| þ | No fee required. | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: | ||

| (2) | Aggregate number of securities to which transaction applies: | ||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

| (4) | Proposed maximum aggregate value of transaction: | ||

| (5) | Total fee paid: | ||

| o | Fee paid previously with preliminary materials. | |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: | ||

| (2) | Form, Schedule or Registration Statement No.: | ||

| (3) | Filing Party: | ||

| (4) | Date Filed: | ||

|

TIME

|

2:00 p.m., Pacific time, on May 7, 2009 | |

|

PLACE

|

AMB Property Corporation, Pier 1, Bay 1, San Francisco, California 94111 | |

|

ITEMS OF BUSINESS

|

1. To elect nine directors to our Board of Directors to

serve until the next annual meeting of stockholders and until

their successors are duly elected and qualified

|

|

|

2. To ratify the selection of PricewaterhouseCoopers LLP as

our independent registered public accounting firm for the year

ending December 31, 2009

|

||

|

3. To transact such other business as may properly come

before the Annual Meeting or any adjournment(s) or

postponement(s) thereof

|

||

|

RECORD DATE

|

Holders of shares of our common stock of record at the close of business on March 3, 2009 are entitled to notice of and to vote at the Annual Meeting or any adjournment(s) or postponement(s) thereof. | |

|

ANNUAL REPORT

|

Our 2008 Annual Report is enclosed. | |

|

PROXY VOTING

|

It is important that your shares be represented and voted at the Annual Meeting. You can vote your shares by one of the following methods: vote by proxy over the Internet, by telephone or by mail using the instructions on your proxy card. Any proxy may be revoked in the manner described in the accompanying proxy statement at any time prior to its exercise at the Annual Meeting. |

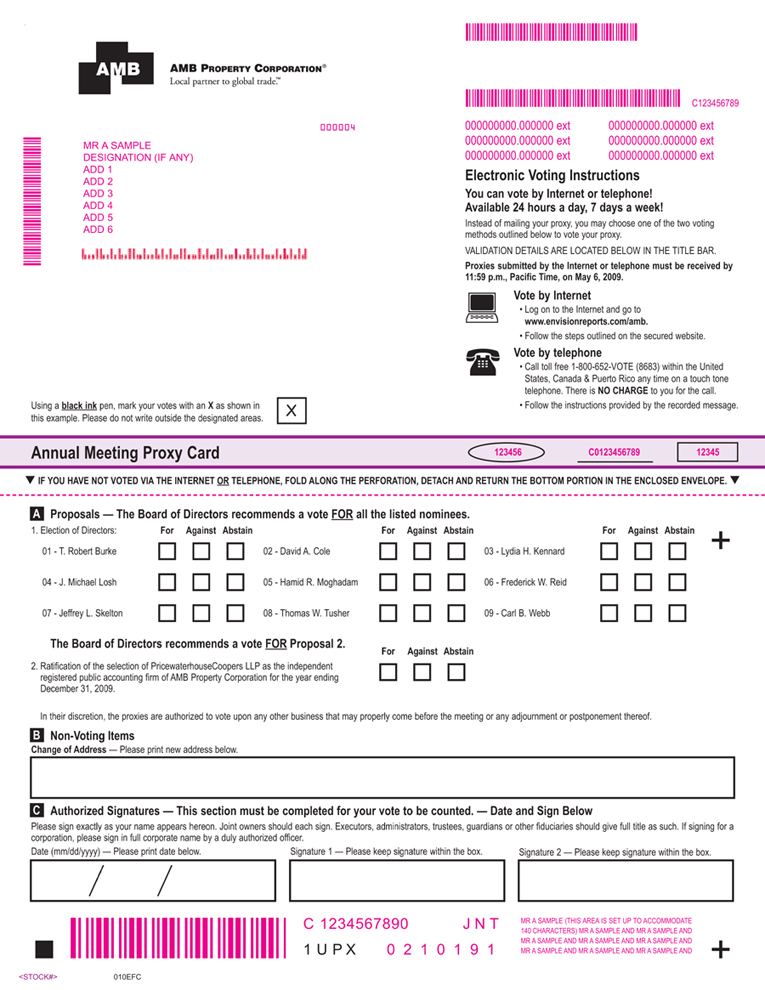

| Q: | Who may vote at the Annual Meeting? | |

| A: | Holders of record of AMB Property Corporation common stock at the close of business on the record date, March 3, 2009, are entitled to notice of and to vote at the Annual Meeting. As of March 3, 2009, there were 98,785,263 shares of our common stock outstanding. Each issued and outstanding share of common stock is entitled to one vote on each matter properly brought before the Annual Meeting. | |

| Q: | What proposals will be voted on at the Annual Meeting? | |

| A: | At the Annual Meeting, you will be asked to consider and vote upon two proposals. | |

|

1. The election of nine directors to serve until the next

annual meeting of stockholders and until their successors are

duly elected and qualified; and

|

||

|

2. The ratification of the selection of

PricewaterhouseCoopers LLP as our independent registered public

accounting firm for the year ending December 31, 2009.

|

||

| We will also consider other matters that may properly come before the Annual Meeting. | ||

| Q: | How does the Board recommend that I vote? | |

| A: | Our Board recommends that you vote: | |

|

• “FOR” each of the nominees to the Board;

and

|

||

|

• “FOR” ratification of the appointment of

PricewaterhouseCoopers LLP as our independent registered public

accounting firm for the year ending December 31, 2009.

|

| Q: | What is the vote required to approve each of the proposals? | |

| A: | The following table sets forth the voting requirement with respect to each of the proposals: |

|

Proposal 1

|

Election of Directors | Each director must be elected by a majority of the votes cast. Accordingly, to elect a particular director nominee, the number of votes cast “FOR” a director nominee by the holders of shares entitled to vote on the election of directors and represented in person or by proxy at the Annual Meeting must exceed the number of such votes cast “AGAINST” that director nominee. Please see the section entitled “Majority Vote Standard for Election of Directors” for a more detailed description of the majority voting procedures in our Bylaws and Corporate Governance Principles and for an explanation of the required vote in a contested election. | ||

|

Proposal 2

|

Ratification of appointment of independent registered public accounting firm | To be approved by stockholders, this proposal must receive the affirmative “FOR” vote of a majority of votes cast on this proposal at the Annual Meeting. |

| For the election of directors and the ratification of selection of our independent registered public accounting firm, abstentions and, if applicable, broker non-votes are not counted as votes cast and will have no effect on the result of the vote. | ||

| Q: | What is the quorum requirement for the meeting? | |

| A: | A majority of the shares of common stock outstanding as of the record date must be represented, in person or by proxy, at the Annual Meeting in order to hold the meeting and transact business. This is called a quorum. | |

| Your shares are counted as present at the meeting if you: | ||

|

• are present and entitled to vote in person at the

meeting; or

|

||

|

• have properly submitted a proxy card or voted by

telephone or by using the Internet.

|

||

| If you are present at the meeting in person or by proxy, but you abstain from voting on any or all proposals, your shares are still counted as present and entitled to vote. | ||

| Broker “non-votes” are also counted as present and entitled to vote for purposes of determining a quorum. A broker “non-vote” occurs when a nominee holding shares of our common stock for a beneficial owner is present at the meeting, in person or by proxy, and entitled to vote, but does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner. | ||

| Q: | How can I vote my shares in person at the Annual Meeting? | |

| A: | Your vote is important. If your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A., you are considered the stockholder of record with respect to those shares, and a notice or printed copies of the proxy materials and proxy card are being sent directly to you by AMB. As the stockholder of record, you have the right to vote in person at the meeting. If you choose to vote in person at the meeting, you can bring the enclosed proxy card, if you received printed copies of the proxy materials, or vote using the ballot provided at the meeting. Even if you plan to attend the Annual Meeting, we recommend that you vote your shares in advance so that your vote will be counted if you later decide not to attend the Annual Meeting. | |

| Most of our stockholders hold their shares in street name through a stockbroker, bank, trustee or other nominee rather than directly in their own name. In that case, you are considered the beneficial owner of shares held in street name, and a notice or printed copies of the proxy materials are being forwarded to you together with a voting instruction card. As the beneficial owner, you are also invited to attend the Annual Meeting. However, |

