Prologis Supplemental Information First Quarter 2023 Unaudited Park Neufahrn, Neufahrn, Germany

Highlights 1 Company Profile 2 Company Performance 4 Prologis Leading Indicators and Proprietary Metrics 5 Guidance Financial Information 6 Consolidated Balance Sheets 7 Consolidated Statements of Income 8 Reconciliations of Net Earnings to FFO 9 Reconciliations of Net Earnings to Adjusted EBITDA Operations 10 Overview 11 Operating Metrics 13 Operating Portfolio 16 Customer Information Capital Deployment 17 Overview 18 Development Stabilizations 19 Development Starts 20 Development Portfolio 21 Third-Party Acquisitions 22 Dispositions and Contributions 23 Land Portfolio Strategic Capital 25 Overview 26 Summary and Financial Highlights 27 Operating and Balance Sheet Information of the Unconsolidated Co-Investment Ventures 28 Non-GAAP Pro-Rata Financial Information Capitalization 29 Overview 30 Debt Components - Consolidated 31 Debt Components - Noncontrolling Interests and Unconsolidated Net Asset Value 32 Components Notes and Definitions 34 Notes and Definitions Contents 1Q 2023 Supplemental

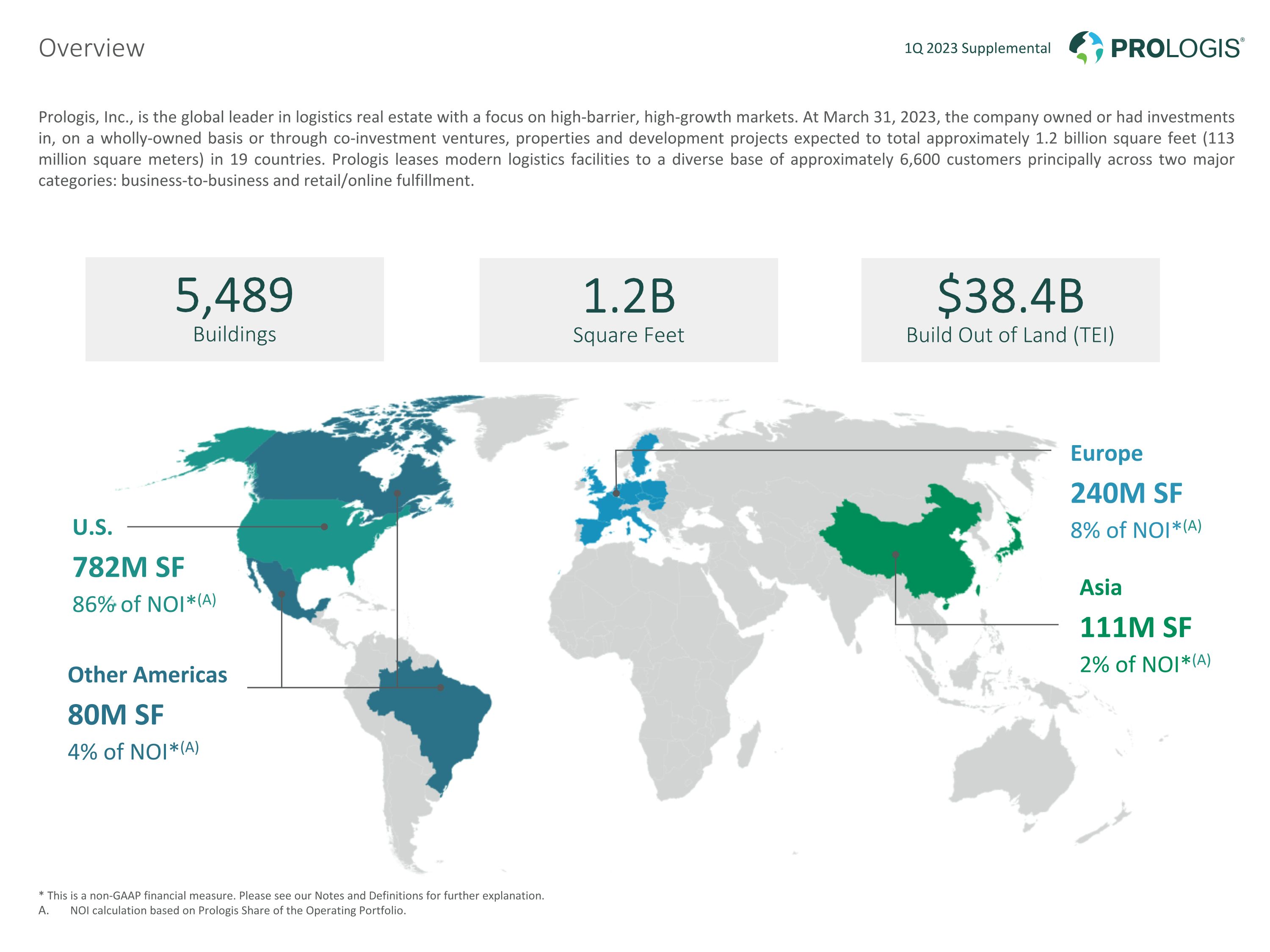

* This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. NOI calculation based on Prologis Share of the Operating Portfolio. 1Q 2023 Supplemental Overview Prologis, Inc., is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. At March 31, 2023, the company owned or had investments in, on a wholly-owned basis or through co-investment ventures, properties and development projects expected to total approximately 1.2 billion square feet (113 million square meters) in 19 countries. Prologis leases modern logistics facilities to a diverse base of approximately 6,600 customers principally across two major categories: business-to-business and retail/online fulfillment. 5,489 Buildings 1.2B Square Feet $38.4B Build Out of Land (TEI) U.S. 782M SF 86% of NOI*(A) Other Americas 80M SF 4% of NOI*(A) Europe 240M SF 8% of NOI*(A) Asia 111M SF 2% of NOI*(A)

Company Profile * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. 1Q 2023 Prologis Share of NOI of the Operating Portfolio annualized. 1Q 2023 third-party share of asset management fees annualized plus trailing twelve months third-party share of transactional fees and Net Promote Income. Prologis Share of trailing twelve month Estimated Value Creation from development stabilizations. Mexico is included in the U.S. as it is U.S. dollar functional. 1Q 2023 Supplemental Highlights Operations $5.2B in annual NOI*(A) Development $1.7B in value creation from stabilizations(C) Gross AUM $208B Prologis Share AUM $147B Market Equity $118B Strategic capital $829M of fees and promotes(B) 1 U.S.(D) Outside the U.S. U.S.(D) Outside the U.S. U.S.(D) Outside the U.S.

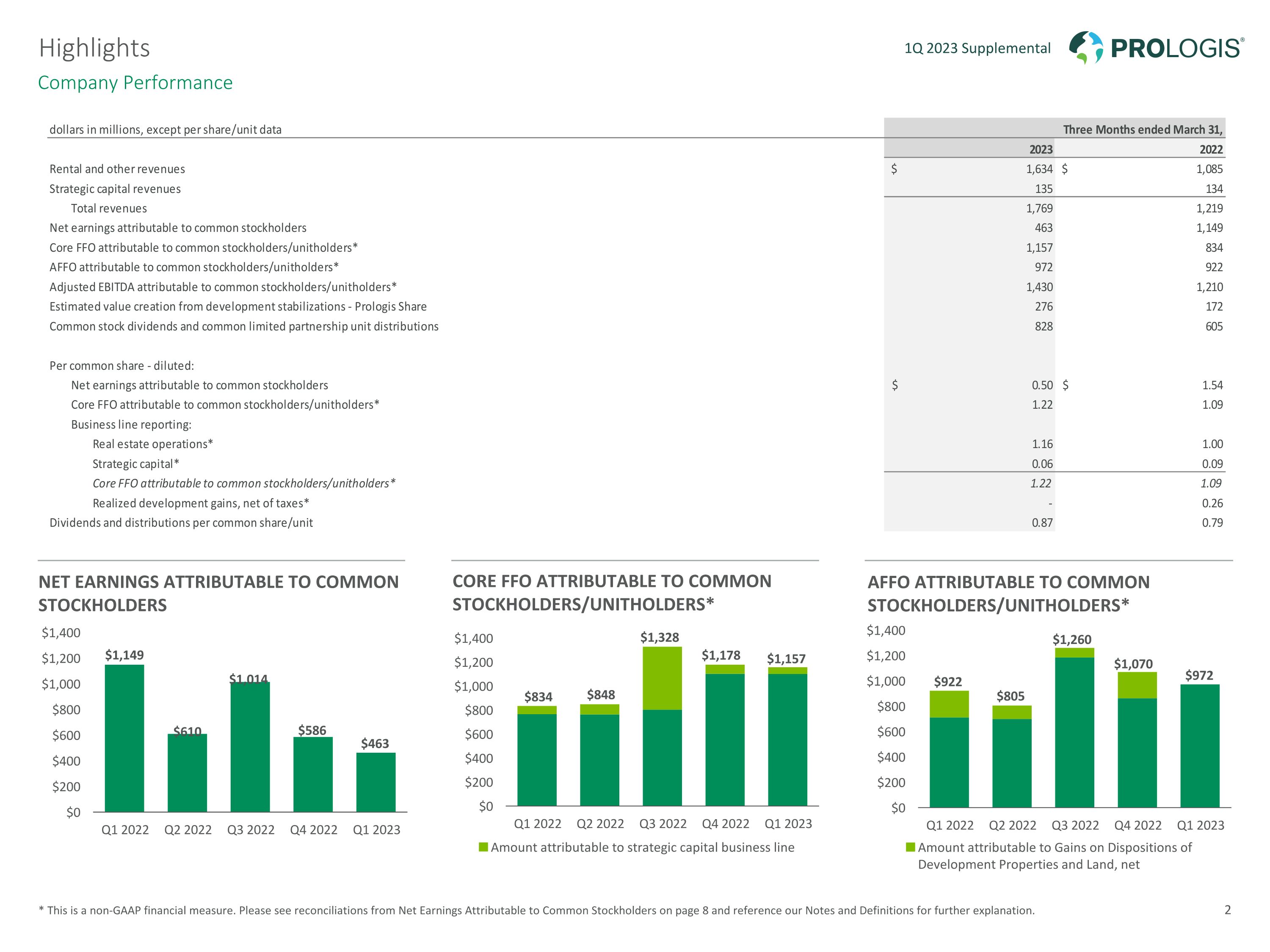

Company Performance * This is a non-GAAP financial measure. Please see reconciliations from Net Earnings Attributable to Common Stockholders on page 8 and reference our Notes and Definitions for further explanation. 1Q 2023 Supplemental Highlights Net earnings attributable to common stockholders Core FFO attributable to common stockholders/unitholders* AFFO attributable to common stockholders/unitholders* 2

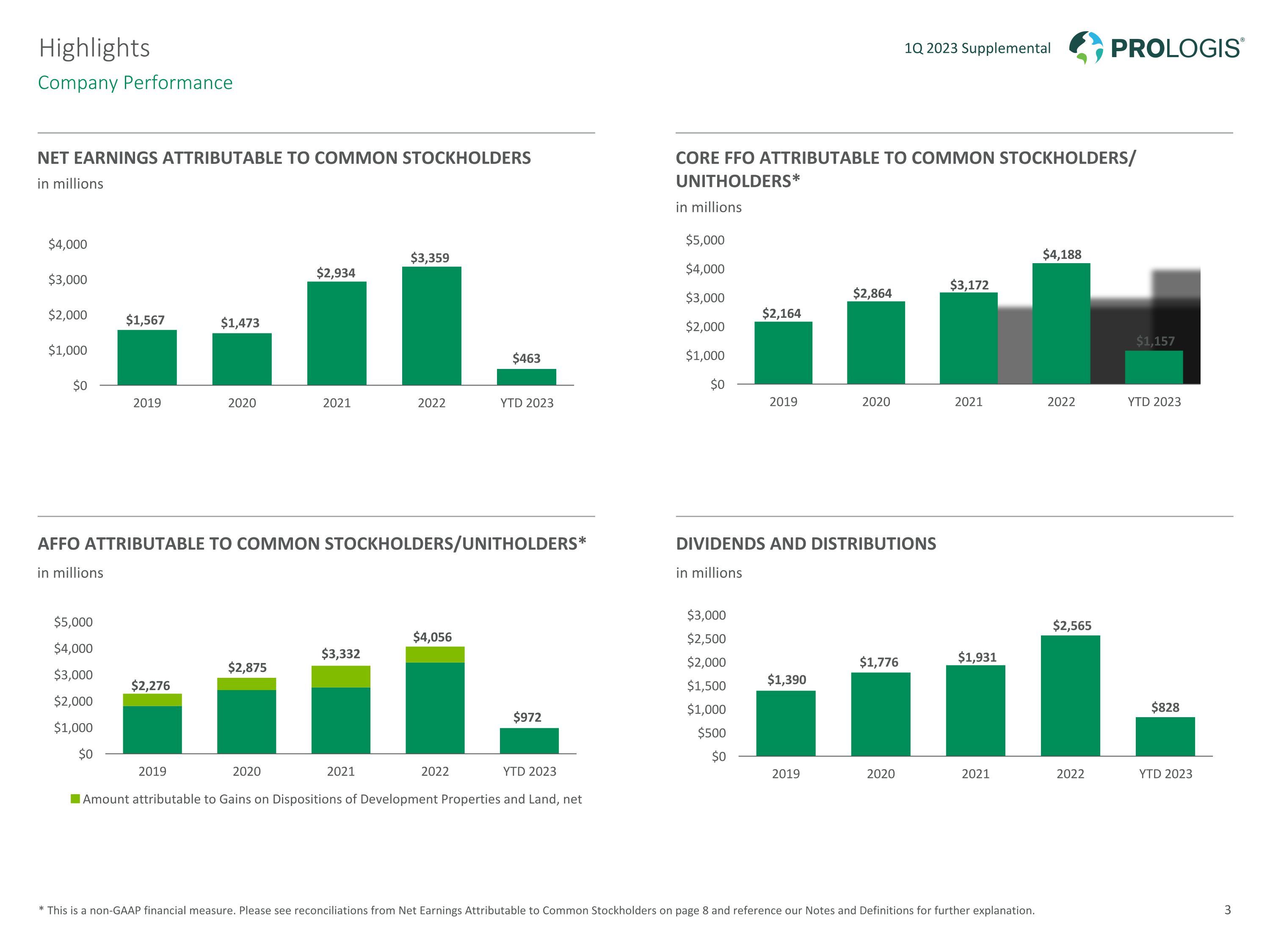

Net earnings attributable to common stockholders in millions Core ffo attributable to common stockholders/ unitholders* in millions affO attributable to common stockholders/unitholders* in millions Dividends and distributions in millions * This is a non-GAAP financial measure. Please see reconciliations from Net Earnings Attributable to Common Stockholders on page 8 and reference our Notes and Definitions for further explanation. Highlights Company Performance 1Q 2023 Supplemental 3

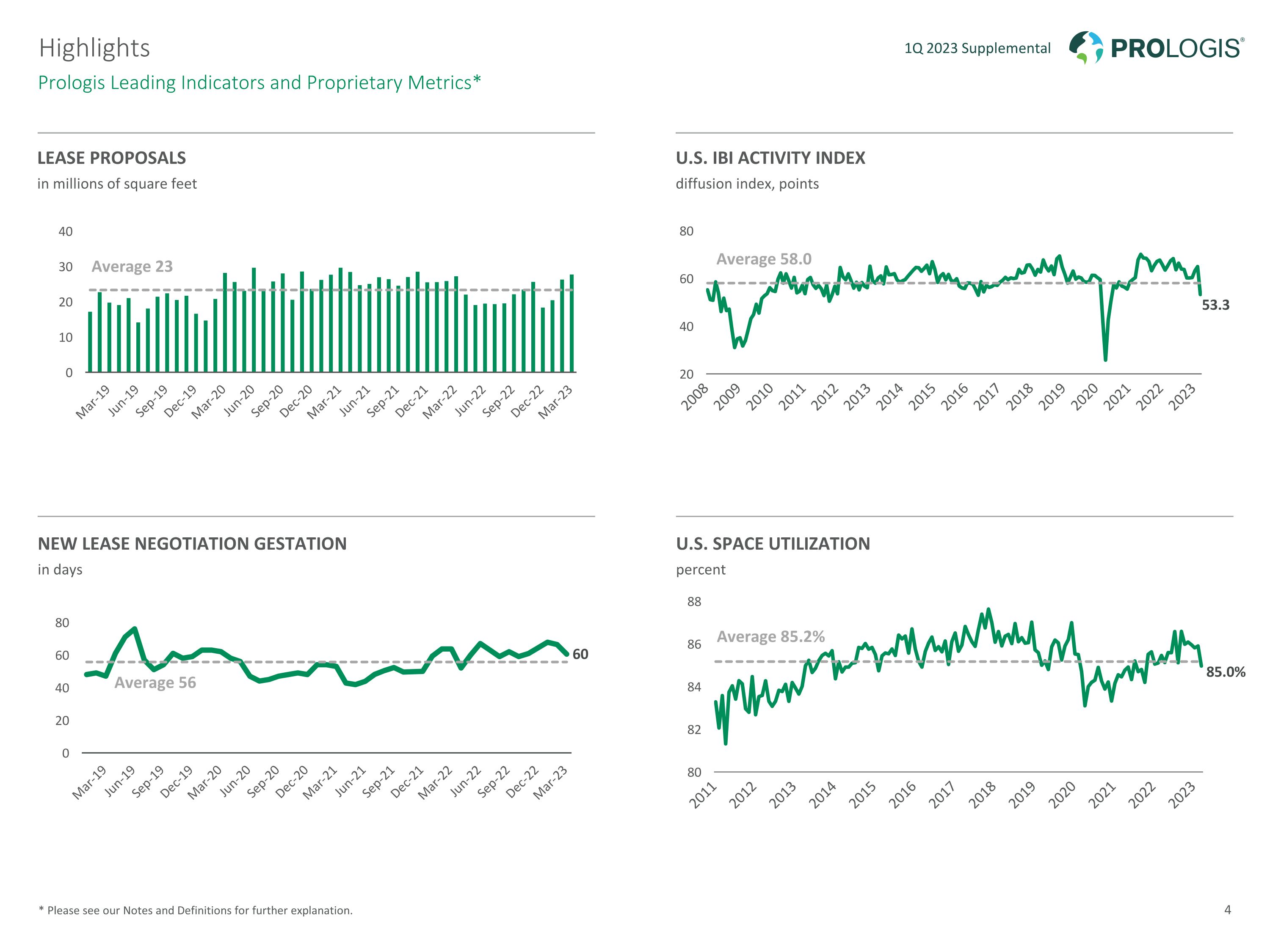

Average 58.0 Average 56 Average 85.2% Lease Proposals in millions of square feet U.s. IBI activity index diffusion index, points New Lease negotiation Gestation in days U.S. space utilization * Please see our Notes and Definitions for further explanation. Prologis Leading Indicators and Proprietary Metrics* 1Q 2023 Supplemental Average 23 4 percent Highlights

