Exhibit 99.2

Prologis and Duke Realty Merger Conference Call 06.13.2022 Caption text sample. Fontana, California

2 Important information Forward - Looking Statements The statements in this communication that are not historical facts are forward - looking statements within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . These forward - looking statements are based on current expectations, estimates and projections about the industry and markets in which Prologis and Duke Realty operate as well as beliefs and assumptions of Prologis and Duke Realty . Such statements involve uncertainties that could significantly impact Prologis’ or Duke Realty’s financial results . Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” and “estimates,” including variations of such words and similar expressions, are intended to identify such forward - looking statements, which generally are not historical in nature . All statements that address operating performance, events or developments that Prologis or Duke Realty expects or anticipates will occur in the future — including statements relating to any possible transaction between Prologis and Duke Realty, rent and occupancy growth, acquisition and development activity, contribution and disposition activity, general conditions in the geographic areas where Prologis or Duke Realty operate, Prologis’ and Duke Realty’s respective debt, capital structure and financial position, Prologis’ and Duke Realty’s respective ability to earn revenues from co - investment ventures, form new co - investment ventures and the availability of capital in existing or new co - investment ventures — are forward - looking statements . These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict . Although Prologis and Duke Realty believe the expectations reflected in any forward - looking statements are based on reasonable assumptions, neither Prologis nor Duke Realty can give assurance that its expectations will be attained and, therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward - looking statements . Some of the factors that may affect outcomes and results include, but are not limited to : (i) Prologis’ and Duke Realty’s ability to complete the proposed transaction on the proposed terms or on the anticipated timeline, or at all, including risks and uncertainties related to securing the necessary shareholder approvals and satisfaction of other closing conditions to consummate the proposed transaction ; (ii) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement relating to the proposed transaction ; (iii) risks related to diverting the attention of Prologis and Duke Realty management from ongoing business operations ; (iv) failure to realize the expected benefits of the proposed transaction ; (v) significant transaction costs and/or unknown or inestimable liabilities ; (vi) the risk of shareholder litigation in connection with the proposed transaction, including resulting expense or delay ; (vii) the risk that Duke Realty’s business will not be integrated successfully or that such integration may be more difficult, time - consuming or costly than expected ; (viii) risks related to future opportunities and plans for the combined company, including the uncertainty of expected future financial performance and results of the combined company following completion of the proposed transaction ; (ix) the effect of the announcement of the proposed transaction on the ability of Prologis and Duke Realty to operate their respective businesses and retain and hire key personnel and to maintain favorable business relationships ; (x) risks related to the market value of the Prologis common stock to be issued in the proposed transaction ; (xi) other risks related to the completion of the proposed transaction and actions related thereto ; (xii) national, international, regional and local economic and political climates and conditions ; (xiii) changes in global financial markets, interest rates and foreign currency exchange rates ; (xiv) increased or unanticipated competition for Prologis’ or Duke Realty’s properties ; (xv) risks associated with acquisitions, dispositions and development of properties, including increased development costs due to additional regulatory requirements related to climate change ; (xvi) maintenance of Real Estate Investment Trust status, tax structuring and changes in income tax laws and rates ; (xvii) availability of financing and capital, the levels of debt that Prologis and Duke Realty maintain and their credit ratings ; (xviii) risks related to Prologis’ and Duke Realty’s investments in co - investment ventures, including Prologis’ and Duke Realty’s ability to establish new co - investment ventures ; (xix) risks of doing business internationally, including currency risks ; (xx) environmental uncertainties, including risks of natural disasters ; (xxi) risks related to the coronavirus pandemic ; and (xxii) those additional factors discussed under Part I, Item 1 A . Risk Factors in Prologis’ and Duke Realty’s respective Annual Reports on Form 10 - K for the year ended December 31 , 2021 . Neither Prologis nor Duke Realty undertakes any duty to update any forward - looking statements appearing in this communication except as may be required by law . Additional Information In connection with the proposed transaction, Prologis will file with the Securities and Exchange Commission (“SEC”) a registration statement on Form S - 4 (“Form S - 4 ”), which will include a document that serves as a prospectus of Prologis and a joint proxy statement of Prologis and Duke Realty (the “joint proxy statement/prospectus”), and each party will file other documents regarding the proposed transaction with the SEC . INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE FORM S - 4 AND THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION . A definitive joint proxy statement/prospectus will be sent to Prologis’ and Duke Realty’s shareholders . Investors and security holders will be able to obtain the Form S - 4 and the joint proxy statement/prospectus free of charge from the SEC’s website or from Prologis or Duke Realty . The documents filed by Prologis with the SEC may be obtained free of charge at Prologis’ website at the SEC Filings section of www . ir . prologis . com or at the SEC’s website at www . sec . gov . These documents may also be obtained free of charge from Prologis by requesting them from Investor Relations by mail at Pier 1 , Bay 1 , San Francisco, CA 94111 . The documents filed by Duke Realty with the SEC may be obtained free of charge at Duke Realty’s website at the SEC Filings section of http : //investor . dukerealty . com or at the SEC’s website at www . sec . gov . These documents may also be obtained free of charge from Duke Realty by requesting them from Investor Relations by mail at 8711 River Crossing Blvd . Indianapolis, IN 46240 . This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction . No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933 , as amended . Participants in the Solicitation Prologis and Duke Realty and their respective directors, executive officers and other members of management may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction . Information about Prologis’ directors and executive officers is available in Prologis’ Annual Report on Form 10 - K for the fiscal year ended December 31 , 2021 , its proxy statement dated March 25 , 2022 , for its 2022 Annual Meeting of Shareholders and its Current Report on Form 8 - K/A filed with the SEC on April 5 , 2022 . Information about Duke Realty’s directors and executive officers is available in Duke Realty’s Annual Report on Form 10 - K for the fiscal year ended December 31 , 2021 , its proxy statement dated March 2 , 2022 , for its 2022 Annual Meeting of Shareholders and its Current Report on Form 8 - K filed with the SEC on April 27 , 2022 . Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when they become available . Investors should read the joint proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions . You may obtain free copies of these documents from Prologis or Duke Realty as indicated above .

