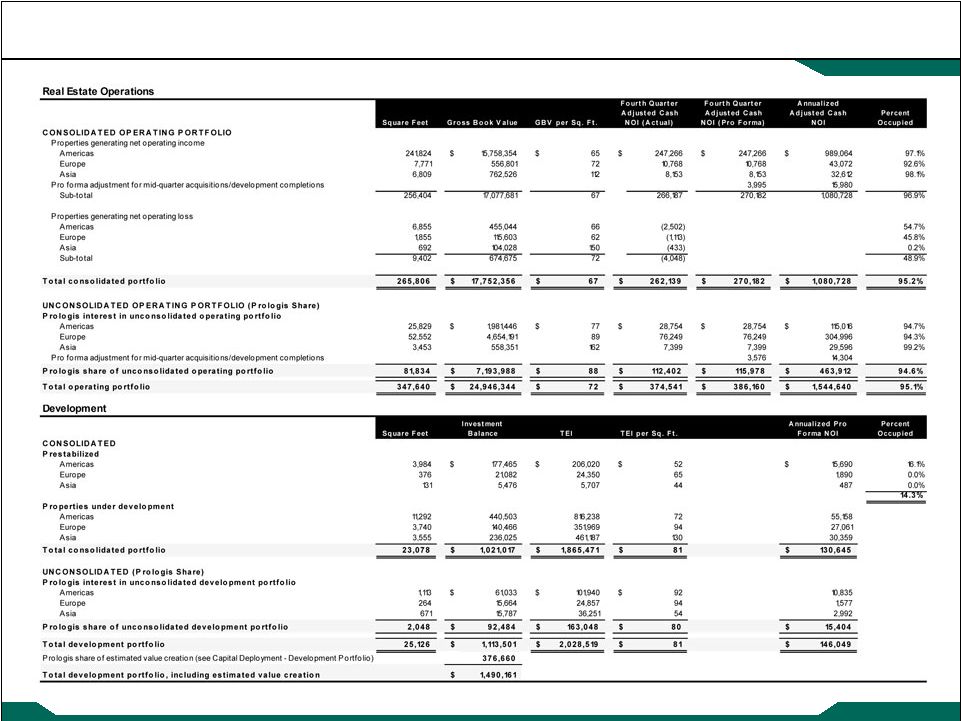

Operating Portfolio Metrics

The company leased a record 43.7 million square feet (4.1 million square

meters) in its combined operating and development portfolios in the fourth

quarter, and 152 million square feet (14.1 million square meters) in 2013.

Prologis ended the quarter with 95.1 percent occupancy in its operating

portfolio, up 120 basis points over the prior quarter.

Tenant retention in the quarter was 86.8 percent, with tenant renewals totaling

27.4 million square feet (2.5 million square meters). GAAP rental rates on

leases signed in the quarter increased 5.9 percent from prior rents compared to

a decrease of 2.1 percent in the same period in 2012.

In the fourth quarter, GAAP same-store net operating income (NOI) increased

2.7 percent, and 3.0 percent on an adjusted cash basis.

Investment Management

During the fourth quarter, Prologis raised $1.8 billion in third-party equity,

leading to a record $4.1 billion in 2013. With the closing of Prologis U.S.

Logistics Venture (USLV), the company has $26.4 billion in assets under

management in 15 ventures.

Capital Deployment

The company increased its total assets owned and under management to

$48.2 billion, up from $44.8 billion at December 31, 2012, an increase of 7.8

percent.

Acquisitions & Equity Investments in Co-investment Ventures

During the fourth quarter, the company invested $539 million ($351 million

Prologis’ share) in building acquisitions and equity in Prologis SGP Mexico.

The stabilized capitalization rate on building acquisitions was 6.7 percent. In

2013, the company invested $2.4 billion ($1.8 billion Prologis’ share) in building

acquisitions and equity in six of its co-investments. The stabilized capitalization

rate on building acquisitions was 6.5 percent.

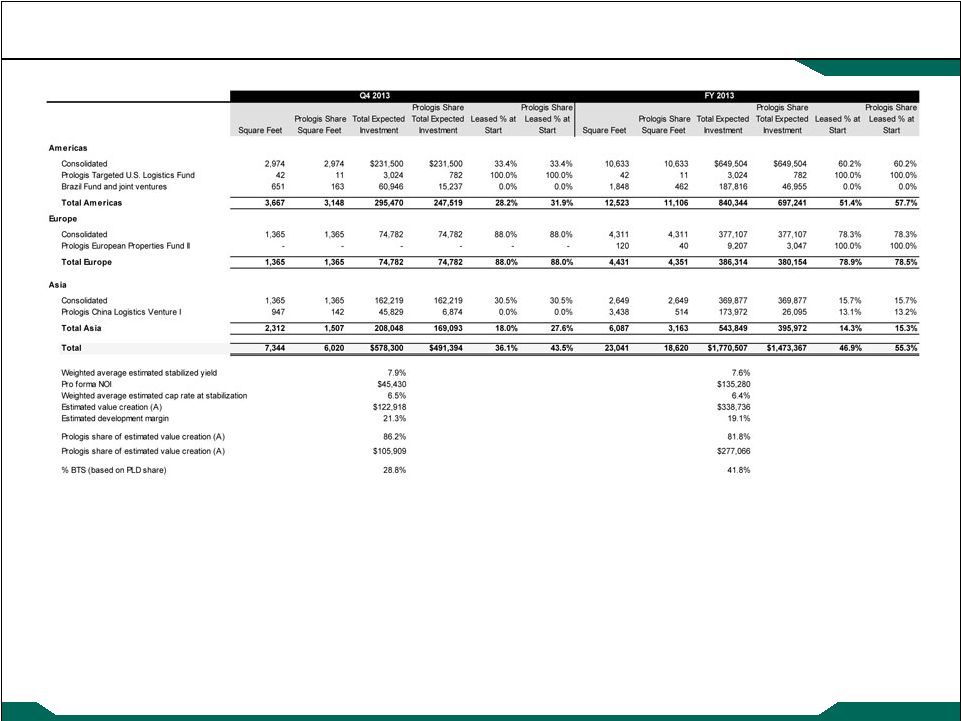

Development Starts and Pipeline

During the quarter, the company started $578 million ($491 million Prologis’

share) of new development projects, 29 percent of which were build-to-suits. In

2013, the company initiated $1.8 billion ($1.5 billion Prologis’ share) of new

development projects, 42 percent of which were build-to-suits. The starts had

an estimated weighted average yield at stabilization of 7.6 percent and an

estimated development margin of 19.1 percent. With these projects, the

company monetized $450 million of land, and its estimated share of value

creation on these starts was $277 million.

The company stabilized $514 million ($429 million Prologis’ share) in

development projects during the fourth quarter, with an estimated margin of

27.9 percent and $143 million ($125 million Prologis’ share) in estimated value

creation. For 2013, the company stabilized $1.4 billion ($1.2 billion Prologis’

|

Copyright ©

2014 Prologis

2 |

Copyright ©

2014 Prologis

3 |

Copyright ©

2014 Prologis

Supplemental 4Q 2013

Prologis

is

the

leading

owner,

operator

and

developer

of

industrial

real

estate,

focused

on

global

and

regional

markets

across

the

Americas,

Europe

and

Asia.

As

of

December

31,

2013,

Prologis

owned

or

had

investments

in,

on

a

wholly

owned

basis

or

through

co-investment

ventures,

properties

and

development

projects

totaling

569

million

square

feet

(52.9

million

square

meters)

in

21

countries.

These properties are leased to more than 4,500 customers, including

third-party logistics providers, transportation companies, retailers,

manufacturers and other enterprises. Highlights

Company Profile

4

(A)

Generally represents properties in which Prologis has an ownership interest but does

not manage (6 msf) and other properties owned by Prologis (4 msf), which includes value added

properties (2 msf).

(B)

Original cost basis for the total land portfolio is $2.5 billion.

Number of operating portfolio buildings

2,238

611

72

357

142

30

17

5

8

7

2

1

Total (msf)

381

149

39

$1,228

$433

$709

6,997

2,949

138

$914

$612

$59

TOTAL

529

$1,585

$2,370

10

30

569

10,084

2,921

Land (acres)

Land book value (millions) (B)

AMERICAS (4 countries)

ASIA (3 countries)

EUROPE (14 countries)

Operating Portfolio (msf)

Development Portfolio (msf)

Other (msf) (A)