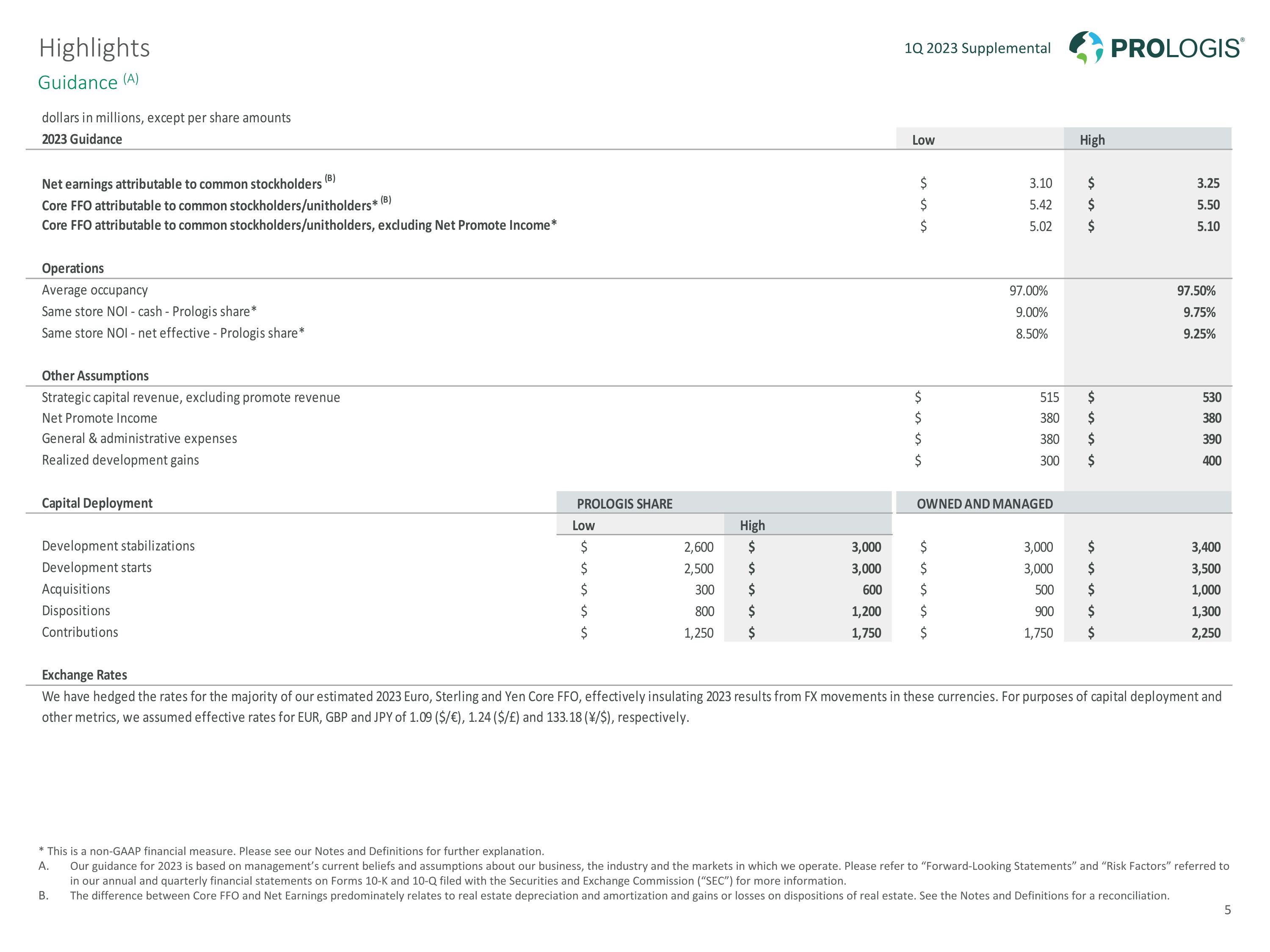

Guidance (A) * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Our guidance for 2023 is based on management’s current beliefs and assumptions about our business, the industry and the markets in which we operate. Please refer to “Forward-Looking Statements” and “Risk Factors” referred to in our annual and quarterly financial statements on Forms 10-K and 10-Q filed with the Securities and Exchange Commission (“SEC”) for more information. The difference between Core FFO and Net Earnings predominately relates to real estate depreciation and amortization and gains or losses on dispositions of real estate. See the Notes and Definitions for a reconciliation. 1Q 2023 Supplemental Highlights 5

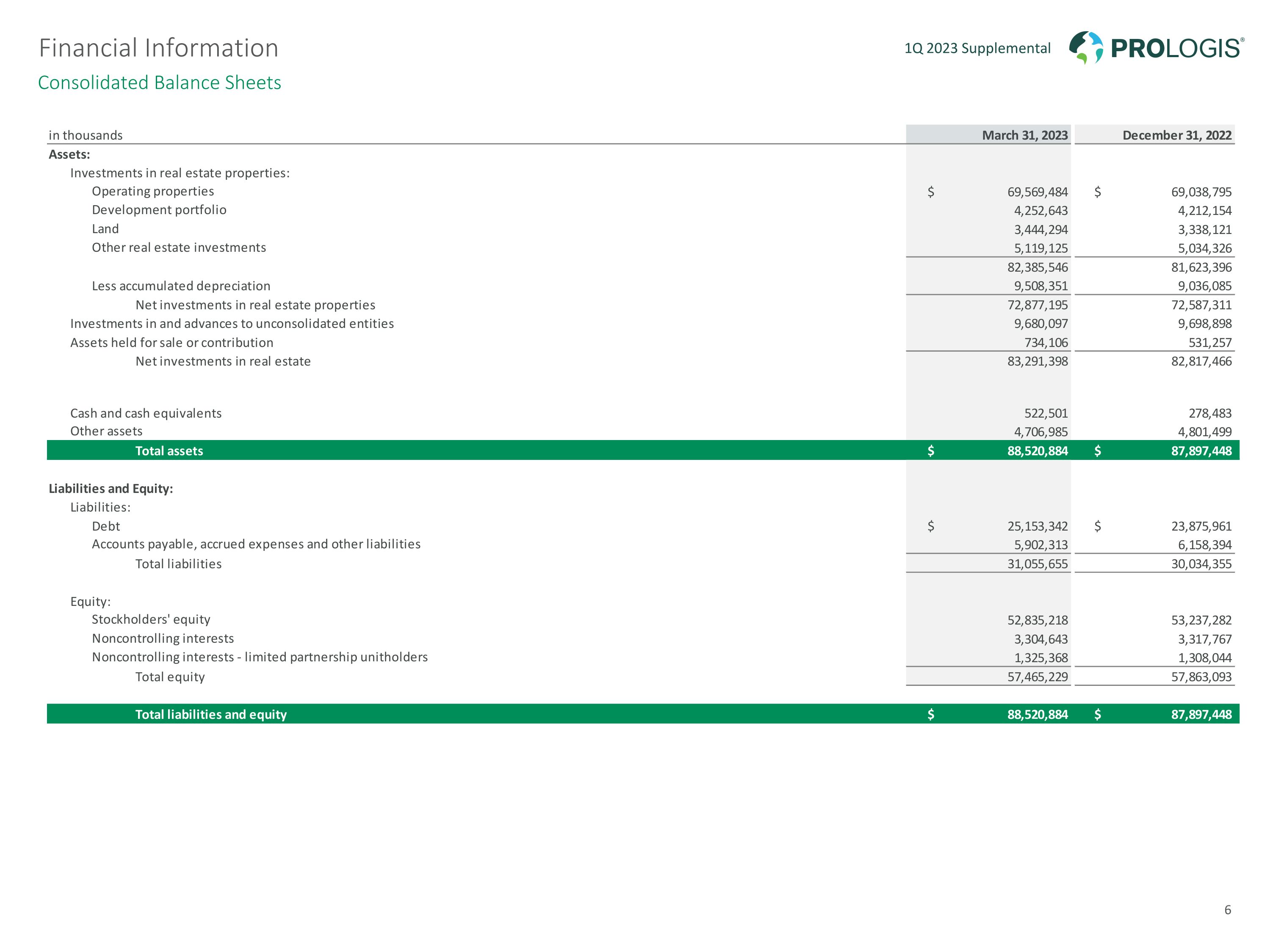

Consolidated Balance Sheets 1Q 2023 Supplemental Financial Information 6

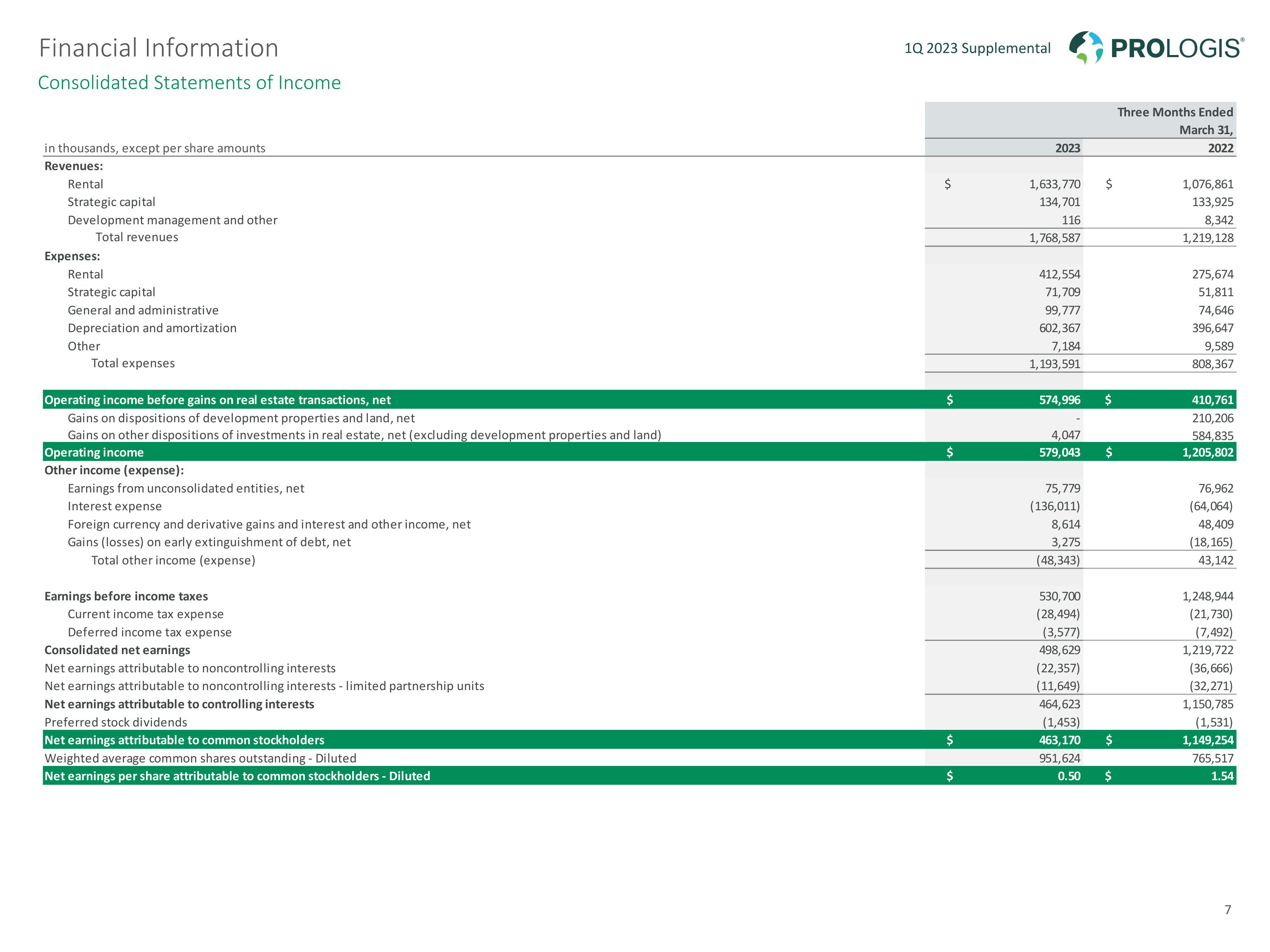

Consolidated Statements of Income 1Q 2023 Supplemental Financial Information 7

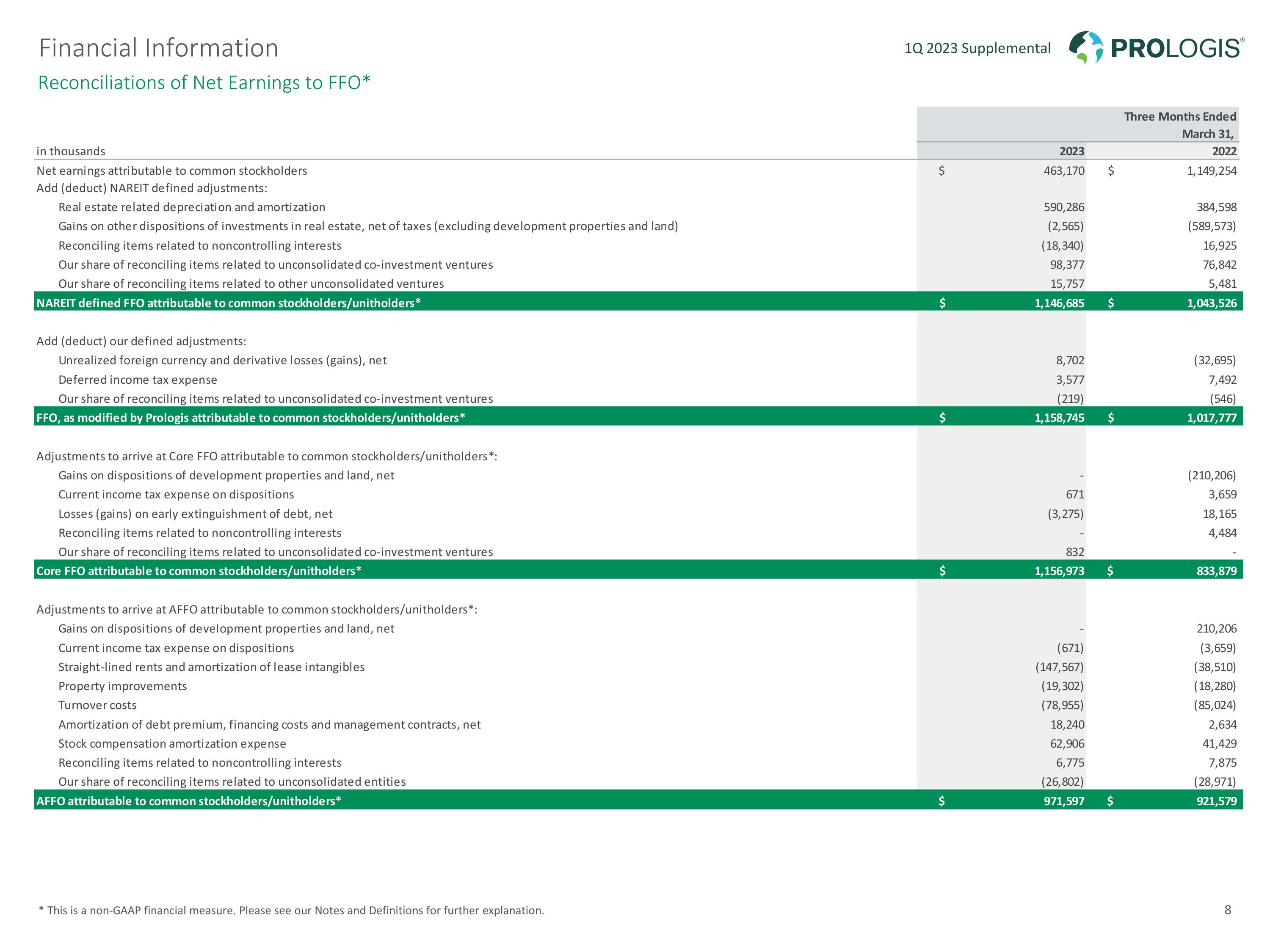

Reconciliations of Net Earnings to FFO* * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. 1Q 2023 Supplemental Financial Information 8

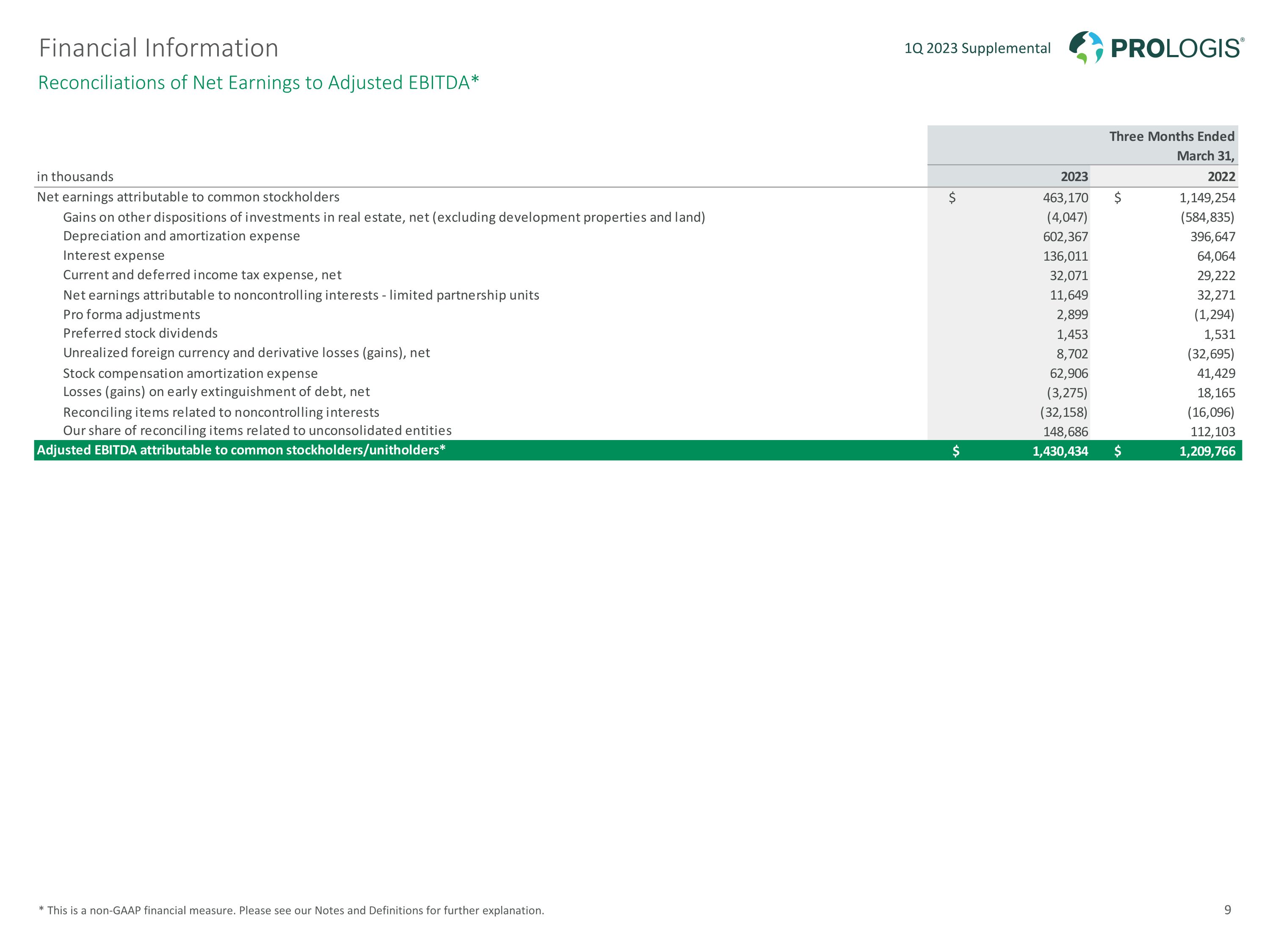

Reconciliations of Net Earnings to Adjusted EBITDA* * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. 1Q 2023 Supplemental Financial Information 9

32.5% 35.7% 43.8% 48.0% 56.3% Occupancy Customer Retention Same Store Change Over Prior Year - Prologis Share* Rent Change - Prologis Share * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Operations Overview 1Q 2023 Supplemental Trailing four quarters – net effective 10

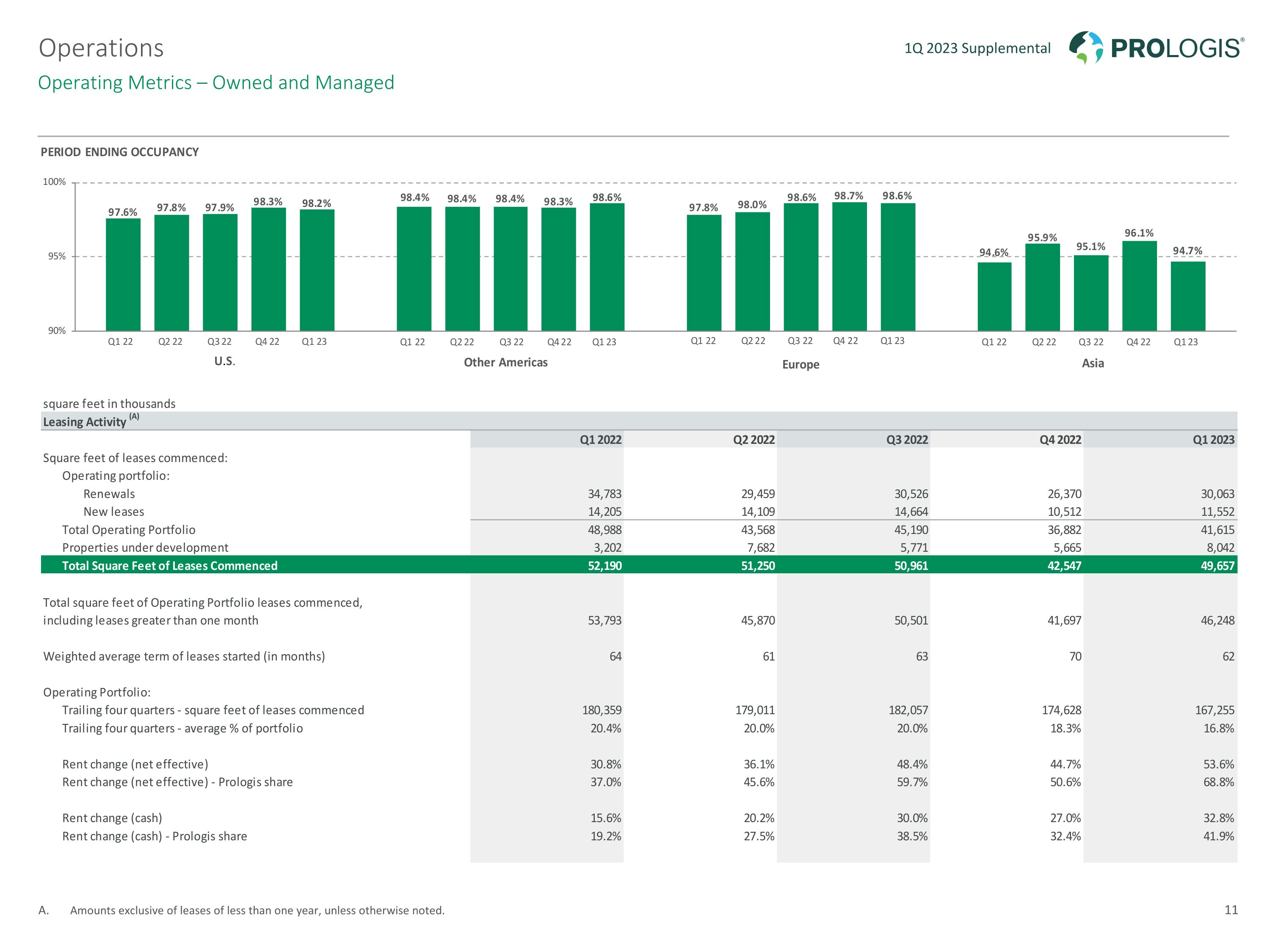

Operating Metrics – Owned and Managed Amounts exclusive of leases of less than one year, unless otherwise noted. 1Q 2023 Supplemental Operations 11