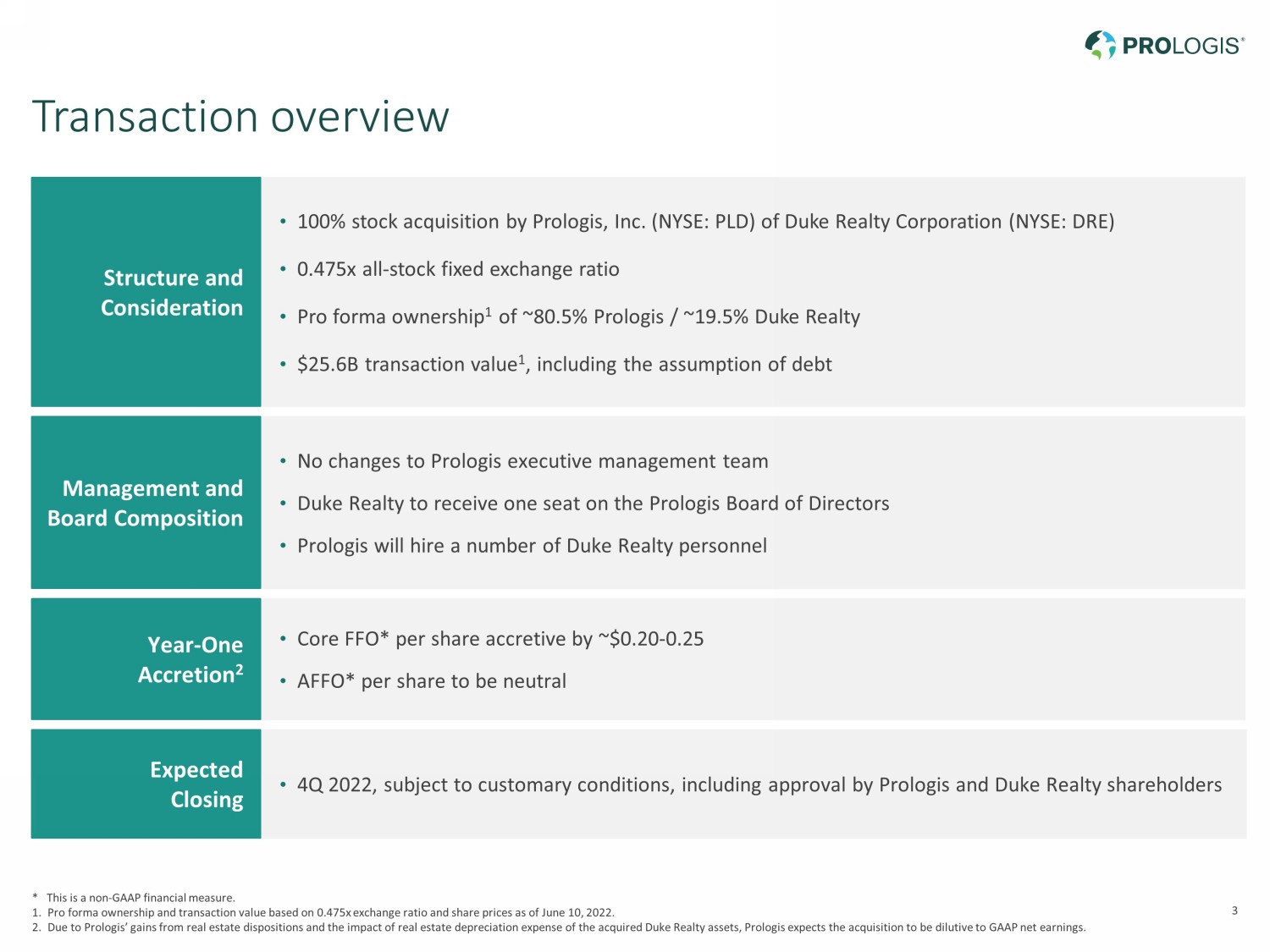

3 Transaction overview • No changes to Prologis executive management team • Duke Realty to receive one seat on the Prologis Board of Directors • Prologis will hire a number of Duke Realty personnel Management and Board Composition • Core FFO* per share accretive by ~$0.20 - 0.25 • AFFO* per share to be neutral Year - One Accretion 2 • 4Q 2022, subject to customary conditions, including approval by Prologis and Duke Realty shareholders Expected Closing • 100% stock acquisition by Prologis, Inc. (NYSE: PLD) of Duke Realty Corporation (NYSE: DRE) • 0.475x all - stock fixed exchange ratio • Pro forma ownership 1 of ~80.5% Prologis / ~19.5% Duke Realty • $25.6B transaction value 1 , including the assumption of debt Structure and Consideration * This is a non - GAAP financial measure. 1. Pro forma ownership and transaction value based on 0.475x exchange ratio and share prices as of June 10, 2022. 2. Due to Prologis’ gains from real estate dispositions and the impact of real estate depreciation expense of the acquired Duke Rea lty assets, Prologis expects the acquisition to be dilutive to GAAP net earnings.