Development portfolio TEI (millions) |

Copyright ©

2014 Prologis

Supplemental 4Q 2013

Highlights

Company Performance

5 |

Copyright ©

2014 Prologis

Supplemental 4Q 2013

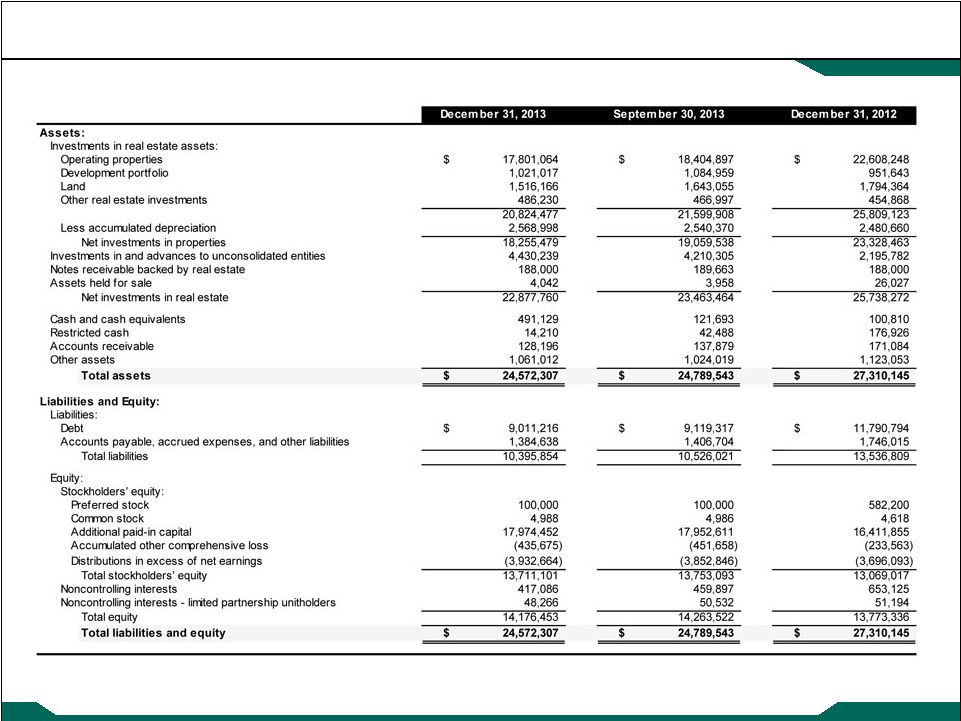

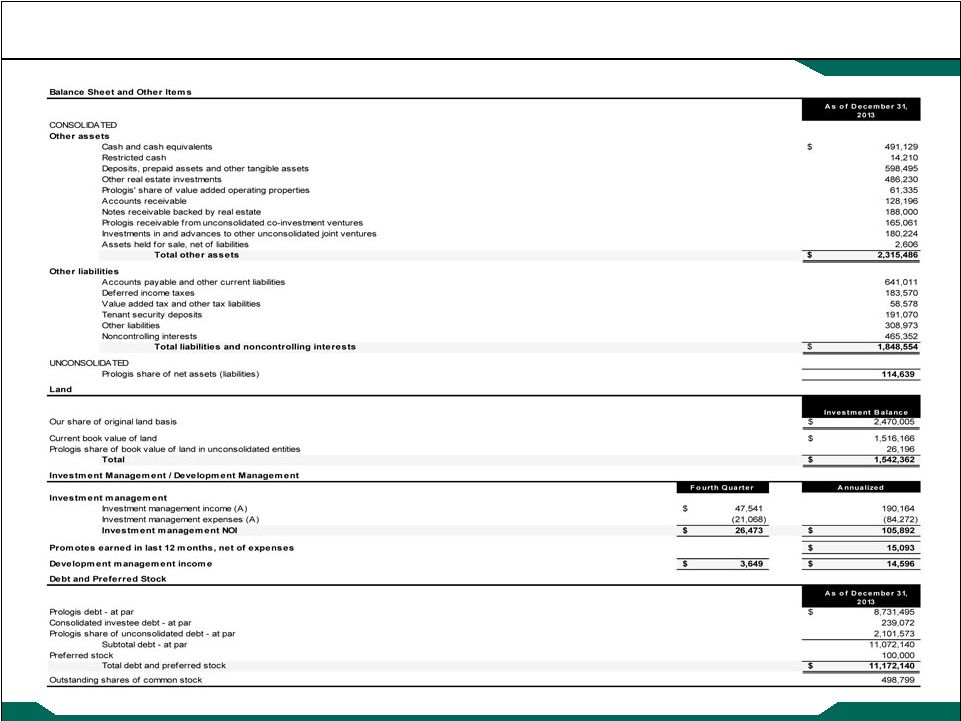

Financial Information

Consolidated Balance Sheets

6

(in thousands) |

Copyright ©

2014 Prologis

Supplemental 4Q 2013

Financial Information

Consolidated Statements of Operations

7

(A) See Calculation of Per Share Amounts in the Notes and Definitions.

(in thousands, except per share amounts)

379,208

$

470,294

$

1,559,493

$

1,823,781

$

53,907

31,715

179,472

126,779

3,649

4,099

11,521

9,958

436,764

506,108

1,750,486

1,960,518

104,936

127,916

451,938

491,239

22,341

16,134

89,279

63,820

63,067

60,608

229,207

228,068

165,453

183,338

648,668

724,262

9,488

9,414

26,982

26,556

-

28,103

-

80,676

-

243,138

-

252,914

365,285

668,651

1,446,074

1,867,535

71,479

(162,543)

304,412

92,983

37,666

11,229

97,220

31,676

4,147

5,107

17,549

22,299

(87,832)

(123,074)

(379,327)

(505,215)

151,702

24,639

597,656

305,607

(32,619)

(2,567)

(24,234)

(19,918)

(112,859)

(19,033)

(277,014)

(14,114)

-

-

-

(16,135)

(39,795)

(103,699)

31,850

(195,800)

31,684

(266,242)

336,262

(102,817)

22,199

3,364

106,733

3,580

9,485

(269,606)

229,529

(106,397)

1,832

5,646

6,970

40,827

56,952

48,620

116,550

35,098

58,784

54,266

123,520

75,925

68,269

(215,340)

353,049

(30,472)

(7,077)

(3,068)

(10,128)

(9,248)

61,192

(218,408)

342,921

(39,720)

(2,135)

(10,305)

(18,391)

(41,226)

-

-

(9,108)

-

59,057

$

(228,713)

$

315,422

$

(80,946)

$

503,760

462,346

491,546

461,848

0.12

$

(0.50)

$

0.64

$

(0.18)

$

2013

2012

Twelve Months Ended

December 31,

Expenses:

2013

2012

Revenues:

Rental income

Investment management income

Development management and other income

Total revenues

Three Months Ended

December 31,

Interest expense

Rental expenses

Investment management expenses

General and administrative expenses

Impairment of real estate properties

Depreciation and amortization

Merger, acquisition and other integration expenses

Total expenses

Operating income (loss)

Other income (expense):

Earnings from unconsolidated entities, net

Interest income

Other expenses

Discontinued operations:

Impairment of other assets

Gains on acquisitions and dispositions of investments in real estate, net

Foreign currency and derivative gains (losses) and other income (expenses), net

Losses on early extinguishment of debt, net

Total other income (expense)

Earnings (loss) before income taxes

Income tax expense - current and deferred

Earnings (loss) from continuing operations

Income attributable to disposed properties and assets held for sale

Net gains on dispositions, including related impairment charges and taxes

Consolidated net earnings (loss)

Net earnings attributable to noncontrolling interests

Net earnings (loss) attributable to controlling interests

Preferred stock dividends

Net earnings (loss) attributable to common stockholders

Total discontinued operations

Net earnings (loss) per share attributable to common stockholders - Diluted

Weighted average common shares outstanding - Diluted (A)

Loss on preferred stock redemption |

Copyright ©

2014 Prologis

Supplemental 4Q 2013

Financial Information

Reconciliations of Net Earnings (Loss) to FFO

8

59,057

$

(228,713)

$

315,422

$

(80,946)

$

159,489

177,702

624,573

705,717

-

13,141

-

34,801

(76,751)

(61,434)

(271,315)

(207,033)

(1,310)

(5,592)

(8,993)

(27,680)

42,107

20,740

153,710

115,790

1,738

2,292

6,082

11,533

184,330

(81,864)

819,479

552,182

33,457

(666)

32,870

14,892

1,704

(2,162)

656

(8,804)

(6,892)

(3,507)

2,168

(5,835)

212,599

(88,199)

855,173

552,435

(117,887)

(5,835)

(336,815)

(121,303)

112,859

19,033

286,122

14,114

Our share of reconciling items included in earnings from unconsolidated entities

7,484

12,717

8,744

23,097

-

229,997

-

264,844

-

28,103

-

80,676

2,456

284,015

(41,949)

261,428

215,055

$

195,816

$

813,224

$

813,863

$

(5,011)

(5,543)

(22,968)

(27,753)

(31,445)

(36,037)

(93,841)

(90,144)

(28,076)

(26,970)

(102,138)

(95,566)

(18,632)

(19,481)

(64,094)

(56,629)

Amortization of management contracts

1,332

1,805

5,726

6,419

Amortization of debt discounts (premiums) and financing costs, net of capitalization

(4,528)

(6,877)

(19,387)

(19,688)

Cash received on net investment hedges

1,804

-

7,848

-

Stock compensation expense

17,055

8,073

56,474

32,678

Core AFFO

147,554

$

110,786

$

580,844

$

563,180

$

Common stock dividends

141,127

$

131,624

$

554,242

$

522,986

$

2012

Twelve Months Ended

December 31,

2013

2012

Three Months Ended

December 31,

Unrealized foreign currency and derivative losses (gains) and related amortization, net

Deferred income tax expense (benefit)

Our share of reconciling items included in earnings from unconsolidated co-investment

ventures Impairment charges on certain real estate properties

2013

Our share of reconciling items included in earnings from other unconsolidated joint ventures

Straight-lined rents and amortization of lease intangibles

Property improvements

Tenant improvements

Leasing commissions

Reconciliation of net earnings (loss) to FFO

Subtotal-NAREIT defined FFO

FFO, as defined by Prologis

Reconciling items related to noncontrolling interests

Core FFO

Net earnings (loss) attributable to common stockholders

Add (deduct) NAREIT defined adjustments:

Add (deduct) our defined adjustments:

Real estate related depreciation and amortization

Net gains on non-FFO acquisitions and dispositions

Our share of reconciling items included in earnings from unconsolidated co-investment

ventures Adjustments to arrive at Core Adjusted FFO ("Core AFFO"), including our share

of unconsolidated entities: Adjustments to arrive at Core FFO, including our share of

unconsolidated entities: Adjustments to arrive at Core FFO

Impairment charges

Merger, acquisition and other integration expenses

Losses on early extinguishment of debt and redemption of preferred stock, net

Net gains on acquisitions and dispositions of investments in real estate, net of expenses

(in thousands) |

Copyright ©

2014 Prologis

Supplemental 4Q 2013

Financial Information

EBITDA Reconciliation

9

Reconciliation of net earnings (loss) to Adjusted EBITDA

59,057

$

(228,713)

$

315,422

$

(80,946)

$

(208,654)

(73,259)

(714,206)

(371,301)

165,453

183,338

648,668

724,262

87,832

123,074

379,327

505,215

112,859

19,033

277,014

14,114

22,199

3,364

106,733

3,580

-

-

(29,533)

12,352

(1,832)

(5,646)

(6,970)

(40,827)

-

(113)

-

(431)

7,077

3,068

10,128

9,248

2,135

10,305

27,499

41,226

33,457

(666)

32,870

14,892

Stock compensation expense (B)

17,055

8,073

59,474

32,678

1,992

-

2,977

-

-

243,138

-

299,645

-

28,103

-

80,676

298,630

313,099

1,109,403

1,244,383

(6,004)

(2,330)

(14,963)

1,993

50,293

32,101

172,975

129,547

19,186

22,659

89,269

92,381

1,086

5,674

2,222

11,673

4,411

1,271

14,898

6,738

(6,892)

(3,507)

2,168

(5,835)

5,954

-

8,302

-

-

304

-

4,200

366,664

$

369,271

$

1,384,274

$

1,485,080

$

Depreciation and amortization from continuing operations

Pro forma adjustment (A)

2012

2013

Interest expense from continuing operations

Current and deferred income tax expense from continuing operations

Twelve Months Ended

December 31,

2013

2012

Net gains on acquisitions and dispositions of investments in real estate, net

Net earnings (loss) attributable to common stockholders

Three Months Ended

December 31,

Losses on early extinguishment of debt

Adjusted EBITDA

Interest expense

Current income tax expense

Depreciation and amortization

Unrealized losses (gains) and deferred income tax expense (benefit), net

Income attributable to disposal properties and assets held for sale

Net losses (gains) on dispositions of investments in real estate, net

Adjusted EBITDA, prior to our share of unconsolidated entities

Unrealized foreign currency and derivative losses (gains) and related amortization, net

Net earnings attributable to noncontrolling interest

Preferred stock dividends and loss on preferred stock redemption

NOI attributable to assets held for sale

Impairment charges

Merger, acquisition and other integration expenses

Acquisition expenses

Acquisition expenses

Our share of reconciling items from unconsolidated entities:

Losses on early extinguishment of debt

Impairment of real estate properties and other assets

(in thousands)

(A)

Adjustments during 2013 include the effects of Nippon Prologis REIT, Inc.