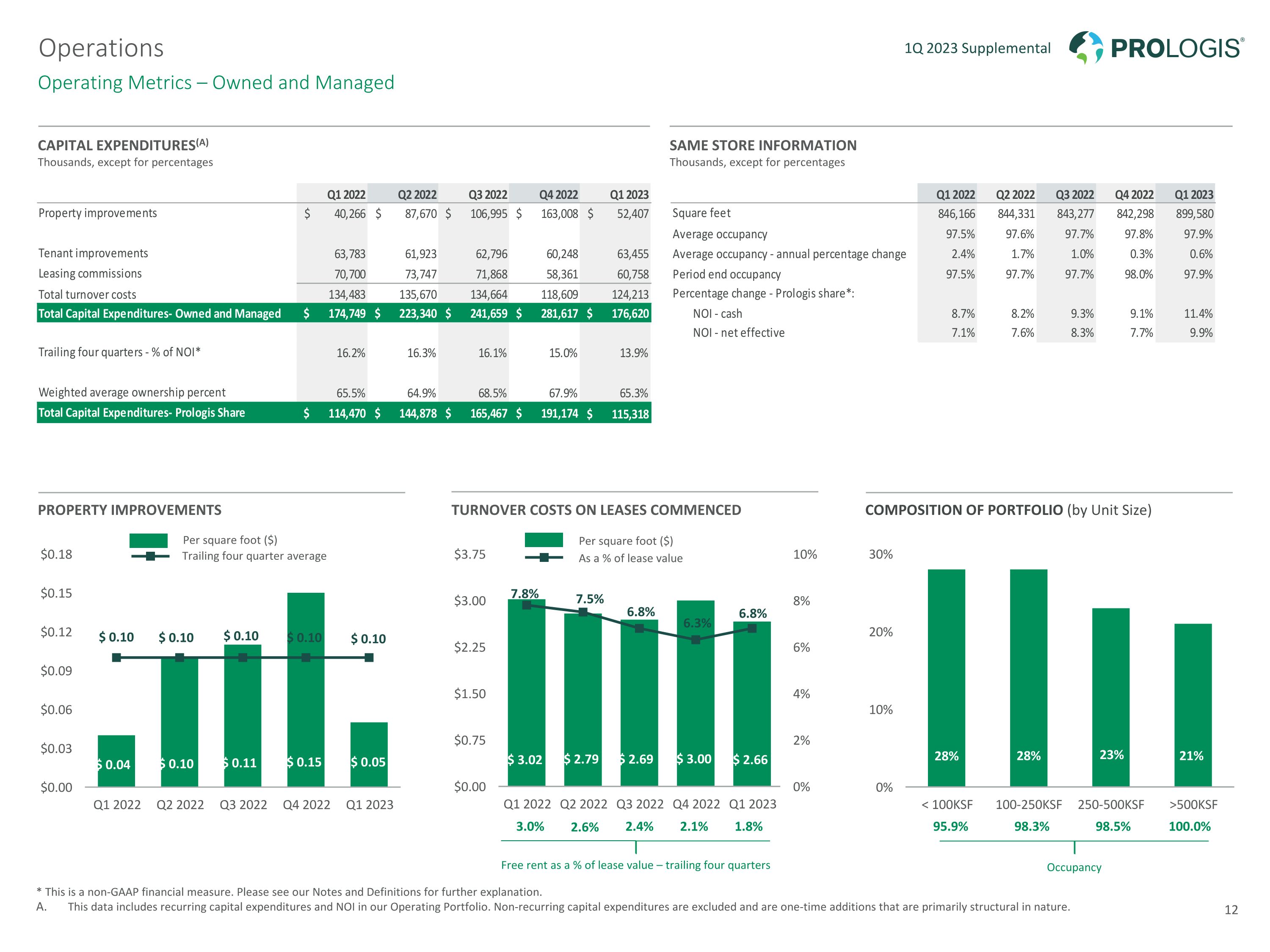

Operating Metrics – Owned and Managed * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. This data includes recurring capital expenditures and NOI in our Operating Portfolio. Non-recurring capital expenditures are excluded and are one-time additions that are primarily structural in nature. 1Q 2023 Supplemental Operations CAPITAL EXPENDITURES(A) Thousands, except for percentages SAME STORE INFORMATION Thousands, except for percentages PROPERTY IMPROVEMENTS TURNOVER COSTS ON LEASES COMMENCED COMPOSITION OF PORTFOLIO (by Unit Size) Free rent as a % of lease value – trailing four quarters 3.0% 2.6% 2.4% 2.1% 1.8% Occupancy 95.9% 98.3% 98.5% 100.0% Trailing four quarter average Per square foot ($) As a % of lease value Per square foot ($) 12

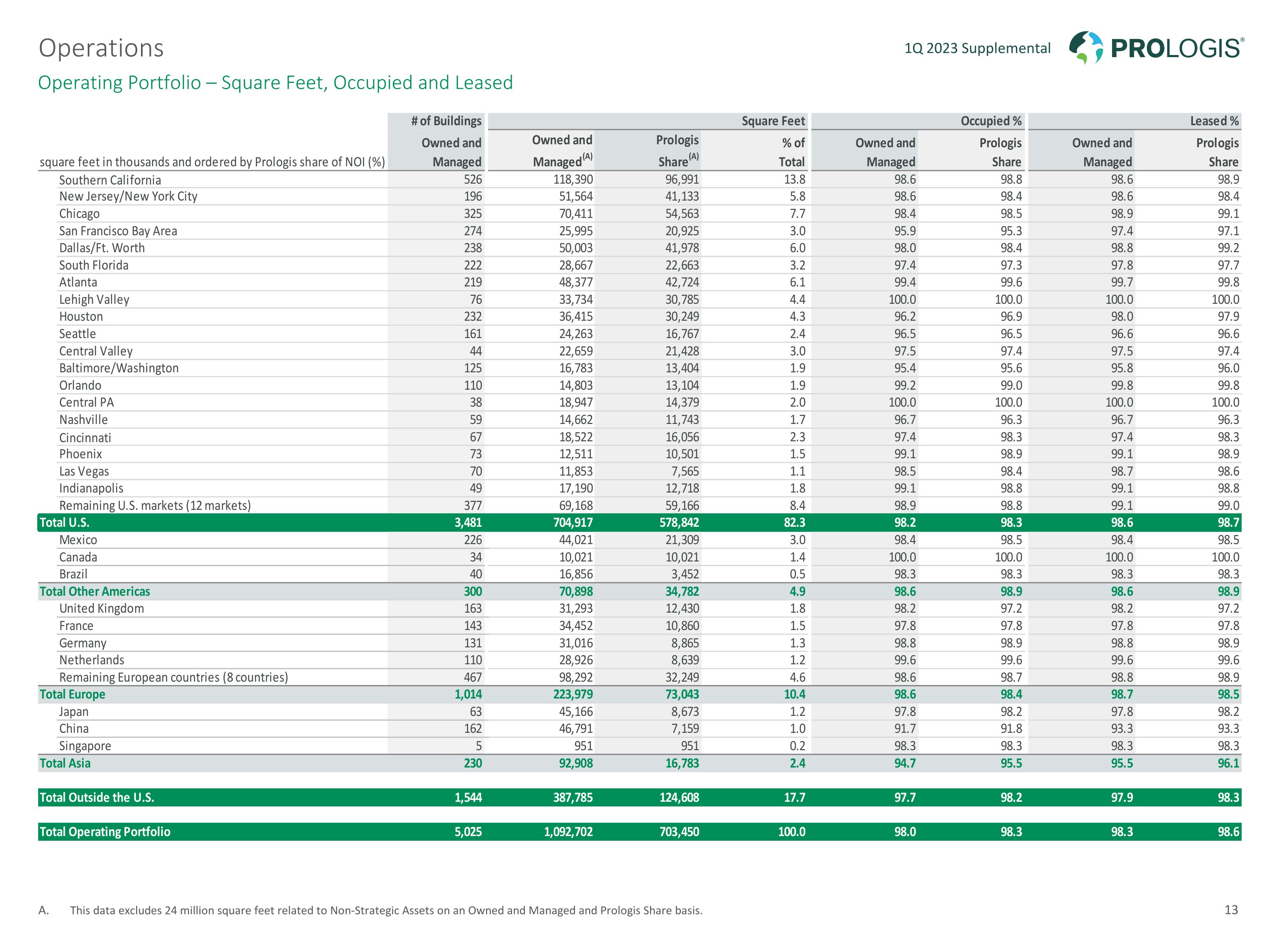

Operating Portfolio – Square Feet, Occupied and Leased This data excludes 24 million square feet related to Non-Strategic Assets on an Owned and Managed and Prologis Share basis. 1Q 2023 Supplemental Operations 13

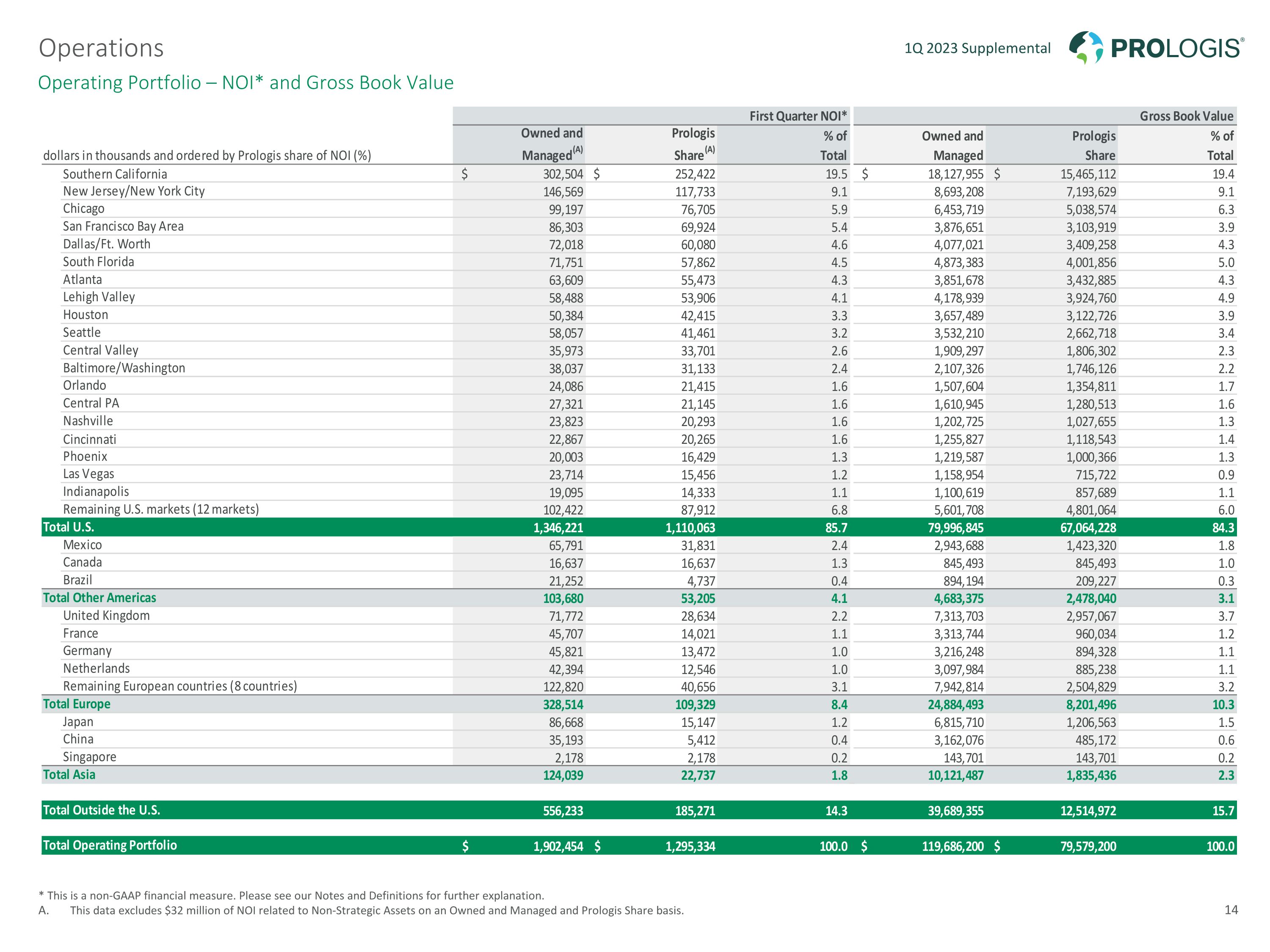

Operating Portfolio – NOI* and Gross Book Value * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. This data excludes $32 million of NOI related to Non-Strategic Assets on an Owned and Managed and Prologis Share basis. 1Q 2023 Supplemental Operations 14

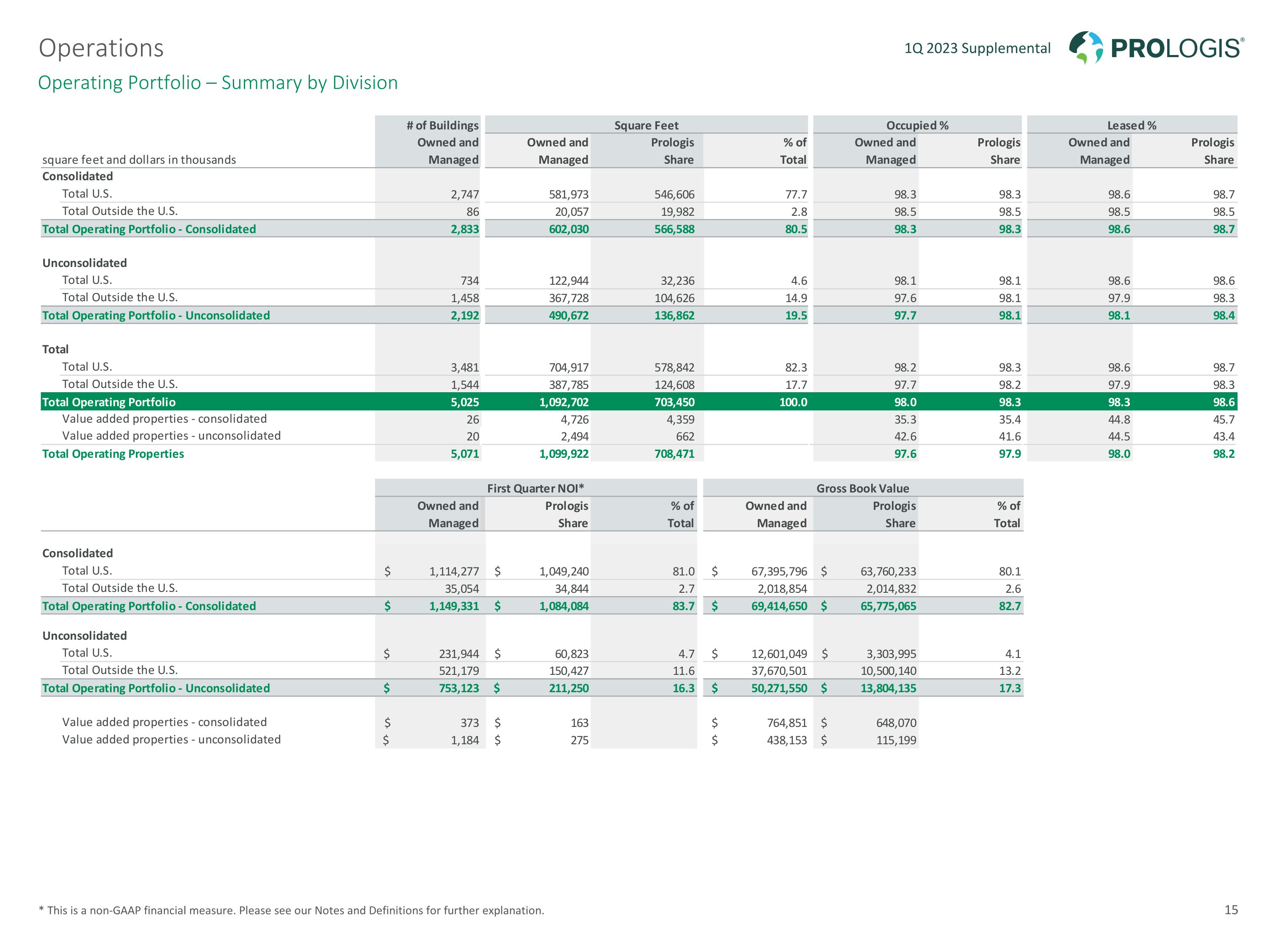

Operating Portfolio – Summary by Division * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. 1Q 2023 Supplemental Operations 15

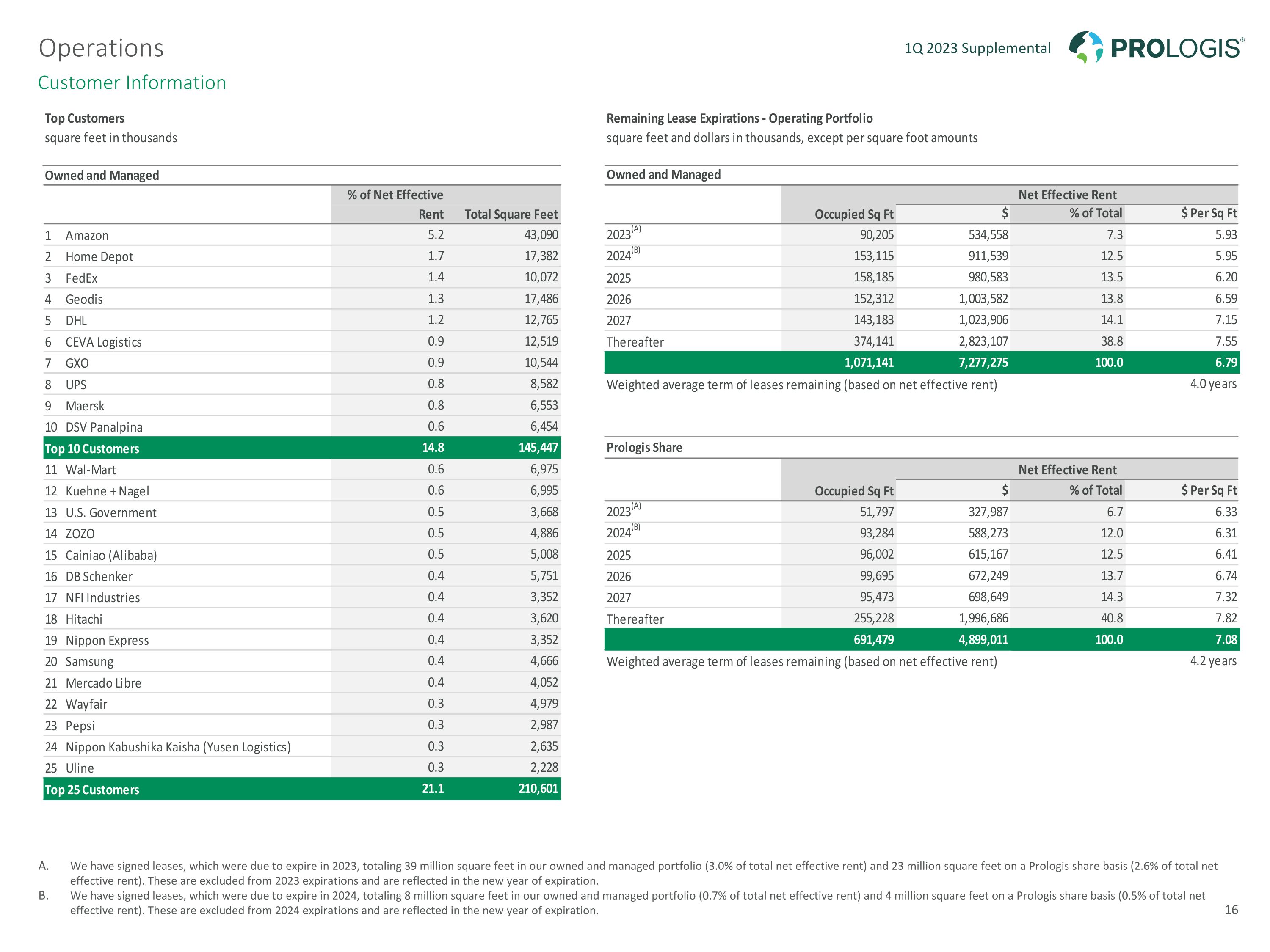

Customer Information We have signed leases, which were due to expire in 2023, totaling 39 million square feet in our owned and managed portfolio (3.0% of total net effective rent) and 23 million square feet on a Prologis share basis (2.6% of total net effective rent). These are excluded from 2023 expirations and are reflected in the new year of expiration. We have signed leases, which were due to expire in 2024, totaling 8 million square feet in our owned and managed portfolio (0.7% of total net effective rent) and 4 million square feet on a Prologis share basis (0.5% of total net effective rent). These are excluded from 2024 expirations and are reflected in the new year of expiration. 1Q 2023 Supplemental Operations 16