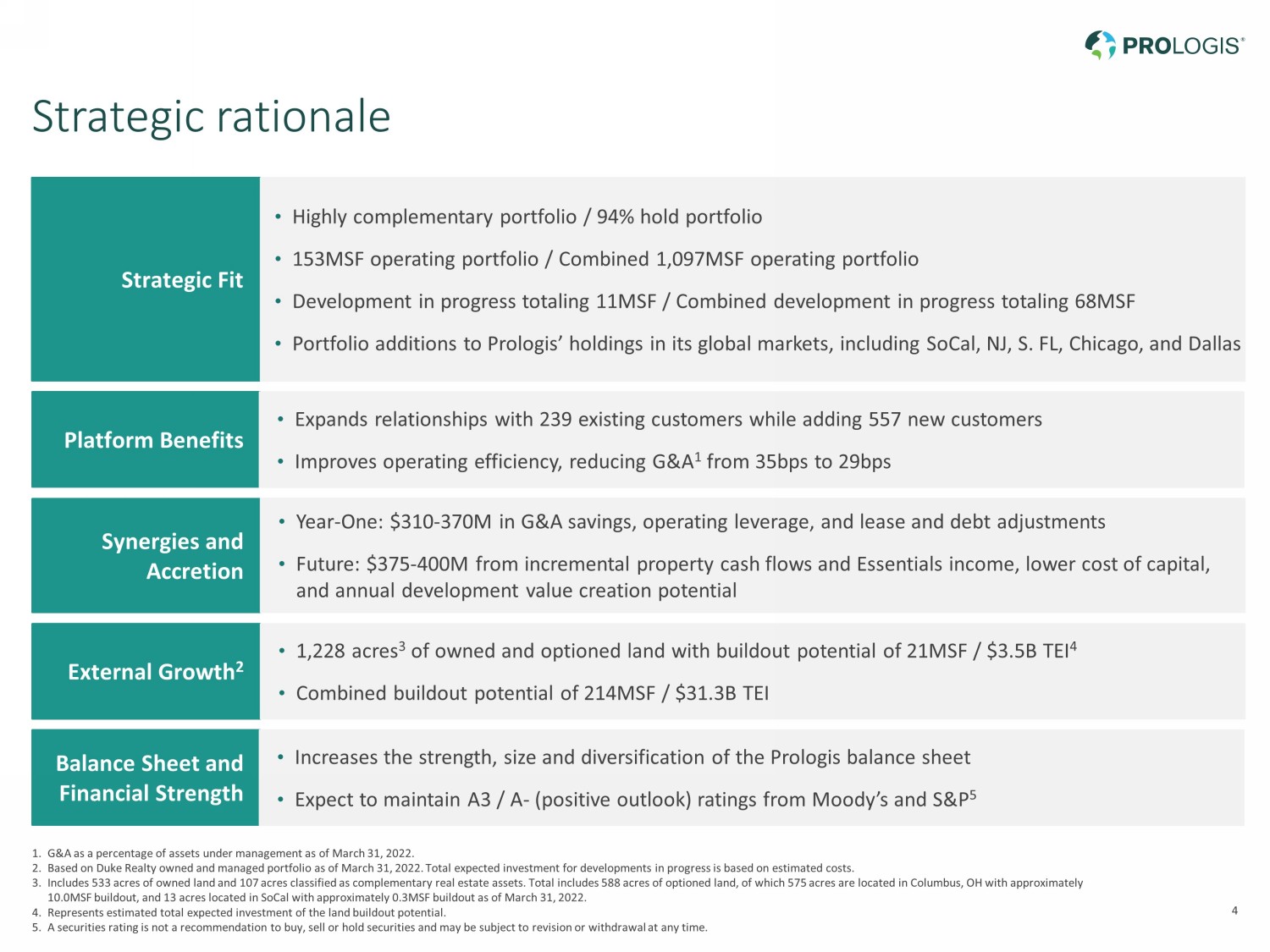

4 Strategic rationale Strategic Fit • Highly complementary portfolio / 94% hold portfolio • 153MSF operating portfolio / Combined 1,097MSF operating portfolio • Development in progress totaling 11MSF / Combined development in progress totaling 68MSF • Portfolio additions to Prologis’ holdings in its global markets, including SoCal, NJ, S. FL, Chicago, and Dallas Platform Benefits • Expands relationships with 239 existing customers while adding 557 new customers • Improves operating efficiency, reducing G&A 1 from 35bps to 29bps Synergies and Accretion • Year - One: $310 - 370M in G&A savings, operating leverage, and lease and debt adjustments • Future: $375 - 400M from incremental property cash flows and Essentials income, lower cost of capital, and annual development value creation potential Balance Sheet and Financial Strength • Increases the strength, size and diversification of the Prologis balance sheet • Expect to maintain A3 / A - (positive outlook) ratings from Moody’s and S&P 5 External Growth 2 • 1,228 acres 3 of owned and optioned land with buildout potential of 21MSF / $3.5B TEI 4 • Combined buildout potential of 214MSF / $31.3B TEI 1. G&A as a percentage of assets under management as of March 31, 2022. 2. Based on Duke Realty owned and managed portfolio as of March 31, 2022. Total expected investment for developments in progress is based on estimated costs. 3. Includes 533 acres of owned land and 107 acres classified as complementary real estate assets. Total includes 588 acres of op tio ned land, of which 575 acres are located in Columbus, OH with approximately 10.0MSF buildout, and 13 acres located in SoCal with approximately 0.3MSF buildout as of March 31, 2022. 4. Represents estimated total expected investment of the land buildout potential. 5. A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at a ny time.

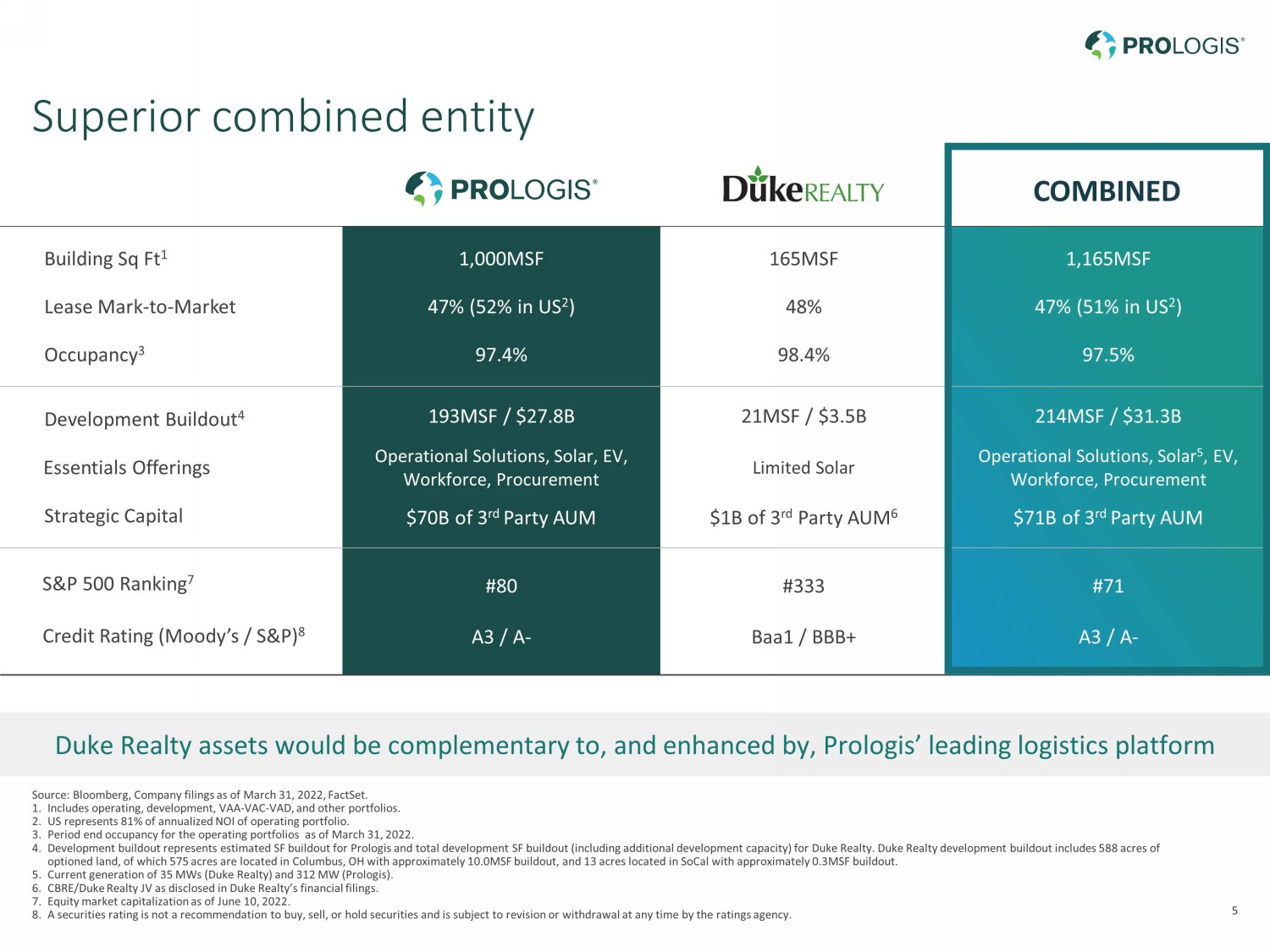

5 Superior combined entity Duke Realty assets would be complementary to, and enhanced by, Prologis’ leading logistics platform Occupancy 3 97.4% Lease Mark - to - Market 47% (52% in US 2 ) Building Sq Ft 1 1,000MSF Development Buildout 4 Strategic Capital Operational Solutions, Solar, EV, Workforce, Procurement Limited Solar Credit Rating (Moody’s / S&P) 8 A3 / A - Baa1 / BBB+ $70B of 3 rd Party AUM $1B of 3 rd Party AUM 6 193MSF / $27.8B 21MSF / $3.5B S&P 500 Ranking 7 #80 #333 97.5% 47% (51% in US 2 ) 1,165MSF Operational Solutions, Solar 5 , EV, Workforce, Procurement A3 / A - $71B of 3 rd Party AUM 214MSF / $31.3B #71 COMBINED Essentials Offerings 98.4% 48% 165MSF Source: Bloomberg, Company filings as of March 31, 2022, FactSet. 1. Includes operating, development, VAA - VAC - VAD, and other portfolios. 2. US represents 81% of annualized NOI of operating portfolio. 3. Period end occupancy for the operating portfolios as of March 31, 2022. 4. Development buildout represents estimated SF buildout for Prologis and total development SF buildout (including additional de vel opment capacity) for Duke Realty. Duke Realty development buildout includes 588 acres of optioned land, of which 575 acres are located in Columbus, OH with approximately 10.0MSF buildout, and 13 acres located in So Cal with approximately 0.3MSF buildout. 5. Current generation of 35 MWs (Duke Realty) and 312 MW (Prologis). 6. CBRE/Duke Realty JV as disclosed in Duke Realty’s financial filings. 7. Equity market capitalization as of June 10, 2022. 8. A securities rating is not a recommendation to buy, sell, or hold securities and is subject to revision or withdrawal at any tim e by the ratings agency.