2

| because a beneficial owner is not the stockholder of record, you may not vote these shares in person at the meeting unless you obtain a “legal proxy” from the broker, bank, trustee or nominee that holds your shares, which will give you the right to vote the shares at the meeting. You will need to contact your broker, bank, trustee or nominee to obtain a legal proxy, and you will need to bring it to the meeting in order to vote in person. | ||

| Q: | How can I vote my shares without attending the Annual Meeting? | |

| A: | Whether you hold shares directly as a stockholder of record or beneficially in street name, you may direct your vote without attending the Annual Meeting. You may vote by granting a proxy, or, for shares held in street name, by submitting voting instructions to your stockbroker, bank, trustee or nominee. In most cases, you will be able to do this by telephone, by using the Internet or by mail. Please refer to the summary instructions included with your proxy materials and on your proxy card. For shares held in street name, the voting instructions will be communicated to you by your stockbroker, bank, trustee or nominee. | |

| By Telephone or the Internet — If you have telephone or Internet access, you may submit your proxy by following the instructions included with your proxy materials or, if you requested a printed copy of the proxy materials, on your proxy card. | ||

| By Mail — If you requested a printed copy of the proxy materials, you may submit your proxy by mail by signing your proxy card, or, for shares held in street name, by following the voting instruction card included by your stockbroker, bank, trustee or nominee and mailing it in the enclosed, postage-paid envelope. If you provide specific voting instructions, your shares will be voted as you have instructed. | ||

| The Internet and telephone proxy voting facilities for stockholders of record will close at 11:59 p.m., Pacific time, on May 6, 2009. | ||

| The availability of telephone and Internet voting for beneficial owners will depend on the voting processes of your broker, bank, trustee or nominee. Therefore, we recommend that you follow the voting instructions in the materials you accessed on the Internet or received by mail. | ||

| If you vote by telephone or on the Internet, you do not have to return a proxy card or voting instruction card. | ||

| The Internet and telephone proxy voting procedures are designed to authenticate stockholders by use of a control number and to allow stockholders to confirm that their instructions have been properly recorded. The method by which you vote will in no way limit your right to vote at the Annual Meeting if you later decide to attend in person. | ||

| Q: | How can I change my vote after I have voted? | |

| A: | You may revoke your proxy at any time and change your vote at any time before the final vote at the Annual Meeting. If you are a stockholder of record, you may do this by signing and submitting a written notice to Tamra D. Browne, Corporate Secretary of the Company, by submitting a new proxy card with a later date, by voting by telephone or by using the Internet (your latest telephone or Internet proxy is counted) or by attending and voting by ballot at the Annual Meeting. If you hold your shares beneficially in street name, you will need to contact your broker, bank, trustee or other nominee to obtain a legal proxy. Merely attending the Annual Meeting will not revoke a proxy unless you specifically request your proxy to be revoked. | |

| All shares that have been properly voted and not revoked will be voted at the Annual Meeting. | ||

| Q: | What happens if I do not give specific voting instructions? | |

| A: | If you hold your shares directly in your name, and you sign and return a proxy card without giving specific voting instructions, the shares of common stock represented by that proxy will be voted as recommended by the Board of Directors. | |

| If you hold your shares in street name through a broker, bank, trustee or other nominee and do not provide your broker with specific voting instructions, your broker will have discretion to vote such shares on routine matters, but not on non-routine matters. As a result, your broker will have the authority to exercise discretion to vote your shares with respect to Proposal 1 (election of directors) and Proposal 2 (ratification of the selection of independent registered public accounting firm), because each involves matters that are considered routine. |

3

| If no voting instructions are received from you, and provided that you hold your shares in street name, typically, your broker will turn in a proxy card for shares held in street name, indicating a “FOR” vote on the routine matters. | ||

| Q: | Why did I receive a notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials? | |

| A: | As explained on our website in a communication to stockholders, we implemented the new Notice and Access Rule enacted by the U.S. Securities and Exchange Commission for distribution of materials for AMB’s 2009 Annual Meeting of Stockholders. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders of record and our beneficial owners. All stockholders will be able to access the proxy materials through the Internet at the website address noted on the Notice or may request to receive printed copies of the proxy materials instead. We believe that the electronic delivery of materials is an innovative proxy communication solution that will allow us to provide our stockholders with the materials they need, while lowering the cost of delivery and reducing the environmental impact of printing and mailing paper copies. | |

| Q: | How can I access the 2009 proxy materials and 2008 annual report electronically? | |

| A: | The Notice provides you with instructions regarding how to view our proxy materials on the Internet. Specifically, you may view a copy of the 2009 proxy materials and 2008 Annual Report on the Internet by visiting www.edocumentview.com\amb. | |

| You may also access an electronic copy of our 2008 Annual Report at the Investor Relations section of our website, www.amb.com/en/media/annual_reports.html. | ||

| Q: | How may I elect to receive future proxy materials electronically instead of by mail? | |

| A: | If you wish to receive future proxy materials electronically by e-mail instead of by mail, you may register to do so at the Investor Relations page of our website, www.amb.com. | |

| By choosing to receive your future proxy materials by e-mail, you would save us the cost of printing and mailing documents to you and would reduce the impact of our annual stockholders’ meetings on the environment. If you register to receive future proxy materials electronically by e-mail, you will receive an e-mail next year with instructions on how to access those proxy materials and how to vote. If you change your e-mail address in the meantime, you will need to update your registration. Your election to receive proxy materials electronically by e-mail will remain in effect until you terminate it. | ||

| Q: | What happens if additional matters are presented at the Annual Meeting? | |

| A: | Other than the two items of business described in this proxy statement, we do not anticipate that any other matters would be raised at the Annual Meeting. If any other matters are properly presented at the Annual Meeting for consideration, the persons named as proxies and acting thereunder will have discretion to vote on those matters for you. | |

| Q: | Who will pay for the cost of this proxy solicitation? | |

| A: | We will pay the cost of soliciting proxies. Proxies may be solicited on our behalf by our directors, officers or employees in person or by telephone, facsimile or other electronic means. These people will not be specially compensated for their solicitation of proxies. | |

| In accordance with the regulations of the U.S. Securities and Exchange Commission and the New York Stock Exchange, we will also reimburse brokerage firms and other custodians, nominees and fiduciaries for their expenses incurred in sending proxies and proxy materials to the beneficial owners of shares of our common stock. | ||

| NO PERSON IS AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS OTHER THAN THOSE CONTAINED IN THIS PROXY STATEMENT AND, IF GIVEN OR MADE, SUCH INFORMATION MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED AND THE DELIVERY OF THIS PROXY STATEMENT SHALL, UNDER NO CIRCUMSTANCES, CREATE ANY |

4

| IMPLICATION THAT THERE HAS BEEN NO CHANGE IN THE AFFAIRS OF AMB PROPERTY CORPORATION SINCE THE DATE OF THIS PROXY STATEMENT. | ||

| Q: | What is the deadline to propose actions for consideration at the 2010 Annual Meeting or to nominate individuals to serve as directors? | |

| A: | You may submit proposals, including director nominations, for consideration at our next annual meeting as follows: | |

| Deadline for Submitting Stockholder Proposals for Inclusion in Our 2010 Proxy Statement. Rule 14a-8 of the Securities Exchange Act of 1934 provides that certain stockholder proposals must be included in the proxy statement for our Annual Meeting. For a stockholder proposal to be considered for inclusion in the 2010 proxy statement for our 2010 Annual Meeting of Stockholders, our Corporate Secretary, Tamra D. Browne, must receive the proposal at our principal executive offices no later than November 25, 2009. The proposal must comply with the Securities and Exchange Commission regulations under Rule 14a-8 of the Securities Exchange Act of 1934 regarding the inclusion of stockholder proposals in our proxy materials. | ||

| Deadline for Submitting Stockholder Proposals not to be Included in Our 2010 Proxy Statement. If you intend to present a proposal at our 2010 Annual Meeting, but you do not intend to have it included in our 2010 proxy statement, your proposal must be delivered to or mailed and received by our Corporate Secretary not less than 90 days nor more than 120 days prior to May 7, 2010. If, however, the date of the 2010 Annual Meeting is advanced or delayed by more than 30 days from May 7, 2010, our Corporate Secretary must receive a stockholder’s notice not more than 120 days prior to the date of the 2010 Annual Meeting and not less than the later of 90 days prior to the date of the annual meeting, or if less than 100 hundred days’ notice or prior public disclosure of the date of the 2010 Annual Meeting is given or made to stockholders, the close of business on the 10th day following the day on which notice of the 2010 Annual Meeting date was mailed or publicly disclosed. | ||

| As set forth in our Bylaws, for stockholder proposals other than director nominations, such stockholder’s notice must contain, among other things, with respect to each proposed matter: a brief description of the business and the reasons for conducting such business at the annual meeting; your name; your record address; the class, series and number of shares you beneficially hold; and any material interest you or any stockholder associated person has in such business. Please review our Bylaws for more information regarding requirements to submit a stockholder proposal outside of Rule 14a-8. | ||

| Deadline for Submitting Director Nominations not to be Included in Our 2010 Proxy Statement. Under our Bylaws, nominations for director may be made only pursuant to the notice of the meeting, by the Board or a committee of the Board, or by a stockholder entitled to vote who delivered notice to us in accordance with our Bylaws. If you want to nominate an individual for election to our Board at the 2010 Annual Meeting, you must deliver a written notice to our Corporate Secretary which is received not less than 90 days nor more than 120 days prior to May 7, 2010. If, however, the date of the 2010 Annual Meeting is advanced or delayed by more than 30 days from May 7, 2010, our Corporate Secretary must receive a stockholder’s notice not more than 120 days prior to the date of the 2010 Annual Meeting and not less than the later of 90 days prior to the date of the annual meeting, or if less than 100 hundred days’ notice or prior public disclosure of the date of the 2010 Annual Meeting is given or made to stockholders, the close of business on the 10th day following the day on which notice of the 2010 Annual Meeting date was mailed or publicly disclosed. | ||

| As set forth in our Bylaws, for director nominations, such stockholder’s notice must contain, among other things, with respect to each proposed nominee: the name, age, business address and residence address of the proposed nominee; the principal occupation or employment of the proposed nominee; the class, series and number of shares beneficially held by the proposed nominee, the date such shares were acquired and the investment intent of such acquisition; any other information relating to the proposed nominee that is required to be disclosed under Regulation 14A of the Securities Exchange Act of 1934; the proposed nominee’s written consent to serve as a director if elected; a statement whether such person will tender an irrevocable resignation effective upon failure to receive the required vote and upon acceptance of such resignation by the board; and, with respect to the stockholder giving the notice, your name and record address; and the class, series and number of shares you beneficially hold, whether and the extent to which hedging or other transaction(s) have been |