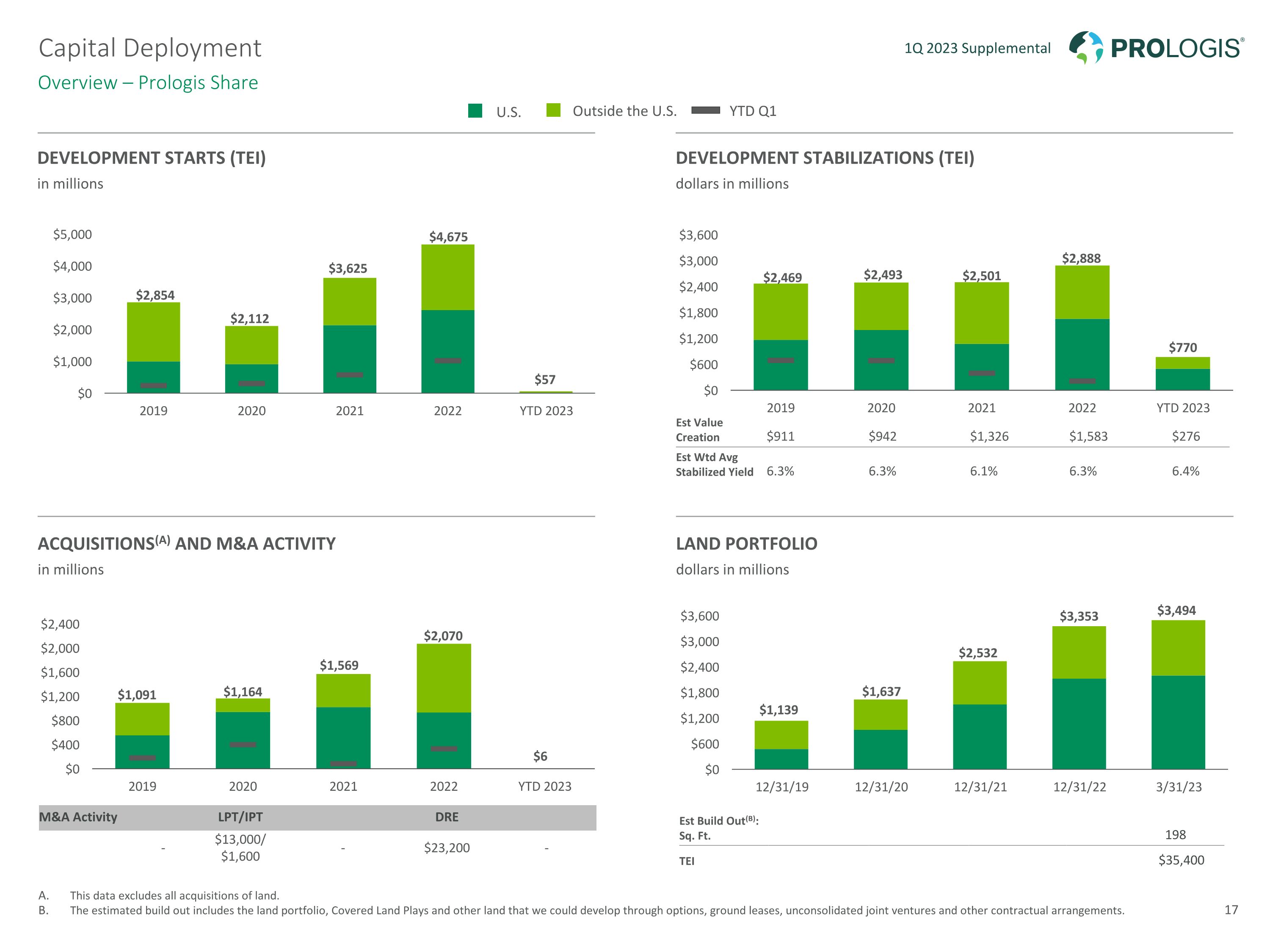

M&A Activity LPT/IPT DRE - $13,000/ $1,600 - $23,200 - Development Starts (TEI) in millions Development Stabilizations (TEI) dollars in millions Acquisitions(a) and M&A Activity in millions Land Portfolio dollars in millions This data excludes all acquisitions of land. The estimated build out includes the land portfolio, Covered Land Plays and other land that we could develop through options, ground leases, unconsolidated joint ventures and other contractual arrangements. Capital Deployment Overview – Prologis Share 1Q 2023 Supplemental Outside the U.S. U.S. Est Value Creation $911 $942 $1,326 $1,583 $276 Est Wtd Avg Stabilized Yield 6.3% 6.3% 6.1% 6.3% 6.4% Est Build Out(B): Sq. Ft. 198 TEI $35,400 17 YTD Q1

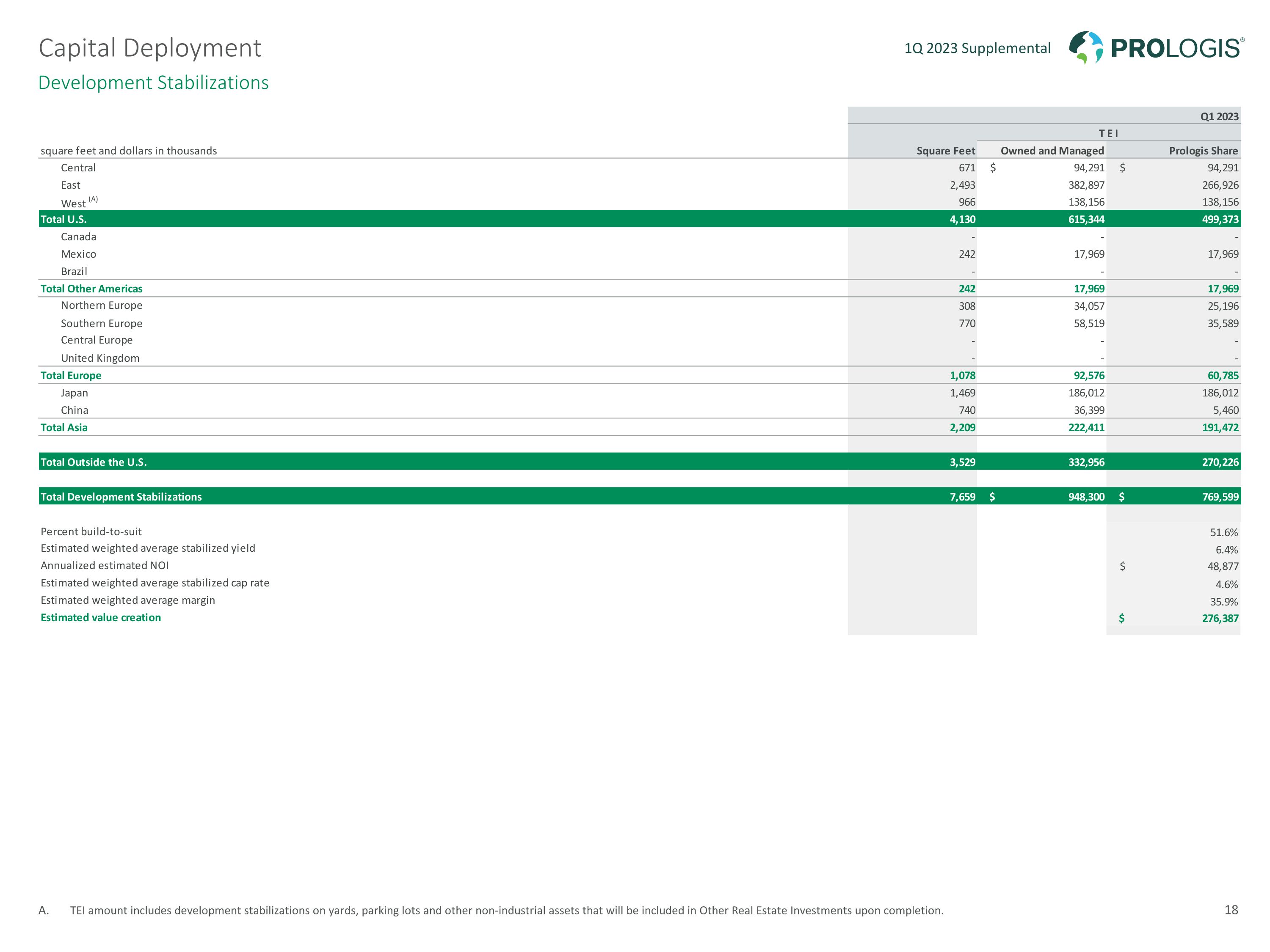

Development Stabilizations TEI amount includes development stabilizations on yards, parking lots and other non-industrial assets that will be included in Other Real Estate Investments upon completion. 1Q 2023 Supplemental Capital Deployment 18

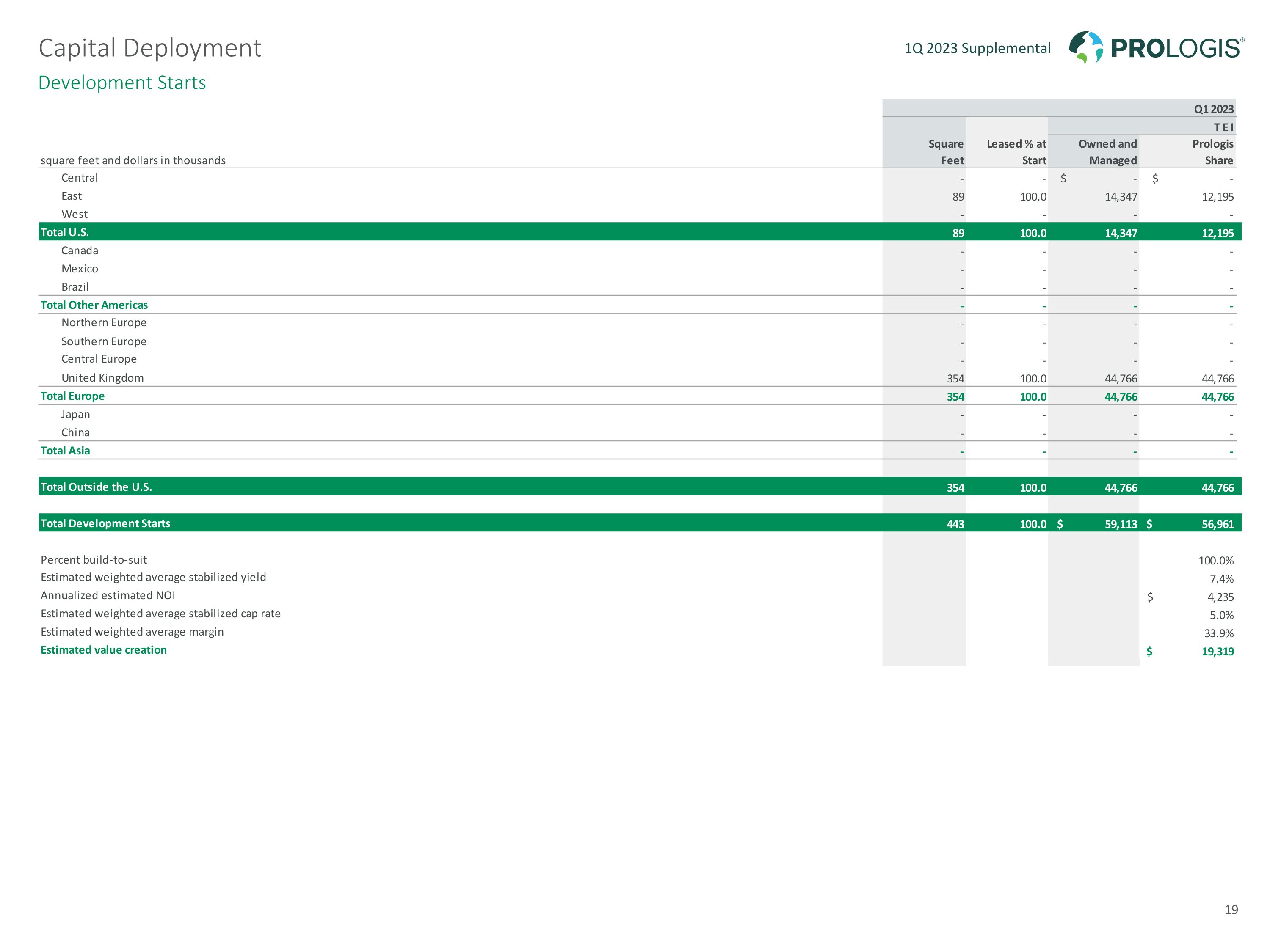

Development Starts 1Q 2023 Supplemental Capital Deployment 19

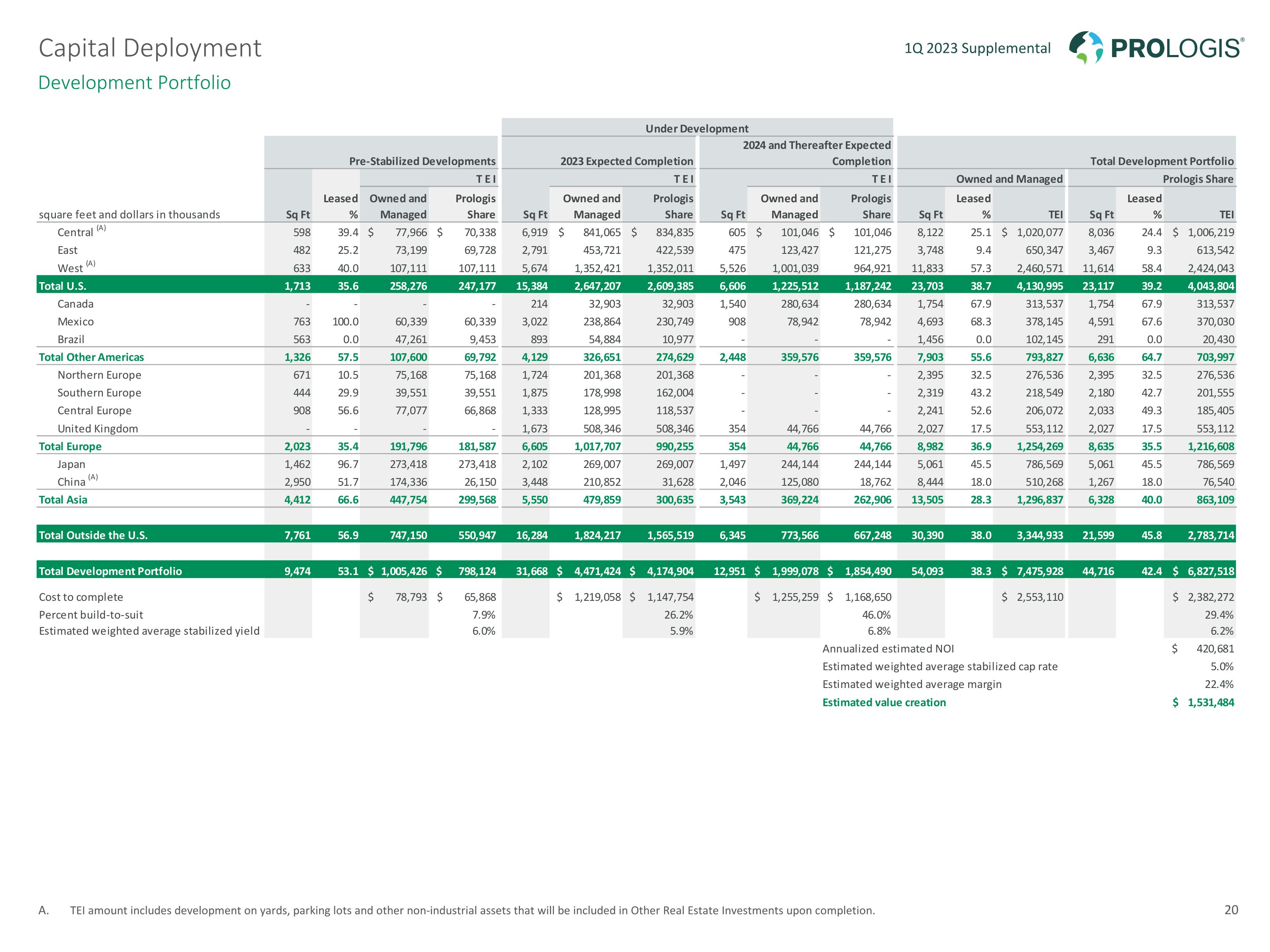

Development Portfolio TEI amount includes development on yards, parking lots and other non-industrial assets that will be included in Other Real Estate Investments upon completion. 1Q 2023 Supplemental Capital Deployment 20