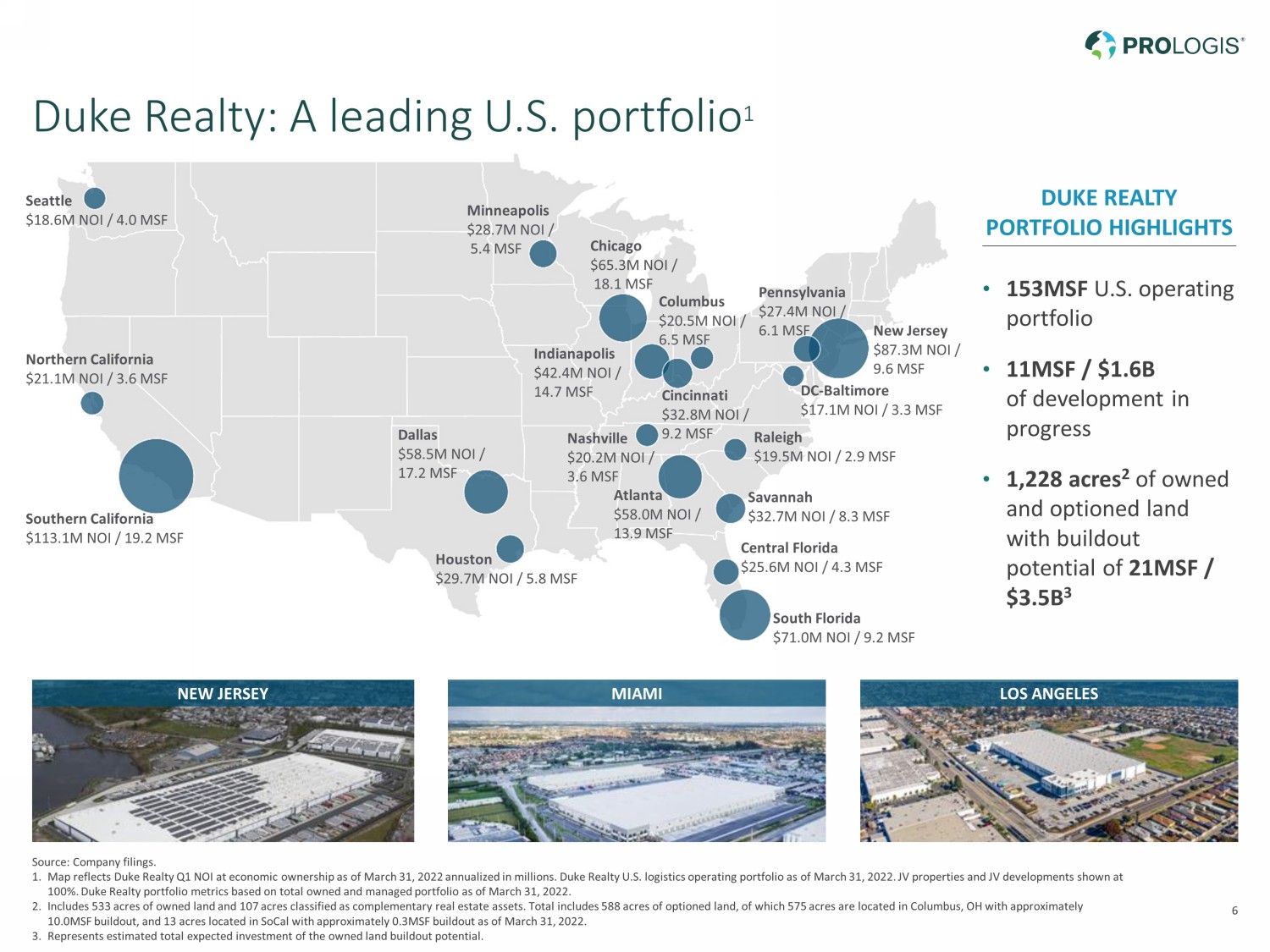

6 Seattle $18.6M NOI / 4.0 MSF Northern California $21.1M NOI / 3.6 MSF Southern California $113.1M NOI / 19.2 MSF Dallas $58.5M NOI / 17.2 MSF Houston $29.7M NOI / 5.8 MSF Minneapolis $28.7M NOI / 5.4 MSF Chicago $65.3M NOI / 18.1 MSF Indianapolis $42.4M NOI / 14.7 MSF Columbus $20.5M NOI / 6.5 MSF Cincinnati $32.8M NOI / 9.2 MSF Nashville $20.2M NOI / 3.6 MSF Raleigh $19.5M NOI / 2.9 MSF Atlanta $58.0M NOI / 13.9 MSF Savannah $32.7M NOI / 8.3 MSF Central Florida $25.6M NOI / 4.3 MSF South Florida $71.0M NOI / 9.2 MSF DC - Baltimore $17.1M NOI / 3.3 MSF New Jersey $87.3M NOI / 9.6 MSF Pennsylvania $27.4M NOI / 6.1 MSF Duke Realty: A leading U.S. portfolio 1 Source: Company filings. 1. Map reflects Duke Realty Q1 NOI at economic ownership as of March 31, 2022 annualized in millions. Duke Realty U.S. logistics op erating portfolio as of March 31, 2022. JV properties and JV developments shown at 100%. Duke Realty portfolio metrics based on total owned and managed portfolio as of March 31, 2022. 2. Includes 533 acres of owned land and 107 acres classified as complementary real estate assets. Total includes 588 acres of op tio ned land, of which 575 acres are located in Columbus, OH with approximately 10.0MSF buildout, and 13 acres located in SoCal with approximately 0.3MSF buildout as of March 31, 2022. 3. Represents estimated total expected investment of the owned land buildout potential. DUKE REALTY PORTFOLIO HIGHLIGHTS • 153MSF U.S. operating portfolio • 11MSF / $1.6B of development in progress • 1,228 acres 2 of owned and optioned land with buildout potential of 21MSF / $3.5B 3 LOS ANGELES NEW JERSEY MIAMI