5

| entered by or on your behalf, as well as similar information regarding any stockholder associated person. We may require a proposed nominee to furnish other information to determine the eligibility of such proposed nominee to serve as a one of our directors, including, without limitation, information regarding the skills, qualifications and experience of a proposed nominee, as well as the other items set forth under the “Nominating and Governance Committee” section below. Please review our Bylaws for more information regarding requirements to nominate directors. | ||

| Copy of Bylaws. A copy of the full text of our Bylaws may be obtained by writing to our Corporate Secretary at Pier 1, Bay 1, San Francisco, California 94111. |

6

7

|

Hamid R. Moghadam

|

||

|

Age:

|

52 | |

|

Director since:

|

1997 | |

|

AMB Board Committees:

|

Member, Executive Committee | |

|

Recent business and educational experience:

|

One of the founders (in 1983) of the predecessor to AMB Property Corporation, Mr. Moghadam has over 26 years of experience in real estate. He is currently our Chairman and Chief Executive Officer. Mr. Moghadam holds bachelor’s and master’s degrees in engineering from the Massachusetts Institute of Technology and an M.B.A. degree from the Graduate School of Business at Stanford University. | |

|

Directorships and other memberships:

|

Mr. Moghadam is a member of the board of trustees of Leland Stanford Junior University, is the Chairman of the board of directors of Stanford Management Company, and is a member of the Stanford Graduate School of Business Advisory Council and its Campaign Steering Committee. He is a former Chairman of the Executive Committee and the Board of Governors of the National Association of Real Estate Investment Trusts, is a former Chairman of the Real Estate Investment Trust Political Action Committee, is a former Chairman of the Northern California Chapter of the Young Presidents’ Organization, is a former member of the board of directors of Plum Creek Timber Company, is a founding member of the Real Estate Roundtable, is a former member of the advisory board of the Wine Group and has served on various committees of the Massachusetts Institute of Technology. In addition, as an active participant in the San Francisco Bay Area community, Mr. Moghadam has served and is currently serving on various philanthropic and community boards, including the California Academy of Sciences and Town School for Boys. | |

|

T. Robert Burke

|

||

|

Age:

|

66 | |

|

Director since:

|

1997 | |

|

AMB Board Committees:

|

Chair, Executive Committee | |

|

Recent business and educational experience:

|

Mr. Burke is one of the founders (in 1983) of the predecessor to AMB Property Corporation. From November 1997 to December 1999, Mr. Burke was our Chairman of the Board. He was formerly a senior real estate partner with Morrison & Foerster LLP and, for two years, served as that firm’s Managing Partner for Operations. Mr. Burke graduated from Stanford University and holds a J.D. degree from Stanford Law School. |

8

|

Directorships and other memberships:

|

Mr. Burke is a former member of the Board of Governors of the National Association of Real Estate Investment Trusts, and is a former member of the Board of Trustees of Stanford University. Mr. Burke is also the former Chairman of the Board of Directors of the Pension Real Estate Association. | |

|

David A. Cole

|

||

|

Age:

|

66 | |

|

Director since:

|

2000 | |

|

AMB Board Committees:

|

Chair, Compensation Committee | |

|

Recent business and educational experience:

|

Mr. Cole was named Chairman of the Board and Chief Executive Officer of Kurt Salmon Associates in January 1988. He retired as Chief Executive Officer in December 1998 and continued to serve as Chairman of the Board until January 2001. Mr. Cole holds a bachelor’s degree in engineering from Auburn University and has successfully completed the Advanced Management Program at Harvard Business School. | |

|

Directorships and other memberships:

|

Mr. Cole was appointed Chairman Emeritus of Kurt Salmon Associates, Inc., a global management consulting firm, in 2001. He is a member of the Board of Directors of PRG-Schultz International, Inc., a publicly traded provider of audit recovery services, is Chairman of its governance and nominating committee and serves on its compensation committee, and is a member of the Board of Directors of Americorp Holding, Inc., a privately held operator of healthcare clinics. He is also a member of the Advisory Board of Goizueza Business School at Emory University. | |

|

Lydia H. Kennard

|

||

|

Age:

|

54 | |

|

Director since:

|

2004 | |

|

AMB Board Committees:

|

Chair, Nominating and Governance Committee | |

|

Recent business and educational experience:

|

From 1999 to 2003 and again from October 2005 to February 2007, Ms. Kennard served as Executive Director of Los Angeles World Airports, a system of airports comprising Los Angeles International, Palmdale Regional and Van Nuys General Aviation Airports. She is currently a principal of Airport Property Ventures, LLC. She served as Deputy Executive for Design and Construction for Los Angeles World Airports from 1994 to 1999. Ms. Kennard holds a J.D. degree from Harvard Law School, a master’s degree in city planning from the Massachusetts Institute of Technology, and a bachelor’s degree in urban planning and management from Stanford University. | |

|

Directorships and other memberships:

|

Ms. Kennard is a director of Intermec, Inc., an industrial technologies company, a member of the UniHealth Foundation Board, a member of the California Air Resources Board, a trustee for RAND Corporation, a trustee for the Polytechnic School, a trustee for the University of Southern California and a director of URS Corporation. |

9

|

J. Michael Losh

|

||

|

Age:

|

62 | |

|

Director since:

|

2003 | |

|

AMB Board Committees:

|

Chair, Audit Committee | |

|

Recent business and educational experience:

|

From July 2004 to May 2005, Mr. Losh served as interim chief financial officer of Cardinal Health, Inc., a health care products and services company. Mr. Losh spent 36 years with General Motors Corporation, most recently as Executive Vice President and Chief Financial Officer of General Motors from July 1994 through August 2000 and as chairman of GMAC, General Motor’s financial services group, from July 1994 until 1999. He oversaw major capacity expansion programs and integrated finance functions when he served as finance director of General Motors de Brazil from 1979 to 1982 and as managing director of General Motors de Mexico from 1982 to 1984. Mr. Losh was elected Vice President of General Motors and General Manager of the Pontiac Division in July 1984, and in June 1989 was named Vice President and General Manager of the Oldsmobile Division. From 1992 to 1994, Mr. Losh served as Group Vice President in charge of North American Vehicle Sales, Service and Marketing. Mr. Losh holds a B.S. degree in Mechanical Engineering from Kettering University and an M.B.A. degree from Harvard University. | |

|

Directorships and other memberships:

|

Mr. Losh currently serves on the boards of Cardinal Health, Inc., where he serves on the audit, executive and nominating and governance committees; AON Corporation, an insurance and risk management company, where he serves on the governance and nominating, finance and compensation committees; Masco Corporation, a home improvement and building products company, where he serves on the audit committee, the pricing committee and the compensation committee; H.B. Fuller Company, a chemical manufacturer, where he serves on the audit committee; and TRW Automotive Inc., an automotive product company, where he serves on the audit and compensation committees. | |

|

Frederick W. Reid

|

||

|

Age:

|

58 | |

|

Director since:

|

2003 | |

|

AMB Board Committees:

|

Member, Compensation Committee; Member, Nominating and Governance Committee | |

|

Recent business and educational experience:

|

Mr. Reid is currently the President of Flexjet and SkyJet U.S. He served as Chief Executive Officer of Virgin America, a startup airline that launched operations in August 2007, until January 2008. Mr. Reid joined Virgin America in April 2004. Previously, Mr. Reid served as President and Chief Operating Officer of Delta Airlines from May 2001 to April 2004 and served as Executive Vice President and Chief Marketing Officer of Delta Airlines from July 1998 to May 2001. Before joining Delta Airlines, Mr. Reid served as President and Chief Operating Officer of Lufthansa German Airlines from April 1997 to June 1998, as Executive Vice President from 1996 to March 1997 and as Senior Vice President, The Americas from 1991 to 1996. Between 1976 and 1991, Mr. Reid held various management positions at Pan American World Airways and American Airlines, based in Western Europe, the Middle East and South Asia. Mr. Reid holds a B.A. degree in Asian Studies from the University of California at Berkeley. | |

|

Directorships and other memberships:

|

He is a member of the Advisory Board for the Taub Institute for Research on Alzheimer’s Disease and the Aging Brain. |