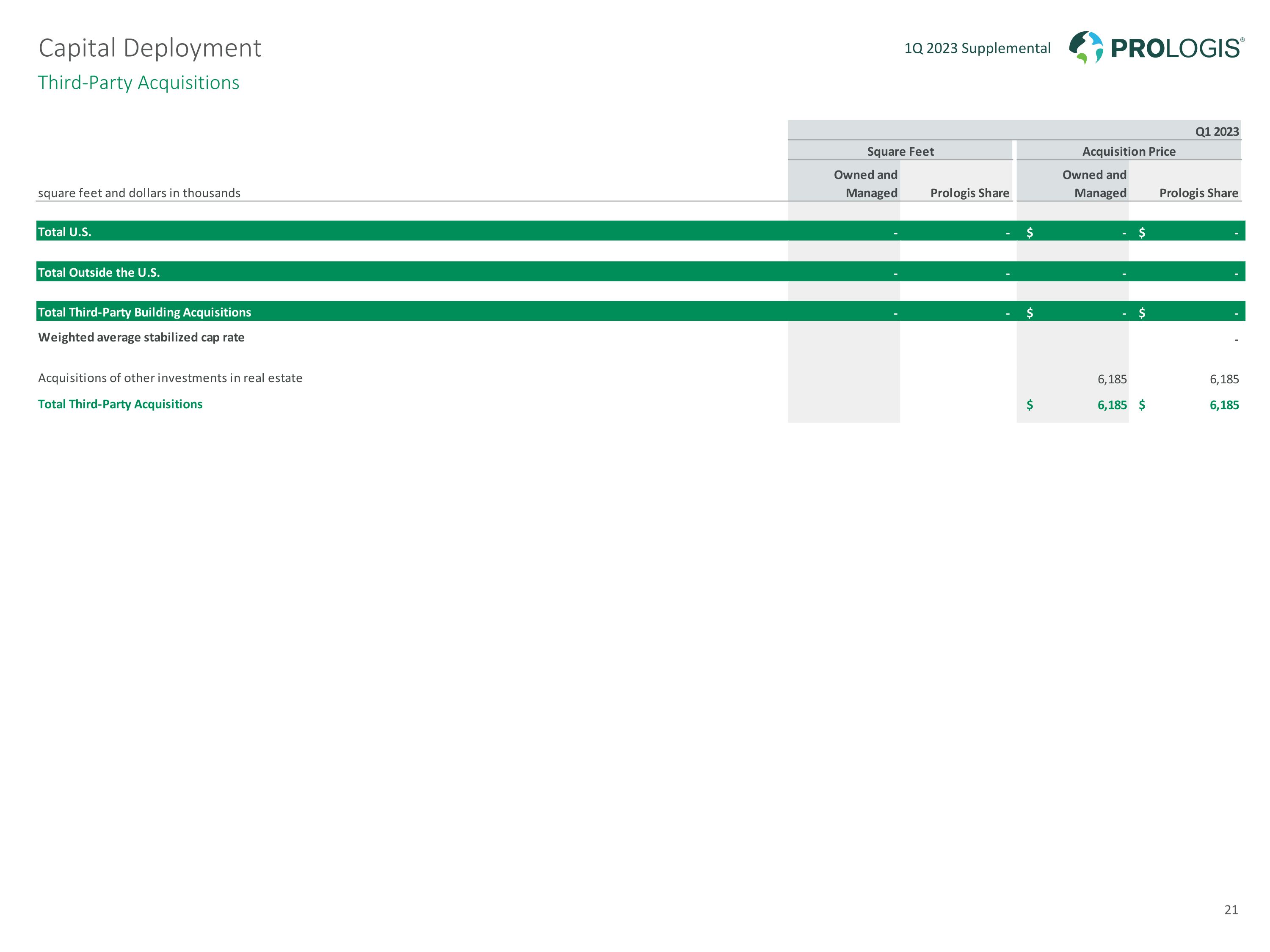

Third-Party Acquisitions 1Q 2023 Supplemental Capital Deployment 21

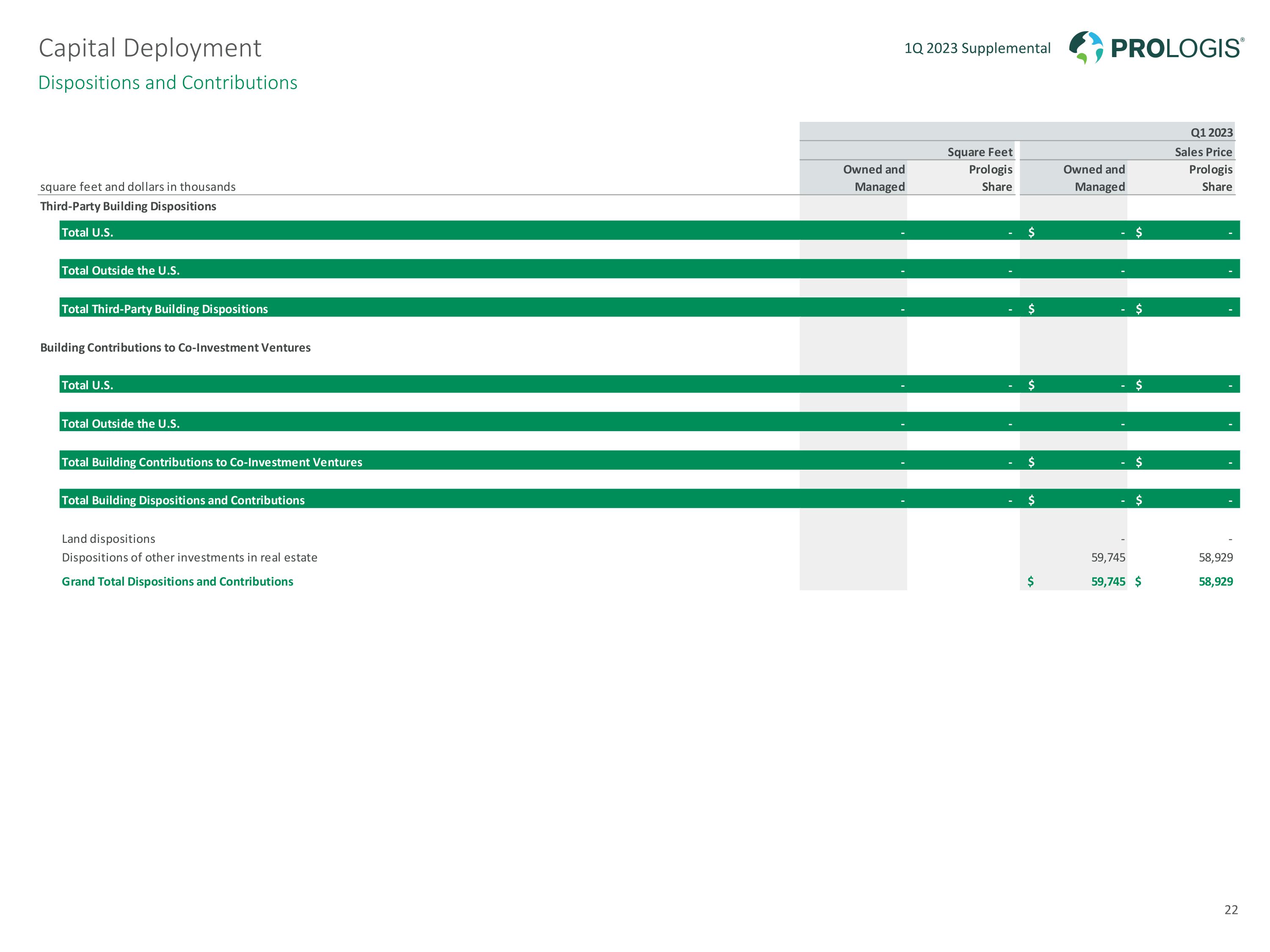

Dispositions and Contributions 1Q 2023 Supplemental Capital Deployment 22

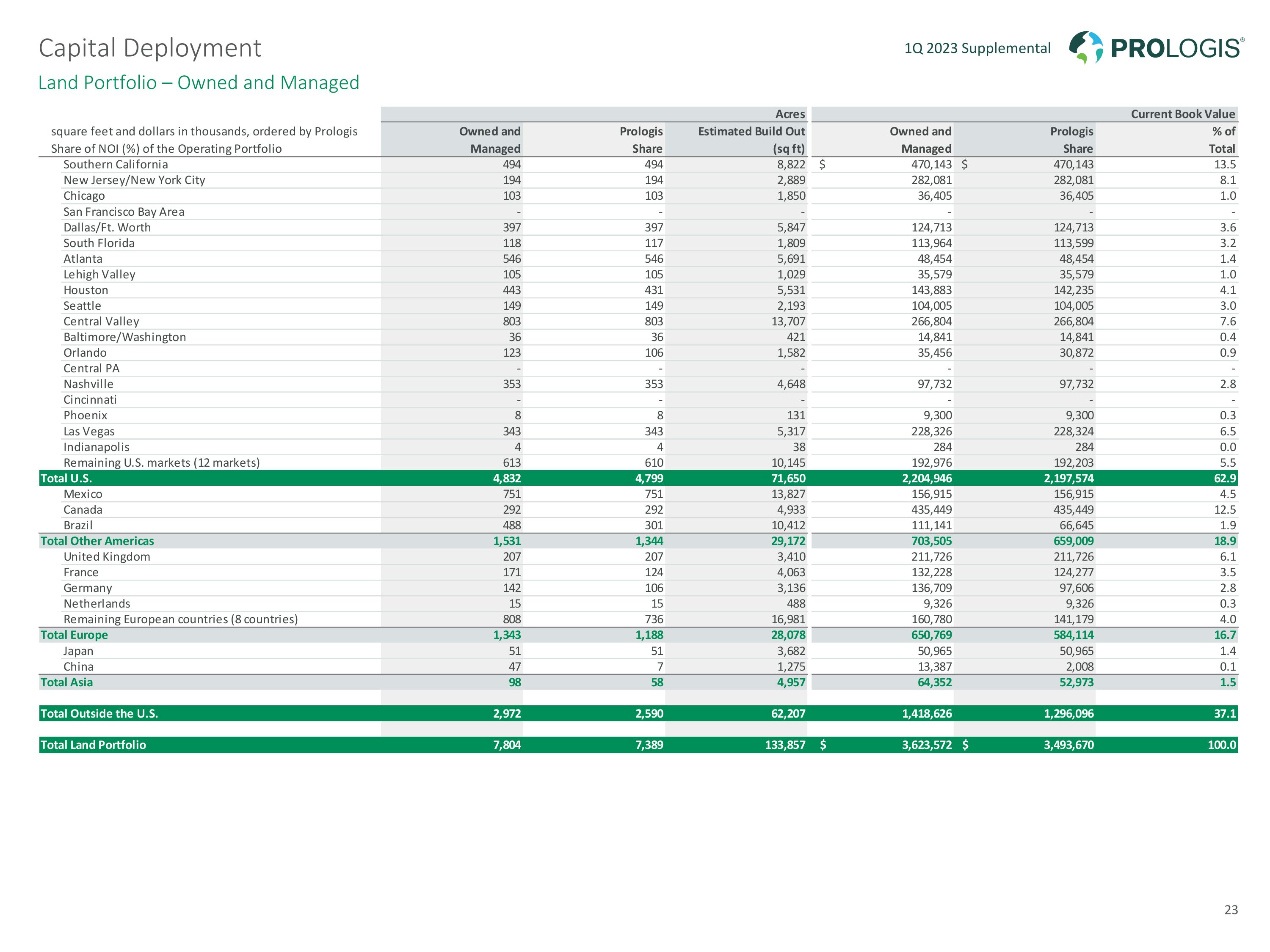

Land Portfolio – Owned and Managed 1Q 2023 Supplemental Capital Deployment 23

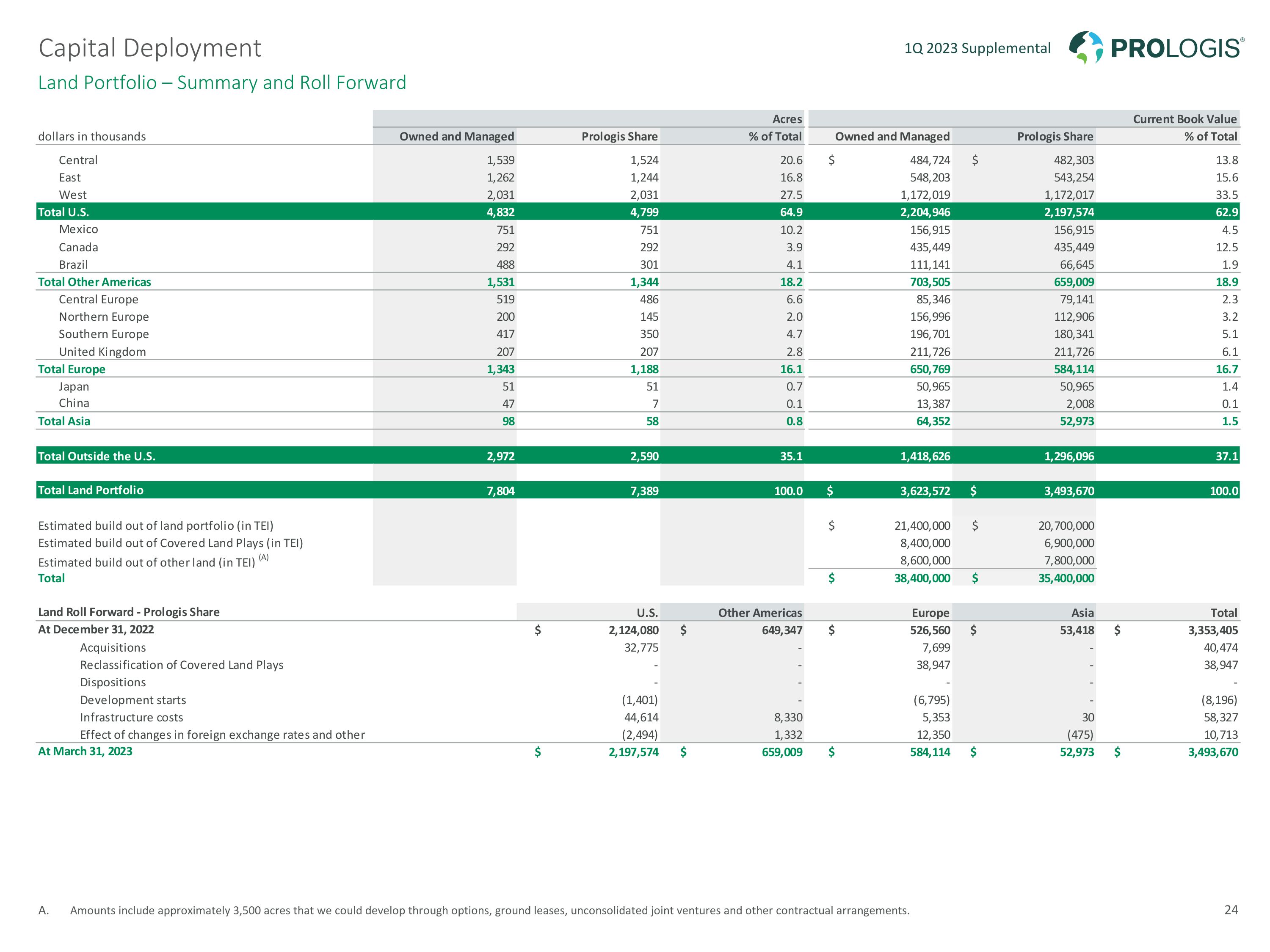

Land Portfolio – Summary and Roll Forward Amounts include approximately 3,500 acres that we could develop through options, ground leases, unconsolidated joint ventures and other contractual arrangements. 1Q 2023 Supplemental Capital Deployment 24

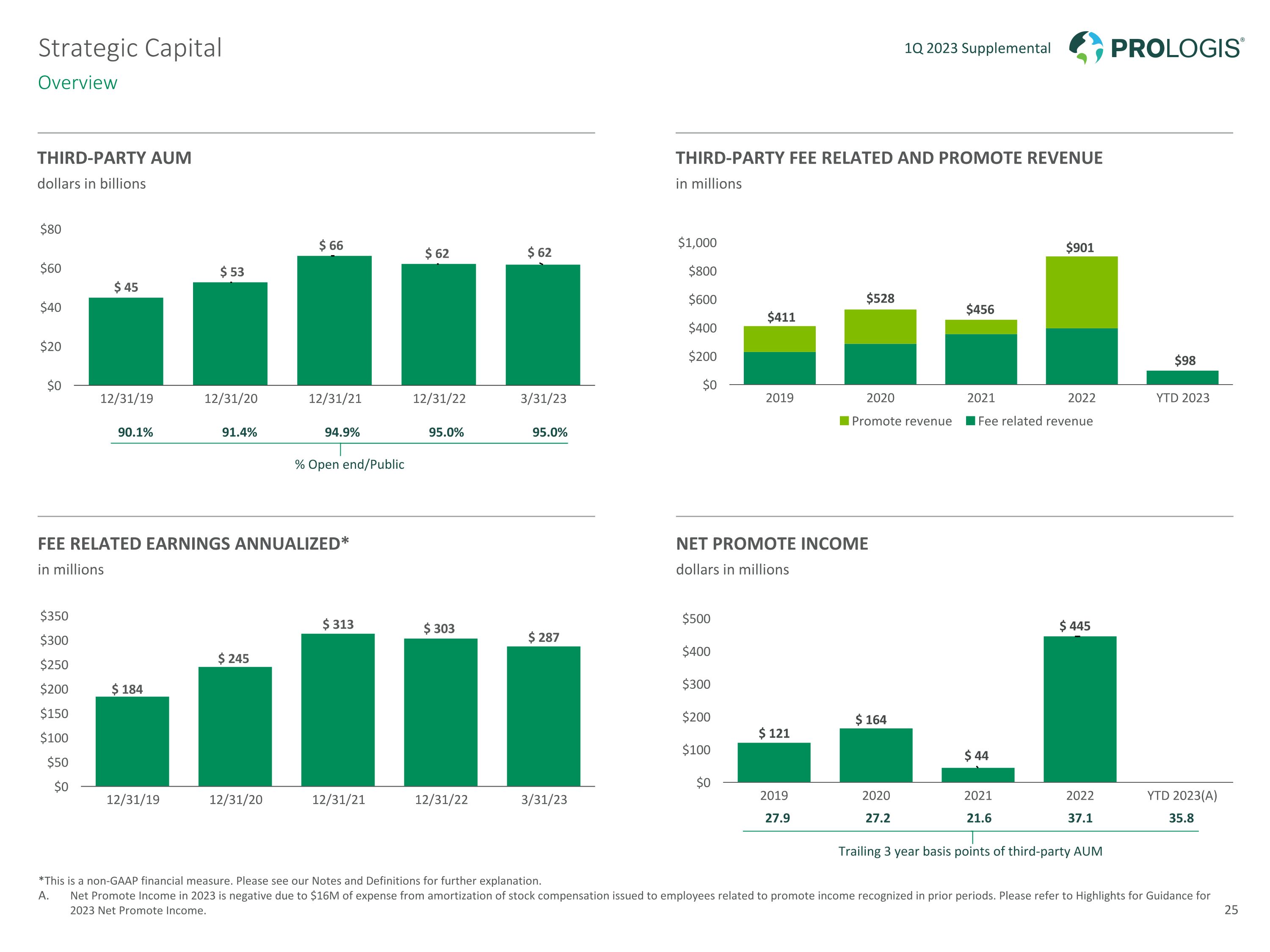

Third-party aum dollars in billions Third-Party Fee Related and promote revenue in millions Fee related earnings annualized* in millions Net Promote income dollars in millions *This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Net Promote Income in 2023 is negative due to $16M of expense from amortization of stock compensation issued to employees related to promote income recognized in prior periods. Please refer to Highlights for Guidance for 2023 Net Promote Income. Strategic Capital Overview 1Q 2023 Supplemental 90.1% 91.4% 94.9% 95.0% 95.0% % Open end/Public 27.9 27.2 21.6 37.1 35.8 Trailing 3 year basis points of third-party AUM 25

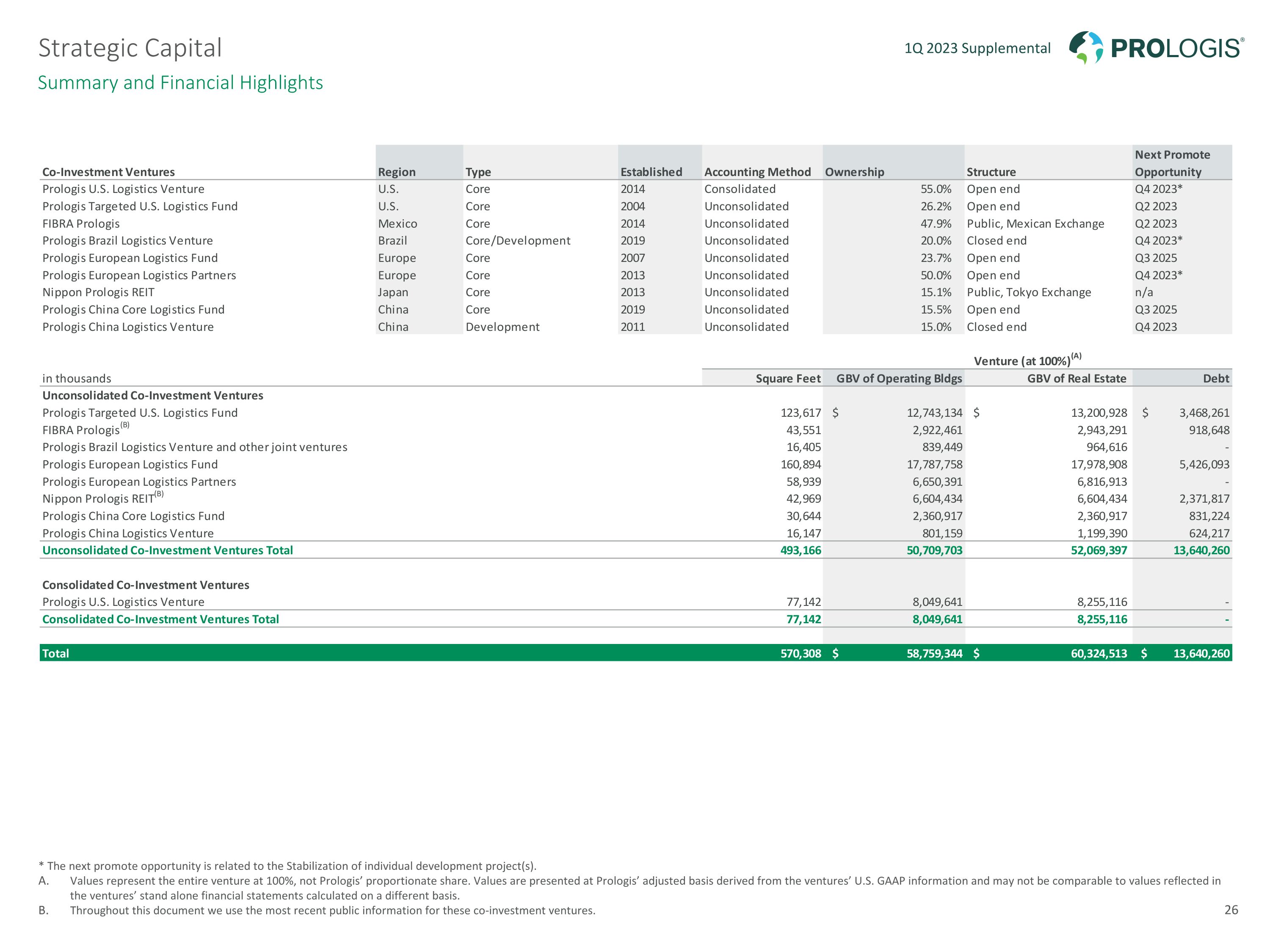

Summary and Financial Highlights * The next promote opportunity is related to the Stabilization of individual development project(s). Values represent the entire venture at 100%, not Prologis’ proportionate share. Values are presented at Prologis’ adjusted basis derived from the ventures’ U.S. GAAP information and may not be comparable to values reflected in the ventures’ stand alone financial statements calculated on a different basis. Throughout this document we use the most recent public information for these co-investment ventures. 1Q 2023 Supplemental Strategic Capital 26