(“NPR”) and Prologis European Logistics Partners Sarl (“PELP”) as if we made the first quarter contribution at the

beginning of the year (i.e. removing actual NOI recognized and replacing with an

estimate of our share of NOI and fees). Adjustments during 2012 include the effects of Prologis North

American Industrial Fund II and Prologis California to reflect NOI for the full

period. (B)

The twelve months ended December 31, 2013 include an adjustment for investment

management expense related to the promote earned in the second quarter as the promote revenue is not

included in Adjusted EBITDA. |

Copyright ©

2014 Prologis

Supplemental 4Q 2013

Financial Information

Pro-rata Balance Sheet Information

10

(in thousands)

Investments in real estate assets:

17,801,064

$

(497,512)

$

7,206,615

$

24,510,167

$

17,121,662

$

41,631,829

3,023,413

(25,665)

118,680

3,116,428

241,146

3,357,574

(2,568,998)

23,756

(501,377)

(3,046,619)

(1,266,800)

(4,313,419)

18,255,479

(499,421)

6,823,918

24,579,976

16,096,008

40,675,984

4,430,239

(84,321)

(4,345,918)

-

84,321

84,321

1,886,589

(114,545)

176,634

1,948,678

839,944

2,788,622

Total assets

24,572,307

$

(698,287)

$

2,654,634

$

26,528,654

$

17,020,273

$

43,548,927

Liabilities:

9,011,216

$

(175,211)

$

2,107,076

$

10,943,081

$

5,780,648

$

16,723,729

1,384,638

(57,724)

547,558

1,874,472

1,029,239

2,903,711

Total liabilities

10,395,854

(232,935)

2,654,634

12,817,553

6,809,887

19,627,440

Equity:

13,711,101

-

-

13,711,101

10,210,386

23,921,487

465,352

(465,352)

-

-

-

-

Total equity

14,176,453

(465,352)

-

13,711,101

10,210,386

23,921,487

Total liabilities and equity

$

24,572,307

$

(698,287)

$

2,654,634

$

26,528,654

$

17,020,273

$

43,548,927

Noncontrolling interests

Debt

Other liabilities

Stockholders' / partners' equity

On this page and the following page, we present balance sheet and income statement information on a

pro-rata basis reflecting our proportionate economic ownership of each entity included in

our Total Owned and Managed portfolio. The consolidated amounts shown are derived from, and

prepared on a consistent basis with, our consolidated financial statements. The PLD Share of

Unconsolidated Co-Investment Ventures column was derived on an entity-by-entity basis by

applying our ownership percentage to each line item to calculate our share of that line item.

For purposes of balance sheet data, we used our ownership percentage at the end of the period and for operating information, we used

our average ownership percentage for the period, consistent with how we calculate our share of net

earnings (loss) during the period. We used a similar calculation to derive the

noncontrolling interests’ share of each line item. In order to present the Total Owned and Managed portfolio, we added our investors’

share of each line item in the unconsolidated co-investment ventures and the noncontrolling

interests share of each line item to the PLD Total Share. PLD Total

Share

Investors'

Share of

Ventures

Total Owned

and Managed

Assets:

Plus PLD Share of

Unconsolidated

Co-Investment

Ventures

Net investments in properties

Pro-rata Balance Sheet Information as of

December 31, 2013

Consolidated

Less Non

Controlling

Interest

Liabilities and Equity:

Gross operating properties

Other real estate

Less accumulated depreciation

Investments in unconsolidated entities

Other assets |

Copyright ©

2014 Prologis

Supplemental 4Q 2013

Financial Information

Pro-rata Operating Information

11

(in thousands)

379,208

$

(11,396)

$

139,395

$

507,207

$

329,627

$

836,834

$

53,907

-

-

53,907

-

53,907

3,649

(295)

1,244

4,598

2,014

6,612

436,764

(11,691)

140,639

565,712

331,641

897,353

104,936

(2,514)

30,159

132,581

76,424

209,005

22,341

-

-

22,341

-

22,341

63,067

-

8,898

71,965

17,980

89,945

165,453

(2,539)

48,009

210,923

118,236

329,159

9,488

(351)

7,727

16,864

21,476

38,340

365,285

(5,404)

94,793

454,674

234,116

688,790

-

-

71,479

(6,287)

45,846

111,038

97,525

208,563

36,802

(218)

(36,584)

-

-

-

864

-

-

864

-

864

4,147

-

428

4,575

569

5,144

(87,832)

1,605

(18,117)

(104,344)

(54,086)

(158,430)

151,702

(1,418)

6,795

157,079

20,294

177,373

(32,619)

437

2,633

(29,549)

3,560

(25,989)

(112,859)

109

(1,021)

(113,771)

(1,446)

(115,217)

(22,199)

705

20

(21,474)

408

(21,066)

58,784

(2,010)

-

56,774

2,010

58,784

68,269

(7,077)

-

61,192

68,834

130,026

(7,077)

7,077

-

-

-

-

(2,135)

-

-

(2,135)

-

(2,135)

59,057

-

-

59,057

68,834

127,891

159,489

(2,962)

48,006

204,533

118,646

323,179

(76,751)

2,077

(6,534)

(81,208)

(20,712)

(101,920)

(1,310)

1,310

-

-

-

-

33,457

(425)

(1,952)

31,080

(3,384)

27,696

1,704

-

(4,305)

(2,601)

(6,931)

(9,532)

35,215

-

(35,215)

-

-

-

1,738

-

-

1,738

-

1,738

212,599

-

-

212,599

156,453

369,052

(117,887)

-

6,398

(111,489)

15,255

(96,234)

112,859

-

1,086

113,945

1,272

115,217

7,484

-

(7,484)

-

-

-

215,055

$

-

$

-

$

215,055

$

172,980

$

388,035

$

Foreign currency and derivative gains (losses) and other income (expenses),

net Net earnings (loss) attributable to common stockholders

FFO, as defined by Prologis

Net losses (gains) on acquisitions and dispositions of investments in real estate,

net of expenses Our share of reconciling items included in earnings from

unconsolidated entities Losses (gains)

on

early

extinguishment

of

debt

and

redemption

of

preferred

stock,

net

Core FFO

Gains (losses) on early extinguishment of debt, net

Income

tax

benefit

(expense)

-

current

and

deferred

Discontinued operations income (loss)

Net loss (earnings) attributable to noncontrolling interests

Preferred stock dividends

Consolidated net earnings (loss)

Deferred income tax expense (benefit)

Our share of reconciling items included in earnings from other unconsolidated joint

ventures Add (deduct) adjustments to arrive at FFO, as defined by

Prologis: Our share of reconciling items included in earnings from

unconsolidated co-investment ventures Real estate related depreciation and

amortization Net losses (gains) on non-FFO acquisitions and

dispositions Reconciling items related to noncontrolling interests

Unrealized foreign currency, derivative losses (gains) and related amortization,

net Earnings from other unconsolidated joint ventures, net

Total Owned

and Managed

Plus PLD Share of

Unconsolidated

Co-Investment

Ventures

PLD Total

Share

Less Non

Controlling

Interest

Total revenues

Pro-rata Operating Information for

Three Months Ended December 31, 2013

Consolidated

General and administrative expenses

Adjustments to arrive at Core FFO, including our share of unconsolidated

entities: Interest expense

Gains on acquisitions and dispositions of investments in real estate, net

Investors'

Share of

Ventures

Development management and other income

Expenses:

Rental expenses

Investment management expenses

Revenues:

Rental income

Investment management income

Depreciation and amortization

Other expenses

Total expenses

Operating income (loss)