10

|

Jeffrey L. Skelton

|

||

|

Age:

|

59 | |

|

Director since:

|

1997 | |

|

AMB Board Committees:

|

Member, Audit Committee; Member, Executive Committee | |

|

Recent business and educational experience:

|

Mr. Skelton is currently President and Chief Executive Officer of Symphony Asset Management, a subsidiary of Nuveen Investments, Inc., an investment management firm. Prior to founding Symphony Asset Management in 1994, he was with Wells Fargo Nikko Investment Advisors from January 1984 to December 1993, where he served in a variety of capacities, including Chief Research Officer, Vice Chairman, Co-Chief Investment Officer and Chief Executive of Wells Fargo Nikko Investment Advisors Limited in London. Mr. Skelton has a Ph.D. in Mathematical Economics and Finance and an M.B.A. degree from the University of Chicago, and was an Assistant Professor of Finance at the University of California at Berkeley, Walter A. Haas School of Business. | |

|

Directorships and other memberships:

|

None. | |

|

Thomas W. Tusher

|

||

|

Age:

|

67 | |

|

Director since:

|

1997 | |

|

AMB Board Committees:

|

Member, Compensation Committee | |

|

Recent business and educational experience:

|

Mr. Tusher was President and Chief Operating Officer of Levi Strauss & Co. from 1984 through 1996, when he retired. Previously, he was President of Levi Strauss International from 1976 to 1984. Mr. Tusher began his career at Levi Strauss in 1969. He was a director of the publicly-held Levi Strauss & Co. from 1978 to 1985, and was named a director of the privately-controlled Levi Strauss & Co. in 1989, a position he held until his retirement at the end of 1996. Prior to joining Levi Strauss & Co., Mr. Tusher was with Colgate Palmolive from 1965 to 1969. Mr. Tusher has a bachelor’s degree from the University of California at Berkeley and an M.B.A. degree from the Graduate School of Business at Stanford University. | |

|

Directorships and other memberships:

|

Mr. Tusher is a director of Amisfield Wine Company in New Zealand. He is a former director of Dash America (Pearl Izumi), Cakebread Cellars, Great Western Financial Corporation and the San Francisco Chamber of Commerce. He is also Chairman Emeritus and a member of the advisory board of the Walter A. Haas School of Business at the University of California at Berkeley. Mr. Tusher is also a director of the World Wildlife Fund, a member of the Board of Trustees of the California Academy of Sciences and a former director of the Stanford Graduate School of Business Advisory Council. |

11

|

Carl B. Webb

|

||

|

Age:

|

59 | |

|

Director since:

|

2007 | |

|

AMB Board Committees:

|

Member, Audit Committee; Member, Nominating and Governance Committee | |

|

Recent business and educational experience:

|

Mr. Webb has served as the Co-Chairman of Triad Financial Corporation, a privately held financial services company, since July 2007 and the interim President and Chief Executive Officer from August 2005 to July 2007. In addition, Mr. Webb has served as a consultant to Hunter’s Glen Ford, Ltd., a private investment partnership, since November 2002. Previously, Mr. Webb was the President, Chief Operating Officer and director of Golden State Bancorp Inc. and its subsidiary, California Federal Bank, FSB, from September 1994 to November 2002. Prior to his affiliation with California Federal Bank, FSB, Mr. Webb was the President and CEO of First Madison Bank, FSB (from 1993 to 1994) and First Gibraltar Bank, FSB (from 1988 to 1993), as well as President and Director of First National Bank at Lubbock (from 1983 to 1988). Mr. Webb received a Bachelor of Business Administration Degree from West Texas A&M University and a Graduate Banking Degree from Southwestern Graduate School of Banking at Southern Methodist University. | |

|

Directorships and other memberships:

|

Mr. Webb is a director of Triad Financial Corporation, Hilltop Holdings, a company specializing in manufactured home communities, and M & F Worldwide Corp., a holding company that manages two financial institution services companies and a licorice flavorings manufacturer, where he serves on the audit committee, and is a former director of Plum Creek Timber Company, where he served on the audit and compensation committees. |

12

|

Nominating and |

||||||||

|

Name

|

Audit | Compensation | Governance | Executive | ||||

|

Hamid R. Moghadam

|

X | |||||||

|

T. Robert Burke

|

Chair | |||||||

|

David A. Cole

|

Chair | |||||||

|

Lydia H.

Kennard(1)

|

Chair | |||||||

|

J. Michael Losh

|

Chair* | |||||||

|

Frederick W. Reid

|

X | X | ||||||

|

Jeffrey L. Skelton

|

X | X | ||||||

|

Thomas W. Tusher

|

X | |||||||

|

Carl B. Webb

|

X* | X |

| * | Designated by the Board as an “audit committee financial expert”. | |

| (1) | Ms. Kennard resigned as a member of the Audit Committee on April 1, 2008. |

13

| • | AMB Property, L.P. Savings and Retirement Plan Committee to administer the 401(k) Savings and Retirement Plan, whose members currently include: the Chief Financial Officer; Senior Vice President, Human Resources; Senior Vice President, General Counsel & Secretary; and Vice President, Human Resources; and | |

| • | Deferred Compensation Committee to administer the Amended and Restated AMB Nonqualified Deferred Compensation Plan and the Amended and Restated AMB 2005 Nonqualified Deferred Compensation Plan, whose members currently include: the Chief Financial Officer; Senior Vice President, General Counsel & Secretary; and Senior Vice President, Human Resources. |

14

| • | information regarding the stockholder making the nomination, including, but not limited to, the name, address, and the number of shares of our stock beneficially owned by the stockholder and any stockholder associated person, and any hedging or similar transaction engaged in by the stockholder or stockholder associated person with respect to our stock; | |

| • | a representation that the stockholder is entitled to vote at the annual meeting at which directors will be elected, and that the stockholder intends to appear in person or by proxy at the meeting to nominate the person(s) specified in the notice; | |

| • | the name and address of the person(s) being nominated and such other information regarding each nominee that would be required in a proxy statement filed pursuant to the U.S. Securities and Exchange Commission’s proxy rules if the person had been nominated for election by the Board of Directors; | |

| • | a description of any arrangements or understandings between the stockholder and such nominee and any other persons (including their names), pursuant to which the nomination is made; | |

| • | the consent of each such nominee to serve as a director if elected; and | |

| • | to facilitate procedures for majority voting for directors, a statement as to whether such person will, if elected, tender his or her resignation from the Board to be effective if not subsequently re-elected by the requisite vote. |

15

|

Fees Earned or |

Stock |

Option |

All Other |

|||||||||||||||||

|

Paid in Cash |

Awards |

Awards |

Compensation |

Total |

||||||||||||||||

|

Name

|

($) | ($)(1)(2)(3) | ($)(1)(3)(4) | ($)(5) | ($) | |||||||||||||||

|

T. Robert Burke

|

24,000 | 72,158 | 49,526 | — | 145,684 | |||||||||||||||

|

David A. Cole

|

34,000 | 80,223 | 41,229 | — | 155,452 | |||||||||||||||

|

Lydia H. Kennard

|

31,500 | 104,136 | 16,591 | — | 152,227 | |||||||||||||||

|

J. Michael Losh

|

40,750 | 72,158 | 49,526 | — | 162,434 | |||||||||||||||

|

Frederick W. Reid

|

26,500 | 120,245 | — | — | 146,745 | |||||||||||||||

|

Jeffrey L. Skelton

|

41,750 | 72,158 | 49,526 | — | 163,434 | |||||||||||||||

|

Thomas W. Tusher

|

25,000 | 88,267 | 32,935 | — | 146,202 | |||||||||||||||

|

Carl B. Webb

|

31,750 | 144,574 | 72,165 | — | 248,489 | |||||||||||||||

| (1) | Measured as value of compensation expense recognized by the company for financial statement reporting purposes in fiscal year 2008, computed pursuant to Financial Accounting Standards Board’s Statement of Financial Accounting Standards No. 123 (revised 2004), Share Based Payment (“FAS 123R”). As of March 16, 2009, none of the options held by the directors are in-the-money. |