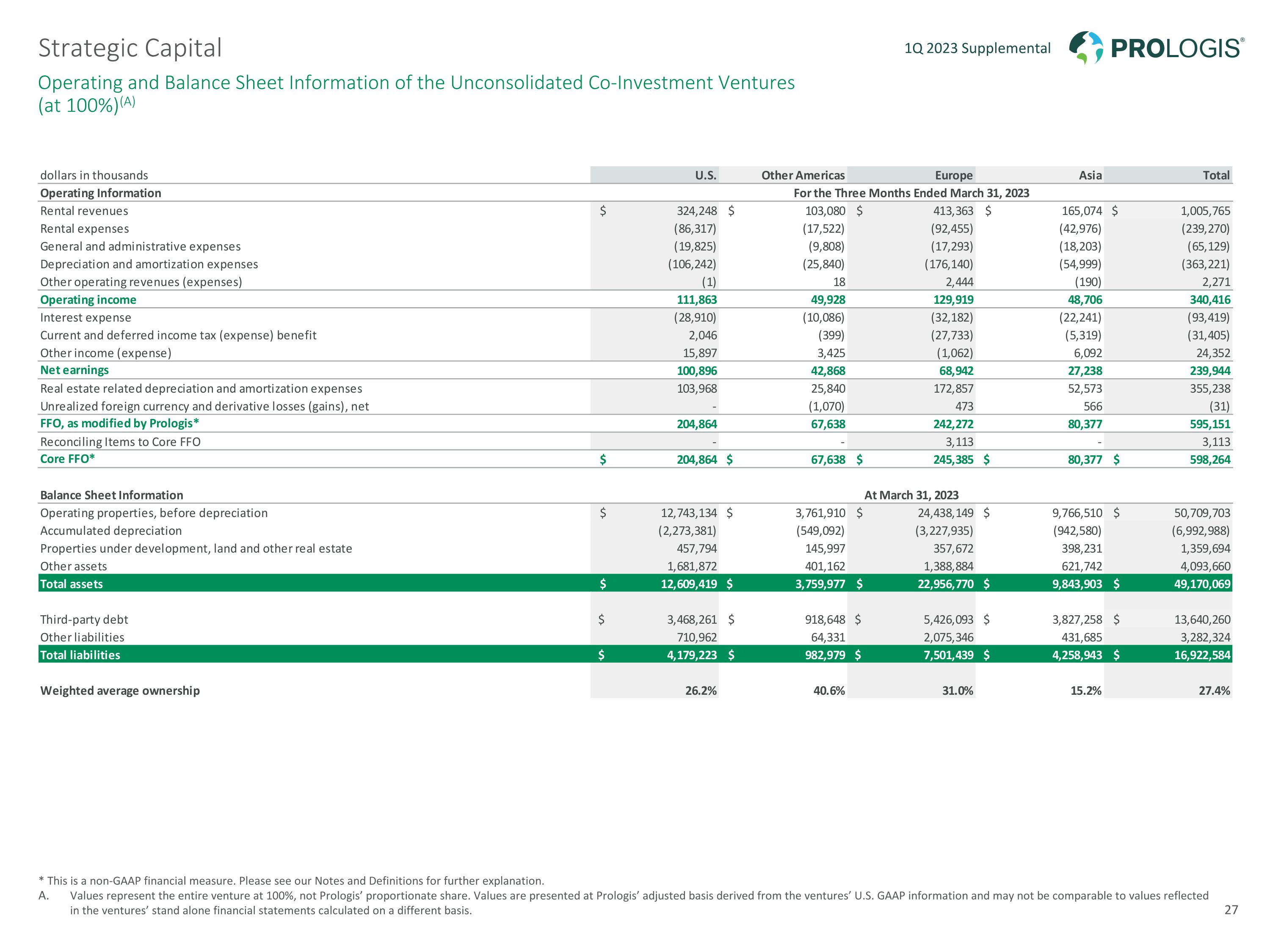

Operating and Balance Sheet Information of the Unconsolidated Co-Investment Ventures (at 100%)(A) * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Values represent the entire venture at 100%, not Prologis’ proportionate share. Values are presented at Prologis’ adjusted basis derived from the ventures’ U.S. GAAP information and may not be comparable to values reflected in the ventures’ stand alone financial statements calculated on a different basis. 1Q 2023 Supplemental Strategic Capital 27

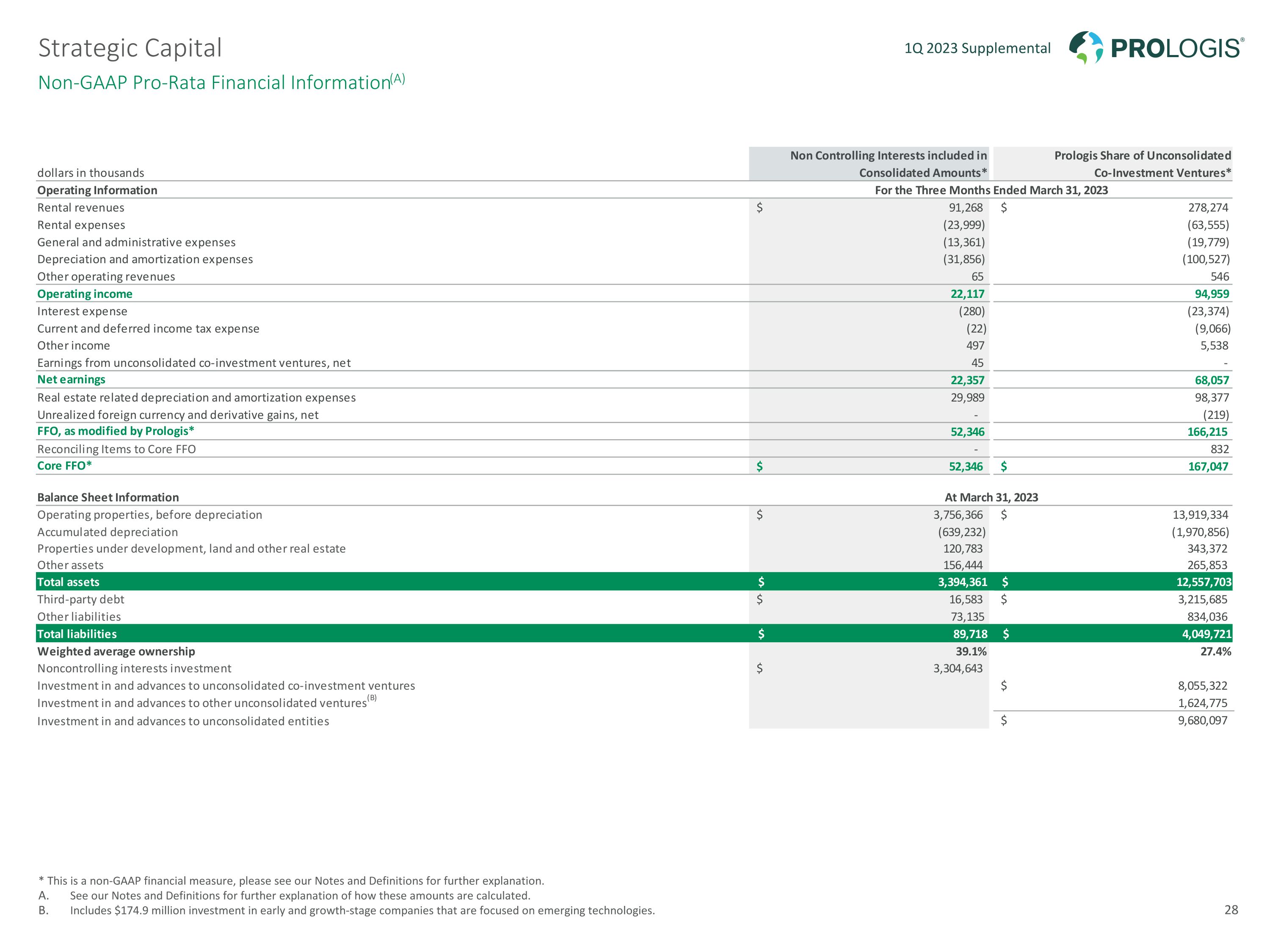

Non-GAAP Pro-Rata Financial Information(A) * This is a non-GAAP financial measure, please see our Notes and Definitions for further explanation. See our Notes and Definitions for further explanation of how these amounts are calculated. Includes $174.9 million investment in early and growth-stage companies that are focused on emerging technologies. 1Q 2023 Supplemental Strategic Capital 28

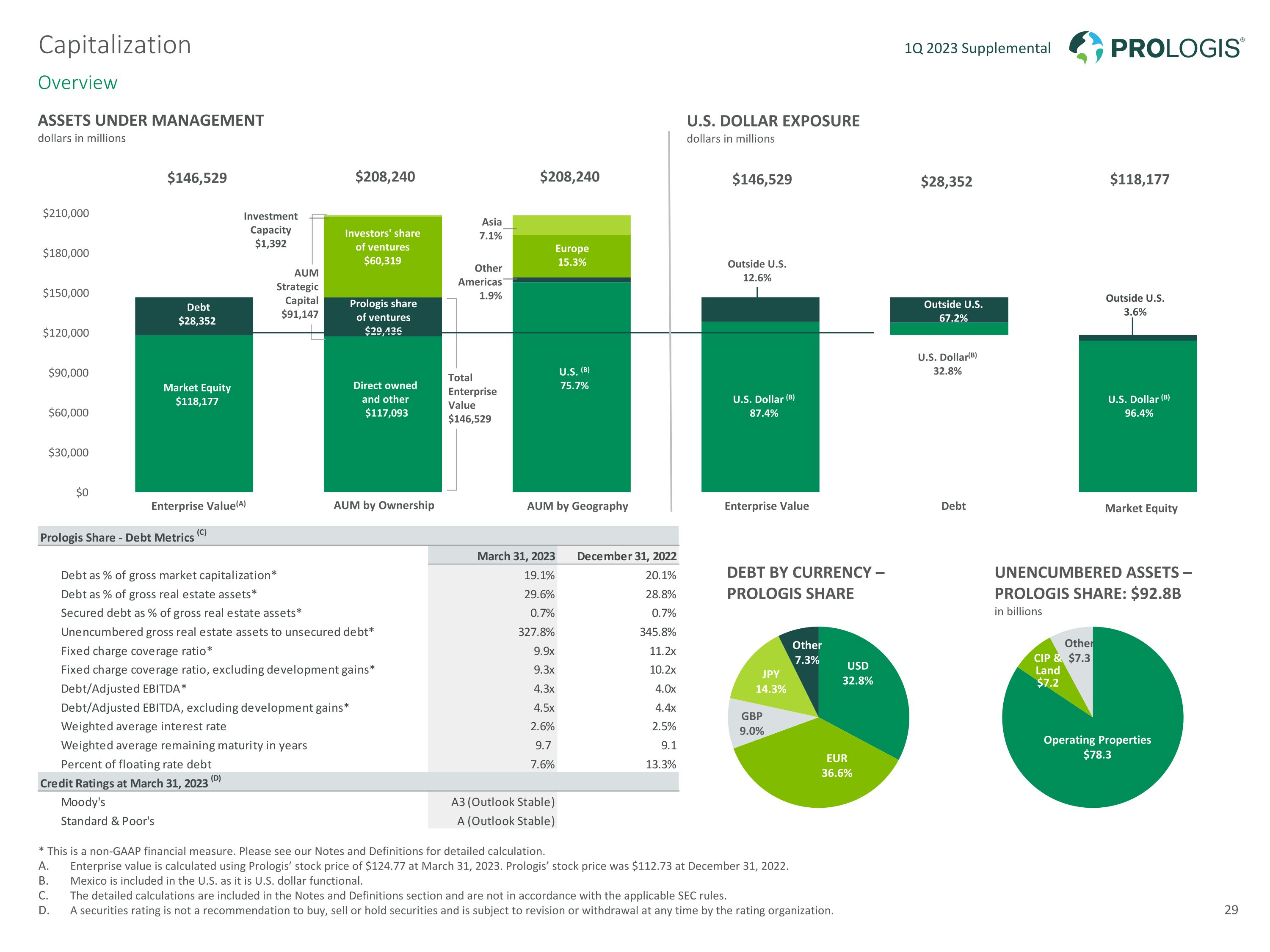

Europe 15.3% $146,529 $208,240 Debt $28,352 Investment Capacity $1,392 U.S. (B) 75.7% $208,240 Direct owned and other $117,093 Market Equity $118,177 AUM Strategic Capital $91,147 Investors' share of ventures $60,319 Prologis share of ventures $29,436 Total Enterprise Value $146,529 $146,529 U.S. Dollar (B) 96.4% Outside U.S. 3.6% Other Americas 1.9% $28,352 $118,177 Asia 7.1% Overview * This is a non-GAAP financial measure. Please see our Notes and Definitions for detailed calculation. Enterprise value is calculated using Prologis’ stock price of $124.77 at March 31, 2023. Prologis’ stock price was $112.73 at December 31, 2022. Mexico is included in the U.S. as it is U.S. dollar functional. The detailed calculations are included in the Notes and Definitions section and are not in accordance with the applicable SEC rules. A securities rating is not a recommendation to buy, sell or hold securities and is subject to revision or withdrawal at any time by the rating organization. 1Q 2023 Supplemental Capitalization ASSETS UNDER MANAGEMENT dollars in millions Enterprise Value(A) AUM by Geography Market Equity U.S. DOLLAR EXPOSURE dollars in millions Enterprise Value Debt U.S. Dollar(B) 32.8% U.S. Dollar (B) 87.4% Outside U.S. 12.6% Outside U.S. 67.2% DEBT BY CURRENCY – PROLOGIS SHARE UNENCUMBERED ASSETS – PROLOGIS SHARE: $92.8B in billions AUM by Ownership 29

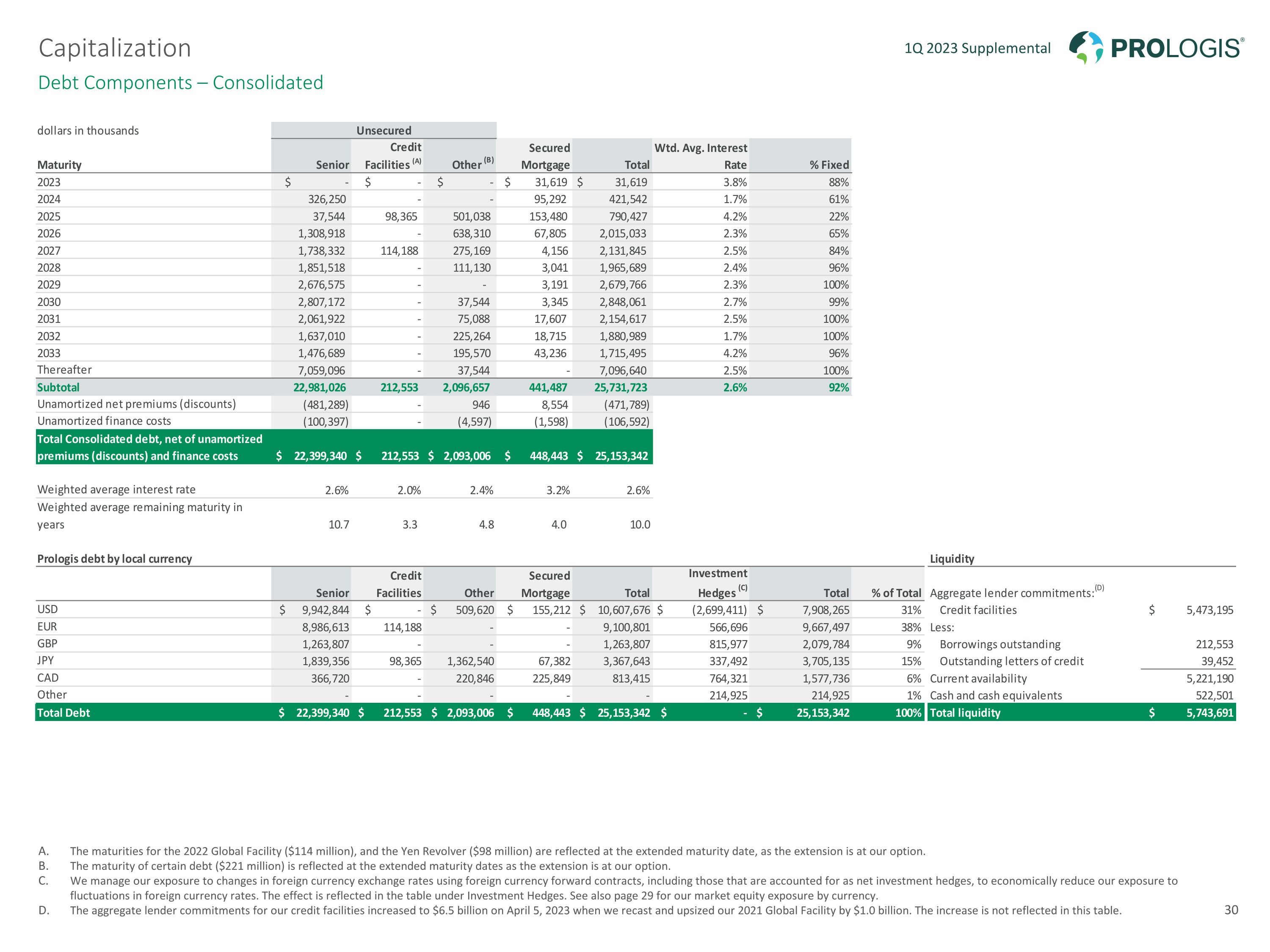

Debt Components – Consolidated The maturities for the 2022 Global Facility ($114 million), and the Yen Revolver ($98 million) are reflected at the extended maturity date, as the extension is at our option. The maturity of certain debt ($221 million) is reflected at the extended maturity dates as the extension is at our option. We manage our exposure to changes in foreign currency exchange rates using foreign currency forward contracts, including those that are accounted for as net investment hedges, to economically reduce our exposure to fluctuations in foreign currency rates. The effect is reflected in the table under Investment Hedges. See also page 29 for our market equity exposure by currency. The aggregate lender commitments for our credit facilities increased to $6.5 billion on April 5, 2023 when we recast and upsized our 2021 Global Facility by $1.0 billion. The increase is not reflected in this table. 1Q 2023 Supplemental Capitalization 30