Interest income

Earnings from unconsolidated co-investment ventures, net

|

Copyright ©

2014 Prologis

Supplemental 4Q 2013

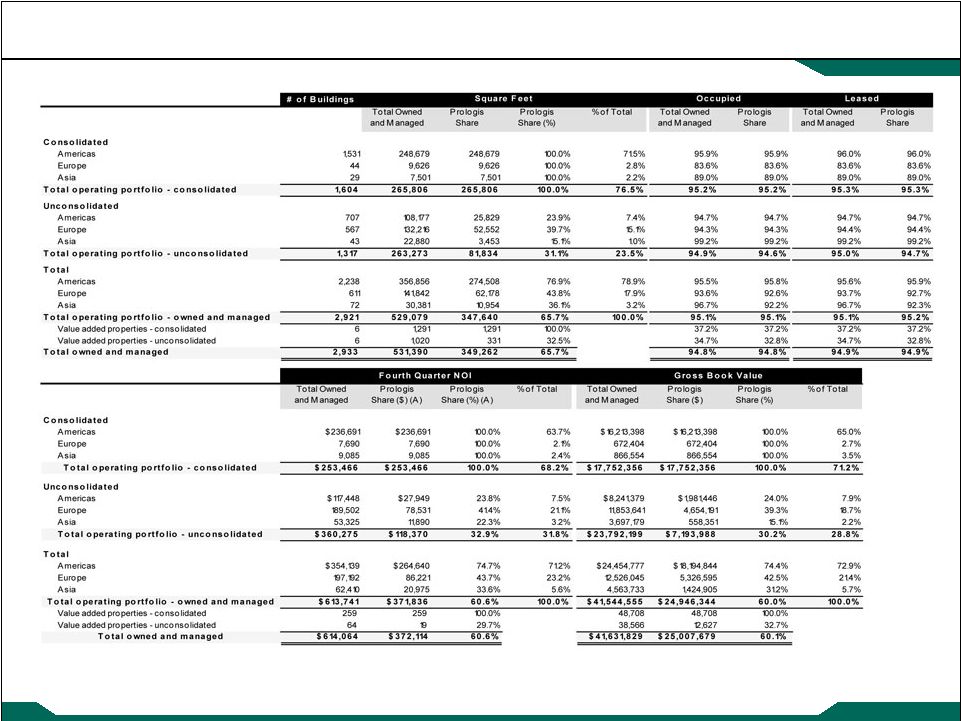

Operations Overview

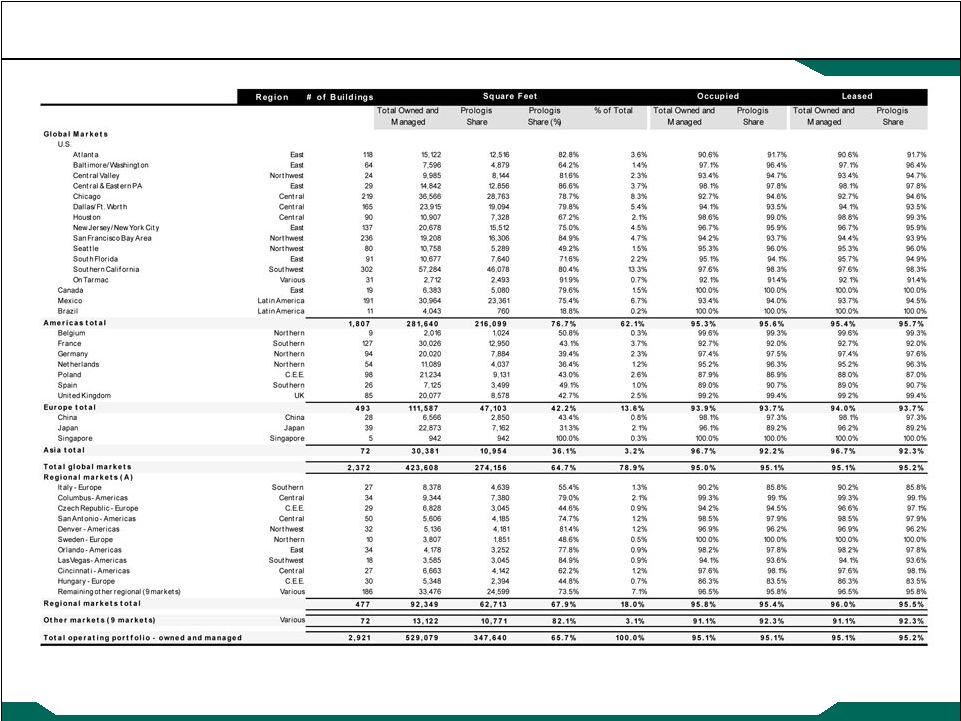

Operating Portfolio –

Square Feet, Occupied and Leased

12

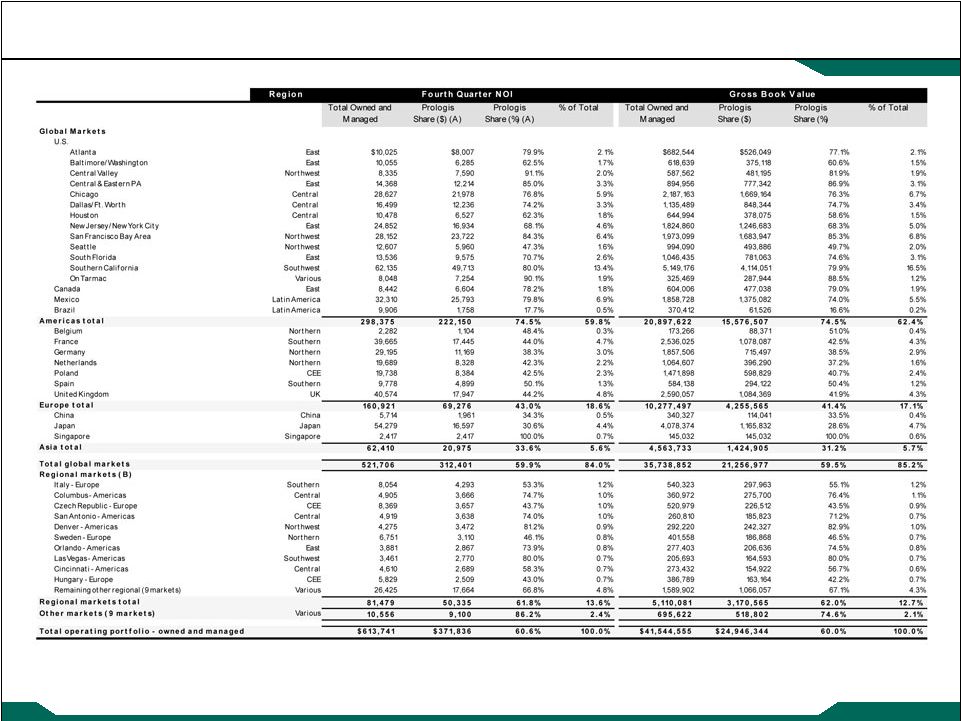

(A) Selected and ordered by Prologis share of NOI ($).

(square feet in thousands) |

Copyright ©

2014 Prologis

Supplemental 4Q 2013

Operations Overview

Operating Portfolio –

NOI and Gross Book Value

13

(A)

Prologis’

share of NOI for the properties that were contributed to the co-investment

ventures includes 100% of the NOI until the contribution date and then Prologis’

share subsequent to the

contribution.

(B)

Selected and ordered by Prologis share of NOI ($).

(dollars in thousands) |

Copyright ©

2014 Prologis

Supplemental 4Q 2013

14

(A)

Prologis’

share of NOI for the properties that were contributed to the co-investment

ventures includes 100% of the NOI until the contribution date and then Prologis’

share subsequent to the

contribution.

Operations Overview

Operating Portfolio –

Summary by Division

(square feet and dollars in thousands) |

Copyright ©

2014 Prologis

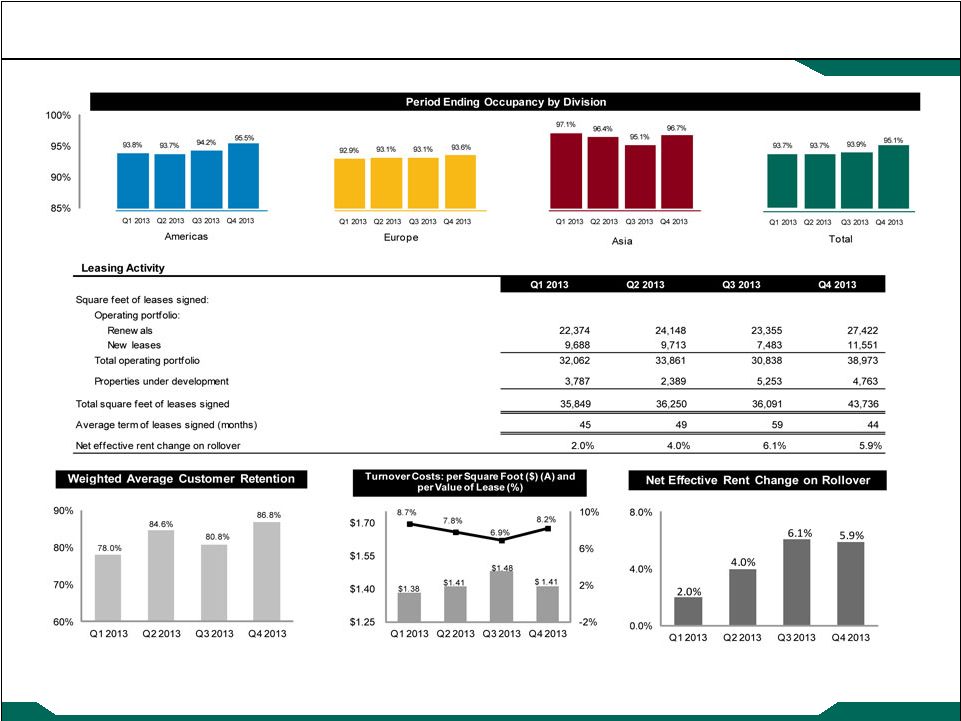

Supplemental 4Q 2013

Operations Overview

Operating Metrics –

Owned and Managed

15

(A) Turnover costs per foot represent expected costs based on the leases

signed during the quarter. (square feet and dollars in thousands)

|

Copyright ©

2014 Prologis

Supplemental 4Q 2013

Operations Overview

Operating Metrics –

Owned and Managed

16

(A)

Turnover costs represent costs incurred during the quarter.

(B)

See the Notes and Definitions for further explanations.

(square feet and dollars in thousands)

Q1 2013

Q2 2013

Q3 2013

Q4 2013

Q1 2013

Q2 2013

Q3 2013

Q4 2013

18,264

$

25,046

$

35,668

$

44,020

$

510,295

508,242

494,941

489,808

0.03

$

0.05

$

0.07

$

0.08

$

Rental income

2.7%

1.4%

1.9%

0.8%

27,241

34,915

32,213

36,116

Rental expenses

9.1%

3.5%

3.2%

(4.2%)

18,344

26,827

17,992

26,450

Net operating income - GAAP

0.3%

0.7%

1.4%

2.7%

Total turnover costs (A)

45,585

61,742

50,205

62,566

Net operating income - adjusted cash

1.8%

(0.4%)

1.8%

3.0%

63,849

$

86,788

$

85,873

$

106,586

$

Average occupancy

1.6%

1.9%

0.9%

0.7%

Trailing four quarters - % of gross NOI

14.0%

14.8%

14.9%

14.5%

75.3%

75.9%

79.1%

73.3%

48,076

$

65,895

$

67,949

$

78,153

$

`

Don’t Delete this cell

Same Store Information (B)

Prologis share

Weighted average ownership percent

$ per square foot

Total capital expenditures

Leasing commissions

Property improvements

Tenant improvements

Capital Expenditures Incurred

Square feet of population

Percentage change:

$0.06

$0.06

$0.06

$0.06

$0.02

$0.04

$0.06

$0.08

Q1 2013

Q2 2013

Q3 2013

Q4 2013

Property Improvements by Square Foot

(trailing four quarters) |

Copyright ©

2014 Prologis

Supplemental 4Q 2013

Operations Overview

Customer Information –

Owned and Managed

17

1

DHL

1.8%

10,687

Month to month customers

$

38,313

1.3%

10,797

2.2%

2

CEVA Logistics

1.3%

6,670

2014

388,995

13.8%

72,618

14.4%

3

Kuehne + Nagel

1.2%

5,963

2015

517,194

18.3%

97,248

19.3%

4

Amazon.com, Inc.

1.0%

4,658

2016

468,076

16.6%

89,187

17.7%

5

Geodis

0.9%

5,698

2017

390,485

13.8%

70,801

14.1%

6

Home Depot, Inc.

0.9%

4,177

2018

327,404

11.6%

54,622

10.9%

7

Hitachi Ltd

0.8%

2,208

Thereafter

695,635

24.6%

107,715

21.4%

8

United States Government

0.8%

1,477

Total

$

2,826,102

100.0%

502,988

100.0%

9

FedEx Corporation

0.8%

2,263

10

Tesco PLC

0.7%

2,693

10.2%

46,494

11

PepsiCo

0.7%

4,883

12

Panasonic Co., Ltd.

0.6%

1,678

Month to month customers

$

28,256

1.6%

8,312

2.5%

13

Wal-Mart Stores, Inc.

0.5%

3,236

2014

242,074

13.8%

47,617

14.4%

14

Panalpina, Inc.

0.5%

2,421

2015

321,192

18.3%

63,610

19.3%

15

Bayerische Motoren Werke Ag (BMW)

0.5%

2,273

2016

296,390

16.8%

59,237

17.9%

16

UPS SCS (United Parcel Service Inc.)

0.5%

2,244

2017

244,241

13.9%

46,549

14.1%

17

Ingram Mico

0.5%

3,018

2018

203,322

11.6%

34,828

10.5%

18

Nippon Express Group

0.4%

1,328

Thereafter

421,640

24.0%

70,438

21.3%

19

National Distribution Centers LP

0.4%

3,720

Total

$

1,757,115

100.0%

330,591

100.0%

20

ND Logistics

0.4%

2,167

21

DB Schenker

0.4%

2,474

22

LG Electronics, Inc.