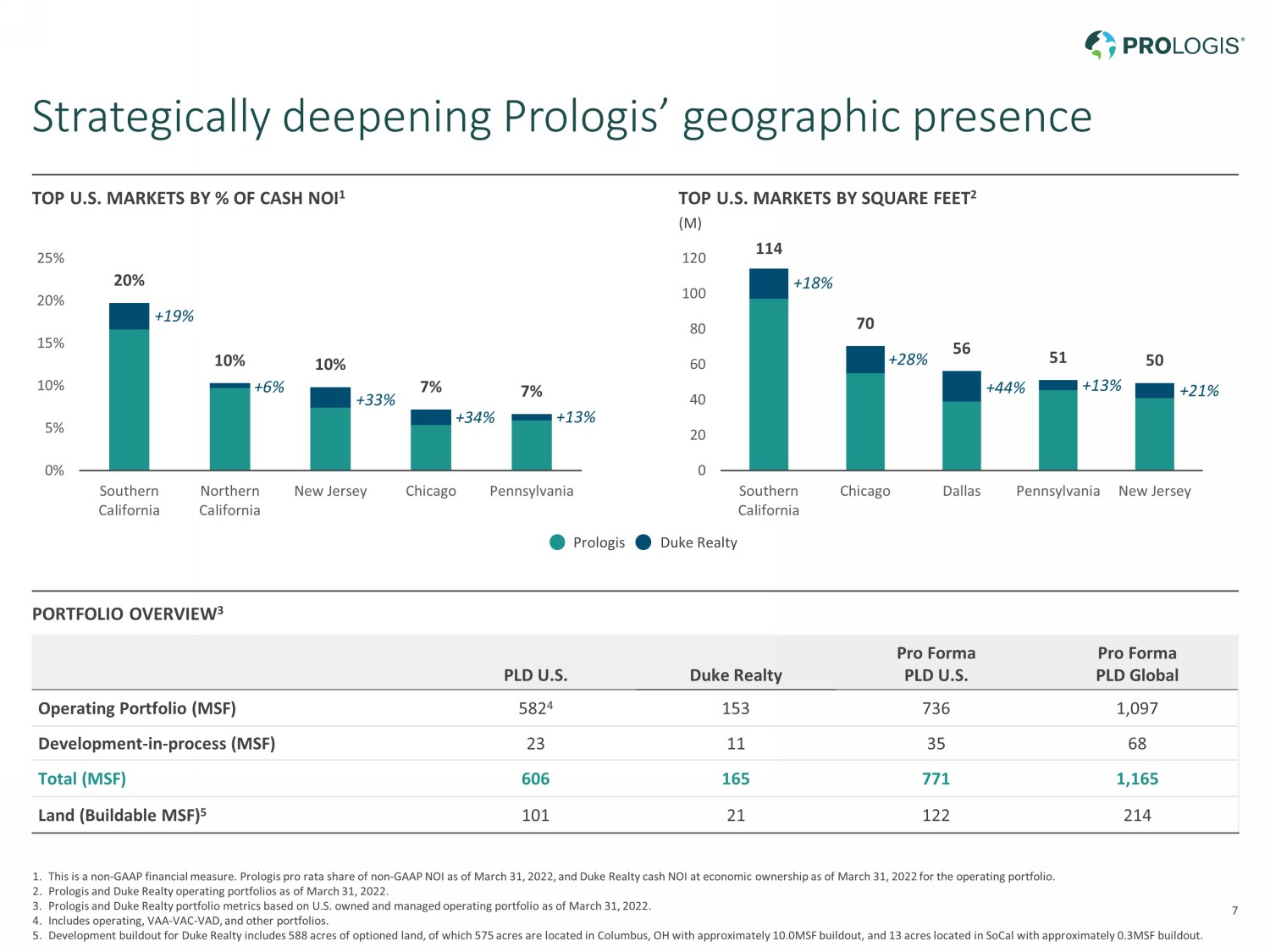

7 Strategically deepening Prologis’ geographic presence 20% 10% 10% 7% 7% 0% 5% 10% 15% 20% 25% Southern California Northern California New Jersey Chicago Pennsylvania TOP U.S. MARKETS BY % OF CASH NOI 1 Duke Realty Prologis TOP U.S. MARKETS BY SQUARE FEET 2 114 70 56 51 50 0 20 40 60 80 100 120 Southern California Chicago Dallas Pennsylvania New Jersey +19% +6% +33% +34% +13% +18% +28% +44% +13% +21% (M) PLD U.S. Duke Realty Pro Forma PLD U.S. Pro Forma PLD Global Operating Portfolio (MSF) 582 4 153 736 1,097 Development - in - process (MSF) 23 11 35 68 Total (MSF) 606 165 771 1,165 Land (Buildable MSF) 5 101 21 122 214 PORTFOLIO OVERVIEW 3 1. This is a non - GAAP financial measure. Prologis pro rata share of non - GAAP NOI as of March 31, 2022, and Duke Realty cash NOI at economic ownership as of March 31, 2022 for the operating portfolio. 2. Prologis and Duke Realty operating portfolios as of March 31, 2022. 3. Prologis and Duke Realty portfolio metrics based on U.S. owned and managed operating portfolio as of March 31, 2022. 4. Includes operating, VAA - VAC - VAD, and other portfolios. 5. Development buildout for Duke Realty includes 588 acres of optioned land, of which 575 acres are located in Columbus, OH with ap proximately 10.0MSF buildout, and 13 acres located in SoCal with approximately 0.3MSF buildout.