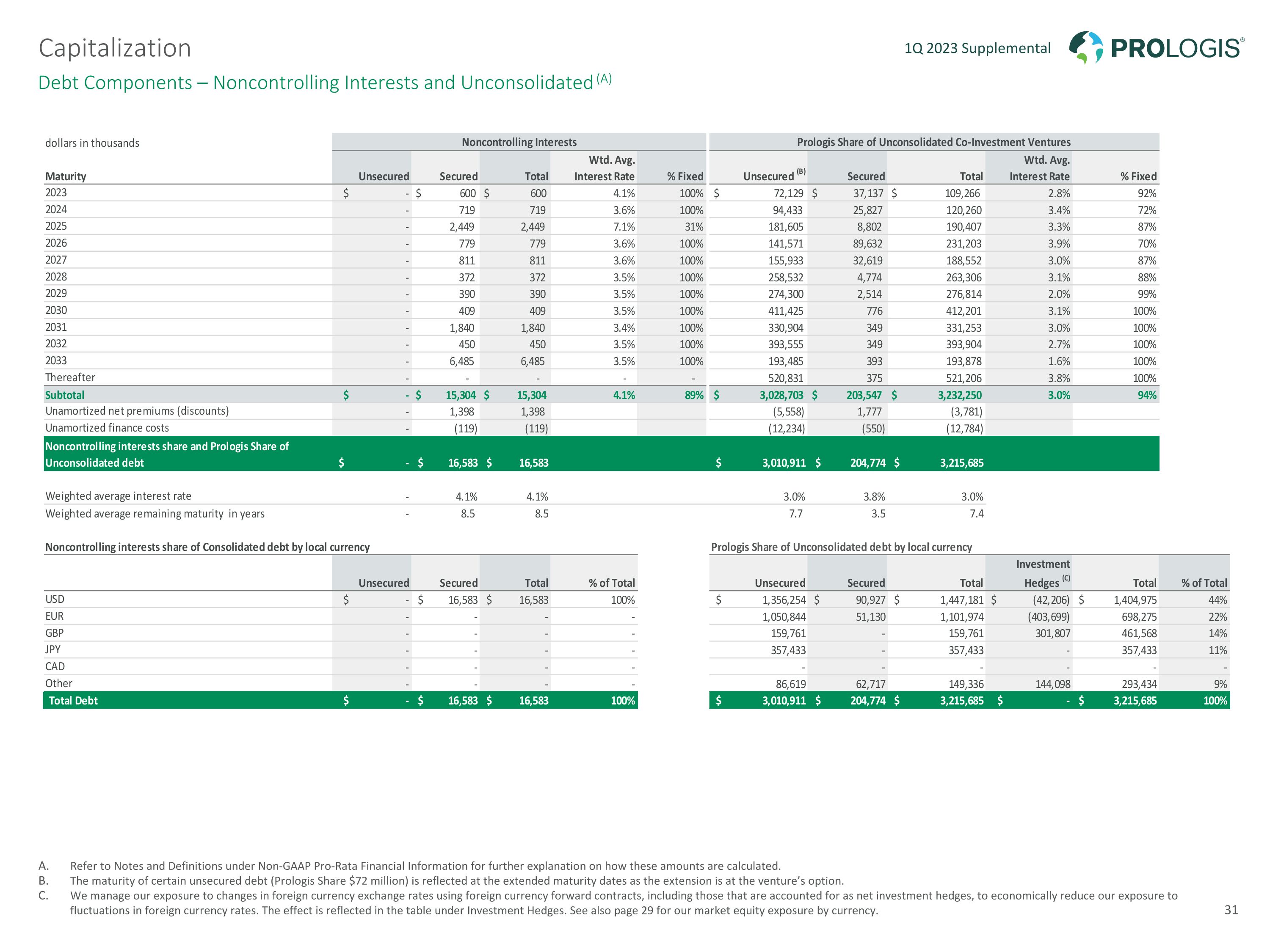

Debt Components – Noncontrolling Interests and Unconsolidated (A) Refer to Notes and Definitions under Non-GAAP Pro-Rata Financial Information for further explanation on how these amounts are calculated. The maturity of certain unsecured debt (Prologis Share $72 million) is reflected at the extended maturity dates as the extension is at the venture’s option. We manage our exposure to changes in foreign currency exchange rates using foreign currency forward contracts, including those that are accounted for as net investment hedges, to economically reduce our exposure to fluctuations in foreign currency rates. The effect is reflected in the table under Investment Hedges. See also page 29 for our market equity exposure by currency. 1Q 2023 Supplemental Capitalization 31

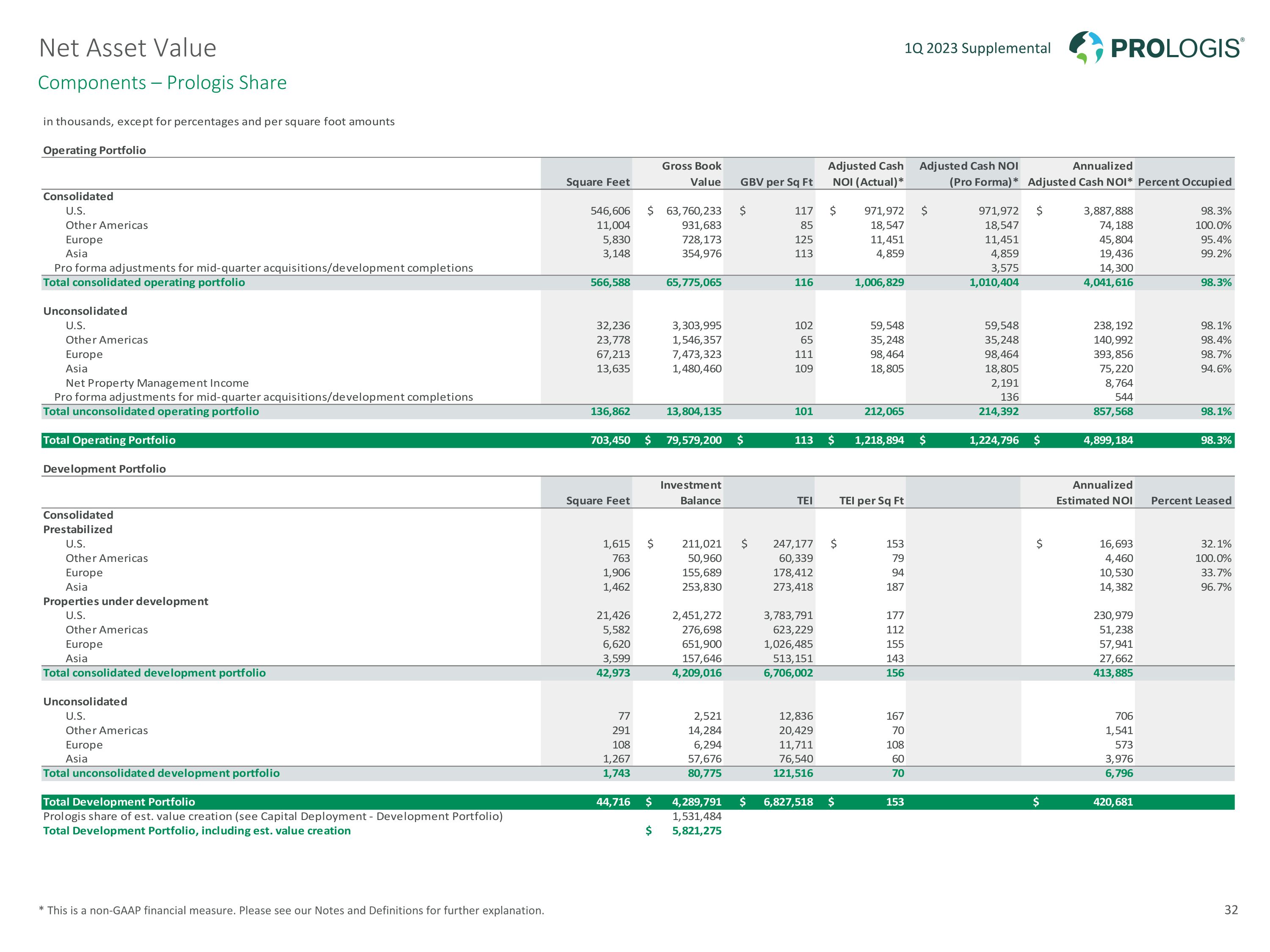

Components – Prologis Share * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. 1Q 2023 Supplemental Net Asset Value 32

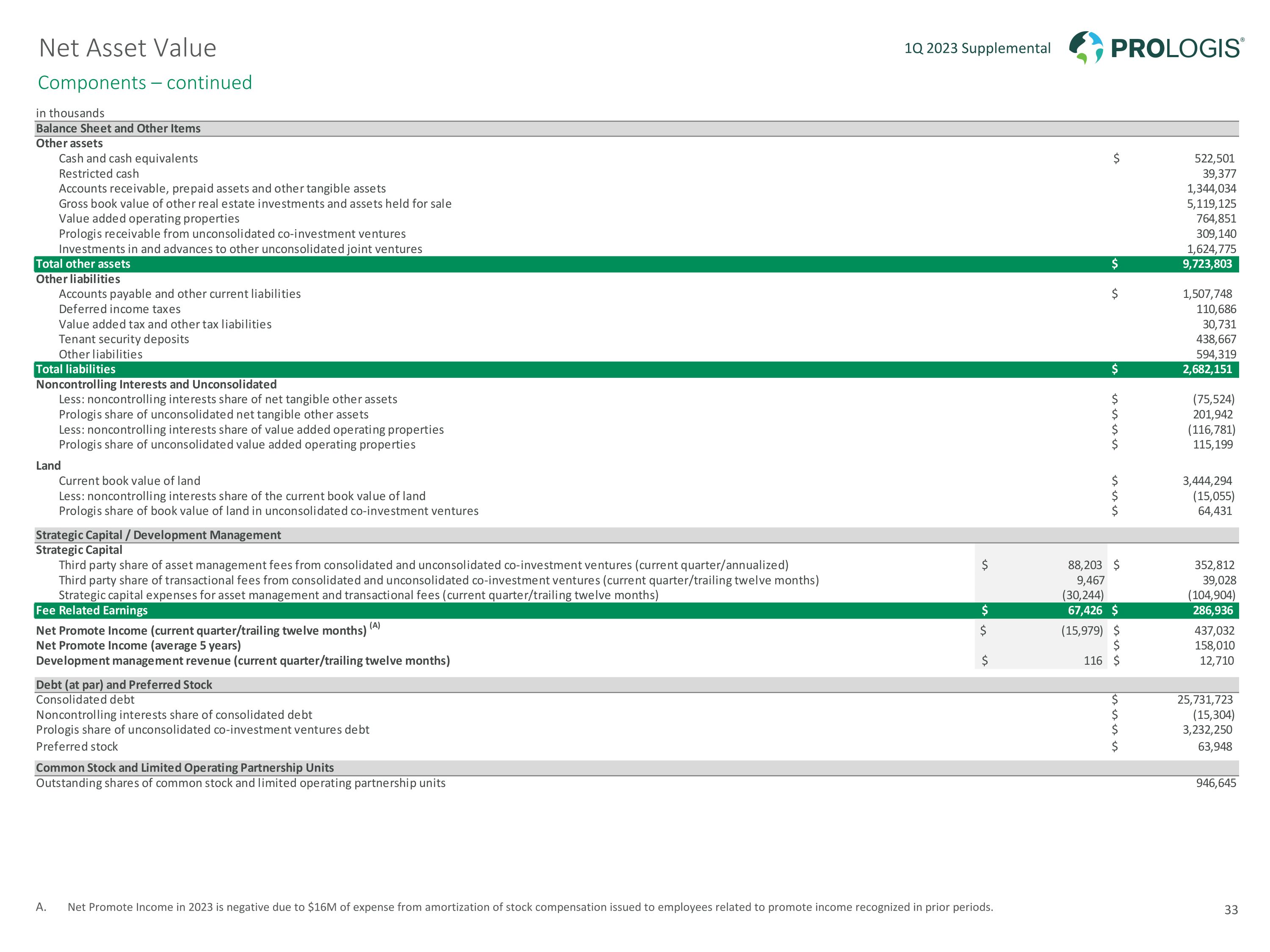

Components – continued Net Promote Income in 2023 is negative due to $16M of expense from amortization of stock compensation issued to employees related to promote income recognized in prior periods. 1Q 2023 Supplemental Net Asset Value 33

Notes and Definitions Prologis Park Venlo, Venlo, the Netherlands 1Q 2023 Supplemental