0.4%

2,540

23

Con-Way (Menlo)

0.4%

2,794

24

La Poste

0.4%

1,278

25

Schneider Electric SA

0.4%

1,640

17.2%

84,188

Top 10 Customers

Top 25 Customers

Lease Expirations - Operating Portfolio - Prologis Share

Year

Annual Base

Rent

Percentage

of Total

Occupied

Square Feet

Percentage

of Total

Percentage

of Total

Top Customers

Lease Expirations - Operating Portfolio - Owned and Managed

Year

Percentage

of Total

% of Annual

Base Rent

Total Square

Feet

Occupied

Square Feet

Annual Base

Rent

(square feet and dollars in thousands) |

Copyright ©

2014 Prologis

Supplemental 4Q 2013

Capital Deployment

Overview –

Owned and Managed

18

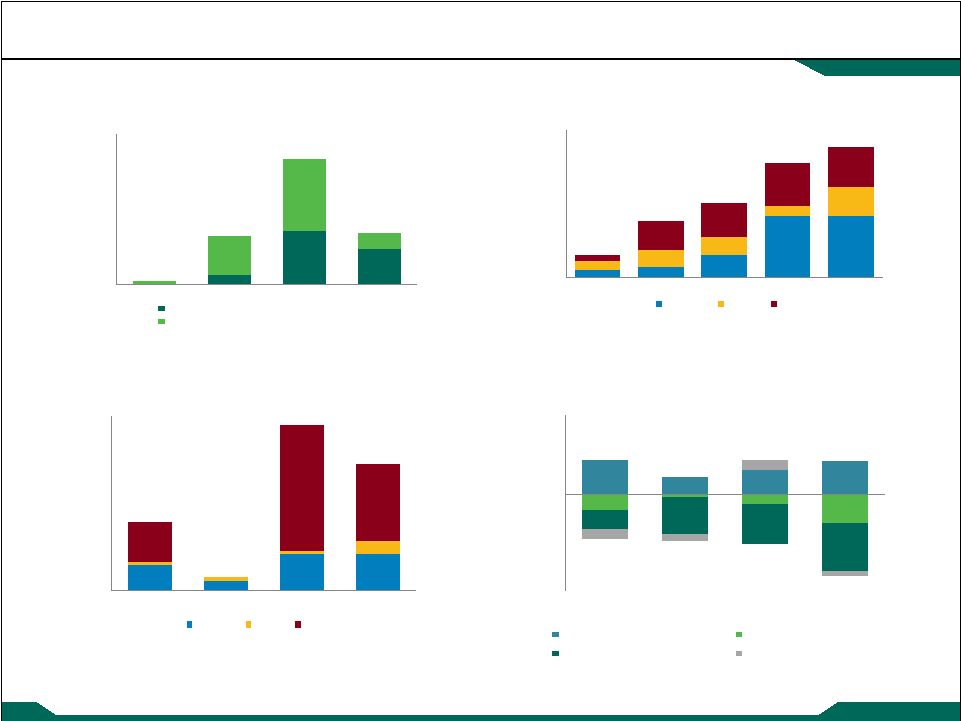

(A) Includes acquisitions and infrastructure costs.

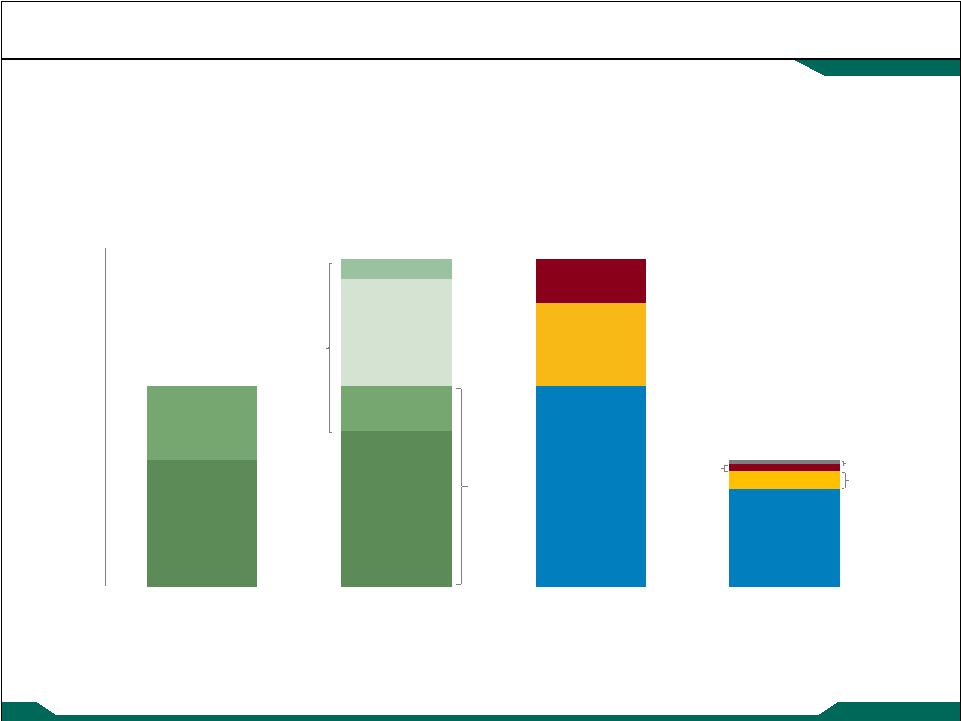

$-

$400

$800

$1,200

$1,600

$2,000

2009

2010

2011

2012

2013

Americas

Europe

Asia

$314

$759

$1,017

$1,553

$1,771

Development

Starts

(TEI)

(in

millions)

Building

Acquisitions

and

Equity

Investments

(in

millions)

Value

Creation

from

Development

Stabilizations

(in

millions)

Land

Activity

(in

millions) $-

$400

$800

$1,200

$1,600

Q1 2013

Q2 2013

Q3 2013

Q4 2013

Third Party Building Acquisitions

Equity Invested in Co-Investment Ventures

$34

$512

$1,322

$-

$40

$80

$120

$160

$200

Q1 2013

Q2 2013

Q3 2013

Q4 2013

Americas

Europe

Asia

$78

$15

$190

$(300)

$(200)

$(100)

$-

$100

$200

Acquisitions (A)

Dispositions

Development Starts

Foreign currency and other

Q1 2013 Q2

2013 Q3 2013

Q4 2013 ($27)

($89)

($43)

$539

($149)

$143 |

Copyright ©

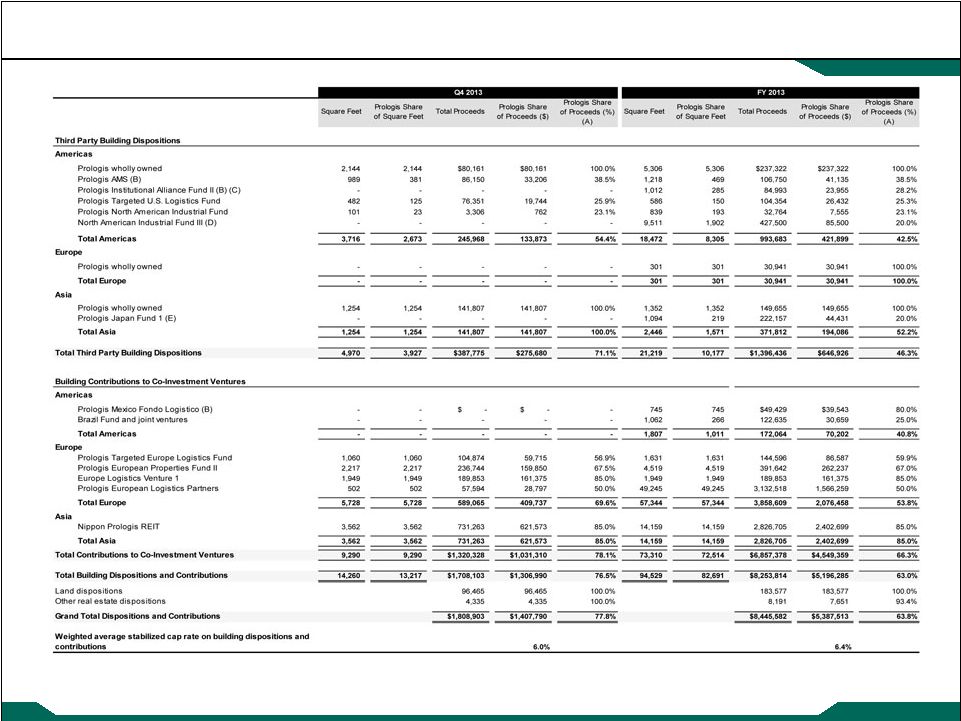

2014 Prologis

Supplemental 4Q 2013

Capital Deployment

Dispositions and Contributions

19

(A)

Prologis share reflects our effective ownership. For contributions, this amount

reflects net cash proceeds to Prologis (net of units received for partial consideration).

(B) This is a consolidated co-investment

venture. (C)

During the second quarter of 2013, Prologis acquired the noncontrolling interest in

this venture. (D)

In connection with the dissolution of this co-investment venture in August 2013,

we acquired the remaining properties of this venture. (E)

In connection with the wind down of this co-investment venture in June 2013, all

the properties owned by this co-investment venture were acquired by Prologis or NPR.

(square feet and dollars in thousands) |

Copyright ©

2014 Prologis

Supplemental 4Q 2013

Capital Deployment

Third Party Building Acquisitions and Equity Invested in Co-Investment

Ventures Prologis Share of

Prologis Share of

Acquisition

Cost (%) (A)

Acquisition

Cost (%) (A)

Third Party Building Acquisitions

Prologis wholly owned

2,128

2,128

99,456

$

99,456

$

100.0%

3,262

3,262

152,747

$

152,747

$

100.0%

Prologis Targeted U.S. Logistics Fund

875

226

65,426

16,919

25.9%

4,369

1,139

282,034

74,108

26.3%

Total Americas

3,003

2,354

164,882

116,375

70.6%

7,631

4,401

434,781

226,855

52.2%

Prologis Targeted Europe Logistics Fund

-

-

-

-

-

72

36

6,915

3,404

49.2%

Prologis European Properties Fund II

2,301

748

206,676

67,129

32.5%

2,569

832

227,975

73,805

32.4%

Prologis European Logistics Partners

-

-

-

-

-

2,584

1,293

383,379

191,689

50.0%

Total Europe

2,301

748

206,676

67,129

32.5%

5,225

2,161

618,269

268,898

43.5%

Asia

-

-

-

-

-

-

-

-

-

-

5,304

3,102

371,558

$

183,504

$

49.4%

12,856

6,562

1,053,050

$

495,753

$

47.1%

6.7%

6.5%

Before

After (B)

Prologis Institutional Alliance Fund II (C)

-

-

-

$

274,326

$

Prologis SGP Mexico

21.6%

100.0%

167,634

167,634

Prologis North American Industrial Fund III

-

-

-

423,781

Prologis Targeted U.S. Logistics Fund

-

-

-

100,000

Prologis Targeted Europe Logistics Fund

-

-

-

209,465

Prologis European Properties Fund II

-

-

-

178,574

167,634

$

1,353,780

$

FY 2013

Total Equity

Invested

Weighted average stabilized cap rate

Q4 2013

Total Equity Invested in Co-Investment Ventures

Equity Invested in Co-Investment Ventures

Ownership

Total Equity

Invested

Q4 2013

Total Third Party Building Acquisitions

Europe

Americas

FY 2013

Prologis Share of

Acquisition Cost ($)

Prologis Share

of Square Feet

Square Feet

Acquisition Cost

Prologis Share of

Acquisition Cost ($)

Acquisition Cost

Square Feet

Prologis Share

of Square

Feet

(square feet and dollars in thousands)

(A)

Prologis share reflects our effective ownership.