16

| (2) | The grant date fair value of each restricted stock award expensed during 2008 and included in the Director Compensation Table, estimated using the closing sales price of our common stock on the date of each grant, is as follows: |

|

Total |

||||||||||||||||||

|

# of |

Grant Date |

Total |

Fair Value |

|||||||||||||||

|

Shares |

Fair Value |

Grant Date |

Expensed in |

|||||||||||||||

|

Director

|

Grant Date

|

Granted | per Share | Fair Value | 2008 | |||||||||||||

|

T. Robert Burke

|

May 10, 2007 | 1,208 | $ | 59.59 | $ | 71,985 | $ | 24,174 | ||||||||||

| May 8, 2008 | 1,346 | $ | 57.94 | $ | 77,987 | $ | 47,984 | |||||||||||

|

David A. Cole

|

May 10, 2007 | 1,611 | $ | 59.59 | $ | 96,000 | $ | 32,239 | ||||||||||

| May 8, 2008 | 1,346 | $ | 57.94 | $ | 77,987 | $ | 47,984 | |||||||||||

|

Lydia H. Kennard

|

May 10, 2007 | 1,208 | $ | 59.59 | $ | 71,985 | $ | 24,174 | ||||||||||

| May 8, 2008 | 2,243 | $ | 57.94 | $ | 129,959 | $ | 79,962 | |||||||||||

|

J. Michael Losh

|

May 10, 2007 | 1,208 | $ | 59.59 | $ | 71,985 | $ | 24,174 | ||||||||||

| May 8, 2008 | 1,346 | $ | 57.94 | $ | 77,987 | $ | 47,984 | |||||||||||

|

Frederick W. Reid

|

May 10, 2007 | 2,013 | $ | 59.59 | $ | 119,955 | $ | 40,283 | ||||||||||

| May 8, 2008 | 2,243 | $ | 57.94 | $ | 129,959 | $ | 79,962 | |||||||||||

|

Jeffrey L. Skelton

|

May 10, 2007 | 1,208 | $ | 59.59 | $ | 71,985 | $ | 24,174 | ||||||||||

| May 8, 2008 | 1,346 | $ | 57.94 | $ | 77,987 | $ | 47,984 | |||||||||||

|

Thomas W. Tusher

|

May 10, 2007 | 2,013 | $ | 59.59 | $ | 119,955 | $ | 40,283 | ||||||||||

| May 8, 2008 | 1,346 | $ | 57.94 | $ | 77,987 | $ | 47,984 | |||||||||||

|

Carl B. Webb

|

September 27, 2007 | 2,000 | $ | 59.20 | $ | 118,400 | $ | 64,612 | ||||||||||

| May 8, 2008 | 2,243 | $ | 57.94 | $ | 129,959 | $ | 79,962 | |||||||||||

| The compensation expense for each of these grants was amortized over the vesting period, and consequently, a portion of each of these grants was recognized as compensation expense in 2008 in accordance with FAS 123R. | ||

| (3) | As of December 31, 2008, our directors held the following number of shares of our unvested restricted stock and options to purchase shares of our common stock: |

|

Number of Shares of AMB Unvested |

Number of Options to Purchase AMB |

|||||||

|

Restricted Stock Held as of |

Common Stock Held as of |

|||||||

|

Director

|

December 31, 2008 | December 31, 2008 | ||||||

|

T. Robert Burke

|

1,346 | 119,770 | ||||||

|

David A. Cole

|

1,346 | 52,878 | ||||||

|

Lydia H. Kennard

|

2,243 | 42,233 | ||||||

|

J. Michael Losh

|

1,346 | 73,078 | ||||||

|

Frederick W. Reid

|

2,243 | 5,000 | ||||||

|

Jeffrey L. Skelton

|

1,346 | 92,700 | ||||||

|

Thomas W. Tusher

|

1,346 | 130,041 | ||||||

|

Carl B. Webb

|

2,243 | 20,000 | ||||||

17

| (4) | The grant date fair value of each option award expensed during 2008 and included in the Director Compensation Table, estimated using the Black-Scholes value of such option award, is as follows: |

|

# of Shares |

Total |

|||||||||||||||||

|

Underlying |

Grant Date |

Total |

Fair Value |

|||||||||||||||

|

Options |

Fair Value |

Grant Date |

Expensed in |

|||||||||||||||

|

Director

|

Grant Date

|

Granted | per Share | Fair Value | 2008 | |||||||||||||

|

T. Robert Burke

|

May 10, 2007 | 4,729 | $ | 10.15 | $ | 47,999 | $ | 16,591 | ||||||||||

| May 8, 2008 | 3,618 | $ | 14.37 | $ | 51,990 | $ | 32,935 | |||||||||||

|

David A. Cole

|

May 10, 2007 | 2,364 | $ | 10.15 | $ | 23,995 | $ | 8,294 | ||||||||||

| May 8, 2008 | 3,618 | $ | 14.37 | $ | 51,990 | $ | 32,935 | |||||||||||

|

Lydia H. Kennard

|

May 10, 2007 | 4,729 | $ | 10.15 | $ | 47,999 | $ | 16,591 | ||||||||||

| May 8, 2008 | — | — | — | — | ||||||||||||||

|

J. Michael Losh

|

May 10, 2007 | 4,729 | $ | 10.15 | $ | 47,999 | $ | 16,591 | ||||||||||

| May 8, 2008 | 3,618 | $ | 14.37 | $ | 51,990 | $ | 32,935 | |||||||||||

|

Frederick W. Reid

|

May 10, 2007 | — | — | — | — | |||||||||||||

| May 8, 2008 | — | — | — | — | ||||||||||||||

|

Jeffrey L. Skelton

|

May 10, 2007 | 4,729 | $ | 10.15 | $ | 47,999 | $ | 16,591 | ||||||||||

| May 8, 2008 | 3,618 | $ | 14.37 | $ | 51,990 | $ | 32,935 | |||||||||||

|

Thomas W. Tusher

|

May 10, 2007 | — | — | — | — | |||||||||||||

| May 8, 2008 | 3,618 | $ | 14.37 | $ | 51,990 | $ | 32,935 | |||||||||||

|

Carl B. Webb

|

Aug 2, 2007 | 20,000 | $ | 8.03 | $ | 160,600 | $ | 72,165 | ||||||||||

| May 8, 2008 | — | — | — | — | ||||||||||||||

|

Dividend |

Expected |

Risk-Free |

Expected |

|||||||||||||

|

Grant Year

|

Yield | Volatility | Interest Rates | Life | ||||||||||||

|

May 2007

|

3.4 | % | 18.7% | 4.5 | % | 6 years | ||||||||||

|

August 2007

|

4.1 | % | 20.5% | 4.5 | % | 6 years | ||||||||||

|

May 2008

|

3.6 | % | 31.0% | 3.5 | % | 7.5 years | ||||||||||

18

| (5) | Dividends were paid on the unvested shares of restricted stock granted to our directors, executive officers and other employees. The value of the dividends is not included in this column because the amounts are factored into the grant date fair value of the award. For 2008, the dividend rate was $1.56 per share and was not preferential. During 2008, each of the directors earned the following dividend amounts on their unvested shares of restricted stock: |

|

2008 Dividends |

||

|

Paid on |

||

|

Unvested Shares of |

||

|

Director

|

Restricted Stock | |

|

T. Robert Burke

|

$2,632 | |

|

David A. Cole

|

$3,043 | |

|

Lydia H. Kennard

|

$3,565 | |

|

J. Michael Losh

|

$2,632 | |

|

Frederick W. Reid

|

$4,386 | |

|

Jeffrey L. Skelton

|

$2,632 | |

|

Thomas W. Tusher

|

$3,453 | |

|

Carl B. Webb

|

$4,373 |

|

January 1, 2008 — June 30, 2008

|

||||

|

Fee per Board Meeting:

|

$ | 2,000 | ||

|

Fee per Committee Meeting:

|

$ | 1,500 | ||

|

Quarterly Retainer for Lead Director:

|

$ | 2,000 | ||

|

Quarterly Retainer for Committee Chairs:

|

||||

|

• Audit Committee

|

$ | 3,000 | ||

|

• Compensation Committee

|

$ | 2,000 | ||

|

• Nominating and Governance Committee

|

$ | 2,000 | ||

|

• Executive Committee

|

$ | 1,250 | ||

19

|

July 1, 2008 — December 31, 2008

|

||||

|

Quarterly Retainer for Board:

|

$ | 7,500 | ||

|

Quarterly Retainer for Audit Committee:

|

$ | 1,875 | ||

|

Quarterly Retainer for Lead Director:

|

$ | 3,750 | ||

|

Quarterly Retainer for Committee Chairs:

|

||||

|

• Audit Committee

|

$ | 3,000 | ||

|

• Compensation Committee

|

$ | 2,500 | ||

|

• Nominating and Governance Committee

|

$ | 2,000 | ||

|

• Executive Committee

|

$ | 1,250 | ||

20

| Fiscal 2007 | Fiscal 2008 | |||||||

|

Audit

Fees(1)

|

$ | 2,952,305 | $ | 3,039,925 | ||||

|

Audit-Related

Fees(2)

|

508,500 | 173,194 | ||||||

|

Tax

Fees(3)

|

3,203,655 | 4,500,500 | ||||||

|

All Other

Fees(4)

|

2,000 | 2,000 | ||||||

|

Total Fees

|

$ | 6,666,460 | $ | 7,715,619 | ||||

| (1) | Audit Fees include amounts related to professional services rendered in connection with the audits of our annual financial statements and those of our subsidiaries, the reviews of our quarterly financial statements, the audit of our internal control over financial reporting and other services that are normally provided by the auditor in connection with statutory and regulatory filings or engagements. | |