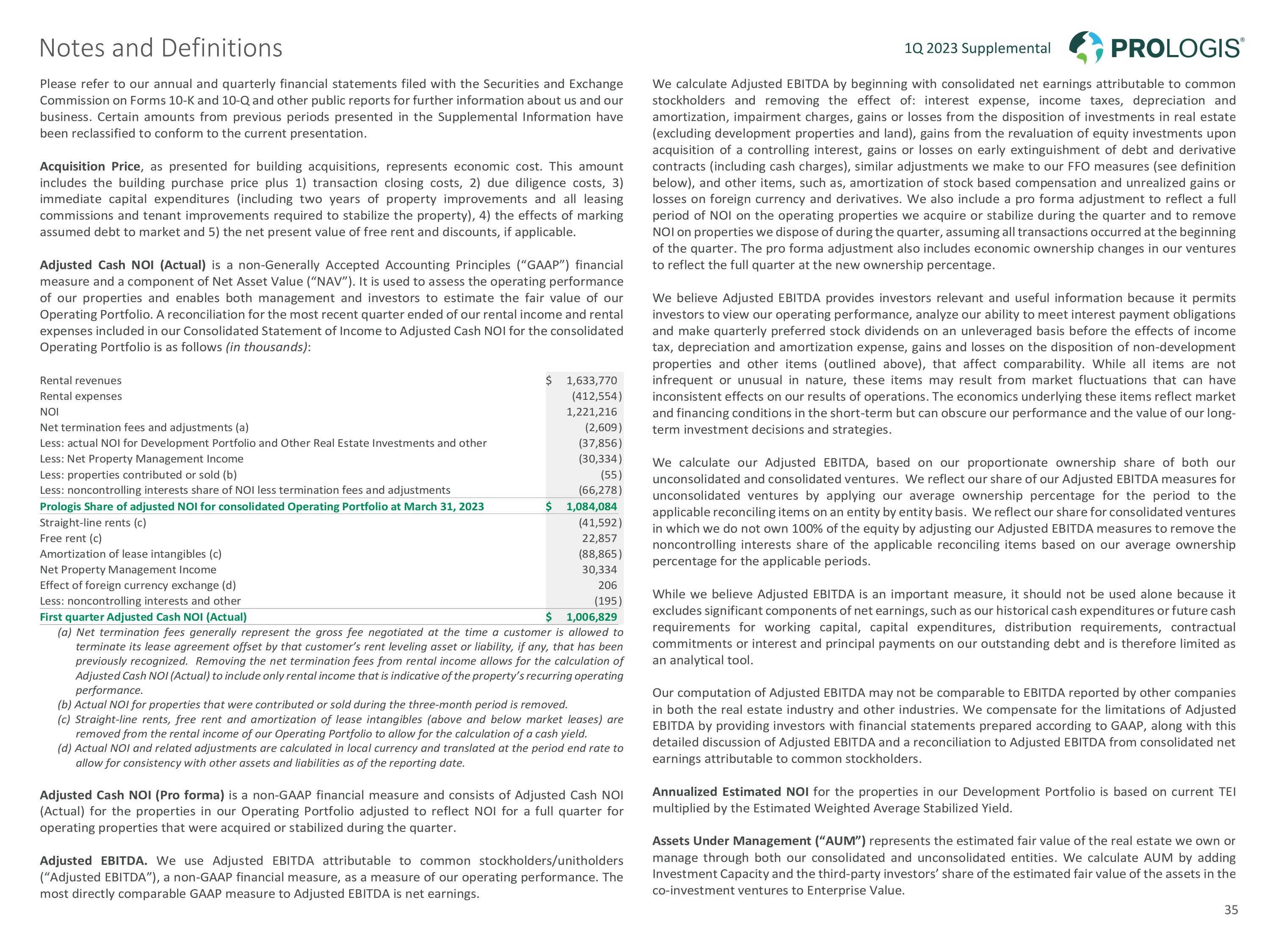

1Q 2023 Supplemental Notes and Definitions 35

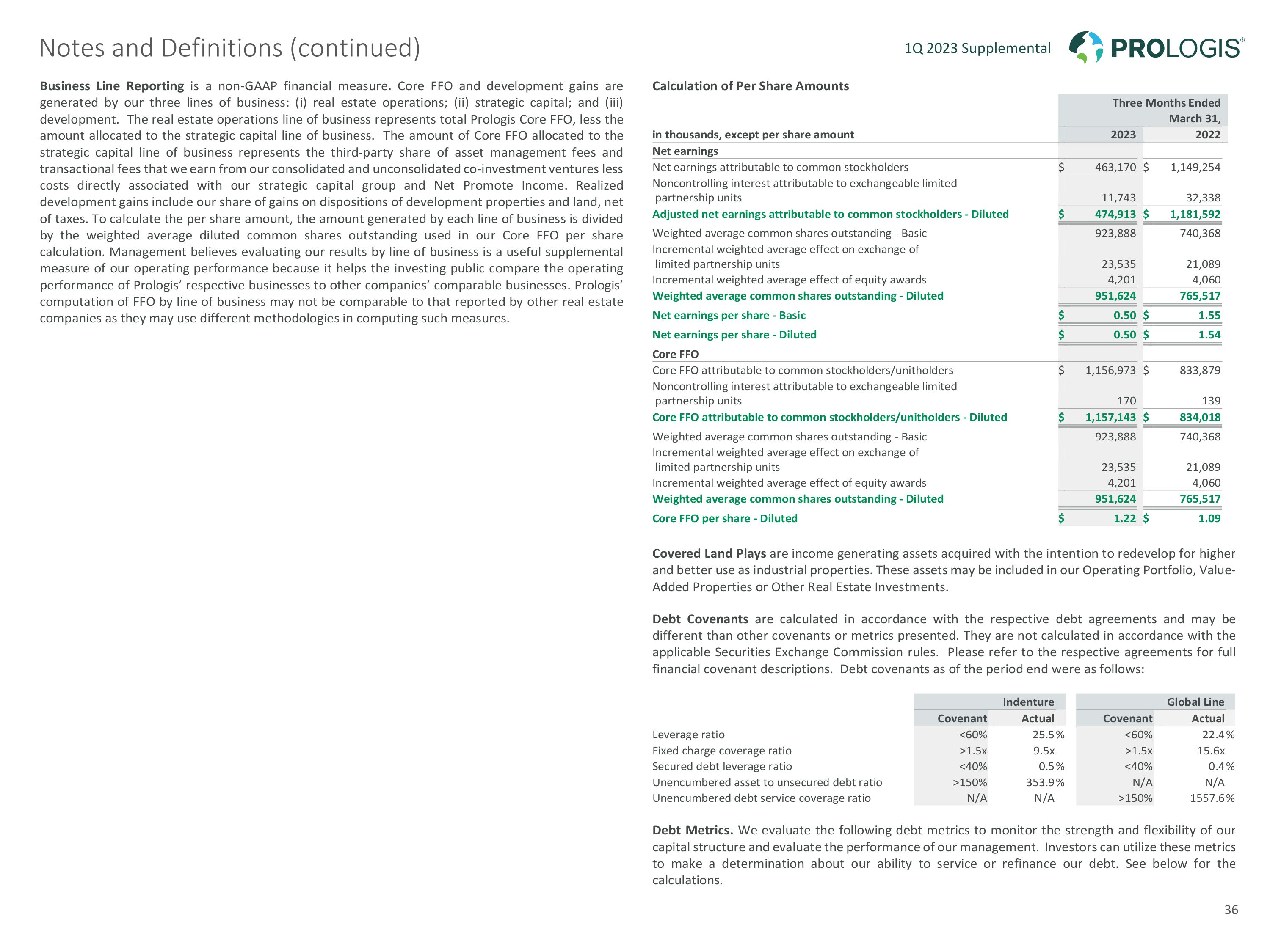

1Q 2023 Supplemental Notes and Definitions (continued) 36

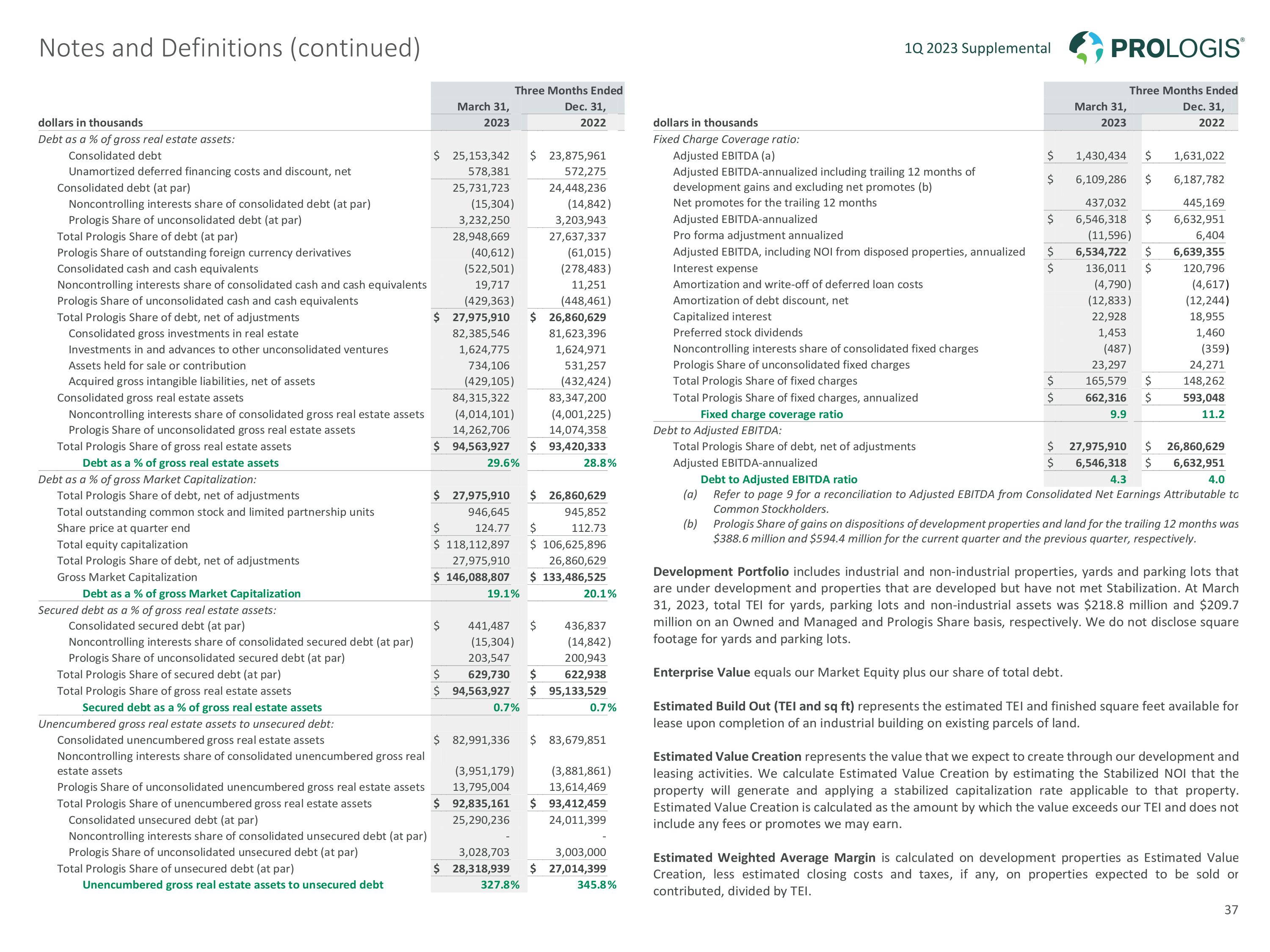

1Q 2023 Supplemental Notes and Definitions (continued) 37

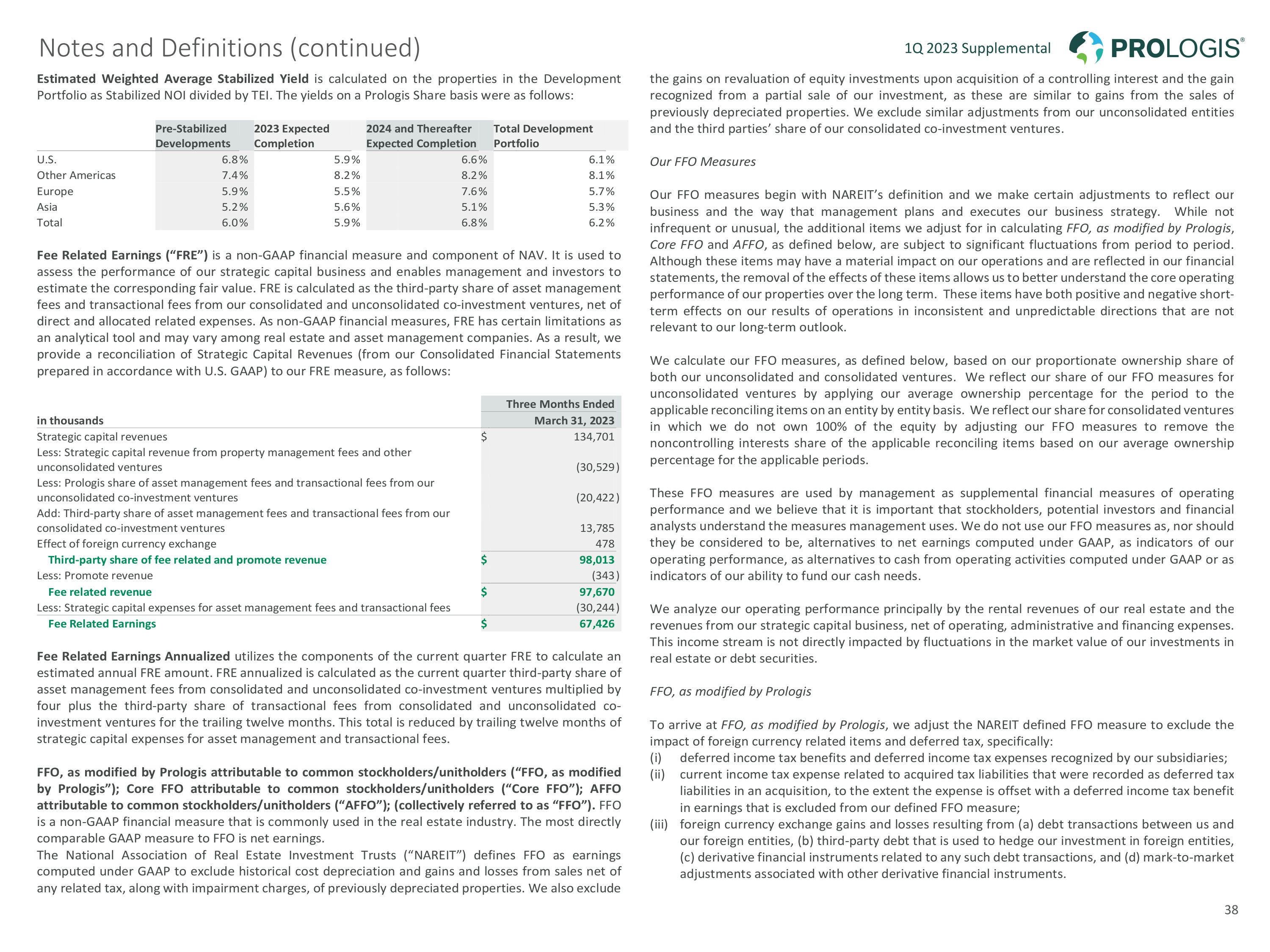

1Q 2023 Supplemental Notes and Definitions (continued) 38

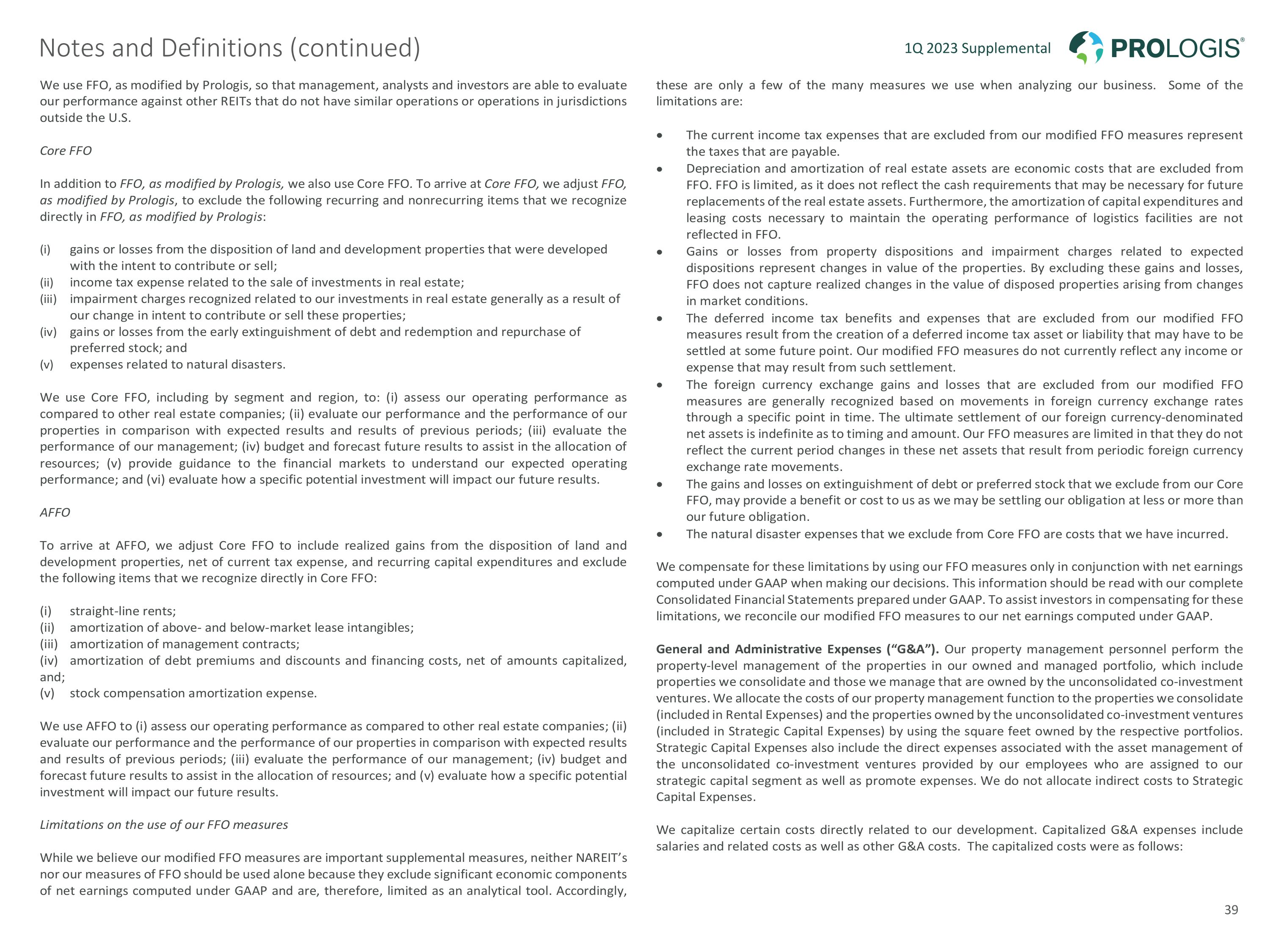

1Q 2023 Supplemental Notes and Definitions (continued) 39

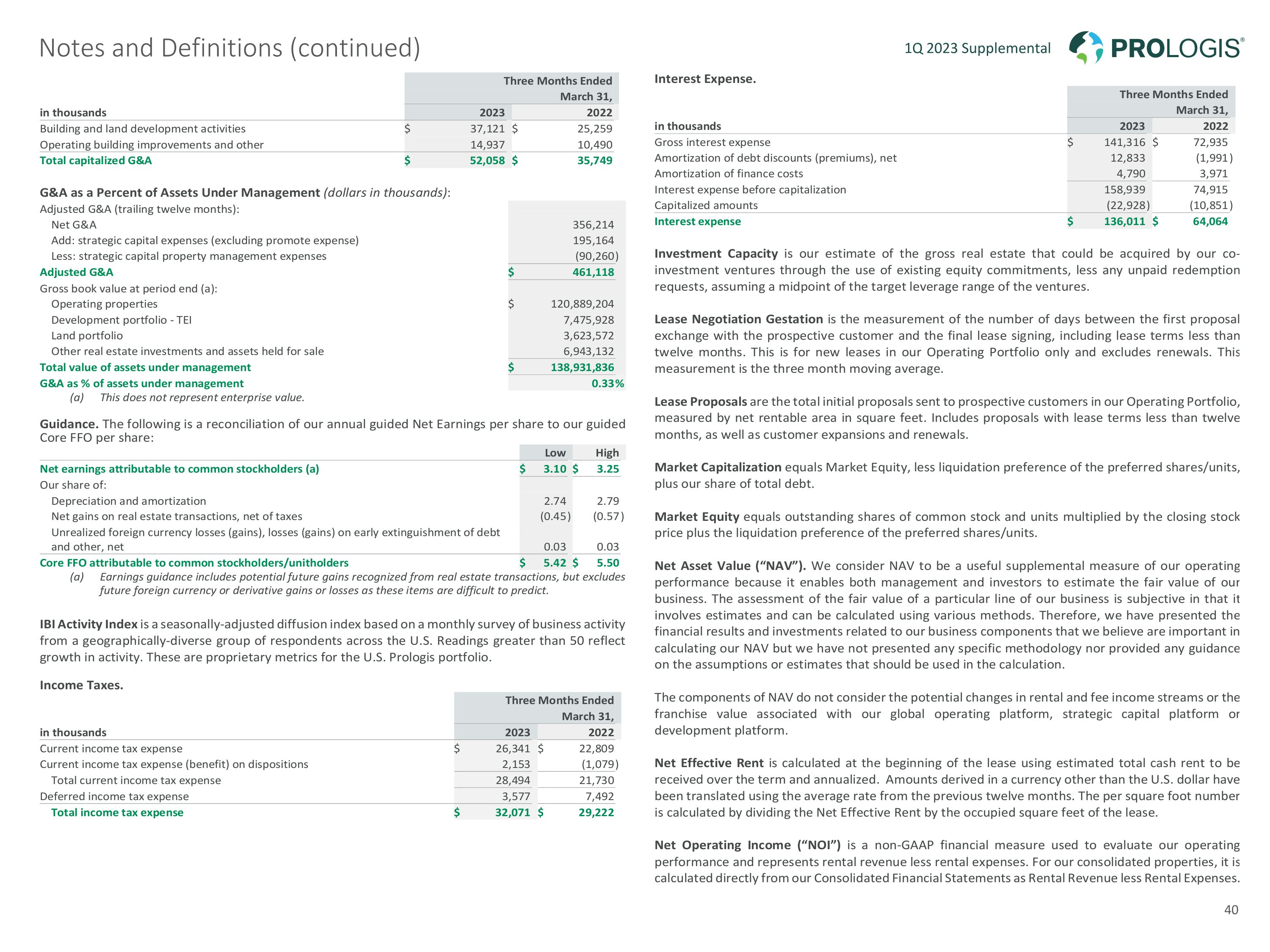

1Q 2023 Supplemental Notes and Definitions (continued) 40

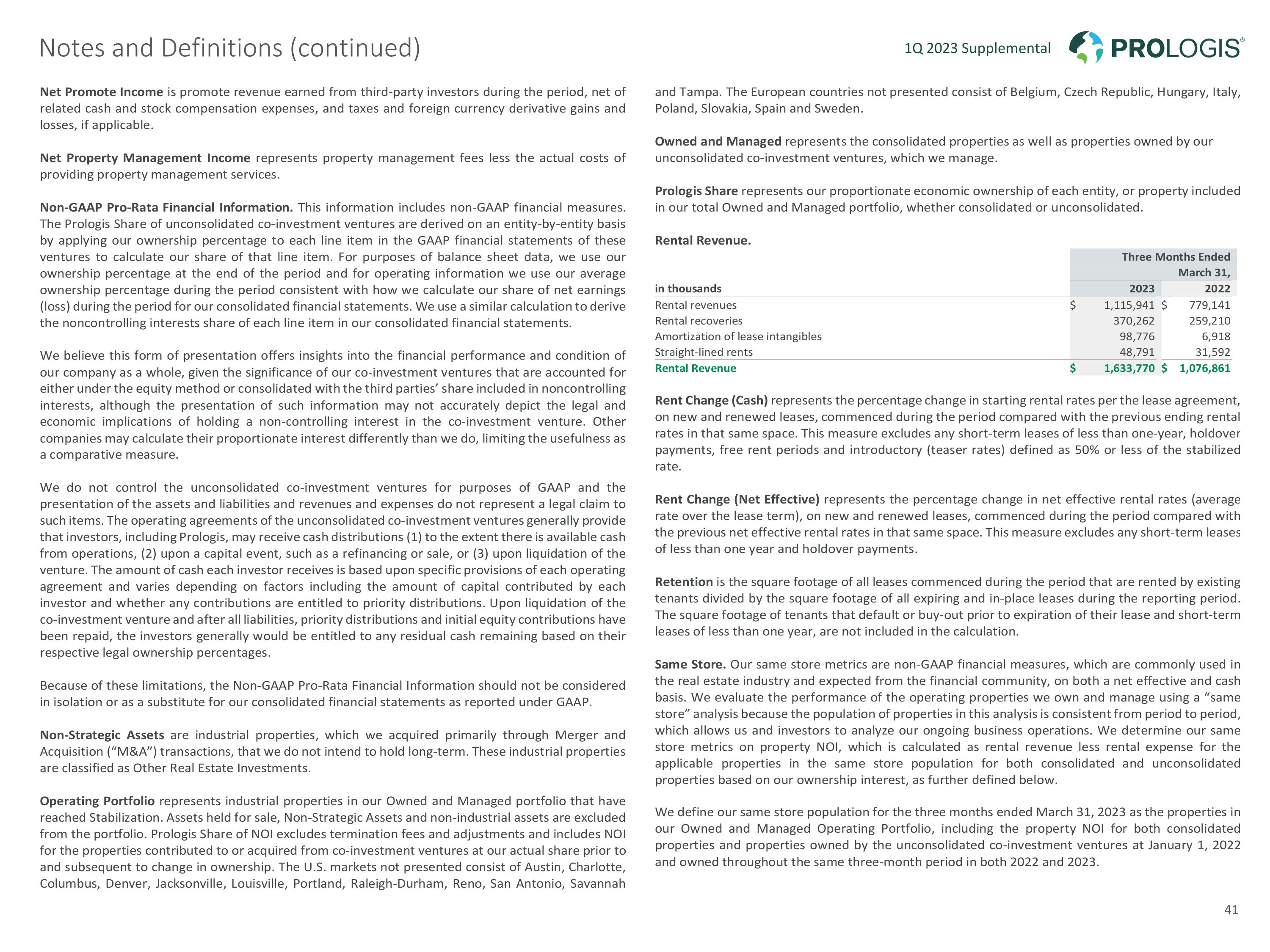

1Q 2023 Supplemental Notes and Definitions (continued) 41

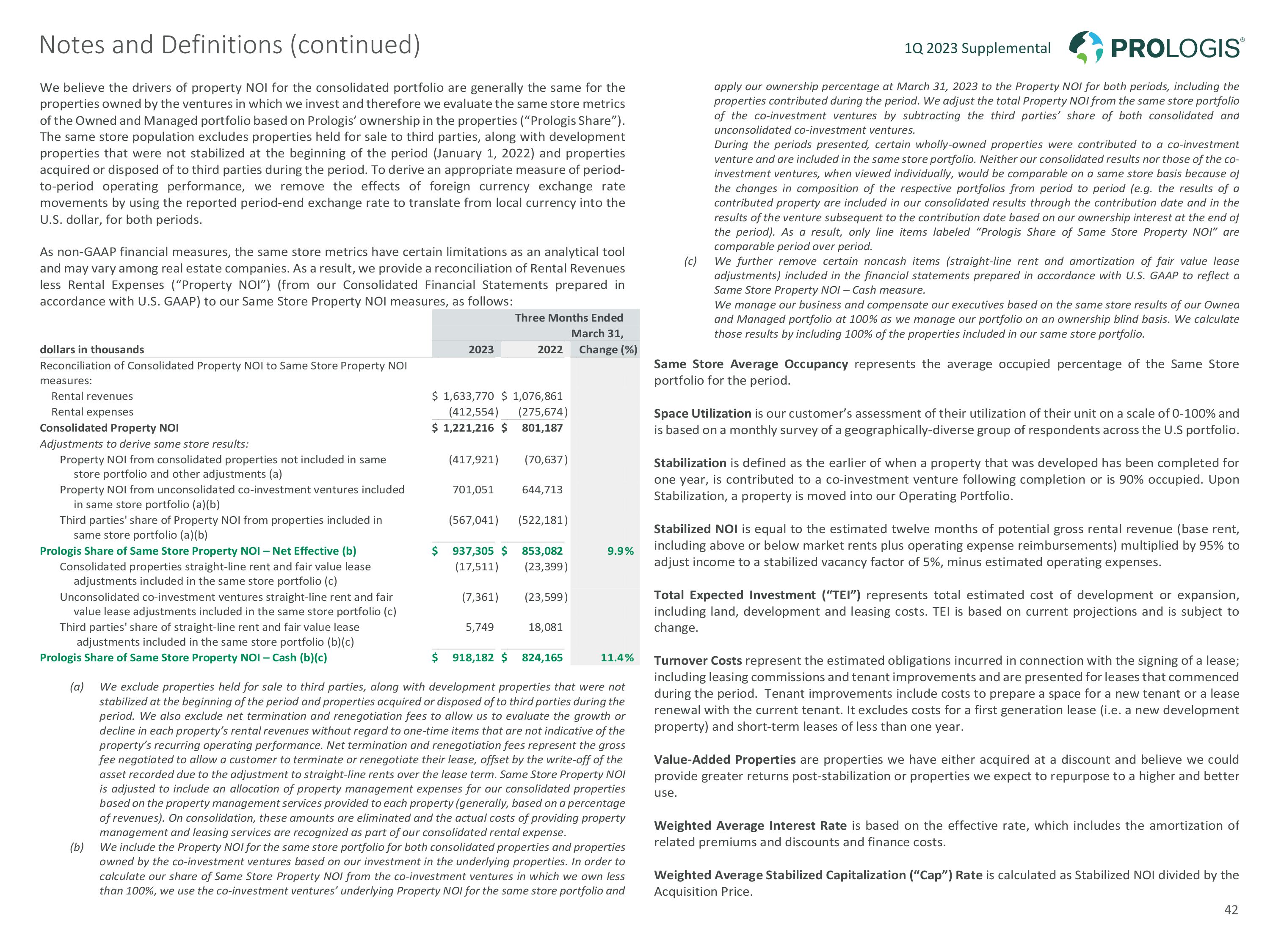

1Q 2023 Supplemental Notes and Definitions (continued) 42