(B)

May include the impact of other equity investments by our partners.

(C)

This

was

a

consolidated

co-investment

venture

before

we

acquired

our

partners’

interest

in

the

second

quarter

of

2013.

20 |

Copyright ©

2014 Prologis

Supplemental 4Q 2013

Capital Deployment

Development Starts

21

(in thousands, except percent)

(A)

Value Creation excludes fees or promotes that we may earn. See complete definition

in the Notes and Definitions section. |

Copyright ©

2014 Prologis

Supplemental 4Q 2013

Capital Deployment

Value Creation from Development Stabilization

22

(A)

Value Creation excludes fees or promotes that we may earn. See complete definition

in the Notes and Definitions section. (in thousands, except percent)

Square Feet

Prologis Share

of Square Feet

Total Expected

Investment

Prologis Share

of Total

Expected

Square Feet

Prologis Share of

Square Feet

Total Expected

Investment

Prologis Share

of Total

Expected

Americas

1,793

1,793

$155,522

$155,522

4,909

4,909

$341,937

$341,937

Prologis Targeted U.S. Logistics Fund

-

-

-

-

272

73

29,730

8,026

Prologis Mexico Fondo Logistico

235

47

13,080

2,616

235

47

13,080

2,616

Brazil Fund and joint ventures

564

141

53,794

13,449

1,893

474

180,180

45,046

Total Americas

2,592

1,981

222,396

171,587

7,309

5,503

564,927

397,625

Europe

564

564

55,407

55,407

2,128

2,128

165,428

165,428

Prologis Targeted Europe Logistics Fund

47

20

5,955

2,564

47

20

5,955

2,564

611

584

61,362

57,971

2,175

2,148

171,383

167,992

Asia

1,591

1,591

194,198

194,198

5,156

5,156

628,659

628,659

Prologis China Logistics Venture I

585

88

35,706

5,356

585

88

35,706

5,356

2,176

1,679

229,904

199,554

5,741

5,244

664,365

634,015

Total

5,379

4,244

$513,662

$429,112

15,225

12,895

$1,400,675

$1,199,632

Weighted average estimated stabilized yield

8.2%

8.1%

$41,884

$113,589

Weighted average estimated cap rate at stabilization

6.1%

6.1%

$143,382

$426,205

Estimated development margin

27.9%

30.4%

Prologis share of estimated value creation (A)

87.3%

87.4%

Prologis share of estimated value creation (A)

$125,184

$372,378

Total Europe

Consolidated

Pro forma NOI

Estimated value creation (A)

Total Asia

Consolidated

Q4 2013

FY 2013

Consolidated |

Copyright ©

2014 Prologis

Supplemental 4Q 2013

Capital Deployment

Development Portfolio

23

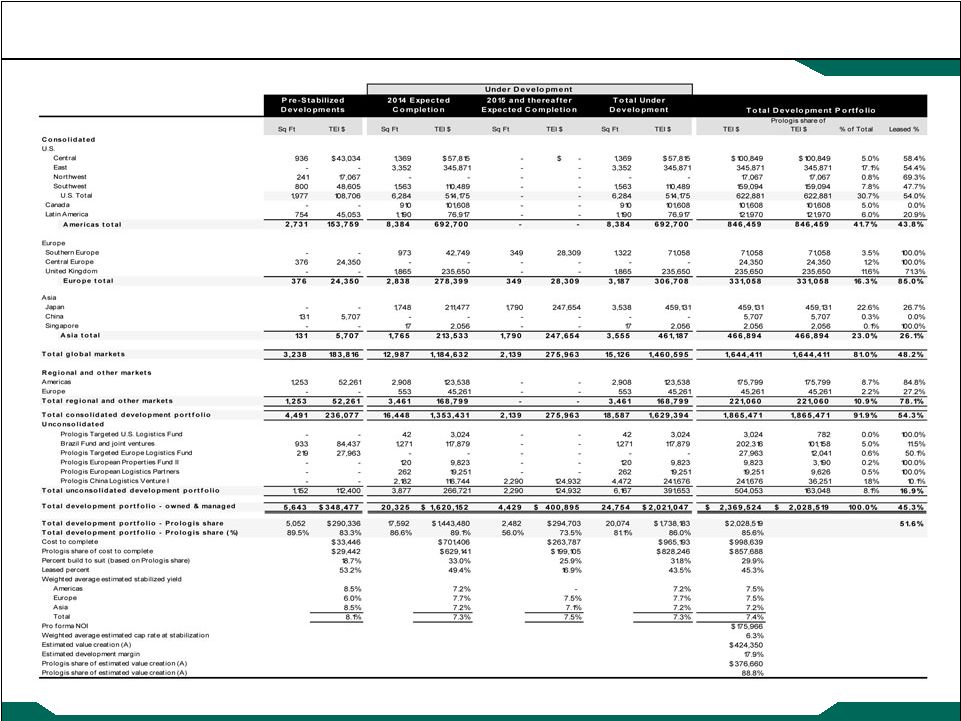

(in thousands, except percent)

(A) Value creation excludes fees or promotes that we may earn. See complete

definition in the Notes and Definitions section. |

Copyright ©

2014 Prologis

Supplemental 4Q 2013

Capital Deployment

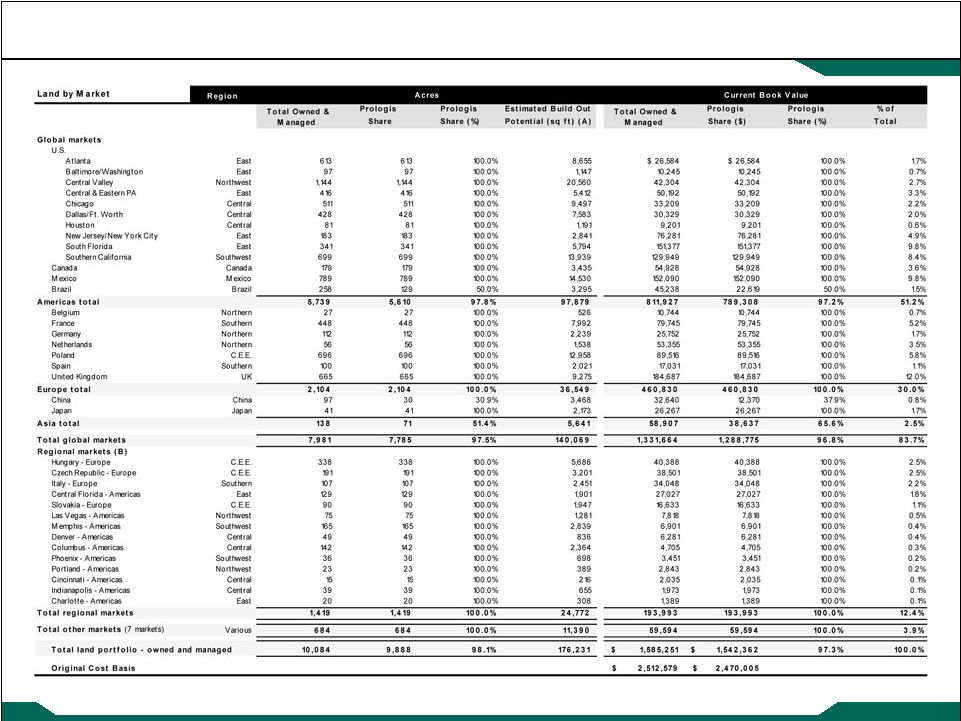

Land Portfolio –

Owned and Managed

24

(A)

Represents estimated finished square feet available for rent upon completion of an

industrial building on existing parcels of land. (B)

Ordered by our share of current book value.

(square feet and dollars in thousands) |

Copyright ©

2014 Prologis

Supplemental 4Q 2013

Capital Deployment

Land Portfolio –

Summary and Roll Forward

25

Investment at

Acres

% of Total

December 31, 2013

% of Total

6,739

66.8%

868,470

$

54.8%

Brazil Fund and joint ventures

258

2.6%

45,238

2.9%

Total Americas

6,997

69.4%

913,708

57.7%

2,949

29.2%

612,636

38.6%

59

0.6%

35,060

2.2%

Prologis China Logistics Venture 1

79

0.8%

23,847

1.5%

Total Asia

138

1.4%

58,907

3.7%

10,084

100.0%

1,585,251

$

100.0%

Americas

Europe

Asia

Total

996,654

$

629,730

$

108,060

$

1,734,444

$

Acquisitions

33,547

19,471

5,489

58,507

Dispositions

(50,547)

(34,526)

(3,246)

(88,319)

Development starts

(88,075)

(10,638)

(48,336)

(147,049)

Infrastructure costs

29,188

14,026

1,407

44,621

Effect of changes in foreign exchange rates and other

(7,059)

(5,427)

(4,467)

(16,953)

913,708

$

612,636

$

58,907

$

1,585,251

$

Land Portfolio Summary

Consolidated

Americas

Total land portfolio - owned and managed

Consolidated

Europe

Asia

Consolidated

As of December 31, 2013

Land Roll Forward - Owned and Managed

As of September 30, 2013

(dollars in thousands)

. |

Copyright ©

2014 Prologis

Supplemental 4Q 2013

Co-Investment Ventures

Summary and Financial Highlights

26

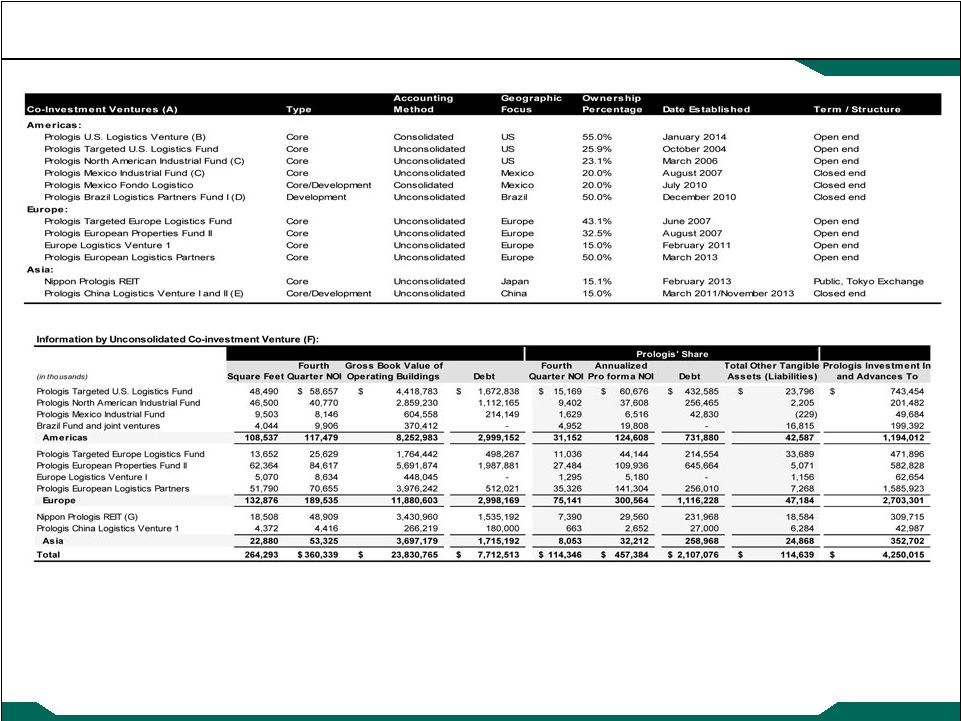

(A)

The

information

presented

excludes

two

ventures-

Prologis

AMS

and

Prologis

DFS

Fund

I,

due

to

the

investment

size

of

the

ventures.