| (2) | Audit-Related Fees include amounts billed for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements but are not reported under “Audit Fees.” These amounts primarily related to acquisition due diligence and consultations on financial accounting and reporting standards. | |

| (3) | Tax Fees include amounts billed for professional services rendered in connection with tax compliance, tax advice and tax planning. These amounts primarily related to certain tax services, including tax advisory and consulting services and tax advice relating to development, acquisition and disposition activities. | |

| (4) | All Other Fees include amounts related to technical research tools. |

21

|

Hamid R. Moghadam

|

||

|

Age:

|

52 | |

|

Position(s):

|

Mr. Moghadam has served as our Chief Executive Officer since November 1997, our president under our bylaws and Maryland corporate law since February 2007 and as Chairman of the Board since January 2000. | |

|

Biographical information:

|

Biographical information regarding Mr. Moghadam is set forth under “Proposal 1: Election of Directors — Nominees For Director.” | |

|

Thomas S. Olinger

|

||

|

Age:

|

42 | |

|

Position(s):

|

Chief Financial Officer | |

|

Biographical information:

|

Mr. Olinger joined us on February 23, 2007 and became our Chief Financial Officer on March 1, 2007. He currently serves as an officer or director of a number of our other subsidiaries. From 2002 until February 2007, Mr. Olinger was the vice president and corporate controller of Oracle Corporation, a software and technology company, where he was responsible for global corporate accounting, external reporting, technical accounting, global revenue recognition, Sarbanes-Oxley compliance and finance merger and acquisition integration, among other duties. At Oracle, Mr. Olinger also oversaw global controllership operations in Dublin, Ireland, Bangalore, India, Sydney, Australia and Rocklin, California. Prior to his employment with Oracle, Mr. Olinger was an accountant and partner at Arthur Andersen LLP. At Arthur Andersen, Mr. Olinger served as the lead audit partner on our account from 1999 to 2002. He also worked with a number of other real estate investment trusts in Arthur Andersen’s real estate practice group and technology companies in Arthur Andersen’s software practice group. Mr. Olinger graduated in 1988 from Indiana University with a B.S. degree in finance with distinction. |

22

|

Guy F. Jaquier

|

||

|

Age:

|

50 | |

|

Position(s):

|

President, Europe & Asia | |

|

Biographical information:

|

Mr. Jaquier joined us in June 2000 and served as our Executive Vice President, Chief Investment Officer from June 2000 to December 31, 2005 and our Executive Vice President, Europe & Asia from January 2006 to February 2007. He served as Vice Chairman of AMB Capital Partners, LLC, one of our subsidiaries from January 2001 to December 2005, and currently serves as an officer or director of a number of our other subsidiaries. He also serves as a director of the Runstad Center Advisory Board for the University of Washington real estate program. Mr. Jaquier has over 20 years of experience in real estate finance and investments. Between 1998 and June 2000, Mr. Jaquier served as Senior Investment Officer for real estate at the California Public Employees’ Retirement System, where his responsibilities included managing a $12 billion real estate portfolio. Prior to that, Mr. Jaquier spent 15 years at Lend Lease Real Estate Investments and its predecessor, Equitable Real Estate, where he held various transactions and management positions. He holds a B.S. degree in Building Construction Management from the University of Washington and an M.B.A. degree from the Harvard Graduate School of Business Administration. | |

|

Eugene F. Reilly

|

||

|

Age:

|

47 | |

|

Position(s):

|

President, The Americas | |

|

Biographical information:

|

Mr. Reilly joined us in October 2003 and has over 25 years of experience in real estate development, acquisition, disposition, financing and leasing throughout the United States. Prior to joining us, Mr. Reilly served as Chief Investment Officer at Cabot Properties, Inc. Mr. Reilly was a founding partner of Cabot Properties, and his tenure there, including its predecessor companies, spanned from 1992 to 2003. From 1985 to 1992, Mr. Reilly served in a variety of capacities at National Development Corporation, ultimately serving as Senior Vice President. Mr. Reilly holds an A.B. degree in Economics from Harvard College and is a member of the National Association of Industrial and Office Parks (NAIOP). He begins service on the national board of directors of NAIOP in 2009, and has previously served on the National Industrial Education Committee of NAIOP, and was a former member of the board of directors of its Massachusetts chapter. | |

|

John T. Roberts, Jr.

|

||

|

Age:

|

45 | |

|

Position(s):

|

President, Private Capital; President of AMB Capital Partners, LLC | |

|

Biographical information:

|

Mr. Roberts has over 20 years of experience in real estate finance and investment. Mr. Roberts joined us in 1997 and has served in a variety of officer positions in our Capital Markets department and our Private Capital group. Prior to joining us, Mr. Roberts spent six years at Ameritech Pension Trust, where he held the position of Director, Real Estate Investments. His responsibilities included managing a $1.6 billion real estate portfolio and developing and implementing the trust’s real estate program. Prior to that, he worked for Richard Ellis, Inc. and has experience in leasing and sales. Mr. Roberts received a bachelor’s degree from Tulane University in New Orleans and an M.B.A. degree in finance and accounting from the Graduate School of Business at the University of Chicago. |

23

24

| • | Base salary, | |

| • | Annual bonus, and | |

| • | Long-term equity incentive awards. |

| • | Compensation tally sheets, and | |

| • | Benchmarking data. |

25

|

Weighting |

||||

|

Corporate v. Group/ |

Bonus as a % of |

|||

|

Individual |

Base Salary |

|||

|

Position

|

Performance | (Minimum-Target-Maximum) | ||

|

Chairman and CEO

|

80% v. 20% | 0% - 150% - 300% | ||

|

President, Europe & Asia

|

60% v. 40% | 0% - 125% - 250% | ||

|

President, The Americas

|

60% v. 40% | 0% - 125% - 250% | ||

|

President, Private Capital

|

60% v. 40% | 0% - 125% - 250% | ||

|

Chief Financial Officer

|

50% v. 50% | 0% - 100% - 200% |

26

|

Performance Measure

|

Weighting | |||

|

FFO per

share(1)

|

45% | |||

|

Operations — Core

GAAP NOI(2)

|

10% | |||

|

Capital Deployment

|

10% | |||

|

Development Value Creation

|

10% | |||

|

Private Capital

|

25% | |||

| 100% | ||||

| (1) | We assigned significantly more weight to the FFO (funds from operations) performance measure relative to the other performance measures as we believe FFO provides the best assessment of our operating performance for the company as a whole. FFO is a non-GAAP financial measure created by the National Association of Real Estate Investment Trusts as a supplemental measure of operating performance for real estate investment trusts (REITs) that excludes historical cost depreciation and amortization, among other items, from net income as defined by GAAP, generally accepted accounting principles. Our FFO results are set forth on page 43 of our annual report on Form 10-K for the year ended December 31, 2008, Item 6, “Selected Company Financial and Other Data,” and our definition of FFO and the calculation of FFO reconciled from net income are set forth beginning on page 82, “Supplemental Earnings Measures” of our annual report on Form 10-K for the year ended December 31, 2008. | |

| (2) | Core properties include all properties that were owned or managed, including development properties, as of January 1, 2008. The core pool is set annually and excludes properties purchased and developments started after December 31, 2007. Net operating income (NOI) is defined as rental revenue (as calculated in accordance with generally accepted accounting principles, GAAP), including reimbursements and straight-lined rents, less property operating expenses, which excludes depreciation, amortization, general and administrative expenses and interest expense. We consider NOI to be an appropriate and useful supplemental performance measure because NOI reflects the operating performance of the real estate portfolio. However, NOI should not be viewed as an alternative measure of financial performance since it does not reflect general and administrative expenses, interest expense, depreciation and amortization costs, capital expenditures and leasing costs, or trends in development and construction activities that could materially impact results from operations. Further, NOI may not be comparable to that of other real estate investment trusts, as they may use different methodologies for calculating NOI. |

27

|

Performance Measure

|

Weighting

|

|

|

Exceed Target

|

Greater than 200 bps above the weighted three-year average TSR of the combined peer group | |

|

Target

|

Within 200 bps of the weighted three-year average TSR of the combined peer group | |

|

Below Target

|

Greater than 200 bps below the weighted three-year average TSR of the combined peer group |