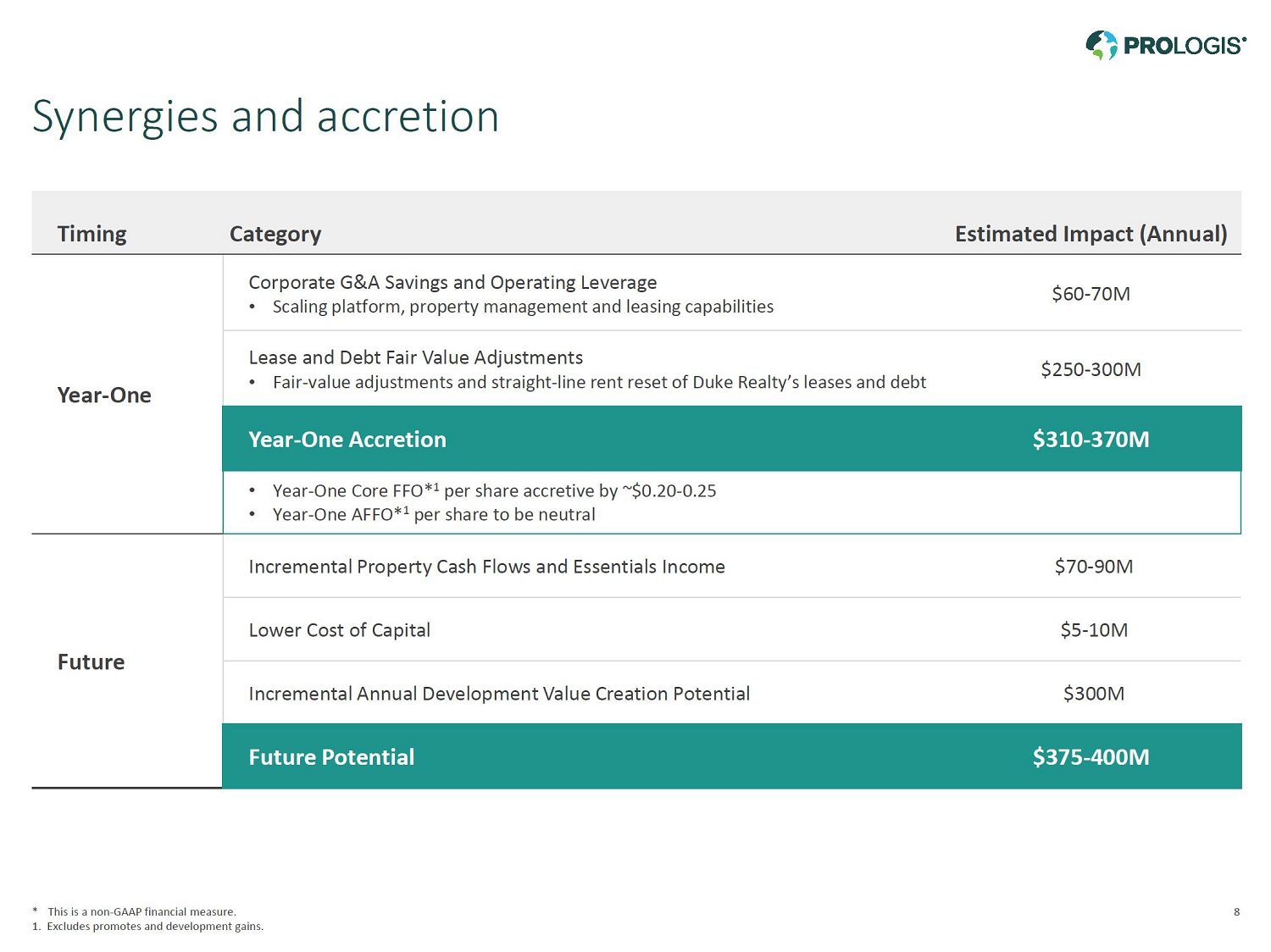

8 Future Incremental Property Cash Flows and Essentials Income $70 - 90M Lower Cost of Capital $5 - 10M Incremental Annual Development Value Creation Potential $300M Future Potential $375 - 400M Synergies and accretion * This is a non - GAAP financial measure. Timing Category Estimated Impact (Annual) Year - One Corporate G&A Savings and Operating Leverage • Scaling platform, property management and leasing capabilities $60 - 70M Lease and Debt Fair Value Adjustments • Fair - value adjustments and straight - line rent reset of Duke Realty’s leases and debt $250 - 300M Year - One Accretion $310 - 370M • Year - One Core FFO* per share accretive by ~$0.20 - 0.25 • Year - One AFFO* per share to be neutral

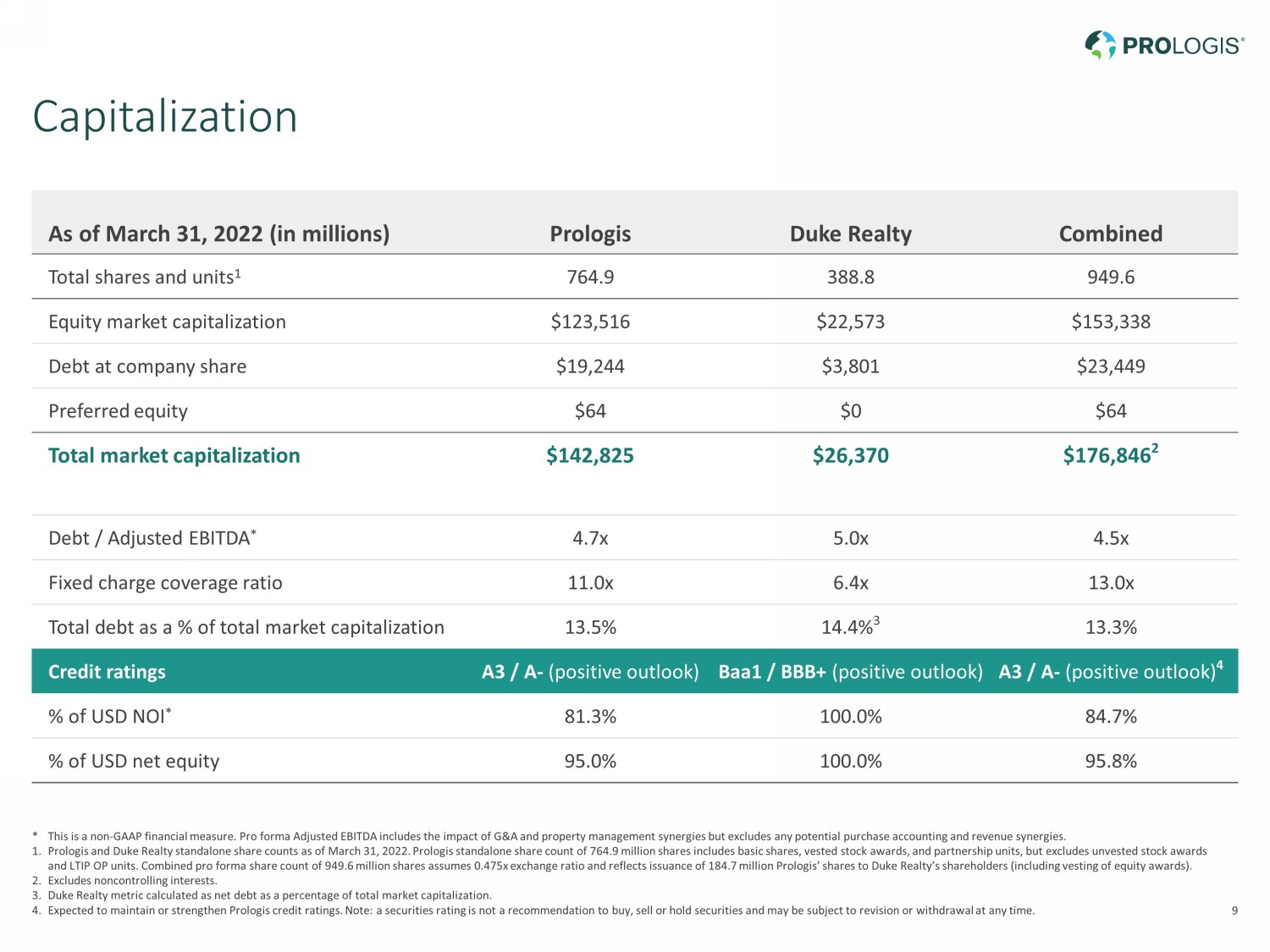

9 Capitalization * This is a non - GAAP financial measure. Pro forma Adjusted EBITDA includes the impact of G&A and property management synergies b ut excludes any potential purchase accounting and revenue synergies. 1. Prologis and Duke Realty standalone share counts as of March 31, 2022. Prologis standalone share count of 764.9 million share s i ncludes basic shares, vested stock awards, and partnership units, but excludes unvested stock awards and LTIP OP units. Combined pro forma share count of 949.6 million shares assumes 0.475x exchange ratio and reflects issuance of 184.7 million Prologis’ shares to Duke Realty’s shareholders (including vesting of equity awards). 2. Excludes noncontrolling interests. 3. Duke Realty metric calculated as net debt as a percentage of total market capitalization. 4. Expected to maintain or strengthen Prologis credit ratings. Note: a securities rating is not a recommendation to buy, sell or ho ld securities and may be subject to revision or withdrawal at any time. As of March 31, 2022 (in millions) Prologis Duke Realty Combined Total shares and units 1 764.9 388.8 949.6 Equity market capitalization $123,516 $22,573 $153,338 Debt at company share $19,244 $3,801 $23,449 Preferred equity $64 $0 $64 Total market capitalization $142,825 $26,370 $176,846 2 Debt / Adjusted EBITDA * 4.7x 5.0x 4.5x Fixed charge coverage ratio 11.0x 6.4x 13.0x Total debt as a % of total market capitalization 13.5% 14.4% 3 13.3% Credit ratings A3 / A - (positive outlook) Baa1 / BBB+ (positive outlook) A3 / A - (positive outlook) 4 % of USD NOI * 81.3% 100.0% 84.7% % of USD net equity 95.0% 100.0% 95.8%