(B)

An investment agreement for Prologis U.S. Logistics Venture was executed in December

2013; the venture closed January 2014. (C)

These co-investment ventures do not expect to be actively investing in new

properties. (D)

We have a 50% ownership interest in and consolidate an entity that in turn owns 50%

of various entities that are accounted for on the equity method (“Brazil Fund”). The Brazil Fund develops

industrial properties in Brazil and has sold properties to an entity in which it

maintains an equity interest. We also have other Brazil joint ventures that we account for using the equity method. We

show our ownership in these Brazil entities at our effective ownership and include

the properties in our owned and managed pool. (E)

The Prologis China Logistics Venture II was formed during the fourth quarter of

2013. (F)

Values

represent

Prologis’

stepped

up

basis

and

may

not

be

comparable

to

values

reflected

in

the

entities’

stand

alone

financial

statements

calculated

on

a

different

basis.

Prologis

U.S.

Logistics

Venture

and

Prologis

China

Logistics

Venture

II

are

not

included

as

they

did

not

own

properties

or

other

net

assets

(liabilities)

for

the

period

ended

December

31,

2013.

(G)

Throughout

this

document,

we

use

the

most

recent

public

information

for

this

co-investment

venture.

If

the

co-investment

venture

acquires

properties

during

the

period

that

is

reported,

we

estimate

the

entire

quarter

of

NOI

based

on

the

results

of

the

properties

while

owned

by

Prologis. |

Copyright ©

2014 Prologis

Supplemental 4Q 2013

Co-Investment Ventures

Operating and Balance Sheet Information

27

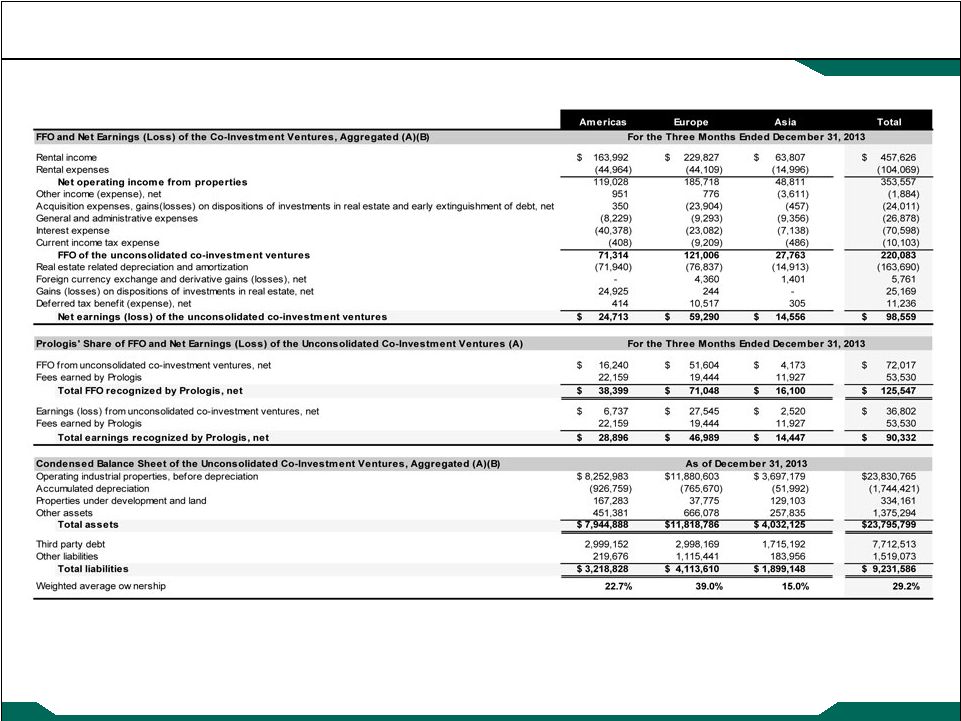

(A)

Includes the unconsolidated co-investment ventures listed on the previous

page. (B)

Represents the entire entity, not our proportionate share.

(dollars in thousands) |

Copyright ©

2014 Prologis

Supplemental 4Q 2013

Capitalization

Debt and Equity Summary

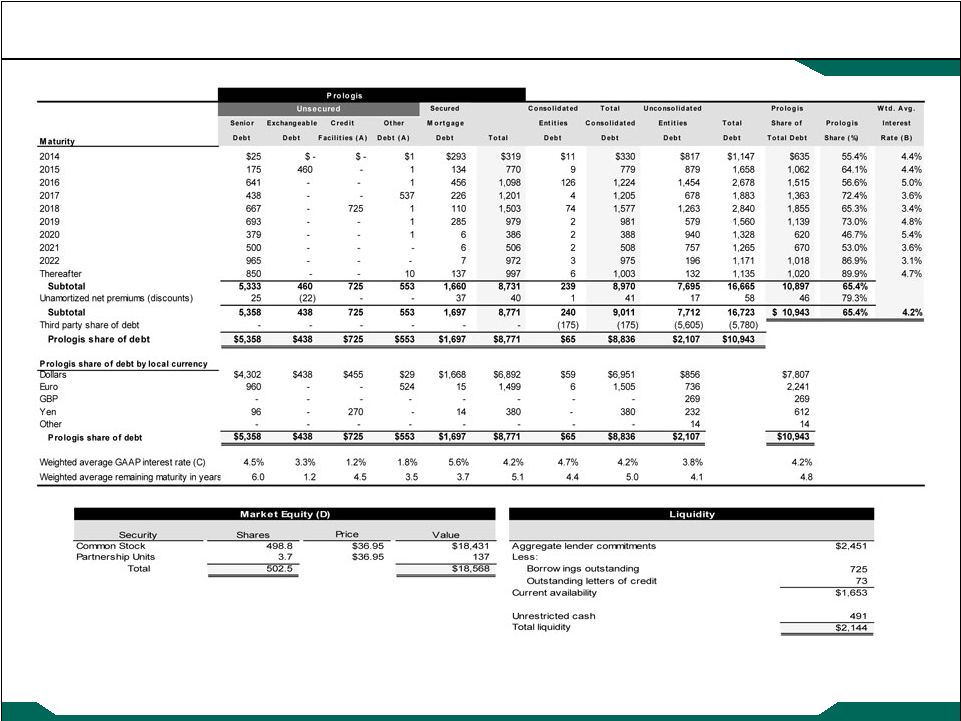

28

(A)

The maturity date for the global senior credit facility and senior term loan is

reflected at maturity assuming we extend the term. (B)

Based on Prologis share of the total debt. Interest rate is based on the

effective rate (which includes the amortization of related premiums and discounts) assuming the net premiums

(discounts) associated with the respective debt were included in the

maturities by year. (C)

Interest rate is based on the effective rate and weighted based on borrowings

outstanding. (D)

In addition to our common stock and partnership units, we have two million shares

of preferred stock outstanding with a liquidation preference of $100 million at December 31, 2013.

(dollars and shares in millions) |

Copyright ©

2014 Prologis

Supplemental 4Q 2013

Capitalization

Debt Covenants and Other Metrics

29

(A)

These calculations are made in accordance with the respective debt agreements, may

be different than other covenants or metrics presented and are not calculated in accordance with the

applicable SEC rules. Please refer to the respective agreements for full financial

covenant descriptions and calculation methods. (B)

These covenants are calculated in accordance with the Indenture dated June 8, 2011

and its supplemental indentures, including the Fifth Supplemental Indenture dated August 15, 2013.

(C)

All metrics include both consolidated and Prologis share of unconsolidated

entities. (D)

See Notes and Definitions for calculation of amounts.

(dollars in thousands)

Covenant

Actual

Covenant

Actual

<60%

32.9%

<60%

32.0%

>1.5x

3.95x

>1.5x

3.58x

<40%

7.0%

< 35%

7.0%

Unencumbered asset to unsecured debt ratio

>150%

259.0%

N/A

N/A

N/A

N/A

>150%

421.0%

2013

2013

Fourth Quarter

Third Quarter

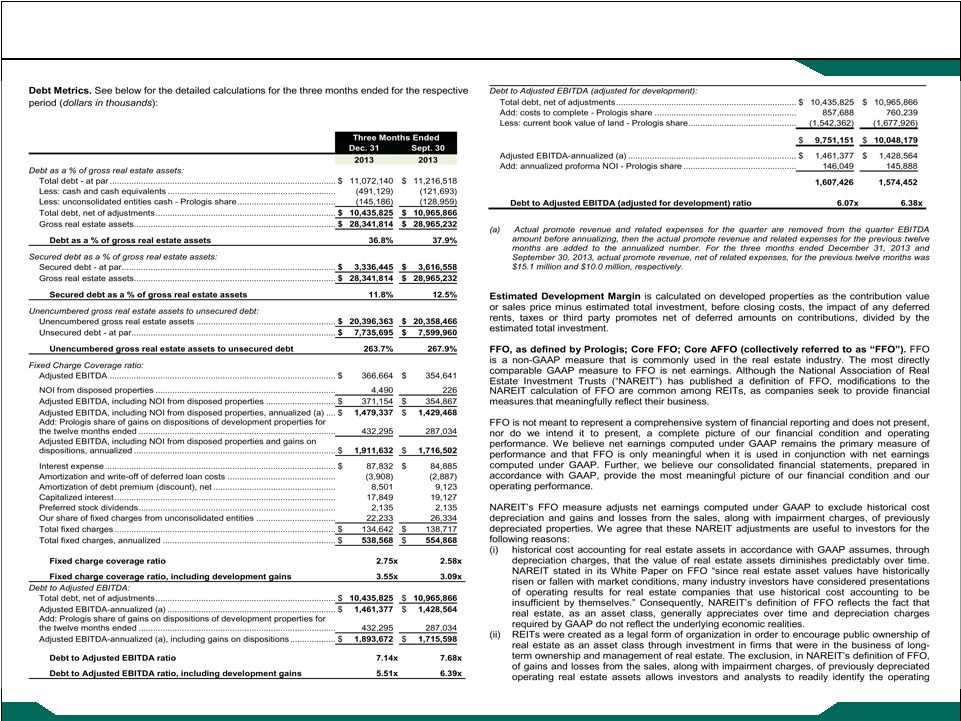

36.8%

37.9%

11.8%

12.5%

263.7%

267.9%

2.75x

2.58x

3.55x

3.09x

7.14x

7.68x

5.51x

6.39x

6.07x

6.38x

Unencumbered

Encumbered

Total

13,240,375

$

4,560,689

$

17,801,064

$

2,501,153

36,030

2,537,183

471,555

206,717

678,272

Total consolidated

16,213,083

4,803,436

21,016,519

4,069,321

3,137,294

7,206,615

113,959

4,721

118,680

Gross real estate assets

20,396,363

$

7,945,451

$

28,341,814

$

Unsecured

Secured

Debt

Mortgage Debt

Total

7,071,503

$

1,659,992

$

8,731,495

$

-

239,072

239,072

664,192

1,437,381

2,101,573

Total debt

-

at

par

7,735,695

3,336,445

11,072,140

-

(174,642)