28

| • | Operating results: We achieved a new leasing record of approximately 8.3 million square feet of our development pipeline, leased more than 23.8 million square feet in our global operating portfolio during 2008, maintained an average occupancy of 94.9% throughout the year and achieved a year-end occupancy rate of 95.1% at December 31, 2008. We delivered same store growth in 2008 of 3.7% (excluding lease termination fees). | |

| • | Investment results: We deployed $1.1 billion of capital, balanced between our domestic and international portfolio, as well as between our acquisition and development platforms. Our development starts for the year were $545 million, our acquisitions results for the year were $543 million and our development contributions and sales totaled $593 million. | |

| • | Private Capital: We added $835 million of properties to the company’s private equity funds across Japan, Mexico, Europe and the U.S., and we raised third party equity in the amount of $173 million. | |

| • | Capital Markets: We completed 35 financing transactions that were a combination of new financings, extensions and re-financings for a total of $2.6 billion throughout the United States, Europe and Asia. As of December 31, 2008, the company had approximately $934 million of capacity, consisting of $224 million of consolidated cash and cash equivalents and $710 million of availability on its lines of credit. | |

| • | Organizational Development: We completed the integration of G.Accion through the buyout of the remaining ownership interests in G.Accion and establishing our new subsidiary in Mexico, AMB Property Mexico. We also expanded our presence in Latin America with a newly formed joint venture in Brazil. Continuing our cost cutting measures to conserve capital during the economic downturn, we reduced our workforce by 22% and reorganized our organization to more efficiently manage the business, our executives took a 10% reduction in base salary for 2009, and other members of our senior management voluntarily reduced their base salary by 5% for 2009. These cost cutting measures were projected to result in an approximate 20% savings in net general and administrative expenses. |

29

| • | The total value of the bonus amount after any exchange into equity as part of our annual bonus exchange program on the grant date; and | |

| • | the total value of long-term equity incentive awards on the grant date. |

| • | the partial value of equity awards made for prior year’s performance that were amortized over the award’s vesting period and expensed in 2008 and 2007 under FAS 123R. |

|

Total Salary |

||||||||||||||||||||||

|

Annual |

Long-Term Equity |

and Incentive |

% Change |

|||||||||||||||||||

|

Executive

|

Year | Base Salary | Annual Bonus(6) | Incentive Value(6) | Compensation | from 2007 | ||||||||||||||||

|

Hamid R. Moghadam,

|

2008 | $ | 657,750 | After Bonus Exchange: $748,910 | $ | 1,500,000 | $ | 2,906,660 | (48.3 | )% | ||||||||||||

|

Chairman and Chief

|

Actual: $570,000 | |||||||||||||||||||||

|

Executive

Officer(1)

|

2007 | $ | 640,500 | After Bonus Exchange: $2,050,000 Actual: $1,640,000 | $ | 2,935,000 | $ | 5,625,500 | — | |||||||||||||

|

Thomas S. Olinger,

|

2008 | $ | 378,000 | After Bonus Exchange: $325,000 | $ | 450,000 | $ | 1,153,000 | (25.5 | )% | ||||||||||||

|

Chief Financial

Officer(2)

|

Actual: $325,000 | |||||||||||||||||||||

| 2007 | $ | 289,947 | After Bonus Exchange: $500,000 Actual: $460,000 | $ | 756,667 | $ | 1,546,614 | — | ||||||||||||||

|

Guy F. Jaquier,

|

2008 | $ | 440,500 | After Bonus Exchange: $463,000 | $ | 950,000 | $ | 1,853,500 | (39.5 | )% | ||||||||||||

|

President, Europe and

Asia(3)

|

Actual: $400,000 | |||||||||||||||||||||

| 2007 | $ | 400,250 | After Bonus Exchange: $913,750 Actual: $860,000 | $ | 1,747,500 | $ | 3,061,500 | — | ||||||||||||||

|

Eugene F. Reilly,

|

2008 | $ | 440,500 | After Bonus Exchange: $463,000 | $ | 950,000 | $ | 1,853,500 | (38.4 | )% | ||||||||||||

|

President, The

Americas(4)

|

Actual: $400,000 | |||||||||||||||||||||

| 2007 | $ | 400,250 | After Bonus Exchange: $860,000 Actual: $860,000 | $ | 1,747,500 | $ | 3,007,750 | — | ||||||||||||||

|

John T. Roberts, Jr.

|

2008 | $ | 440,500 | After Bonus Exchange: $334,534 | $ | 500,000 | $ | 1,275,034 | (49.2 | )% | ||||||||||||

|

President, Private

Capital(5)

|

Actual: $260,000 | |||||||||||||||||||||

| 2007 | $ | 400,250 | After Bonus Exchange: $715,300 Actual: $715,300 | $ | 1,392,200 | $ | 2,507,750 | — | ||||||||||||||

| (1) | For 2008 performance, Mr. Moghadam elected to receive his entire annual bonus in equity. However, because the 800,000 share limit on the number of shares to be distributed under the company’s bonus exchange program was reached, he was required to receive his annual bonus in a combination of cash and equity. Thus, he received $170,359 in cash and was awarded 6,567 shares of restricted stock which included a 25% exchange premium equal to 1,313 shares, which vests over 3 years. He also received 150,000 stock options which included a 50% premium equal to 50,000 stock options with 100,000 stock options which immediately vested upon the grant |

30

| date and the remaining 50,000 stock options which vest over 3 years. Mr. Moghadam’s long-term incentive award included 47,110 shares of restricted stock, which vests over 4 years, and 237,341 stock options, which vest over 3 years. | ||

| (2) | For 2008 performance, Mr. Olinger’s long-term incentive award included 16,959 shares of restricted stock, which vests over 4 years, and 56,603 stock options, which vest over 3 years. | |

| (3) | For 2008 performance, Mr. Jaquier exchanged $127,200 of his annual bonus award into stock options and was awarded 60,000 stock options which included a 50% exchange premium equal to 20,000 stock options with 40,000 stock options which immediately vested upon the grant date and the remaining 20,000 stock options which vest over 3 years. His long-term incentive award included 29,836 shares of restricted stock, which vest over 4 years, and 149,371 stock options, which vest over 3 years. | |

| (4) | For 2008 performance, Mr. Reilly exchanged $127,200 of his annual bonus award into stock options and was awarded 60,000 stock options which included a 50% exchange premium equal to 20,000 stock options with 40,000 stock options which immediately vested upon the grant date and the remaining 20,000 stock options which vest over 3 years. His long-term incentive award included 29,836 shares of restricted stock, which vest over 4 years, and 149,371 stock options, which vest over 3 years. | |

| (5) | For 2008 performance, Mr. Roberts elected to receive his entire annual bonus in equity. However, because the 800,000 share limit on the number of shares to be distributed under the company’s bonus exchange program was reached, he was required to receive his annual bonus in a combination of cash and equity. Thus, he received $89,065 in cash and was awarded 3,434 shares of restricted stock which included a 25% exchange premium equal to 686 shares, which vests over 3 years. He also received 60,000 stock options which included a 50% premium equal to 20,000 stock options with 40,000 stock options which immediately vested upon the grant date and the remaining 20,000 stock options which vest over 3 years. His long-term incentive award included 15,703 shares of restricted stock, which vest over 4 years, and 78,616 stock options, which vest over 3 years. | |

| (6) | The amounts included for the bonus exchange value listed above for participating officers are based on the closing sales price of our common stock on the date the bonuses and shares were awarded: (i) with respect to 2008 performance, February 10, 2009, $15.92 per share, and (ii) with respect to 2007 performance, February 21, 2008, $48.76 per share. | |

| Based on the closing sales price of our common stock on March 16, 2009 of $12.23 per share, all of the options granted for 2007 and 2008 performance are out-of-the-money, and all of the shares of restricted stock granted for 2007 and 2008 performance to our Named Executive Officers are worth less than the value reported in these columns. | ||

| The number of options granted with respect to bonus exchange and long-term equity incentive awards to our Named Executive Officers was based on the Black-Scholes value on the date of grant, which was calculated utilizing the following assumptions: |

| • | Market price on date of grant; | |

| • | Exercise price — same as market price on date of grant; | |

| • | Assume average outstanding term of seven or eight years (While stock options have a term of ten years, we assume a shorter term to reflect the historical forecasted average length of time that our executive officers hold the options until exercise); | |

| • | Risk-free rate, seven-year or eight-year interpolated US Treasury; | |

| • | Volatility — ten-year historical volatility; and | |

| • | Dividend rate — annual dividend of $1.12. |

31

| Perquisites | Other Compensation | |||||||||||||||||||||||||||||||||||

|

Dividends on |

Tax Gross |

|||||||||||||||||||||||||||||||||||

|

Unvested |

401(k) |

up on |

||||||||||||||||||||||||||||||||||

|

Financial |

Restricted |

Company |

Life |

Financial |

||||||||||||||||||||||||||||||||

|

Executive

|

Planning | Parking | Subtotal | Stock | Match | Insurance | Planning | Subtotal | Total | |||||||||||||||||||||||||||

|

Hamid R. Moghadam

|

$ | 37,500 | $ | 5,160 | $ | 42,660 | $ | 410,136 | $ | — | $ | 576 | $ | 20,866 | $ | 431,578 | $ | 474,238 | ||||||||||||||||||

|

Thomas S. Olinger

|

$ | 8,111 | $ | 5,160 | $ | 13,271 | $ | 42,033 | $ | 6,900 | $ | 576 | $ | 4,513 | $ | 54,022 | $ | 67,293 | ||||||||||||||||||

|

Guy A. Jaquier

|

$ | 8,330 | $ | 2,160 | $ | 10,490 | $ | 127,015 | $ | 6,900 | $ | 576 | $ | 4,635 | $ | 139,126 | $ | 149,616 | ||||||||||||||||||

|

Eugene F. Reilly

|

$ | — | $ | 3,415 | $ | 3,415 | $ | 116,817 | $ | 6,900 | $ | 576 | $ | — | $ | 124,293 | $ | 127,708 | ||||||||||||||||||

|

John T. Roberts, Jr.