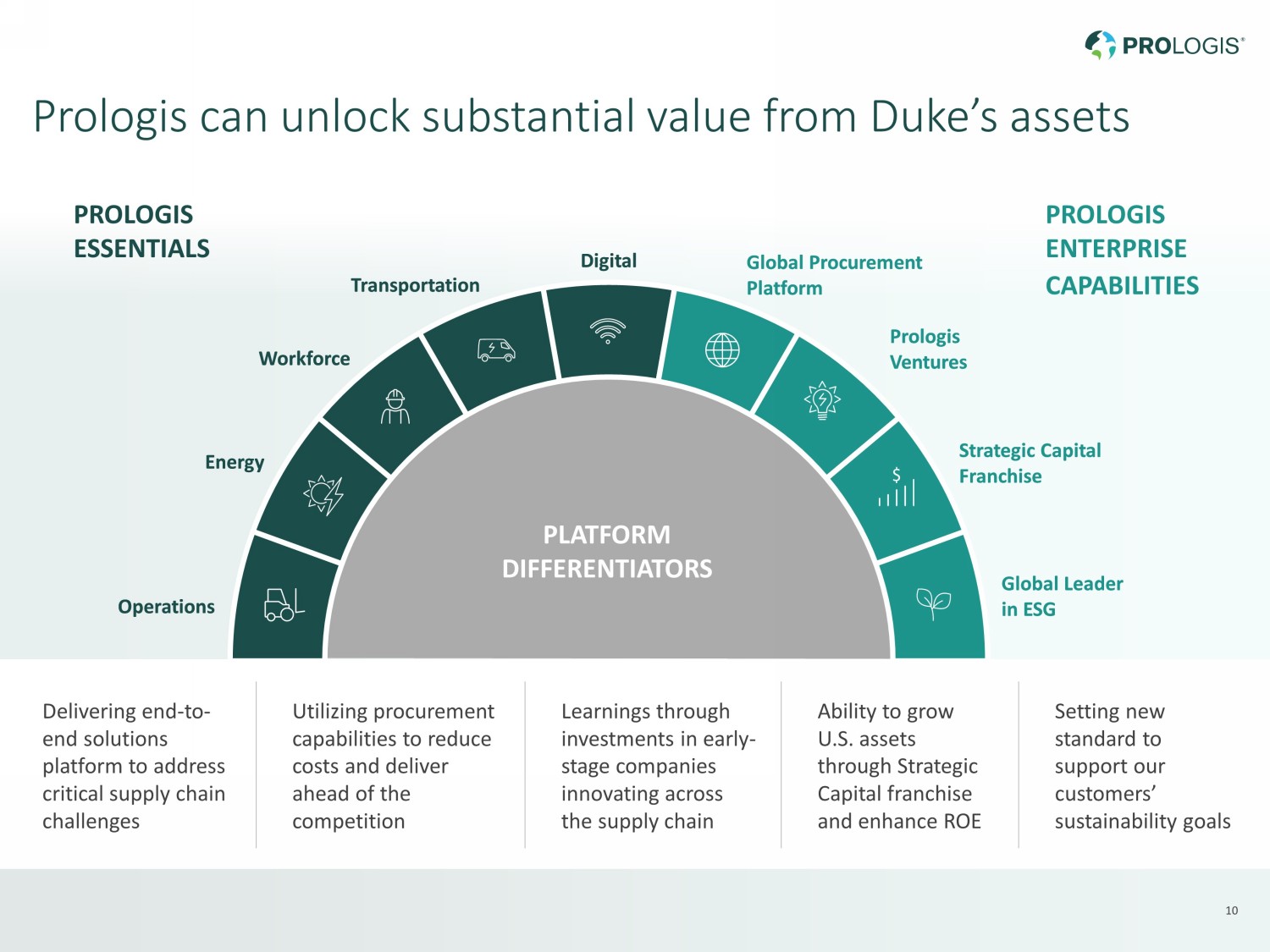

10 Strategic Capital Franchise Operations Energy Workforce Global Leader in ESG Prologis Ventures Global Procurement Platform Transportation Digital PLATFORM DIFFERENTIATORS Prologis can unlock substantial value from Duke’s assets PROLOGIS ENTERPRISE CAPABILITIES PROLOGIS ESSENTIALS 10 Strategic Capital Franchise Operations Energy Workforce Global Leader in ESG Prologis Ventures Global Procurement Platform Transportation Digital PLATFORM DIFFERENTIATORS Delivering end - to - end solutions platform to address critical supply chain challenges Utilizing procurement capabilities to reduce costs and deliver ahead of the competition Learnings through investments in early - stage companies innovating across the supply chain Ability to grow U.S. assets through Strategic Capital franchise and enhance ROE Setting new standard to support our customers’ sustainability goals