(174,642)

Total

Prologis

share

of

debt

-

at

par

7,735,695

3,161,803

10,897,498

3,123

37,526

40,649

-

(569)

(569)

-

5,503

5,503

Total Prologis share of debt, net of premium (discount)

7,738,818

$

3,204,263

$

10,943,081

$

Global Line

Indenture (B)

Debt as % of gross real estate assets

Debt/Adjusted EBITDA

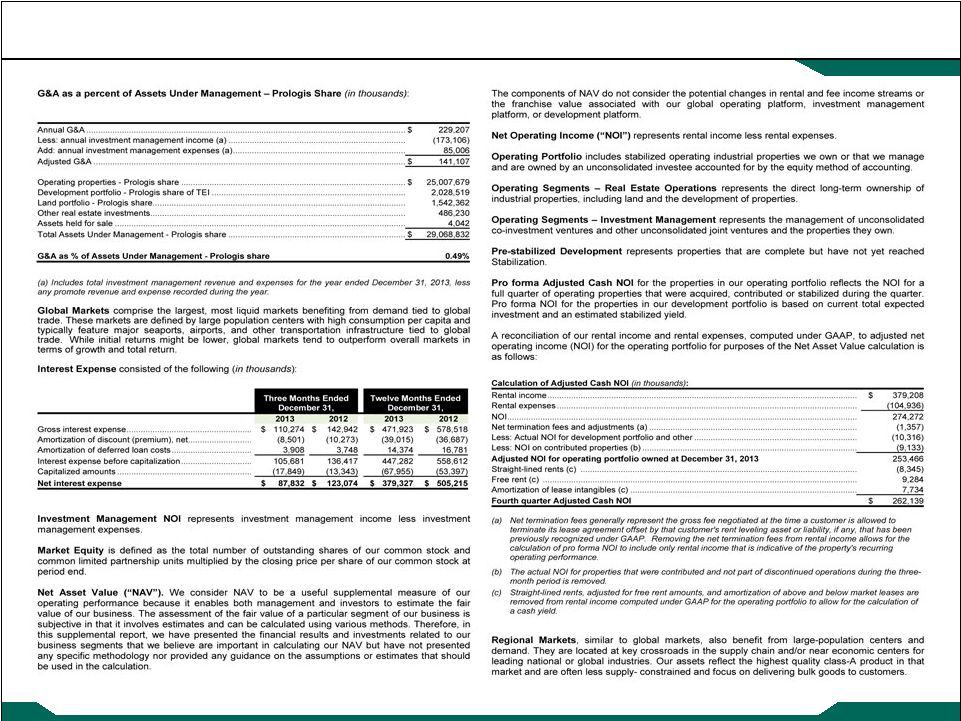

Leverage ratio

Debt Metrics (A) (C) (D)

Fixed charge coverage ratio

Fixed charge coverage ratio, including development gains

Covenants as of December 31, 2013 (A)

Fixed charge coverage ratio

Secured debt leverage ratio

Unencumbered debt service coverage ratio

Unconsolidated

development

portfolio

and

land

-

Prologis'

share

Consolidated operating properties

Unconsolidated

operating

properties

-

Prologis'

share

Encumbrances as of December 31, 2013

Secured debt as % of gross real estate assets

Unencumbered gross real estate assets to unsecured debt

Consolidated development portfolio and land

Debt/Adjusted EBITDA (adjusted for development)

Consolidated other investments in real estate

Debt/Adjusted EBITDA, including development gains

Our

share

of

premium

(discount)

-

unconsolidated

Premium

(discount)

-

consolidated

Secured and Unsecured Debt as of December 31, 2013

Prologis debt

Consolidated entities debt

Our share of unconsolidated entities debt

Less: third party share of consolidated debt discount (premium)

Less: third party share of consolidated debt |

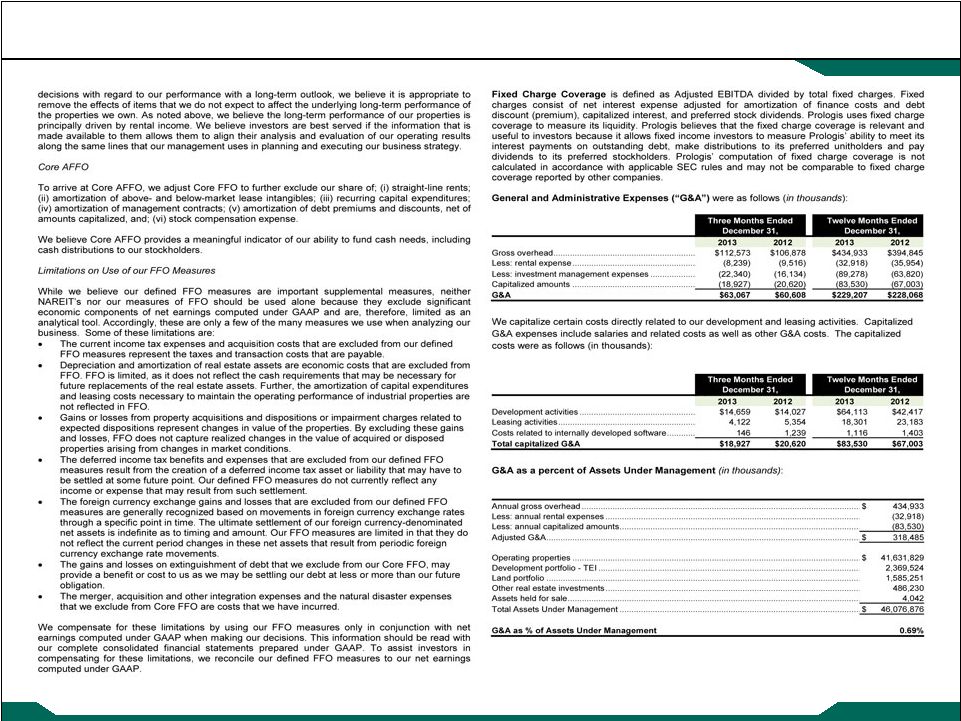

Copyright ©

2014 Prologis

Supplemental 4Q 2013

Capitalization

Assets Under Management

30

U.S. Dollar

77%

Euro

14%

Yen

6%

$-

$5,000

$10,000

$15,000

$20,000

$25,000

$30,000

$35,000

$40,000

$45,000

$50,000

Europe

25.5%

Asia

13.2%

$ 29,611

$ 48,241

Debt

$10,943

Committed

Equity/Investment

$2,823

Americas

61.3%

$ 48,241

Direct owned

and other

assets

$22,878

Equity

Cap and

Preferred Shares

$18,668

AUM

Investment

Management

$25,363

Investors' share of

assets in JVs/funds

$15,807

Prologis share of

assets in JVs/funds

$6,733

Total

Enterprise

Value

$29,611

$ 18,668

Other

3%

Total Enterprise Value

Total AUM by Division

Assets Under Management

(in millions)

Net Equity |

Copyright ©

2014 Prologis

Supplemental 4Q 2013

Net Asset Value

Components

31

(in thousands, except for percentages and per square foot)

|

Copyright ©

2014 Prologis

Supplemental 4Q 2013

Net Asset Value

Components -

Continued

32

(in thousands)

(A) Excludes revenue and expenses related to the promotes earned during

the fourth quarter of 2013. |

Copyright ©

2014 Prologis

Supplemental 4Q 2013

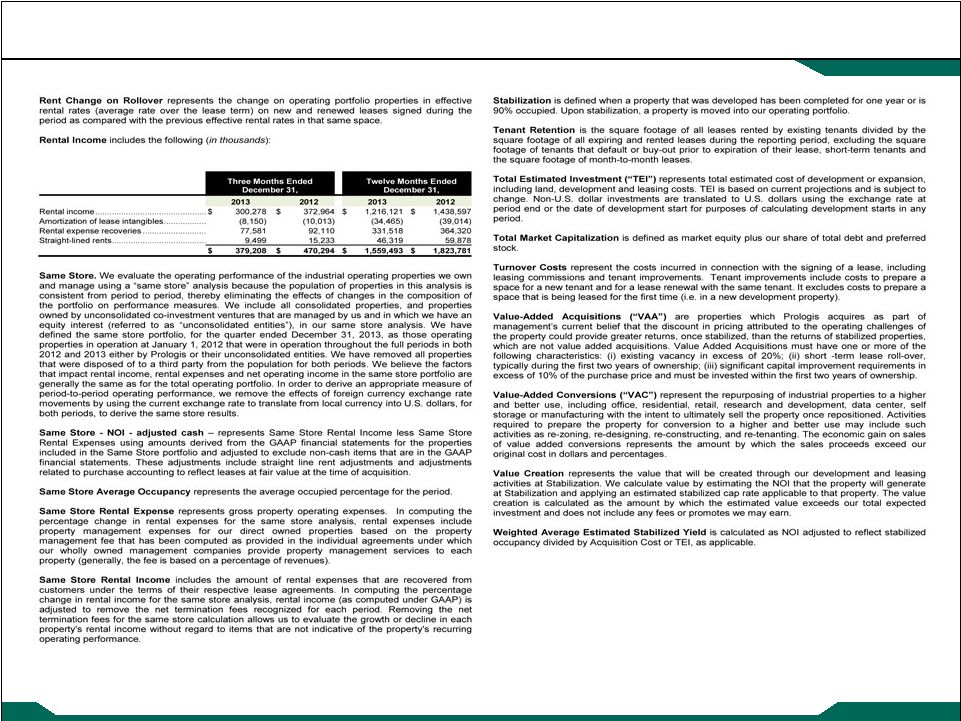

Notes and Definitions

33 |

Copyright ©

2014 Prologis

Supplemental 4Q 2013

Notes and Definitions

34 |

Copyright ©

2014 Prologis

Supplemental 4Q 2013

Notes and Definitions

35 |

Copyright ©

2014 Prologis

Supplemental 4Q 2013

Notes and Definitions

36 |

Copyright ©

2014 Prologis

Supplemental 4Q 2013

Notes and Definitions

37 |

Copyright ©

2014 Prologis

Supplemental 4Q 2013

Notes and Definitions

38 |

Copyright ©

2014 Prologis

Supplemental 4Q 2013

39

Notes and Definitions |