|

$ | 8,330 | $ | 2,160 | $ | 10,490 | $ | 126,860 | $ | 6,900 | $ | 576 | $ | 4,635 | $ | 138,971 | $ | 149,461 | ||||||||||||||||||

|

Salary and |

||||||||||||||||||||||

|

Incentive |

Other |

Total |

% Change |

|||||||||||||||||||

|

Executive

|

Year | Compensation | Perquisites | Compensation | Remuneration | from 2007 | ||||||||||||||||

|

Hamid R. Moghadam

|

2008 | $ | 2,906,660 | $ | 42,660 | $ | 431,578 | $ | 3,380,898 | (43.8)% | ||||||||||||

| 2007 | $ | 5,625,500 | $ | 43,850 | $ | 348,443 | $ | 6,017,793 | — | |||||||||||||

|

Thomas S. Olinger

|

2008 | $ | 1,153,000 | $ | 13,271 | $ | 54,022 | $ | 1,220,293 | (22.9)% | ||||||||||||

| 2007 | $ | 1,546,614 | $ | 10,625 | $ | 24,697 | $ | 1,581,936 | — | |||||||||||||

|

Guy A. Jaquier

|

2008 | $ | 1,853,500 | $ | 10,490 | $ | 139,126 | $ | 2,003,116 | (37.0)% | ||||||||||||

| 2007 | $ | 3,061,500 | $ | 12,800 | $ | 104,807 | $ | 3,179,107 | — | |||||||||||||

|

Eugene F. Reilly

|

2008 | $ | 1,853,500 | $ | 3,415 | $ | 124,293 | $ | 1,981,208 | (36.2)% | ||||||||||||

| 2007 | $ | 3,007,750 | $ | 13,420 | $ | 82,870 | $ | 3,104,040 | — | |||||||||||||

|

John T. Roberts, Jr.

|

2008 | $ | 1,275,034 | $ | 10,490 | $ | 138,971 | $ | 1,424,495 | (46.1)% | ||||||||||||

| 2007 | $ | 2,507,750 | $ | 12,800 | $ | 122,521 | $ | 2,643,071 | — | |||||||||||||

32

33

|

All Other |

||||||||||||||||||||||||||||

|

Salary |

Bonus |

Stock Awards |

Option Awards |

Compensation |

Total |

|||||||||||||||||||||||

|

Name and Principal Position

|

Year | ($) | ($)(1) | ($)(2)(3)(4)(5) | ($)(2)(6)(7) | ($)(4) | ($) | |||||||||||||||||||||

|

Hamid R. Moghadam

|

2008 | 657,750 | 570,000 | (8) | 3,741,455 | (8) | 589 | (8) | 474,238 | (9) | 5,444,032 | |||||||||||||||||

|

Chairman and Chief Executive

|

2007 | 640,500 | 1,640,000 | (8) | 2,839,234 | (8) | 215,442 | (8) | 392,293 | (9) | 5,727,469 | |||||||||||||||||

|

Officer

|

2006 | 627,500 | 1,550,391 | (8) | 2,082,110 | (8) | 480,866 | (8) | 333,301 | (9) | 5,074,168 | |||||||||||||||||

|

Thomas S. Olinger

|

2008 | 378,000 | 325,000 | (10) | 283,384 | (10) | 53,829 | (10) | 67,293 | (9) | 1,107,506 | |||||||||||||||||

|

Chief Financial Officer

|

2007 | 289,947 | (10) | 460,000 | (10) | 97,543 | (10) | — | 35,322 | (9) | 882,812 | |||||||||||||||||

| 2006 | — | — | — | — | — | — | ||||||||||||||||||||||

|

Guy F. Jaquier

|

2008 | 440,500 | 400,000 | (11) | 1,035,658 | (11) | 263,359 | (11) | 149,616 | (9) | 2,289,133 | |||||||||||||||||

|

President, Europe & Asia

|

2007 | 400,250 | 860,000 | (11) | 717,073 | (11) | 270,788 | (11) | 117,607 | (9) | 2,365,718 | |||||||||||||||||

| 2006 | 375,000 | 625,000 | (11) | 522,232 | (11) | 304,726 | (11) | 100,574 | (9) | 1,927,532 | ||||||||||||||||||

|

Eugene F. Reilly

|

2008 | 440,500 | 400,000 | (12) | 826,363 | (12) | — | (12) | 127,708 | (9) | 1,794,571 | |||||||||||||||||

|

President, The Americas

|

2007 | 400,250 | 860,000 | (12) | 479,730 | (12) | — | (12) | 96,290 | (9) | 1,836,270 | |||||||||||||||||

| 2006 | 375,000 | 600,000 | (12) | 363,109 | (12) | 11,999 | (12) | 66,792 | (9) | 1,416,900 | ||||||||||||||||||

|

John T. Roberts, Jr.

|

2008 | 440,500 | 260,000 | (13) | 1,078,270 | (13) | — | (13) | 149,461 | (9) | 1,928,231 | |||||||||||||||||

|

President, Private Capital

|

2007 | 400,250 | 715,300 | (13) | 823,074 | (13) | — | (13) | 135,321 | (9) | 2,073,945 | |||||||||||||||||

| 2006 | 375,000 | 575,000 | (13) | 867,217 | (13) | — | (13) | 134,492 | (9) | 1,951,709 | ||||||||||||||||||

| (1) | The Compensation Committee of the Board of Directors determined the amount of any such bonus. The bonuses for 2006 were paid in 2007, the bonuses for 2007 were paid in 2008, and the bonuses for 2008 were paid in 2009. At the option of the Named Executive Officer, the officer may receive his bonus in any combination of cash, restricted shares of our common stock (valued at 125% of the cash bonus, with a three-year vesting period) or options to purchase shares of our common stock (valued at 150% of the cash bonus in 2008, 2007 and 2006 based on our Black-Scholes value, 150% of the cash bonus in 2005 and 2004 based on a standardized discounted binomial value and 135% of the cash bonus in 2003 based on our Black-Scholes value, with a three-year vesting period on options in excess of the 100% cash bonus value and immediate vesting of the remainder). |

34

| (2) | Measured as value of compensation expense recognized by the company for financial statement reporting purposes in 2008, 2007 and 2006, computed pursuant to FAS 123R. This column includes a portion of the bonus amount disclosed in the “Bonus” column for prior years. | |

| Based on the closing sales price of our common stock on March 16, 2009 of $12.23 per share, all of the stock option grants reported in these columns are out-of-the-money, and all of the shares of restricted stock granted to our Named Executive Officers are worth less than the value reported in these columns. | ||

| (3) | In accordance with FAS 123R, we value restricted stock using the closing sales price of our common stock on the date of grant and recognize this amount as an expense over the vesting period of the restricted stock. The compensation expense disclosed in the Summary Compensation Table for each of the Named Executive Officers aggregates tranches of restricted stock awarded in 2001 to 2008 for performance in 2000 to 2007, as well as new hire grants, which were accrued toward vesting or expensed in 2006, 2007 and 2008. This column includes a portion of the bonus amount disclosed in the “Bonus” column for prior years. | |

| (4) | Dividends will be paid on the restricted stock granted to our directors, executive officers and other employees. For 2008, the dividend rate of $1.56 per share; for 2007, the dividend rate of $2.00 per share and for 2006, the dividend rate of $1.84 per share, were factored into our grant date fair value. These dividends were not preferential. All of our restricted stock grants vest annually in either three, four or five installments assuming continued employment. |

|

Aggregate Dividends |

Shares of Unvested |

|||||||||||

|

Paid on |

Restricted Stock |

|||||||||||

|

Fiscal |

Unvested |

Held at |

||||||||||

|

Executive

|

Year | Restricted Stock ($) | December 31, 2008 (#) | |||||||||

|

Hamid R. Moghadam

|

2008 | 410,136 | 208,356 | |||||||||

| 2007 | 327,808 | |||||||||||

| 2006 | 257,439 | |||||||||||

|

Thomas S. Olinger

|

2008 | 42,033 | 23,739 | |||||||||

| 2007 | 15,000 | |||||||||||

| 2006 | — | |||||||||||

|

Guy F. Jaquier

|

2008 | 127,015 | 65,893 | |||||||||

| 2007 | 93,030 | |||||||||||

| 2006 | 74,833 | |||||||||||

|

Eugene F. Reilly

|

2008 | 116,817 | 63,124 | |||||||||

| 2007 | 71,822 | |||||||||||

| 2006 | 54,456 | |||||||||||

|

John T. Roberts, Jr.

|

2008 | 126,860 | 63,909 | |||||||||

| 2007 | 110,744 | |||||||||||

| 2006 | 108,751 | |||||||||||