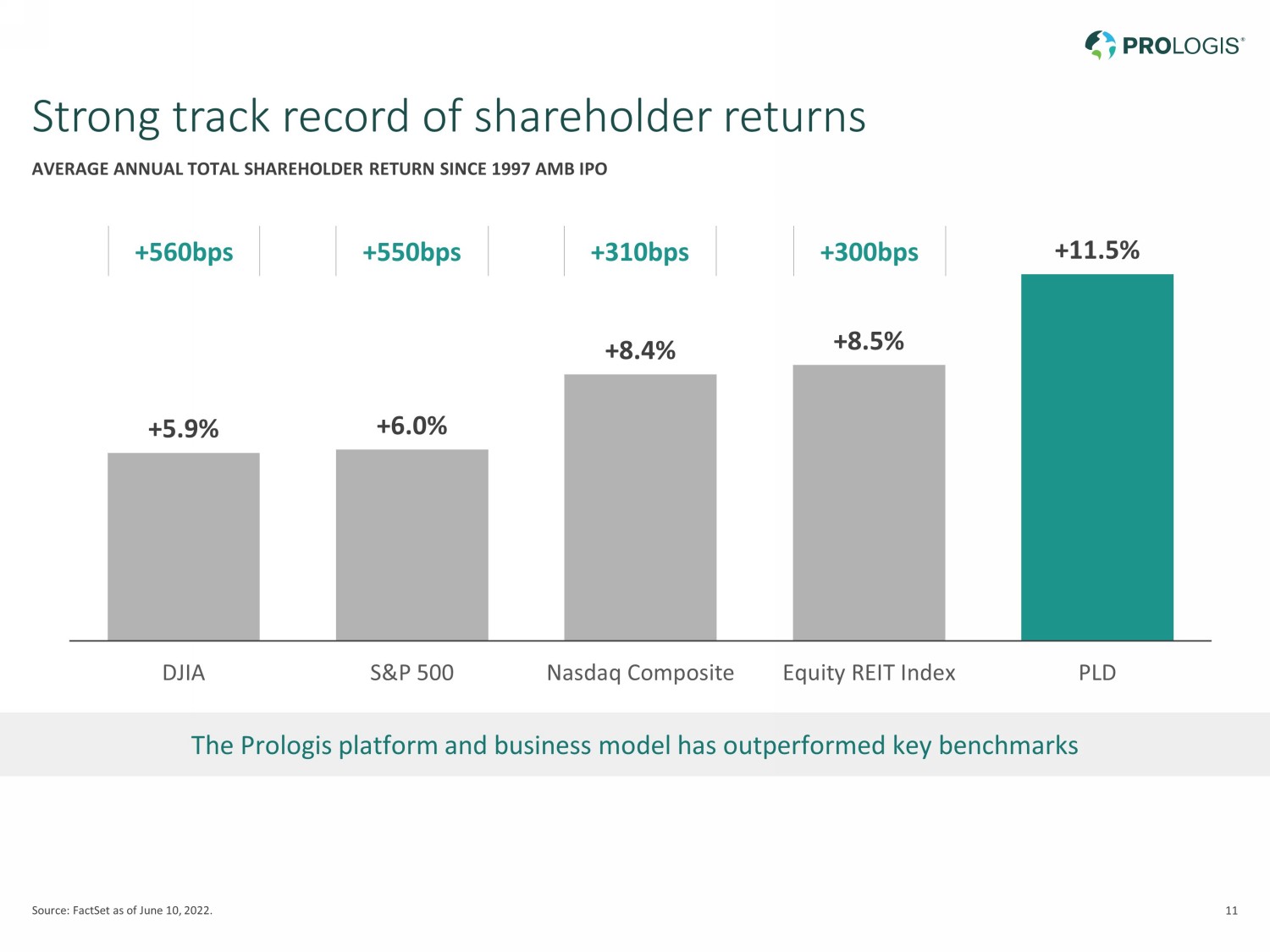

11 +5.9% +6.0% +8.4% +8.5% +11.5% DJIA S&P 500 Nasdaq Composite Equity REIT Index PLD Strong track record of shareholder returns Source: FactSet as of June 10, 2022. AVERAGE ANNUAL TOTAL SHAREHOLDER RETURN SINCE 1997 AMB IPO The Prologis platform and business model has outperformed key benchmarks +560bps +550bps +310bps +300bps

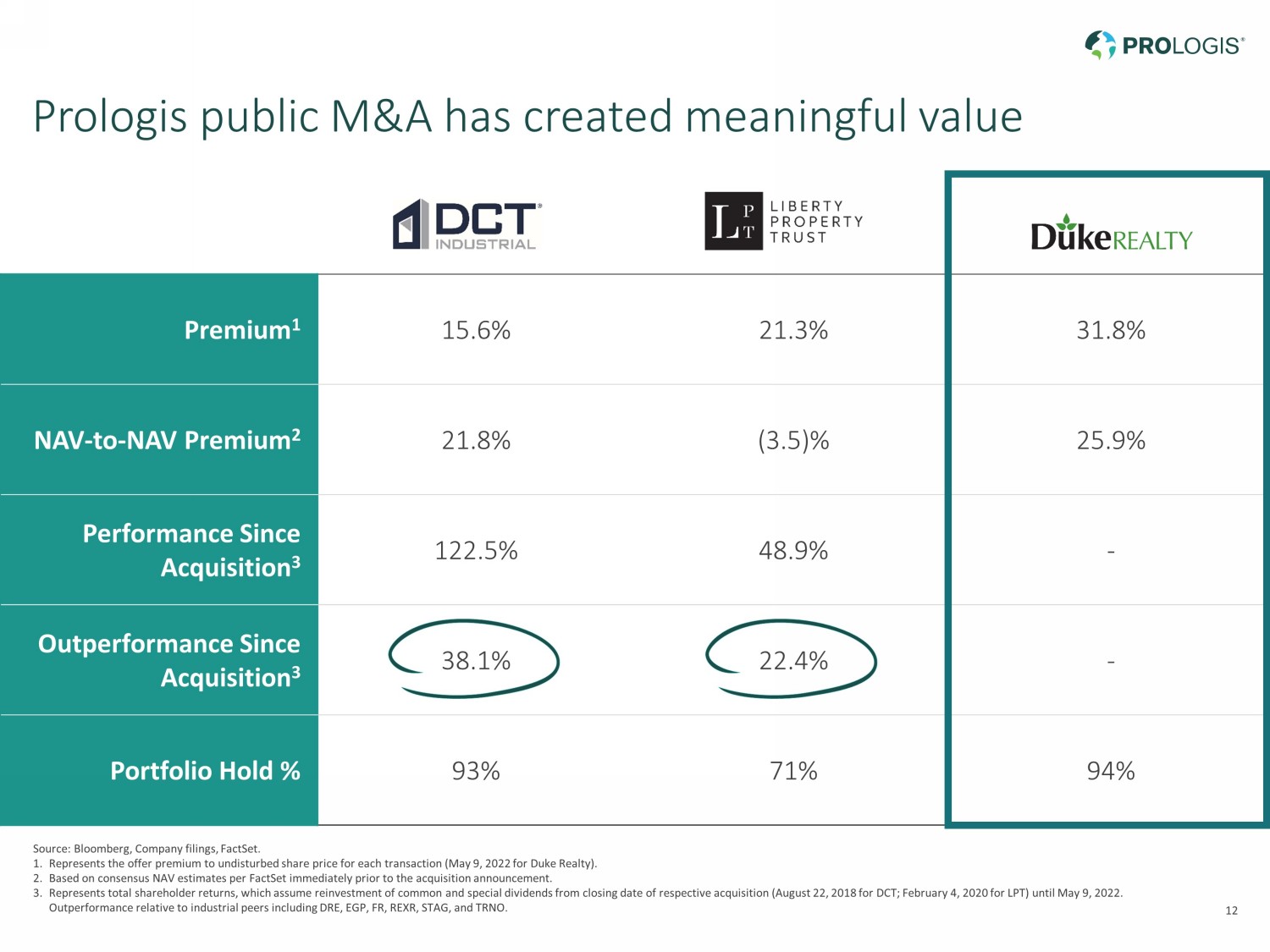

12 Prologis public M&A has created meaningful value Premium 1 15.6% 21.3% 31.8% NAV - to - NAV Premium 2 21.8% (3.5)% 25.9% Performance Since Acquisition 3 122.5% 48.9% - Outperformance Since Acquisition 3 38.1% 22.4% - Portfolio Hold % 93% 71% 94% Source: Bloomberg, Company filings, FactSet. 1. Represents the offer premium to undisturbed share price for each transaction (May 9, 2022 for Duke Realty). 2. Based on consensus NAV estimates per FactSet immediately prior to the acquisition announcement. 3. Represents total shareholder returns, which assume reinvestment of common and special dividends from closing date of respecti ve acquisition (August 22, 2018 for DCT; February 4, 2020 for LPT) until May 9, 2022. Outperformance relative to industrial peers including DRE, EGP, FR, REXR, STAG, and TRNO.

13 13 A highly compelling transaction • Duke Realty has built a business that has performed well compared to other industrial REITs • Highly complementary assets will enhance Prologis’ current portfolio • Significant synergies will drive accretion • Prologis’ scaled platform can unlock value in Duke Realty’s portfolio, as it has with past acquisitions 13